Best Rating Updates

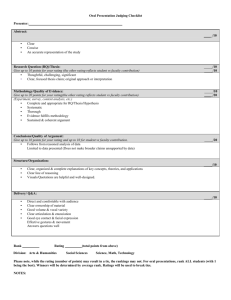

advertisement

Best Rating Updates Property/Casualty—April—June 2005 MA Status Codes: D=State of domicile L=Licensed R=Licensed for Reinsurance A=Approved for Reinsurance O=Reinsurance (Other) S=Surplus Lines Writer F=Authorized under the Risk Retention Act Rating Action codes: (+) or (-) Rating upgraded or downgraded (New) Assigned initial rating (U) Rating placed under review (*) Rating was downgraded to E from C– on March 22. Current rating effective 3/25. Secure Best’s Ratings A++ and A+ = Superior A and A- = Excellent B++ and B+ = Very Good Vulnerable Best’s Ratings B and B- = Fair C++ and C+ = Marginal C and C- = Week D = Poor E =Under Regulatory Supervision F= In Liquidation S= Rating Suspended Effective Date-Represents effective date of Rating Action Rating Modifiers u - Under Review pd-Public Data Affiliation codes g - Group p– Pool s-Syndicate r - Reinsured Not Rated Categories (NR) NR-1 Insufficient Data NR-2– Insufficient Size and/or Operating Experience NR-3 Rating Procedure Inapplicable NR-4 Company Request NR-5 Not formally Followed Rating Action + U + - Company AMB# Acceptance Insurance Company 02681 ACSTAR Insurance Company 10607 AIG Centennial Insurance Company 00876 AIG Premier Insurance Company 02123 AIU Insurance Company 02389 Alea North America Insurance Co 12467 American Feed Industry Ins Co RRG 10730 American Home Assurance Co 02034 American Internat Specialty Lines 03535 American International Ins Co 03641 American International Pacific 02359 Current Rating NR-1 A A+u A+u A+u A-u AA+u A+u A+u A+u Eff. Date 6/13/05 4/25/05 5/16/05 5/16/05 5/16/05 6/20/05 5/30/05 5/16/05 5/16/05 5/16/05 5/16/05 Prior Rating E AA++u A++u A++u AB++ A++u A++u A++u A++u MA Status S L L L L L F L S L L Rating Action + - - NEW U + U + - Company AMB# American Manufacturers Mutual Ins 02273 American Motorists Ins Co 02274 American Road Insurance Co 00152 Armed Forces Ins. Exchange 03240 Birmingham Fire Ins Co of PA 02349 Chicago Title Insurance Company 04645 CIM Insurance Corporation 02197 Commerce and Industry Ins Co 04000 Countryway Insurance Company 03206 CPA Mutual Ins Co of America RRG 11319 Eastern Casualty Group 18541 Eastern Casualty Insurance Co 01961 Fidelity National Title Ins Co 11977 Granite State Insurance Co 02360 Groveland Mutual Insurance Co 11701 Highlands Insurance Company 02239 Independence Casualty Ins Co 10088 Illinois National Insurance Co 02361 Insurance Co of State of PA 02035 Insurance Corporation of NY 03500 Integon General Ins. Corp. 02459 Integon National Ins Co 02387 Integon Preferred Ins Co 11650 Kemper Casualty Ins Co 12301 Landmark Insurance Co 03756 Lexington Insurance Co 02350 Lumbermens Mutual Casualty Co 02279 Medical Mutual Ins. Co. of ME 01757 Medical Protective Co 00591 MIC General Ins Corp 02669 MIC Property & Casualty Ins Corp 02652 Monumental General Cas. Com. 03694 Motors Insurance Corp 00654 National General Ins Co 03366 National Union Fire Ins Co Pit PA 02351 New Hampshire Ins Co 02363 New South Insurance Co 00698 Omaha Property& Casualty Ins Co 01860 Pennsylvania Lumbermens Mutual 00756 Pharmacists Mutual Ins Co 00320 Putnam Reinsurance Co 03727 Savers P&C Ins. Co. 00524 Security Union Title Ins Co 11908 Senior Citizens Mutual Insurance 10835 Specialty Surplus Insurance Co 12349 Current Rating NR-4 NR-4 AAA+u AAA+u AB NR-5 NR-3 AA+u NR-5 NR-5 A A+u A+u NR-1 AAANR-4 A+u A+u NR-4 B++ A-u AANR-3 AAA+u A+u ANR-5 A A a+U B++ AF NR-4 Eff. Date 5/9/05 5/9/05 5/16/05 5/30/05 5/16/05 5/30/05 5/16/05 5/16/05 4/4/05 6/27/05 6/20/05 6/20/05 5/30/05 5/16/05 4/4/05 6/20/05 6/6/05 5/16/05 5/16/05 6/13/05 5/16/05 5/16/05 5/16/05 5/9/05 5/16/05 5/16/05 5/9/05 4/4/05 5/16/05 5/16/05 5/16/05 6/13/05 5/16/05 5/16/05 5/16/05 5/16/05 5/16/05 5/23/05 6/6/05 6/27/05 5/16/05 4/25/05 5/30/05 6/27/05 5/9/05 Prior Rating D D A A A++u A A A++u B++ B+ B++ B++ A A++u NR-3 E A++u A++u E A A A D A++u A++u D AAA A AA A A++u A++u A A-u AA+ a+ B+ A B-u D MA Status L L L L L L L L L F D D L L D L D L L L L L L L L S L L L L L L L L L L L L L O L L F S Rating Action + + U Company South Carolina Insurance Co Star Insurance Company State Farm General Ins Co Ticor Title Insurance Company Transatlantic Reinsurance Co Trenwick America Reinsurance Ulico Indemnity Company AMB# 00840 00695 02478 11918 03126 03747 11329 Current Rating F B++ B++ AA+U NR-3 NR-5 Eff. Date 4/11/05 4/25/05 6/27/05 5/30/05 5/16/05 6/6/05 5/30/05 Prior Rating E B+ B+ A A+ NR-4 B- MA Status L L L L L A S RATIONALE ACSTAR Insurance Company (A.M. Best #: 10607 NAIC #: 22950) RATING RATIONALE Rating Rationale: The rating reflects the company's strong capitalization, solid operating performance, favorable liquidity, as well as management's strict discipline and noteworthy ability to manage through market cycles. These positive rating factors are offset by the company's limited product diversification, elevated loss reserve leverage, continued debt service obligations, stockholder dividends and the heightened challenges associated with current investment yields. Despite these attenuating factors, the rating and rating outlook support management's prudent business strategy, ACSTAR's excellent financial position, favorable earnings prospects, and the reduced financial leverage at ACMAT Corporation (parent holding company). Much of ACSTAR's success over the years stems from its parent's long-standing involvement in the construction industry and the advantages gained by management's expertise. ACSTAR also benefits from the utilization of construction and underwriting services provided by ACMAT Corporation, a construction services contractor. Specializing in surety bonds for the general building, specialty trade, environmental contractors and asbestos abatement contractors, ACSTAR's product offerings are limited to surety and are highly prone to competition and market cyclicality in this segment. This is partially offset by the company's considerable geographic diversity and management's approach to managing market cycles. During the most recent period of soft market conditions and intense price competition, ACSTAR demonstrated its resiliency and unwillingness to compete as premium volume declined substantially further corroborating management's adherence to disciplined underwriting and pricing strategies. However, since 2002, this trend has reversed as more favorable market conditions have led to vast opportunities at ACSTAR. According to management, new business prospects via increased submissions remain prevalent. At year end 2004, ACMAT Corporation maintains financial leverage (total debt & preferred stock to capital) of 27%, which is less than half the level reported in 1998. Over the years, ACSTAR has been the principal provider and source of funding that has enabled ACMAT the ability to repay its debt, reduce interest expense and lower its financial leverage. In addition, debt restructuring in 2002 helped to significantly lower interest expense and, in turn, accelerated principal payments. Proceeds from various private debt offerings have been used to facilitate an aggressive share repurchase program. A.M. Best anticipates that management may continue to repurchase shares but on a far more limited scale over the near-term. Share repurchases are also expected to be funded through available cash flow at ACMAT Corp. Best's Rating: A Outlook: Stable AIG Centennial Insurance Company (A.M. Best #: 00876 NAIC #: 34789) AIG Premier Insurance Company (A.M. Best #: 02123 NAIC #: 20796) RATING RATIONALE The following text is derived from the report of AIG Personal Lines Pool. Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, would retire as CEO, although he remained non-executive Chairman at the time. The retirement of Mr. Greenberg followed concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The company additionally announced that the CFO, Howard Smith, had taken leave and that the filing of AIG's 2004 10-K had been delayed. Mr. Greenberg was succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. Howard Smith was succeeded by Steven J. Bensinger. The ratings were lowered on May 1, 2005 and remain under review. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management bench-strength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. Rating Rationale: The rating applies to American International Group Inc. 's (AIG) twelve member personal lines pool, led by American International Insurance Company (AIIC), and is based on the consolidation of these entities. A.M. Best has downgraded the financial strength of most of American International Group, Inc.'s (AIG) (New York, NY) (NYSE:AIG) wholly-owned insurance subsidiaries to A+ (Superior) from A++ (Superior) following the company's disclosure on May 1, 2005 of the more complete findings of its extensive internal review. Additionally, the issuer credit ratings (ICR) assigned to the operating companies on April 6, 2005 have been downgraded to "aa-" from "aa+". The more pervasive level and extent of the internal control issues disclosed in the press release were beyond A.M. Best expectations, although the financial impact to shareholders' equity was not. The financial strength and ICR ratings remain under review with negative implications. The under review status was placed on the financial strength ratings of these companies on March 15 following the company's announcement that Maurice Greenberg stepped down as CEO and that the filing of AIG's 2004 10K had been delayed. The extent and number of accounting re-statements, as well as the disregard of accounting regulations and financial reporting to auditors, regulators and others made even more apparent in the current press release is the direct cause of the downgrade. Rating determinations have many components on both a qualitative and quantitative basis. The downgrade is not based on the absolute level of negative financial affect on shareholder's equity, which A.M. Best understands and believes is manageable on a GAAP accounting basis given the still formidable financial strength of AIG. Rather, the action reflects the fact that such a failure in internal controls, which is expected to result in an adverse opinion by AIG's auditors, is inconsistent with A.M. Best's highest rating category. While A.M. Best believes the new management team is actively addressing the control issues and is instituting a new culture of heeding those controls, absolute faith in financial reporting, particularly on a statutory basis, cannot be assumed at the present time. Further, it may take time to re-establish the confidence of the group's constituents. On Aug. 29, 2003 five personal lines companies were acquired by AIG from GE Assurance Holdings, Inc. and on Dec. 31, 2004, four of these companies were added to the AIG Personal Lines Pool. The former GE companies are directly owned by Lexington Insurance Co., an excess and surplus lines company and member of AIG's Domestic Brokerage Group, which also provides an unconditional and irrevocable guarantee to the companies. The rating reflects the advantages of being affiliated with American International Group, Inc., one of the largest property/casualty insurance organizations in the U.S. The benefits of AIG ownership is supported by the pool's broad geographic diversification, low-cost distribution channels and strategic partnering. Since its formation in 1996, the pool has benefited from the ongoing support and commitment of its parent through substantial reinsurance linkage, sharing of intellectual resources, the formation of a dedicated personal lines business unit and increased brand-building initiatives. American Home Assurance Co., a member of the AIG commercial lines pool, provides an unconditional and irrevocable guarantee to AIIC. In addition, the pool's utilization of multiple distribution channels enhances its market penetration and limits its reliance on any one distribution source. Finally, upgraded technological capabilities and a rapidly growing direct marketing program continue to enhance its already lowcost expense structure. Offsetting these positive factors are the historical variability in premium, underwriting income and net income, which have all improved in 2003 and 2004. However, the average combined ratio over the past five years has remained acceptable at 100.9%. The inclusion of the GE companies acquired by AIG should prove beneficial going forward as their underwriting performance in 2004 has produced an underwriting profit. Capitalization is adequate for the rating level, although growth in premiums and liabilities have outpaced surplus appreciation in recent years. The pool has historically maintained elevated underwriting and investment leverage relative to its personal lines peers. However, this aggressive leverage is mitigated by the financial strength and flexibility of AIG, its strong balance sheet, outstanding profitability and excellent capital formation capability, and the explicit support provided to the personal lines pool. Other negative factors include very competitive market conditions and increasing, but still somewhat modest, brand-name recognition. These factors are tempered by AIG's expense advantage and its extensive advertising campaign, effectively enhancing AIG's ability to compete and increasing consumer awareness. Best's Rating: A+ pu Implication: Negative AIU Insurance Company (A.M. Best #: 02389 NAIC #: 19399) American Home Assurance Company (A.M. Best #: 02034 NAIC #: 19380) American Internat Specialty Lines Ins Co (A.M. Best #: 03535 NAIC #: 26883) American International Insurance Company (A.M. Best #: 03641 NAIC #: 32220) American International Pacific Ins Co (A.M. Best #: 02359 NAIC #: 23795) Birmingham Fire Insurance Company of PA (A.M. Best #: 02349 NAIC #: 19402) Commerce and Industry Insurance Company (A.M. Best #: 04000 NAIC #: 19410) Granite State Insurance Company (A.M. Best #: 02360 NAIC #: 23809) Illinois National Insurance Company (A.M. Best #: 02361 NAIC #: 23817) Insurance Company of State of PA (A.M. Best #: 02035 NAIC #: 19429) Landmark Insurance Company (A.M. Best #: 03756 NAIC #: 35637) Lexington Insurance Company (A.M. Best #: 02350 NAIC #: 19437) National Union Fire Ins Co Pittsburgh PA (A.M. Best #: 02351 NAIC #: 19445) New Hampshire Insurance Company (A.M. Best #: 02363 NAIC #: 23841) RATING RATIONALE Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, will retire as CEO, although he remains non-executive Chairman. Mr. Greenberg will be succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. The company additionally announced that the CFO, Howard Smith, has taken leave and that the filing of AIG's 2004 10-K has been delayed. Howard Smith will be succeeded by Steven J. Bensinger. The retirement of Mr. Greenberg follows concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The vast majority of AIG's major insurance subsidiaries have held financial strength ratings of A++, A.M. Best's highest rating, for many years. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of two top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management benchstrength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. The following text is derived from the report of American International Group. Rating Rationale: The rating of the eleven members of the American International Group (AIG) Commercial Lines Pool, led by National Union Fire Insurance Company of Pittsburgh, Pa., and certain strategic affiliates is based on the consolidated operating performance of AIG's domestic property / casualty insurance group, which includes the operating results of the following companies: the AIG Commercial Pool; the AIG Personal Lines Pool; the Lexington Insurance Pool; the Hartford Steam Boiler Group; majority-owned Transatlantic Holdings, Inc.; and majority-owned 21st Century Industries. Each of the aforementioned Pools/Groups are separately rated. A.M. Best downgraded the financial strength of most of American International Group, Inc.'s (AIG) (New York, NY) (NYSE:AIG) wholly-owned insurance subsidiaries to A+ (Superior) from A++ (Superior) following the company's disclosure on May 1, 2005 of the more complete findings of its extensive internal review. Additionally, the issuer credit ratings (ICR) assigned to the operating companies on April 6, 2005 have been downgraded to "aa-" from "aa+". The more pervasive level and extent of the internal control issues disclosed in the press release were beyond A.M. Best expectations, although the financial impact to shareholders' equity was not. The financial strength and ICR ratings remain under review with negative implications. The under review status was placed on the financial strength ratings of these companies on March 15 following the company's announcement that Maurice Greenberg stepped down as CEO and that the filing of AIG's 2004 10K had been delayed. The extent and number of accounting re-statements, as well as the disregard of accounting regulations and financial reporting to auditors, regulators and others made even more apparent in the current press release is the direct cause of the downgrade. Rating determinations have many components on both a qualitative and quantitative basis. The downgrade is not based on the absolute level of negative financial affect on shareholder's equity, which A.M. Best understands and believes is manageable on a GAAP accounting basis given the still formidable financial strength of AIG. Rather, the action reflects the fact that such a failure in internal controls, which is expected to result in an adverse opinion by AIG's auditors, is inconsistent with A.M. Best's highest rating category. While the new management team is actively addressing the control issues and is instituting a new culture of heeding those controls at the highest levels, absolute faith in financial reporting, particularly on a statutory basis, cannot be assumed at the present time. Further, it may take time to re-establish the confidence of the group's constituents. The rating continues to reflect AIG's positive operating performance, specialty underwriting focus, and recognized global leadership position within its select and highly specialized market segments, particularly management liability (including directors and officers liability), commercial umbrella, environmental coverages and excess and surplus lines. The nation's largest underwriters of commercial and industrial coverages, AIG is widely recognized in the broker community for its unique and highly innovative product offerings, substantial risk management and service capabilities, as well as its ability to provide high coverage limits and broad global capacity. AIG also benefits from its profit center approach and strong broker relationships. Through its extensive overseas network and full array of commercial products, AIG can accommodate most of its clients' global insurance needs. Finally, the group maintains a high-quality investment portfolio and a conservative net limit risk profile that minimizes AIG's exposure to potentially large losses. Partially offsetting these strengths is the uncertainty associated with AIG's ongoing exposure to asbestos and environmental (A&E) liabilities. Despite these uncertainties, A.M. Best believes that AIG's exposure to A&E claims is very manageable given its relatively lower market share of exposed policies, greater utilization of reinsurance and extremely strong earnings generation. The group also maintains a sizeable amount of stacked capital with affiliated investments equal to approximately one-third of its capital base. A.M. Best believes AIG's long-term growth and profitability prospects continue to be favorable given its quality management operating teams, franchise value, product innovation, specialized underwriting expertise and use of high-quality reinsurance. Financial flexibility and access to capital markets is afforded by its ultimate parent-American International Group, Inc., a globally diversified leader in the insurance and financial services industries. Best's Rating: A+ pu Best's Rating: A+ gu Implication: Negative Implication: Negative American Feed Industry Ins Co RRG , Inc (A.M. Best #: 10730 NAIC #: 44202) RATING RATIONALE Rating Rationale: The rating reflects American Feed Industry Insurance Company's (AFIIC) strong capitalization, improved operating performance, historically low loss ratios, and a high member retention rate. The rating further reflects the company's proven underwriting expertise in its niche marketplace. Partially offsetting these positive factors, is the fluctuation in premium volume, variability in operating results, and a gradual decline in reserve redundancies over the past five years. Management has taken measures to exit all lines of business not related to liability coverages for the feed industry in an effort to generate increased profitability and operating stability. The company had made some efforts in the past to expand its offerings, however, at this point, management is focused on retaining risks on its core businesses, which are primary and excess product and general liability coverage for the feed industry. On June 30, 2003 American Feed sold its 100% ownership stake in American Agri-Business Insurance Company to ARMTech Holdings, Inc. Current market conditions have afforded American Feed Industry Insurance Company continued growth within their niche. It has maintained consistent surplus levels over the last five years and adheres to a very conservative investment strategy. The management team has numerous years of insurance industry experience and is highly respected in the feed industry. Best's Rating: A- Outlook: Stable American Road Insurance Company (A.M. Best #: 00152 NAIC #: 19631) RATING RATIONALE Rating Rationale: The rating recognizes TARIC'S excellent capitalization level, history of positive operating performance, conservative reserve practices and effective management of exposures. Over the past five years, return on surplus has averaged 19.3%, while capital and surplus levels have grown at a compound rate of 47.0% through the accumulation of net profits. Partially offsetting these positive rating factors is A.M. Best's concern regarding the operations and profitability of TARIC's ultimate parent, Ford Motor Company, and its potential impact on the operations of its captive. An additional offsetting rating factor is the moderate amount of credit risk assumed by TARIC with placement of reinsurance to an offshore affiliate. Although its ceded leverage is well above that of its peer companies, nearly all of its ceded reserves are backed by a trust account with TARIC named as the sole beneficiary. Best's Rating: A- Outlook: Negative Armed Forces Insurance Exchange (A.M. Best #: 03240 NAIC #: 41459) RATING RATIONALE Rating Rationale: The rating reflects Armed Forces Insurance Exchange's (AFIE) adequate capitalization, solid balance sheet liquidity and long standing history of providing homeowners and inland marine insurance to the preferred-risk segment of the military market. Partially offsetting the positive rating factors is a continued deterioration in operating performance, geographic exposure concentration and elevated expense ratios. Despite management's detailed strategic plan and implementation of corrective actions to improve profitability and curtail the loss of surplus, the outcome of these measures remains uncertain. Accordingly, over the long-term a large degree of uncertainty exists with regards to the stability of current risk-adjusted capitalization and the impact that catastrophe events will have on projected performance. Although surplus has continued to decline, the company's capitalization remains adequate as reflected in its conservative leverage position. The Exchange maintains a competitive advantage due to its high business retention and direct response distribution system that results in minimal commission costs. The rating further reflects AFIE's considerable reinsurance protection with high-quality carriers which reduces its relatively high gross probable maximum loss from a severe event to a manageable level. Offsetting these positive factors is AFIE's continued poor operating performance and inherent exposure to frequent and severe weather related events. During the latest five year period, operating returns steadily declined due to severe weather related events, increased mold claims, overall historical rate inadequacy and costs incurred for system development. As a result, five year average pre-tax operating returns on revenue and equity are negative and compare unfavorably to the property lines industry composite. In addition, AFIE's earnings are impacted by its geographical exposure concentration with subsequent susceptibility to weather-related events, as most military establishments are located in coastal regions. The company is further challenged by a shrinking target market associated with the downsizing of the country's active military force and inability to significantly change its geographic profile due to its specialized market niche. In response, the company has implemented aggressive corrective actions which include significant rate increases, stricter underwriting guidelines, improved technology capabilities and an expansion of AFIE's eligibility criteria to include certain civilian employees of the Department of Defense. In an attempt to offset its catastrophe exposure, the company is focusing on products with less catastrophe exposure such as inland marine and personal auto, in conjunction with spreading its risk to non-coastal military installations. Best's Rating: A- Outlook: Negative Chicago Title Insurance Company (A.M. Best #: 04645 NAIC #: 50229) Fidelity National Title Insurance Co (A.M. Best #: 11977 NAIC #: 51586) Security Union Title Insurance Company (A.M. Best #: 11908 NAIC #: 50857) Ticor Title Insurance Company (A.M. Best #: 11918 NAIC #: 50067) RATING RATIONALE The following text is derived from the report of Fidelity National Financial Inc. Rating Rationale: This rating reflects the group's solid capitalization, favorable operating results and strong market profile as the largest title insurance group in the United States. These positive rating factors are somewhat offset by the group's challenge to manage future economic cycles, inherent risks with managing significant premium growth in recent years, and increased debt leverage at the parent holding company on a consolidated basis. The group's rating outlook is based on Fidelity's solid capitalization, favorable operating earnings and leading market position. The group's positive rating factors are derived from the franchise value of their leading brands Fidelity National Title Insurance Company (FNTIC) and Chicago Title Insurance Company (CTIC). The CTIC business complements FNTIC's predominantly residential title book of business with commercial title products. In addition, management's disciplined approach focusing on underwriting while minimizing revenue and earnings volatility through cost mitigation efforts and geographic and service diversification has allowed the group to realize excellent operating results in recent years. Negative rating factors include the susceptibility of the group's underwriting revenue and profitability to fluctuating interest rate levels, and a changing legal and regulatory environment which could potentially have a generally negative impact on the title industry. The group has inherent market and execution risks associated with managing significant premium growth through acquisitions and organic growth related to the surge in refinancing activity in recent years, along with rapidly appreciating real estate markets. Additionally, debt/capital ratios at the parent, FNF, increased significantly in 2005 primarily due to the payment of an extraordinary shareholder dividend. However, FNF has shown good experience in managing debt. Additionally, the group has an excellent record of managing economic cycles as evidenced by the favorable operating results over the last five years. Best's Rating: A- g Outlook: Stable CIM Insurance Corporation (A.M. Best #: 02197 NAIC #: 22004) Integon General Insurance Corporation (A.M. Best #: 02459 NAIC #: 22780) Integon National Insurance Company (A.M. Best #: 02387 NAIC #: 29742) Integon Preferred Insurance Company (A.M. Best #: 11650 NAIC #: 31488) MIC General Insurance Corporation (A.M. Best #: 02669 NAIC #: 38660) MIC Property and Casualty Insurance Corp (A.M. Best #: 02652 NAIC #: 38601) Motors Insurance Corporation (A.M. Best #: 00654 NAIC #: 22012) National General Insurance Company (A.M. Best #: 03366 NAIC #: 23728) New South Insurance Company (A.M. Best #: 00698 NAIC #: 12130) RATING RATIONALE The following text is derived from the report of GMAC Insurance Group. Rating Rationale: The rating reflects GMAC Insurance Group's (GMACI) excellent stand-alone capitalization, consistently solid operating results, well-established market presence as one of the top 35 property/casualty insurers in the United States and leading position as a provider of extended service contracts. As a member of General Motors (GM), GMACI's positive rating factors are somewhat offset by the significant challenges and intense competitive environment the ultimate parent company faces in the automobile industry. Additional negative factors at GM include its high fixed cost structure, large unfunded retiree medical obligations, as well as its pension and healthcare burden. The rating outlook is based on the accelerating deterioration of GM's financial performance and the potential burden on the insurance operations. GMACI's positive rating attributes are derived from management's focused operating strategy, extensive product knowledge, diversified product offerings and multiple distribution channels. Capitalization is reflective of reasonable underwriting leverage and nominal exposure to a catastrophic event. The group has consistently generated capital through operating earnings reflective of disciplined underwriting, an efficient expense structure and a steady stream of investment income. Through the affiliation with General Motors, the group benefits from the extensive penetration of GM dealerships, as well as GMAC's brand name recognition, widespread marketing network and direct sales support. In addition, this rating reflects the group's diversification outside traditional GM-related businesses, particularly its wellestablished presence in the non-standard automobile market through the GMAC personal lines business. Additional offsetting rating factors include the group's elevated investment leverage due to its significant common stock exposure, and its recent adverse loss reserve development partially attributable to foreign currency movements, rising loss costs and weather-related events. Prior to 2003, surplus losses were driven by the unfavorable performance of the equity portfolio and parental dividends. Although GMACI's common stock portfolio has rebounded in recent years, investment leverage remains high with common stocks comprising approximately 95% of surplus at year-end 2004. Further, a portion of the group's business, extended warranty and non-standard automobile, is exposed to downturns in economic conditions. This rating applies to Motors Insurance Corporation, its fourteen reinsured subsidiaries and affiliates, and is based on the consolidated financial results of these companies. Best's Rating: A- r Outlook: Negative Countryway Insurance Company (A.M. Best #: 03206 NAIC #: 10022) RATING RATIONALE Rating Rationale: The rating reflects the company's solid capitalization, consistent improvement in the underwriting results, and conservative investment income strategy. The company's 5-year overall earnings rate of return ratios exceeded the industry's private passenger auto and homeowners composite averages and the company's underwriting results, as measured by the combined ratio, also compared favorably. These positive rating factors are partially offset by the company's elevated underwriting leverage, above average expense ratio, and recent adverse loss reserve development. The expense ratio has gradually declined in recent years, however. The rating outlook is based on the company's solid capital position, the expectation of continued favorable earnings, and operating synergies with its parent company, United Farm Family Mutual. The company's positive rating factors are derived from its local market knowledge and competitive position as a leading writer of farm-related businesses in the Northeast. Operating profits have been posted in each of the last five years, driven by solid investment income generation. In addition, the company benefits from the operational support of its parent. Negative rating factors include underwriting losses, which were adversely influenced by claim frequency and severe weather activity, and a high expense ratio. However, the company has emphasized the application of tight underwriting standards and is utilizing the expertise of its parent's actuarial department to ensure rate adequacy. Consequently, with the close attention given by management coupled with firm market conditions, underwriting performance improved in recent years. Additionally, the company's recent expense position has benefited from cost saving strategies with its parent. Best's Rating: A- CPA Mutual Insurance Co of America RRG (A.M. Best #: 11319 NAIC #: 10164) RATING RATIONALE Rating Rationale: This rating reflects the company's strained level of risk-adjusted capitalization due to adverse loss reserve development, the deterioration in policyholders' surplus and the significant dependence on reinsurance. The rating also recognizes the company's volatile operating results, high common stock leverage, and concentration of risk as the company provides professional liability insurance for certified public accountants. Partially offsetting these negative factors are the benefits to the company derived from its relationship with CPAmerica International, one of the largest networks of accounting firms in the United States, particularly through geographic and name recognition among its targeted sector of small sized firms. Also, the variety of services provided through its longstanding association with CPAmerica and management's objective of providing low cost coverage for its members has enabled the company to maintain high policyholder retention. The rating also acknowledges the measures designed to improve operating performance including the adherence to strict underwriting guidelines and risk management initiatives, non-renewal of poor Outlook: Stable performing accounts, a refocus on its niche of smaller sized accounts, and increased rate structure including the elimination of several credits. The outlook is based on the continued uncertainty regarding loss reserve adequacy and future operating performance. Best's Rating: B Outlook: Negative Independence Casualty Insurance Co (A.M. Best #: 10088 NAIC #: 11984) RATING RATIONALE The following text is derived from the report of Charter Insurance Group. Rating Rationale: This rating is based on the consolidated results of Atlantic Charter Insurance Company (Atlantic) and its 100% reinsured affiliates, Endeavour Insurance Company (Endeavour) and Independence Casualty Insurance Company (Independence). The rating reflects the group's excellent operating results and strong capitalization while recognizing management's disciplined underwriting approach and long standing expertise in the Massachusetts workers' compensation marketplace. Offsetting these factors is the group's vulnerability, as a single state mono-line insurer, to adverse developments in the economic and regulatory environment. The outlook is supported by the group's track record of consistently strong operating income, favorable underwriting results and solid capital position. The rating also considers the benefits associated with Charter's proactive loss control and claims management program, which better aligns Charter with its clients, strengthening business relationships while affording better overall underwriting results. Over the past fourteen years Charter has maintained its market share in the field of long-term care, and has successfully expanded its focus to other markets particularly, hospitals, auto-dealers, plastic manufacturers, precision equipment manufacturers, tool and die, clothing manufacturers, high-tech firms and home health care businesses. These other classes now account for more than 75% of the total book of business. The group has also positioned itself for further growth through the development of strong broker relationships and has chosen to participate in the Mass voluntary direct assignment carrier (VDAC) market in lieu of the assigned risk pool. Finally, the group has also gained additional underwriting flexibility through its formation of Endeavour and Independence, which allows the group rate flexibility when writing business. Best's Rating: A r Outlook: Stable Medical Mutual Insurance Company of ME (A.M. Best #: 01757 NAIC #: 36277) RATING RATIONALE Rating Rationale: The rating reflects Medical Mutual Insurance Company of Maine's (MMIC) adequate risk-adjusted capitalization, leadership position within the medical professional liability markets in which it operates and its high policyholder retention rate. The rating also recognizes the actions taken by management to restore operating profitability through continued premium rate increases, scheduled credit and discount decreases. These positive rating factors are offset by the recent deterioration in operating profitability and risk-adjusted capitalization, driven by continued adverse loss reserve development primarily in the most recent accident years, and surplus' ongoing susceptibility to fluctuating equity values. The rating outlook will remain until reserve development stabilizes and operating performance improves and is sustained over the near-term. Best's Rating: B++ Outlook: Negative Pennsylvania Lumbermens Mutual Ins Co (A.M. Best #: 00756 NAIC #: 14974) RATING RATIONALE Rating Rationale: The rating reflects Pennsylvania Lumbermens Mutual Insurance Company's (PLM) very strong capitalization, favorable operating results, and the company's established market presence providing multiple line coverages to the lumber, woodworking, and building material industries. Somewhat offsetting these strengths are the company's unsatisfactory operating results reported in soft market conditions and relatively elevated common stock leverage. The outlook reflects the group's solid balance sheet strength and good position within its niche markets. Driven by management's corrective actions that were implemented several years ago and benefits realized from hard market conditions, the company's overall operating performance has improved in consecutive years since 2000. The company has aggressively focused on garnering adequate rate per exposure unit by underwriting on an individual account basis. Although PLM's operating results have rebounded noticeably, operating results in years prior to 2001 trailed industry averages. Impacting PLM's underwriting results in prior years were extremely competitive market conditions, frequent and severe weather related losses, large fire losses, and state mandated rate decreases in its workers' compensation line of business. Additionally affecting the company's operating results in 2000 and 2001 were losses incurred in non-core businesses such as participation in external reinsurance programs (now discontinued) and involuntary FAIR (Fair Access to Insurance Requirements) plans. Absent of these one-time charges, the improvement in the company's results is magnified in these respective years. While A.M. Best recognizes that PLM's improved underwriting results are in large part a function of the initiatives deployed by management during the last several years, there are concerns that underwriting results could be impacted in the intermediate-term based on the historically susceptible fundamentals of the company's specialty market niche during soft market conditions. Best's Rating: A Pharmacists Mutual Insurance Company (A.M. Best #: 00320 NAIC #: 13714) RATING RATIONALE Rating Rationale: The rating reflects the company's solid capitalization, historically favorable underwriting results, efficient direct marketing strategy and the benefits derived from its enduring reputation and leadership position as the largest independent insurer of pharmacists in the United States. Offsetting these positive rating factors is the company's substantial adverse prior year loss reserve development over the past five years, above average growth, below-average historical operating returns and the recent variability in underwriting and operating results. On the other hand, Pharmacists Mutual should benefit from several actions taken by management in 2004 related to the reorganization of the company's claims operations, which could ultimately lead to more adequate loss reserves going forward. The company's rating outlook is based on the stabilization of reserves and the benefits to be derived from these corrective actions. Pharmacists Mutual has specialized in providing commercial and professional liability coverage for pharmacies and pharmacy owners, primarily in the central region of the United States, for almost 100 years. Its positive rating attributes are derived from the company's niche underwriting expertise, conservative underwriting and investment philosophies and excellent geographic diversification. Consistently high customer Outlook: Stable retention ratios in recent years further demonstrates Pharmacists' solid standing within this specialty market. The company also benefits from overall market hardening and the company's ability to increase rates, apply more stringent terms and conditions in conjunction with lowering policyholder dividends. The company's solid capitalization reflects its low, although increased, underwriting leverage, high-quality bond portfolio and utilization of highly-rated reinsurers. In addition, the company benefits from its successful direct marketing strategy that has created built-in expense advantages. Much of the adverse loss reserve development reported in recent years has largely occurred within its commercial multi-peril, workers' compensation and personal auto liability lines. In addition, underwriting results also have been adversely affected by the company's expansion in its home health care target market, which has produced loss ratios much higher than its home medical equipment and core pharmacy markets. The company's weaker than historical loss experience has also led to higher reinsurance costs and the need to pursue more adequate premium rates. Furthermore, in 2003, the company settled a highly-publicized, class action lawsuit (the Courtney case) involving an insured who intentionally diluted various compounded drugs over a number of years. Due to the unusual nature of this lawsuit, the settlement amount of $6 million (net of reinsurance) was accounted for as a write-in item and was not included in underwriting results reported in 2003. Best's Rating: A Outlook: Stable Savers P & C Ins Co (A.M. Best #: 00524 NAIC #: 16551) Star Insurance Company (A.M. Best #: 00695 NAIC #: 18023) RATING RATIONALE The following text is derived from the report of Meadowbrook Insurance Group. Rating Rationale: This rating is based upon the consolidated results of Meadowbrook Insurance Group and applies to its domestic property and casualty companies: Star Insurance Company, Savers Property and Casualty Insurance Company and Williamsburg National Insurance Company. The rating reflects Meadowbrook's solid capitalization, continued underwriting and operating improvements through 2004, and the group's recognized expertise in the alternative risk market and program business arena. The rating also recognizes the significant improvement in 2004, Meadowbrook's earnings prospects in 2005 and the lessened reserve development from prior year reserves. The rating also takes into consideration the manageable level of holding company financial leverage at the group's parent, Meadowbrook Insurance Group, Inc. These positive factors are offset by the poor operating results reported by Meadowbrook prior to 2002, its consequential impact on capitalization and leverage during that period and the fact that all of Meadowbrook's capital formation in recent years was derived from external capital raising, versus organically via retained earnings. There is also some uncertainty regarding the long-term profit outlook for the new business written, including business written as insurance programs rather than managed programs. The rating outlook reflects A.M. Best's current views that management has effectively identified and developed plans which has enabled the group to progress to levels reported over the past two years. A.M. Best will continue to closely monitor the results of the operating companies, scrutinizing the continued enhancement of operational profitability and the sustainability of those results. Over the years, capitalization has been bolstered by Meadowbrook's successful offering of common stock in 2002, the issuance of trust preferred securities, and healthy operating earnings as reported in 2004. This was only the second time since the end of 1998 that net income was generated. Much of the capital raised in recent years was, in large part, to support growth efforts and to bolster the balance sheet of the group's lead company, Star Insurance Company. The group's ability to fund parent company debt obligations through the income of its non-regulated subsidiaries, including income generated from outside and intercompany management fees, enhances the overall financial condition of the parent company and relieves pressure that might otherwise be borne by its insurance subsidiaries. Having this flexibility allows for greater potential capital formation at the subsidiary insurance company level. Additionally, the replacement of the group's credit facility facilitated the pay off of the group's former term loan while the new revolving line of credit adds additional flexibility for short-term working capital needs. Meadowbrook reported improved calendar year underwriting results for the fourth straight year. Management attributes much of this to numerous underwriting and operational initiatives introduced since 2000. Among these initiatives were increased rate levels, the discontinuation of poorly performing programs, a focus on previously managed (versus new) programs that have long-term histories of generating underwriting profits. Over the years, management discontinued approximately 20 select programs which accounted for a disproportionate share of incurred losses. Further, corrective actions have been aimed at stabilizing loss reserve development. This initiative includes positioning the group's loss reserves nearer to the high-end of the actuarial range. Meadowbrook Insurance Group maintains a strong market position as a provider of risk management services to industry associations, affinity groups and individual businesses. The group continues to benefit from improved market conditions and reduced competition as several players in this arena have exited the market - either voluntarily or involuntarily. The rating also acknowledges the prudent risk selection process and effective implementation of loss control practices, which have enabled the group to generate strong comparative results on continuing business while maintaining a high retention percentage. A.M. Best also recognizes that a portion of the significant prior loss reserve increases represented a material change in management's reserving philosophy. While there have been significant measures taken to improve all aspects of the Group's operations, it is recognized that these initiatives will continue to gradually impact results over the near term to the extent that underwriting profits are generated, which has not occurred recently on a calendar year basis. The improved underwriting results over the past three calendar years have been somewhat tempered by areas of additional reserve increases intended to address prior accident years on isolated discontinued and terminated programs. It is anticipated that further stabilization on the underwriting side will lead to profitability that further enhances operating performance on a consistent basis. However, despite the underwriting losses in 2003 and 2004, management feels that future adverse development has been effectively contained. A.M. Best continues to view the reserve position with some uncertainty going forward, particularly because a portion of the continued, though moderating, adverse development over the last two years that was attributable to some of the discontinued programs. Nevertheless, A.M. Best believes the recent improvements in the group's financial and operating parameters represent a stabilization of the group's financial condition. Best's Rating: B++g Outlook: Stable Senior Citizens Mutual Insurance Co (A.M. Best #: 10835 NAIC #: 44172) RATING RATIONALE Rating Rationale: On June 2, 2005, the Second Judicial Circuit Court in Leon County, Florida, signed the Consent Order placing Senior Citizens Mutual Insurance Company ("Senior Citizens") in receivership for purposes of liquidation. Senior Citizens consented to the appointment of the Florida Department of Financial Services as the court appointed Receiver of Senior Citizens. Senior Citizens previously consented to be placed into rehabilitation on May 9, 2005; however, the Receiver determined that a successful rehabilitation of the company was not possible. Senior Citizens is a Florida domestic insurer that is licensed to write business in 20 states. The company specializes in other liability and commercial multi-peril coverage for senior citizens' housing communities and had approximately 15 policies in force as of May 2005. The company also reinsures approximately 600 policies written directly by two other unaffiliated companies. Senior Citizens' home office is located in Miami, Florida. In accordance with the terms of the Liquidation Order, all policies are cancelled 11:59 p.m. on July 1, 2005, unless otherwise cancelled earlier in the normal course of business. State Farm General Insurance Company (A.M. Best #: 02478 NAIC #: 25151) RATING RATIONALE Rating Rationale: This rating reflects State Farm General's role as a member of the State Farm Group, parental support and improved operating results in recent years. Partially offsetting these factors has been the company's historically lackluster operating performance and geographic business concentration in California, which exposes its operating results to potential catastrophic loss accumulation, regulatory mandates and competitive market pressures. Nonetheless, the rating outlook is based on the improved operating results and favorable stand-alone risk-adjusted capitalization. State Farm General's operating results improved recently over prior years due to tightened underwriting guidelines and pricing increases associated with firm market conditions. As a result of the company's improved operating performance and strong investment income, capitalization improved in 2003 and 2004. The parent company, State Farm Mutual Automobile Insurance Company, displayed its commitment to this separately capitalized California entity by funding a $200 million surplus note issued by State Farm General during 2002. This parental support followed the deterioration in surplus in 2000 and 2001 driven by increased loss severity. In addition, the parent provides significant catastrophe reinsurance protection. Partially offsetting these factors has been the company's historically lackluster operating performance and geographic business concentration in California, which exposes its operating results to potential catastrophic loss accumulation, regulatory mandates and competitive market pressures. Operating performance prior to 2003 was unfavorable due to increasing loss costs and a corresponding increase in average severity coupled with market share pricing decisions. To a smaller extent, results also reflected the impact of mold related losses due to increased public awareness. As a result, State Farm General posted significant operating losses with sizeable surplus declines and a corresponding increase in premium leverage. With a predominant property book of business, State Farm General's gross exposure to a 250-year earthquake is in excess of its capitalization with a net probable maximum loss representing approximately 15% of risk-adjusted surplus. Best's Rating: B++ Outlook: Stable