incurred cost electronically (ice) manual

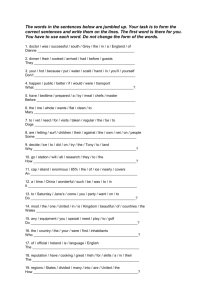

advertisement