Inflation Targeting in South Africa: A VAR Analysis

advertisement

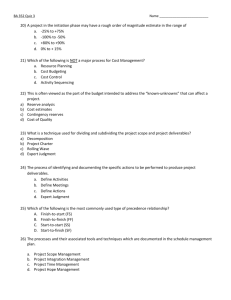

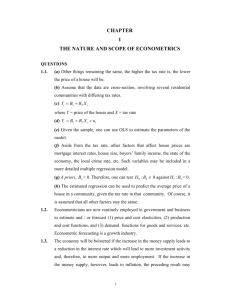

INFLATION TARGETTING IN SOUTH AFRICA: A VAR ANALYSIS G Woglom* Abstract T he first part of the paper analyses CPI inflation targeting in an open economy context. Inflation targeting makes the exchange rate less flexible in response to foreign shocks and thus lessens the automatic stabilisation provided by flexible exchange rates. The second part uses VAR techniques to study the relative frequencies of different kinds of shocks impinging on the South African, New Zealand and Canadian economies. The results suggest that South Africa is not a good candidate for an inflation target relative to the other two countries because of the relative importance of foreign shocks and of the weak linkage between monetary policy and inflation. 1. Introduction A number of industrial countries have recently adopted inflation targets with an apparent degree of success (see Bernanke and Mishkin (1997)). This apparent success has led some to speculate that inflation targets might also be desirable for countries at somewhat lower stages of economic development (see Masson et al (1997)), including South Africa. The idea of an inflation target for South Africa has, in fact, drawn growing support as a practical response to the increasing difficulty of monetary targeting with a liberalised capital account (see Casteleijn (1999), Stals (1999) and Mboweni(1999)). This paper looks at the historical evidence to judge whether South Africa is a good candidate for an inflation target. In particular, the South African evidence is compared to the evidence from Canada and New Zealand, two countries that have adopted inflation targets in 1991 and 1990, respectively. The main conclusion of the paper is negative primarily for two reasons: 1) The exchange rate is highly volatile in South Africa, and some of this volatility appears to be stabilising the effects of external * Visiting Fulbright Scholar (University of the Western Cape), Department of Economics, Amherst College, Amherst, MA 01002, United States of America. Email: grwoglom@amherst.edu J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 1 shocks. Under inflation targeting, monetary policy would have to dampen these exchange rate movements which are affecting the consumer price index (CPI); 2) The linkage between monetary policy instruments and future inflation rates in South Africa is weak. As a consequence wide swings in policy instruments would be needed to fulfill an inflation target. The rest of the paper comprises the next three sections. In the first of these sections the complications of inflation targeting in an open economy are analysed. It is shown that inflation targeting has the disadvantage of making the exchange rate less flexible in response to shocks to the goods market. The subsequent section uses vector autoregression techniques to provide a description of the dynamic behavior of the South African economy and the Canadian and New Zealand economies for the period before their adoption of an inflation target. The performance of the South African economy is then compared to the pretarget performance of the other two economies with regard to the importance of the exchange rate and to the strength and predictability of the linkage between policy instruments and subsequent rates of inflation. The paper’s major conclusions are summarised in the last section. 2. The theoretical analysis monetary policy procedures 2.1 The traditional literature on inflation bias and nominal anchors Ever since Kydland and Prescott (1977) introduced the time inconsistency problem into macroeconomics, the analysis of monetary policy regimes has focused on two aspects of any rule or procedure (e.g., Rogoff (1985)): 1) The inflationary bias inherent in the rule or procedure and 2) the stabilisation properties of the rule or procedure. Thus discretionary monetary policy with the dual objectives of inflation and real output stabilisation is viewed as having the advantage of the greatest potential for stabilising all types of shocks, but the disadvantage of an inherent inflationary bias. The stabilisation advantage of totally discretionary policy, however, only exists to the extent that the central bank can use its discretion effectively to offset the effects of shocks. The disadvantage of the inflationary bias can be lessened by adopting a monetary policy rule aimed at a single nominal objective, e.g., the money stock, the inflation rate, or nominal GDP (although not the nominal interest rate). The most popular of the single nominal targets, or nominal anchors, is a CPI inflation target. Relative to discretion with dual objectives, inflation targeting has less of an inflationary bias. Inflation targets do, however, decrease the potential for active stabilisation, at least with regard to supply shocks.1 For demand shocks, both monetary policy based on an 1 In principle, it is possible to adopt an inflation target with no loss in stabilisation. Walsh (1995) has shown that “optimal” stabilisation can be achieved by writing a contract with an independent central bank that imposes an added cost to inflation. Svenson (1997) has shown that the same result can be achieved by 2 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) inflation target and on dual objectives will attempt to offset shocks to aggregate demand. With supply shocks, however, inflation targeting mandates a totally nonaccommodative response that maintains the inflation rate, whereas a fully discretionary policy response may find it optimal to accommodate at least some of the supply shock. While the advantage of nominal targets like the inflation rate is a reduction in inflationary bias, the extent of the reduction depends on how credible the target is. Recent discussions of credibility (see for example, Goodhart and Vinals (1994) and Debelle and Fisher (1994)) have focused on the transparency of the targeting procedure and the extent to which the procedure can make the central bank accountable for its actions.2 Greater transparency and accountability increase credibility, but they decrease a central bank’s flexibility in responding to unforeseen circumstances. The inflation targeting regimes that have been adopted, however, have tried to preserve at least some central bank flexibility. For example, the inflation targets that have been adopted specify that the target is to be met over long horizons (1-2 years) with substantial tolerance bands for acceptable inflation rates (2-3 percentage points). Finally, some countries have adopted explicit escape clauses, where the central bank can ignore the inflation target because of adverse consequences of achieving the target (e.g., hitting an inflation target in the face of an adverse supply shock; see Masson et al (1997) for a description of specific procedures). The variety of institutional procedures that have been adopted to provide flexibility under an inflation target has led some authors to describe inflation targeting as a policy framework rather than a policy rule (Bernanke and Mishkin (1997)). But surely there must be a tradeoff between the benefits of increased flexibility and the benefits from the inflation target. For example, long targeting horizons may make it more difficult to hold the central bank accountable for missing the target: was the target missed due to inappropriate central bank actions or to large subsequent shocks? Tolerance bands allow the central bank some discretion in how to respond to the current shock, but they thereby make the central bank’s response less predictable, and their actions become less transparent. More fundamentally, long horizons, tolerance bands, and escape clauses reintroduce an element of discretion into how actively the central bank pursues the nominal target. The benefits from inflation targeting in terms of transparency and accountability as well as in a reduction in inflationary bias, setting the inflation target sufficiently below the socially optimal inflation rate. The inflation targets that have been adopted have not used these methods, and consequently imply a loss in active stabilisation of supply shocks. 2 Accountability and transparency issues have led many (see for example Debelle and Fisher (1994)) to favor inflation targets over nominal GDP targets, in spite of the greater stabilisation potential of nominal GDP targets. J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 3 however, can only achieved if the targets place some constraint on central bank behavior. In summary, the traditional literature on targeting procedures implies that an inflation target is desirable when 1) monetary policy makers have little reputation for inflation stability, so that the inflationary bias of fully discretionary policy with multiple objectives is high and/or rising; 2) aggregate supply shocks are not an important source of instability, or 2’) monetary policy makers are ineffective in making discretionary changes in the policy instrument to offset the effects of shocks, and 3) the linkages between the monetary instrument and future inflation are sufficiently strong and predictable, so that targeting horizons can be short enough and tolerance bands narrow enough to substantially reduce the inflation bias. 2.1 Inflation targeting on open economies Most of the theoretical analysis of policy procedures and policy rules has been conducted in a closed economy context.3 An open economy, however, can make the analysis of the desirability of an inflation target significantly more complicated because of the distinction between the consumer price index (CPI) and the price of domestically produced goods. For simplicity, the CPI can be written as: CPE (1 )p / e, … (1) where P is the price of domestically produced goods. is the weight of imported goods in the CPI and e is the nominal exchange rate expressed as foreign currency per unit of domestic currency (with the foreign price level normalised to 1). This simple equation immediately implies a distinction between stabilising the inflation rate as measured by the price of domestically produced goods versus as measured by the CPI. This distinction is important when the central bank must change the exchange rate in order to stabilise the price of domestic goods and the level of output. For example, the distinction is not important in the case of shocks to the money market (e.g., an autonomous change in the velocity of money). Shocks to the money market affect both the price of domestic goods and the exchange rate by changing the level of aggregate demand. Therefore the central bank, by offsetting the effect of the velocity shock on aggregate demand, can stabilise both the exchange rate and the domestic price level, and therefore also the CPI. 3 The literature on time inconsistency and inflation bias has been extended to the open economy context (see Romer (1993)). Romer argues that the inflationary bias of discretionary policy should be smaller the more open the economy for two reasons: 1) the slope of the aggregate supply curve is likely to be steeper, so that a surprise inflation leads to a smaller increase in output, and 2) central bankers in open economies are likely to be more averse to surprise inflations because monetary induced inflations have the added cost of depreciating the currency 4 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) The distinction between the price of domestic goods and the CPI is important for goods market shocks, say an autonomous drop in export demand. The importance of this distinction is illustrated in the figures on the next page. These figures depict a simple textbook, ISLM version (e.g., Mankiw (1997)) of the Mundell Fleming model of a small open economy. The LM curve has a vertical slope because the demand for money is assumed to depend only on the price of domestic goods and the interest rate is determined by the world interest rate. In this simple model, a perfectly flexible exchange rate provides complete, automatic stabilisation of IS shocks. Notice, however, that while the depreciation of the currency completely offsets the effects of the IS shock on output and the price of domestic goods, the CPI still increases because of the rise in the local currency price of imported goods. Under a binding CPI inflation target, the central bank would have to enact a contractionary monetary policy to offset the increase in the CPI, as is illustrated in the bottom figure. The offsetting monetary policy leads to a net decline in the exchange rate, but also to a fall in output and the price of domestic goods, so that the net change in the CPI is zero. A comparison of the two figures shows that relative to a perfectly flexible exchange rate, CPI inflation targeting makes the exchange rate less flexible in response to external shocks. [Figures 1 and 2 About Here] Thus CPI inflation targeting partially abandons some of the stabilisation advantages provided by completely flexible exchange rates. It is important to note that the stabilisation advantage of flexible exchange rates is due to the automatic stabilisation of goods market shocks including external shocks, such as volatility in the demand for traded goods and country risk premia.4 It should be noted that at least one country, New Zealand, has attempted to deal explicitly with the potential problem of the linkage between the exchange rate and the CPI. New Zealand adopted an “escape clause” that allows the Reserve Bank of New Zealand to exclude the effects of changes in import prices due to significant changes in the terms of trade. And, in fact, this escape clause has been invoked on at least three occasions (see Mishkin and Posen (1997)). But escape clauses from changes in the terms of trade are another example of the tradeoff between maintaining flexibility while trying to achieve the benefits of an inflation target. CPI inflation targets will only provide benefits if they put some constraints on central bank behavior. Escape clauses can lessen, but not eliminate the loss in automatic stabilisation relative to perfectly flexible exchange rates. Thus considerations of an open economy add one more attribute for a good candidate for a CPI inflation target: 4) Automatic stabilisation from the exchange rate is unimportant either because IS shocks are unimportant, or because the central bank is currently not allowing the exchange rate to float freely. An increase in a country’s risk premia cause shifts in the LM curve as well as the IS curve, as the domestic interest rate increases. In this case, the central bank must use discretion to offset the shift in the LM curve so that the exchange rate can fall far enough to stabilise output and employment 4 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 5 A decision for South Africa to switch to inflation targeting would presumably be based on the judgement that the South African economy fulfills most if not all of the 4 attributes of a good candidate for an inflation target. To make judgments on these 4 key issues one must use the imperfect evidence provided by the historic performance of the South African economy. The historic evidence is imperfect because of the Lucas critique: changing the policy rule will affect the way people use past information to form expectations of the future (and, in particular, their expectations of future monetary policy, which is the whole point of adopting an inflation target). While the historical evidence on the dynamic behavior of the economy is imperfect, it is not irrelevant. In particular, a measure of the relative sizes of the shocks hitting the economy should be independent of the policy regime. In addition, one can also put the historic evidence in perspective by comparing the South African performance to the performance of other countries immediately prior to their adoption of an inflation target. In particular, the pretarget experiences of Canada, which adopted an inflation target at the start of 1991, and of New Zealand, which adopted an inflation target at the start of 1990, seem relevant. While clearly Canada, New Zealand and South Africa are at different stages of economic development, they are all relatively open economies (with exports 25% of GDP in South Africa and 33% in New Zealand and 37% in Canada) with some similar features (manufacturing is about 25% of GDP in Canada and South Africa and 18% in New Zealand). Consequently, it is useful to compare the current South African evidence relating to the key issues concerning the desirability of inflation targeting to the pretarget evidence for Canada and New Zealand. 3. The historical evidence for South Africa, Canada and New Zealand In this section, vector autoregressions (VARs) are used to provide historic evidence on the dynamic interaction of the key variables of interest. 3.1 Empirical methodology A VAR model is a reduced form of an unidentified structural model, which provides a simple description of the dynamic behavior of the economy. Any VAR can be written as: … (2) X t B(L)X t t X , where X is a vector of the variables of interest. In this case, one is interested in the dynamic interaction of a monetary instrument, M, the price level as measured by the CPI, the level of real GDP, Y, and the nominal exchange rate, e. B(L) is a matrix of 6 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) coefficients; L is the lag operator; X is a vector of VAR shocks which are assumed to be i.i.d.. The VAR shocks will in general be linear combinations of all of the structural shocks (i.e., external shocks to the goods market, velocity shocks, technology shocks, etc.). The estimated coefficients in B(L) and the estimated residuals allow one to draw inferences about 2 out of the 4 key issues (issues #3, and #4). For example, the estimates from the VAR can be used to infer the relative importance of automatic stabilisation in the economy, and in particular the nature of the structural shocks influencing the economy. The analysis depicted in Figure 1 suggests that in the simplest model, IS shocks (a structural shock) should have no influence on output but should cause an inverse relationship between shocks to the CPI (a VAR shock, CPI) and the exchange rate (a VAR shock, e). LM shocks should cause an inverse relationship between shocks to output and the exchange rate and also between shocks to the CPI and the exchange rate. Therefore, if automatic stabilisation is important, the correlation between the CPI and exchange rate shocks should be negative and the correlation between output and exchange rate shocks should be small or negative. If the exchange rate is less than perfectly flexible, then the correlations between output and exchange rate shocks and between CPI and exchange rate shocks (as is illustrated in Figure 2 for inflation targeting5) become ambiguous. In the case of a less than perfectly flexible exchange rate, the correlations will depend upon the relative frequency of IS and LM shocks. The greater the relative importance of IS shocks, the more likely are these correlations to be negative. Thus there are two ways one might observe negative correlations between the exchange rate shocks and the CPI and Y: 1) the exchange rate is flexible so that most IS shocks are being automatically stabilised; 2) the exchange rate is imperfectly flexible but the economy is being hit by a preponderance of LM shocks. Measuring the relative importance of lagged exchange rates for determining the CPI and Y can help to distinguish between these two cases. If automatic stabilisation from the exchange rate is important, then lagged exchange rates should not be an important determinant of Y, while they will be an important determinant of the CPI. In the case of imperfectly flexible exchange rates, lagged exchange rates should be an important determinant of Y, no matter what the relative frequency of IS and LM shocks. If there are a preponderance of LM shocks, one would expect that the lagged exchange rates would also be an important determinant of the CPI. If there are a preponderance of IS shocks, whose effects on the CPI are being fully (as is illustrated in Figure 2) or partially offset by monetary policy, then one would expect that lagged exchange rates 5 Figure 2 is illustrating the imperfect flexibility of the exchange rate under a CPI inflation target in which case IS shocks would cause zero correlation between shocks to the CPI and to the exchange rate. With even less flexibility in the exchange rate, so that the exchange rate doesn’t fall as far as e1, one would observe a positive correlation. J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 7 would not be an important determinant of the CPI. The results of this analysis are summarised in Table 1. The economic importance of a variable in a VAR equation can be measured in two ways: 1) by the size of the sum of the estimated coefficients, and 2) by the forecast error variance decomposition or FEVD. For example, the FEVD of the CPI measures the response of the CPI over time in response to a VAR shock to the CPI equation (i.e. CPI). The FEVD breaks down the variation in output over any horizon into the variation that is caused by the lagged values of all of the endogenous variables in the model. If one finds that most of the variation in CPI is due to lagged values of the CPI itself, and to lagged values of M and Y, this would suggest that lagged exchange rates are not important for explaining the variations in CPI. FEVD’s as measures of economic importance suffer from the fact that one must assume a causal ordering of the structural shocks (see Bernanke and Blinder (1992) for further discussion of the strengths and weaknesses of FEVDs). Unfortunately, the results may differ substantially depending on the assumed ordering. One can, however, present the FEVDs for various ordering assumptions to show their sensitivity to the ordering assumption.6 All the FEVD calculations reported in the paper list values at an 8 quarter horizon for two different orderings of the variables: 1) the exchange rate first: e, M, P, Y, and, 2) the exchange rate last: M, P, Y, e. Finally, the CPI equation in the VAR is also relevant for measuring the strength and predictability of the policy linkage and changes in inflationary bias. If there is a strong, predictable relationship between monetary instruments and future CPI inflation, then this equation should be estimated precisely and lagged changes in the monetary instrument should be economically important and statistically significant in explaining the CPI. 3.2 Data and diagnostics Data on the CPI, real GDP, the nominal exchange rate, and monetary policy instruments for South Africa were gathered from The South African Reserve Bank and Statistics South Africa, for Canada from the IMF’s International Financial Statistics (IFS) and Statistics Canada and for New Zealand from the IMF’s IFS. The available South African data are from the first quarter of 1979 (1979:1) to 1999:1. For Canada, the available data are from 1980:1 to 1998:3, and for New Zealand 1982:2 to 1998:3. The money supply used for South Africa and New Zealand was M3 and for Canada a 6 The causal orderings used in the paper are block recursive or Choleski decompositions. It is important to recognise that in general, the “true” structural model will not imply a block recursive ordering. It is assumed, however, that if the structural inferences don’t vary much with the ordering of the variables, then one has some hope that the inference would be roughly the same under the “true” structural model. Again, see Bernanke and Blinder (1992) for more discussion. 8 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) similarly broad measure was used, M2 plus deposits at institutions such as credit unions. The exchange rate for South Africa is the nominal effective exchange, whereas for Canada and New Zealand it is the US$ rate (although using a multilateral rate for Canada, like the C6, rate had little effect on the results). The interest rate is the 3-month Treasury bill rate for Canada and South Africa. A long enough time series for interest rates was not available for New Zealand from the IFS (and for reasons discussed below, interest rate data for New Zealand were not pursued). All variables are measured as natural logs with the exception of interest rates. Table 1: VAR results and the importance of automatic stabilisation Predictions: Automatic Stabilisation from e is important (bad candidate for CPI inflation targeting) COV ( ) 0, COV ( e Y ) small or lagged exchange rates unimportant for Y, lagged exchange rates important for CPI Automatic Stabilisation from e is unimportant (good candidates for CPI inflation targeting) CASE I (IS shocks more important) COV( e Y ) small or +, COV( e CPI ) small or + lagged exchange rates important for Y, lagged exchange rates relatively unimportant for CPI e CPI Case II (LM shocks more important): COV ( e Y ) 0, COV ( e CPI ) 0 lagged exchange rates important for Y, lagged exchange rates important for CPI COV is the covariance. Unit root tests were conducted for the full sample periods, and these tests suggested that first differencing of all variables except interest rates is necessary to provide stationary time series. First differencing transforms logs into growth rates, which have a natural interpretation: the first difference of the log of the CPI is the CPI inflation rate. From here on CPI will stand for the inflation rate; Y for the rate of real GDP growth, e the rate of nominal appreciation of the exchange rate, and M the rate of J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 9 money growth. Interest rates were not differenced because of their more modest “p” value for unit roots, and also because the Fisher effect implies that the nominal rate is already a function of the rate of inflation. More to the point, however, the interest rates were eventually dropped as measures of the monetary instrument because the sum of the coefficients on the interest rate in the inflation equations was consistently positive. Presumably, this reflects the Fisher effect and the problem of an uncontrolled “third variable” in the VAR methodology: Shocks that are not contained in CPI, Y and e cause an expectation of higher inflation which leads the central bank to raise the nominal rate. Therefore the positive coefficients reflect the influence of the third factor, not the effect of a change in monetary policy on inflation. The positive coefficient was robust to choice of time periods, interest rate (i.e., the bank rate for Canada), and also persisted when the real interest rate was substituted for the nominal rate. Table 2 presents the variance/covariance matrix for the detrended growth rates. For all countries data from two periods are presented. For South Africa, the full sample period is from the beginning of Chris Stals’ tenure as Govenor of the Reserve Bank of South Africa. The shorter period is the period since the first all-democratic election. For Canada and New Zealand the two periods are the periods prior to the adoption of an inflation target (the pertarget period) and the period since (the target period). The most striking aspect of the data is the tremendous volatility of the nominal variables in South Africa and pretarget New Zealand, most notably the volatility in the exchange rate. South Africa has relatively low volatility in real GDP growth (although this may be sensitive to the different sample periods), particularly in the comparison with New Zealand. Both countries with inflation targets show a decrease in the volatility of both nominal and real variables after the adoption of the inflation target. It is important to note, however, that a similar decrease in volatility was experienced by the industrial countries that didn’t adopt inflation targets (see Jonsson (1999)) 3.3 VAR evidence on automatic stabilisation Table 3 presents the VAR evidence from a 2 lag specification on the importance of automatic stabilisation from the exchange rate (a full set of VAR results is available from the author upon request). 7 In the table the covariances of the VAR shocks are 7 The Schwarz Bayes and Akaike criteria were not helpful in choosing lag lengths. For South Africa, the Schwarz Bayes statistic rose monotonically with lag length and the Akaike information criterion fell monotonically. Consequently the VARs were estimated with specifications of 2 and 4 lags. For South Africa, the 2 lag specification yielded higher “F” statistics for all equations with the exception of the exchange rate equation, which was statistically insignificant for either lag specification. Consequently, the results of the 2 lag model are used for the remaining analysis. The results in most cases were broadly similar. Finally, all VARs included a time trend and a constant term. 10 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) measured by correlations to make the covariances comparable across countries. The evidence for South Africa and for the pretarget periods in New Zealand and Canada seem to fit the three separate cases listed in Table 1. South Africa corresponds to the case where automatic stabilisation appears to be important: 1) The correlation of exchange shocks with CPI shocks is negative and large in absolute value and the correlation with Y is relatively small. 2) Lagged exchange rates are important for the CPI, but relatively unimportant for Y. Pretarget New Zealand seems to fit the case of imperfectly flexible exchange rates with a preponderance of LM shocks: 1) Both exchange rate correlations are negative and relatively large. 2) Lagged exchange rates are an important determinant of both CPI and Y. Finally, pretarget Canada seems to fit the case of imperfectly flexible exchange rates with a preponderance of IS shocks: 1) The negative correlation of exchange rate shocks and CPI is relatively small, while the correlation of exchange rate shocks with Y is positive and large. 2) Lagged exchange rates are important for Y, but relatively unimportant for CPI. Table 2: Variance/Covariance of detrended growth rates (in percentage pts per quarter) South Africa: 1990:1-1999:1 M CPI M 2,60 CPI 0,848 7,86 Y 0,036 0,161 e -0,797 -1,82 South Africa: 1994:3-1999:1 M CPI M 2,54 CPI -0,160 7,24 Y 0,068 -0,114 e -2,46 -3,99 Canada Pretarget Period: 1981:2-1990:4 M CPI M 0,470 CPI 0,117 0,302 Y -0,039 -0,340 e -0,153 -0,125 Canada Inflation Target: 1991:1-1998:3 M CPI M 0,303 CPI 0,143 0,296 Y -0,150 -0,160 e 0,224 0,388 New Zealand Pretarget Period: 1983:3-1989:4 M CPI M 9,90 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) Y e 0,469 -0,190 16,1 Y e 0,213 -0,181 29,1 Y e 1,10 0,233 4,33 Y e 0,301 0,109 4,54 Y e 11 CPI 2,39 2,87 Y -5,17 -3,06 e -2,13 1,46 New Zealand Inflation Target: 1990:1-1998:3 M CPI M 8,17 CPI 0,327 0,177 Y -1,02 -0,053 e -1,29 0,394 16,67 -8,89 58,4 Y e 2,01 1,74 13,0 Thus in terms of the importance of automatic stabilisation, pretarget Canada and New Zealand appear to have been better candidates for a switch to inflation targeting than does current South Africa. In pretarget Canada automatic stabilisation does not appear to have been important because the exchange rate was not allowed to offset IS shocks. In pretarget New Zealand, automatic stabilisation does not appear to have been important because the economy was suffering from a preponderance of LM shocks (and a switch to inflation targeting could very well have reduced the frequency of these shocks). The last two columns in Table 3 provide the same information for the two inflation targeting countries during the targeting period. These columns are of interest because they reflect how the change in the monetary policy regime has affected the dynamic behavior of the economy. Unfortunately, these columns may also reflect the different nature of shocks impinging on these economies in the pre and post-targeting periods. In spite of this complication, the change in exchange rate correlations is striking. The correlations of exchange rate shocks and CPI rise substantially and become positive in both countries during the targeting period. The correlation of exchange rate shocks with Y rises in New Zealand and is large and positive in both countries during the targeting period. In addition, in New Zealand, the importance of the lagged exchange rate for CPI falls dramatically and the importance for Y rises dramatically. All of these changes are consistent with a rise in the frequency of IS shocks relative to LM shocks during the targeting period, where the effects of the IS shocks on the exchange rate are being offset by changes in monetary policy. Thus New Zealand and Canada seem to be making less use of the automatic stabilisation of IS shocks from the exchange rate since switching to inflation targeting. The increasing relative importance of lagged exchange rates for CPI and the decreasing relative importance for Y in Canada during the targeting period is not consistent with this interpretation. Again, this partial inconsistency may be due to a change in the relative frequencies of shocks impinging on the Canadian economy during the targeting period. In addition, of course, one must note that in spite of the possible loss of automatic stabilisation, Y became much more stable in the two countries during the targeting period. Recall, however, that the industrial countries that did not adopt inflation targets also experienced more stable output growth during the 90s. 12 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) Consequently it is hard to separate out the effect on output volatility from the changes in the severity shocks and the change in monetary policy regimes. On the other hand, it seems hard to posit that the changes in the correlations in Table 3 from the pre to post targeting period are solely due to changes in the relative frequency of different kinds of shocks. CPI inflation targeting seems to make these correlations more likely to be positive, thereby implying a loss in exchange rate flexibility and a loss in automatic stabilisation. Table 3: VAR evidence on the importance of automatic stabilisation from the exchange rate 2 18,1 SA NZ, pre 69,3 CA, pre 4,66 NZ, post 9,72 CA, post 4,73 ( e , CPI ) ( e , Y ) -0,39 -0,33 -0,25 0,17 0,37 0,13 -0,22 0,35 0,32 0,22 sum of coeff. in CPI F statistic on coeff. FEVD of e in CPI sum of coeff. in Y F statistic on coeff. FEVD of e inY -0,02 F(2,27)=0,46 18,1-3,7% -0,02 F(2,27)=0,21 6,2-1,1% -0,13 F(2,16)=0,94 36,9-15,2% 0,13 F(2,16)=1,16 24,2-8,1% 0,01 F(2,29)=0,12 4,3-2,7% 0,09 F(2,29)=0,62 15,3-3,6% 0,00 F(2,25)=0,06 9,0-0,8% 0,25 F(2,25)=3,66 17,0-11,3% -0,10 F(2,21)=0,72 12,9-5,6% -0,00 F(2,21)=0,03 6,3-1,9% 3.4 VAR evidence on the strength and predictability of the policy linkage Table 4 present the VAR evidence on the linkage between money growth and CPI inflation. On this dimension, South Africa comes out in the middle between pretarget Canada and New Zealand. Relative to pretarget Canada the policy linkage is somewhat less strong and much less predictable. However the comparison is exactly reversed with pretarget New Zealand. The large standard error in the South African CPI equation along with the relatively small importance of the money supply suggests that inflation targeting may be difficult to implement. In particular, wide swings in the policy instrument may be needed to achieve the inflation target, a problem that New Zealand has experienced with inflation targeting (see Mishkin and Posen (1997)). Yet, the CPI equation is more unpredictable in South Africa than in New Zealand during the targeting period. It is somewhat ironic that growing instability in the relationship between monetary aggregates and inflation is frequently cited as an argument for inflation targeting. It is true that increasing financial instability makes targeting monetary aggregates less attractive, but it also makes the implementation of inflation targeting increasingly difficult. J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 13 Table 4: VAR evidence on the strength and predictability of policy linkage std error of CPI equation sum of the coeff on M F statistic on coeff. FEVD of M 3.5 SA 0,86 0,09 F(2,27)=1,48 8,6-7,5% NZ, pre 1,34 0,02 F(2,16)=0,06 2,2-3,5% CA, pre 0,18 0,15 F(2,29)=0,89 12,9-13,5% NZ, post 0,38 -0,05 F(2,29)=0,86 11,7-11,4% CA, post 0,54 0,29 F(2,21)=1,89 31,9-31,9% Exchange rate correlations under the random walk hypothesis On interesting aspect of the VAR results is that for South Africa, Canada, and pretarget New Zealand, one cannot reject the hypothesis that the exchange rate follows a random walk. This result is consistent with the view that the exchange rate is more of an asset price than a goods price. More importantly, however, if this hypothesis is true, then the covariances of shocks to the exchange rate and to CPI and Y can be measured by the covariances of the detrended logs. In this case, one doesn’t have to estimate VAR equations to measure the covariances. This saving of degrees of freedom allows one to look at covariances with the exchange rate in the most recent period in South Africa, which is done in Table 5. Again to make the covariances comparable, the covariances have been expressed as correlation coefficients.8 The top panel in the table shows that it doesn’t matter much for the correlation of e with CPI if the correlation is measured by VAR residuals or detrended changes in the log. The correlation of e with Y changes from a small positive to a small negative correlation. In either case, the correlations tell a story that is consistent with the view that variations in the exchange rate have provided automatic stabilisation of IS shocks. In fact, the correlations in the most recent period are consistent with the view that this automatic stabilisation has become of increasing importance. The bottom panel explores whether there are other widely used measures of inflation that might be a more suitable target variable. The panel shows, however, that Core CPI, which excludes mortgage interest and other volatile prices, has an even larger negative correlation with the exchange rate. The produce price index lowers this correlation a bit, but it isn’t until one adopts a price measure that excludes imports, viz., 8 While the covariances of the detrended variables are unbiased estimates of the covariances of the shocks under the null hypothesis, the absolute correlation coefficients understate the correlations of the shocks. In our VAR models there are 3 covariances of exchange rate shocks for each country and each time period. Therefore there are a total of 18 covariances. The signs of the exchange rate covariances as measured by the VAR residuals agrees with the sign as measured by the corresponding covariance of the detrended change in the logs in 16 out of the 18 cases. 14 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) the producer price index for South African goods that this correlation falls substantially. The last entry shows that the covariance actually becomes positive for the GDP deflator. Thus the only way to implement an inflation target without forgoing the benefits of automatic stabilisation from the exchange rate requires targeting a measure of inflation that excludes imported goods. Any move away from headline inflation as the target variable, however, implies a loss in “transparency.” Table 5: Exchange rate variances and covariances in South Africa M VAR Residual, 90:1-99:1 detrended variables, 90:1-99:1 detrended variables, 94:3-99:1 Covariance of e with other measures of inflation CPI Y 2 -0,39 -0,36 -0,48 0,13 -0,07 -0,07 18,1 16,1 29,1 Core CPI PPI PPI SA IPD measures of inflation 90:1-99:1 -0,37 -0,22 -0,16 0,29 94:3-99:1 -0,49 -0,42 -0,27 0,08 4. Conclusion On the basis of the VAR evidence, Canada and New Zealand appear to have been two quite different countries in the pretarget periods. Yet, both countries have enjoyed greater real economic stability since adopting an inflation target. In addition, both countries enjoyed a reduction in average inflation with the adoption of the inflation target in a manner that is consistent with a falling inflationary bias. The South African economy, on the basis of the VAR evidence, looks more similar to pretarget New Zealand: in both countries exchange rate shocks and CPI shocks were substantially negative. In both countries exchange rate shocks were an economically important determinant of the CPI. This might seem to suggest that South Africa could usefully follow the New Zealand example by adopting an inflation target to lower volatility and average inflation. There is, however, one crucial difference between the behavior of the pretarget New Zealand economy and the recent South African experience. In New Zealand, during both the pre and post inflation targeting periods, lagged exchange rates were an important determinant of real output. This suggests that the volatility of the exchange J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 15 rate was not associated with the automatic stabilisation of IS shocks. In South Africa, on the other hand, while the exchange rate has been volatile and an important determinant of the CPI, it has not been an important determinant of output. Thus this evidence suggests that the exchange rate has been providing important automatic stabilisation of IS shocks in South Africa. The adoption of an inflation target would force South Africa to forego this automatic stabilisation, which implies more volatile real economic activity. In addition, South Africa does not have a strong and predictable linkage between the CPI inflation rate and monetary aggregates. This could present problems of instrument instability for South African monetary policy under an inflation target; problems similar to those experienced by New Zealand (see Mishkin and Posen(1997)). These results lead me to conclude that South Africa is not a good candidate for CPI inflation targeting because of the implied loss in the benefits provided by a fully flexible exchange rate. The issue of inflation targeting’s effect on the flexibility of the exchange rate is important because, as was illustrated in Table 5, the correlation between exchange rate changes and all of the popular measures of inflation in South Africa has been substantially negative and has become more so most recently. Apparently, IS shocks are becoming more important in the South African economy. A monetary policy aimed at stabilising the CPI inflation rate in the face of frequent and severe IS shocks would lead to more output volatility, not less. REFERENCES Bernanke, BS and Mishkin, F (1997): “Inflation Targeting: A New Framework for Monetary Policy?”, Journal of Economic Perspectives, 11, 97-116. Casteleijn, AJH (1999): “The Viability of Implementing an Inflation Targeting Monetary Policy Framework in South Africa”, South African Reserve Bank Quarterly Economic Review, June. Debelle, G and Fischer, S (1994): “How Independent Should a Central Bank Be?” in J Fuhrer (ed.): Goals, Guidelines, and Constraints Facing Monetary Policymakers, Federal Reserve Bank of Boston, Conference Series No. 38. Goodhart, C and Vinals, J (1994): “Strategy and Tactics of Monetray Policy: Examples from Europe and the Antipodes”, in J.Fuhrer (ed.): Goals, Guidelines, and Constraints Facing Monetary Policymakers, Federal Reserve Bank of Boston, Conference Series No. 38. Jonsson, G (1999): “The Relative Merits and Implications of Inflation Targeting for South Africa”, IMF Working Paper. 16 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) Kydland, F and Prescott, E (1977): “Rules Rather than Discretion: The Inconsistency of Optimal Plans”, Journal of Political Economy, 87, 473-492. Mankiw, NG (1997): Macroeconomics, 3rd. edit., New York: Worth Publishers. Masson, P, Savastano, M and Sharma, S. (1997): “The Scope for Inflation Targeting in Developing Countries”, IMF Working Paper, WP/97/130. Mboweni, T. (1999): “Governor’s Address”, South African Reserve Bank August 24. Mishkin, F. and Posen, A. (1997): “Inflation Targeting: Lessons from Four Countries”, NBER Working Paper 6126. Rogoff, K. (1985): “The Optimal Commitment to an Intermediate Monetary Target”, Quarterly Journal of Economics, 100, 1169-1190. Romer, D (1993): “Openness and Inflation: Theory and Evidence”, Quarterly Journal of Economics,108, 869-903. Stals, C (1999): “Inflation Targeting as an Anchor for Monetary Policy”, March 17 address from the Governor of the South African Reserve Bank. Svensson, LEO (1997): “Optimal Inflation Targets, ‘Conservative Central Banks’, and Linear Inflation Contracts”, American Economic Review, 87, 98-114. Walsh, C (1995): “Optimal Contracts for Independent Central Banks”, American Economic Review, 85, 150-167. J.STUD.ECON.ECONOMETRICS, 2000, 24(2) 17 LM e Y = P = 0 CPI > 0 e0 e1 IS IS’ Y0=Y1 Y Figure 1: Automatic Stabilisation of a Goods Market Shock e LM’ LM Y < 0 P < 0 CPI = 0 e0 e1 IS IS’ Y1 Y0 Y Figure 2: CB Response to Goods Market Shock with CPI Targeting 18 J.STUD.ECON.ECONOMETRICS, 2000, 24(2) J.STUD.ECON.ECONOMETRICS, 1999, 23(3) 19