Applying for and Taking the CPA Exam

advertisement

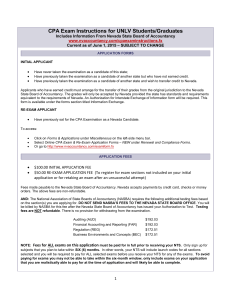

Applying for and Taking the CPA Exam Summarized By Sarah Darby Brown, Graham, and Co., PC *Information and amounts current as of 9/24/07, subject to change! STEP 1: Right Now: A. Take all your classes (the right ones) and LEARN as much as you can! Earn at least a baccalaureate degree and 150 hours, with 30 in upper division accounting coursework. a. 150 hours must include i. 30 hours upper division accounting coursework (15 hours must result from physical attendance at a regular university institutional setting) ii. 21 hours of upper division business related coursework iii. A three hour Ethics course in a traditional classroom setting B. Keep a clean record – even misdemeanors can count against you! C. Eventually, by the time you have passed all of your sections, you will need at least one year of work experience under a licensed CPA in good standing to get your own license. STEP 2: Application of Intent – 2 to 3 weeks to process, lasts for two years A. B. C. D. Standard form- Contact Information and Education Check for $50 Official Transcripts (sealed!) from all the colleges or universities you’ve attended 2 Passport-Type Photos – One of these becomes your Testing ID you have to take with you to each section exam E. Notarized Copies of: a. Driver’s License b. Social Security Card c. Authorization and Release Form – for Background Check d. Verification of Legal Status Form F. Official Certificate of Good Moral Character G. If needed – American Disabilities Act package STEP 3: Eligibility Application-24-48 hours for online processing, 2-3 weeks for paper application processing, lasts for 90 days (or basically one two-month testing window) A. Standard Form B. Check for $70 per section you are applying for After this is approved by the Board, they send the candidate notice of approval and advise the National Association of State Boards of Accountancy (NASBA) that the candidate has been approved. Then NASBA will send the candidate a payment coupon by mail and email. Make sure your email address is current and check your SPAM box to make sure the coupon doesn’t end up there or get accidentally deleted, which is what happened to me. STEP 4: NASBA Payment Coupon- Takes around a week to process, maybe less (they won’t state officially) A. Pay for your exam through the internet or by phone. Current Cost (it will go up): a. AUD - $209.33 b. BEC - $161.63 c. FAR - $197.40 d. REG- $173.55 e. Total Cost of $741.91, but you only pay for one or two exam(s) at a time, just the one you are going to take immediately! B. If you haven’t received what you need within a reasonable amount of time, call NASBA!!! STEP 5: Notice to Schedule – Should be issued within two weeks of paying NASBA. A. This document must be taken with you to take the test! Save the email and attachment to a safe location and print multiple copies!!! It contains a reference number you will need at the testing site and which section exam you can sit for. B. Make sure all the information is right, particularly your name, because the Prometric testing site won’t let you take your exam unless it is exactly right. C. Use this document and the numbers it provides to register for the exam at the location, date, and time of your choosing. D. Slots fill up QUICK! Sign up as soon as you can. E. Rescheduling - $, more $$$ if last minute! (Free to move earlier or up!) F. You will repeat Step 3 - 5, sending in a new Eligibility Application and $70 for each section you take. Receive new payment coupon, pay, then NTS, and schedule the exam STEP 6: Studying for the exam. A. B. C. D. Many Programs – varying in quality My recommendation (I receive no fee for this, I promise!): Becker You can’t wing this one! Persevere – you will succeed eventually STEP 7: Licensing Application A. B. C. D. Standard Form verifying current address, phone number and other info Notarized Oath Paper Exam and Answer Sheet on Texas State Board of Accountancy Rules and Principles Requirement for proof of another 4 hour Ethics Course (to be taken online or in a one-time seminar setting, not a class) E. $50 Processing Fee F. Another verification of Character – or re-disclosure of previously disclosed discreditable misdemeanors, etc. STEP 8: A. Pay for your license – around $200 B. Call yourself a CPA once payment has cleared! OTHER ODDS AND ENDS: A. Testing Schedule/”Windows” – January -February open, with March closed, and the other open windows were April-May, July-Aug, and Oct-Nov. This is the typical pattern currently. B. Practice simulations and multiple choice C. D. E. F. Look for shortcuts – For example, the online EPAY system Employer Reimbursement One Year of Experience Joining Texas Society of CPAs – discounted memberships for students and candidates Closing Summary of Timing: (After Step 1) Step 2: Application of Intent - Two or three weeks to process Step 3: Eligibility Application - A few days (assuming online processing) Step 4-5: NASBA Processing – A week for payment coupon, two weeks to get NTS (Notice to Schedule) Step 6: Scheduling Exam – 1 day So, this process will take from five to seven weeks from beginning to end. If you take one exam per testing window and pass each, you can finish in one year from this, which works out since you need at least one year of working experience! Summary of Cost: Step 1: Undergraduate/Graduate Degree - $$$$ Step 2: $70+ (depending on transcripts cost) + Postage Step 3: $280 for all four sections + Postage Step 4-6: $742 Step 7-8: $50 + Licensing Fee – stands at $200 now Renewal is $200/year currently from thereafter… Total Cost (not including study materials or renewal): $1342 Again, see why it is very beneficial to have your employer foot this bill? Becoming a CPA is expensive! Importance of Becoming a CPA Helpful Websites Online Services for CPA Exam Candidates (Texas State Board): http://www.tsbpa.state.tx.us/index.htm This is the Texas State Board of Public Accountancy website. It details everything I discussed with you and summarized here. It is very comprehensive and my number one resource for this information. Also, you may call them if you have specific questions left unanswered. Texas Society of CPAs: http://www.tscpa.org/ This website is great for employment links, job tips, reference use, and a source of contacts. Practice Tutorial: www.cpa-exam.org