ch10_IM_1E

advertisement

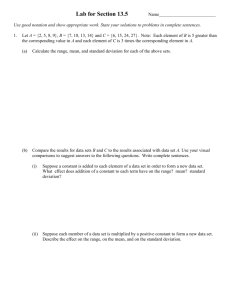

CHAPTER 10 AN OVERVIEW OF RISK MANAGEMENT 10.1 10.2 10.3 10.4 10.5 10.6 10.7 10.8 Objectives To explore how risk affects financial decision-making. To provide a conceptual framework for the management of risk. To explain how the financial system facilitates the efficient allocation of risk-bearing. Outline What Is Risk? Risk and Economic Decisions The Risk Management Process The Three Dimensions of Risk Transfer Risk Transfer and Economic Efficiency Institutions for Risk Management Portfolio Theory: Quantitative Analysis for Optimal Risk Management Probability Distributions of Returns Summary Risk is defined as uncertainty that matters to people. Risk management is the process of formulating the benefitcost trade-offs of risk-reduction and deciding on a course of action to take. Portfolio theory is the quantitative analysis of those trade-offs to find an optimal course of action. All risks are ultimately borne by people in their capacity as consumers, stakeholders of firms and other economic organizations, or taxpayers. The riskiness of an asset or a transaction cannot be assessed in isolation or in the abstract; it depends on the specific frame of reference. In one context, the purchase or sale of a particular asset may add to one’s risk exposure; in another, the same transaction may be risk-reducing. Speculators are investors who take positions that increase their exposure to certain risks in the hope of increasing their wealth. In contrast, hedgers take positions to reduce their exposures. The same person can be a speculator on some exposures and a hedger on others. Many resource-allocation decisions, such as saving, investment, and financing decisions, are significantly influenced by the presence of risk and therefore are partly risk-management decisions. We distinguish among five major categories of risk exposures for households: sickness, disability, and death; job loss; consumer-durable asset risk; liability risk; and financial asset risk. Firms face several categories of risks: production risk, price risk of outputs, and price risk of inputs. There are five steps in the risk-management process: risk identification, risk assessment, selection of riskmanagement techniques, implementation, review. There are four techniques of risk management: risk avoidance, loss prevention and control, risk retention, risk transfer. There are three dimensions of risk transfer: hedging, insuring, and diversifying. Diversification improves welfare by spreading risks among many people, so that the existing uncertainty matters less. From society’s perspective risk-management institutions contribute to economic efficiency in two important ways. First, they shift risk away from those who are least willing or able to bear it to those who are most willing to bear it. Second, they cause a reallocation of resources to production and consumption in accordance with the new distribution of risk-bearing. By allowing people to reduce their exposure to the risk of undertaking certain business ventures, they may encourage entrepreneurial behavior that can have a benefit to society. Over the centuries, various economic organizations and contractual arrangements have evolved to facilitate a more efficient allocation of risk-bearing by expanding the scope of diversification and the types of risk that are shifted. Among the factors limiting the efficient allocation of risks are transactions costs and problems of adverse selection and moral hazard. Instructor’s Manual Chapter 10 Page 126 Solutions to Problems at End of Chapter On the Nature of Risk and Risk Management 1. Suppose that you and a friend have decided to go to a movie together next Saturday. You will select any movie for which tickets are available when you get to the theater. Is this a risky situation for you? Explain. Now suppose that your friend has already purchased a ticket for a movie that is going to be released this Saturday. Why is this a risky situation? How would you deal with the risk? SOLUTION: No, the uncertainty doesn’t represent risk since you do not care which movie you see. However, if your friend has a ticket already, and if you wait till Saturday to buy yours, the show may be sold out. To eliminate the risk that you may not be able to sit with your friend and see the same movie, you might buy your ticket in advance. 2. Suppose you are aware of the following investment opportunity: You could open a coffee shop around the corner from your home for $25,000. If business is strong, you could net $15,000 in after-tax cash flows each year over the next 5 years. a. If you knew for certain the business would be a success, would this be a risky investment? b. Now assume this is a risky venture and that there is a 50% chance it is a success and a 50% chance you go bankrupt within 2 years. You decide to go ahead and invest. If the business subsequently goes bankrupt, did you make the wrong decision based on the information you had at the time? Why or why not? SOLUTION: a. No, this investment would not be risky. b. No, you did not make a “wrong” decision. When you made your decision, you did not know for certain that the company would go bankrupt. You decided to invest for many reasons, including the possibility of making a lot of money. Given your tolerance for risk and the fact that you based our decision on the information available at the time, your decision was not wrong and may have been optimal at the time. 3. Suppose you are a pension fund manager and you know today that you need to make a $100,000 payment in 3 months. a. What would be a risk-free investment for you? b. If you had to make that payment in 20 years instead, what would be a risk free investment? c. What do you conclude from your answers to Parts a and b of this question? SOLUTION: a. A risk-free investment for you would be a Treasury Bill (default risk free) which matures in exactly 3 months. b. A risk-free investment would be a zero coupon U.S. Treasury security maturing in 20 years and which would have the same single payment of $100,000. c. Because risk is dependent upon circumstances, what is risk-free for one individual may be risky for another too. There can be any number of risk-free investments depending upon circumstances. Your investment time horizon is critical to choosing the best risk-free investment (so payments in can exactly match payments out so that you are left with no risk). 4. Is it riskier to make a loan denominated in dollars or in yen? SOLUTION: It depends on the context. For people whose income and expenses are denominated in dollars (perhaps because they live in the U.S), denominating a loan in yen would be riskier than denominating it in dollars. But for someone whose income and expenses are denominated in yen, denominating the loan in yen would be less risky than in dollars. Instructor’s Manual 5. Chapter 10 Page 127 Which risk management technique has been chosen in each of the following situations? Installing a smoke detector in your home Investing savings in T-bills rather than in stocks Deciding not to purchase collision insurance on your car Purchasing a life insurance policy for yourself SOLUTION: Loss prevention and control. Risk avoidance Risk retention Risk transfer 6. You are considering a choice between investing $1,000 in a conventional one-year T-Bill offering an interest rate of 8% and a one-year Index-Linked Inflation Plus T-Bill offering 3% plus the rate of inflation. a. Which is the safer investment? b. Which offers the higher expected return? c. What is the real return on the Index-Linked Bond? SOLUTION: a. The inflation-indexed T-Bill offers a fixed real rate of return of 3% over the life of the investment. The real return on the conventional T-Bill’s real return depends upon the expected rate of inflation over the life of the investment. The safer investment is the Inflation Plus T-Bill. b. The real rate of return on the conventional T-Bill depends upon the expected rate of inflation over the life of the investment. You do not know which expected return is higher unless you know what inflation is expected to be. c. The real return on the index-linked T-Bill is 3%. Hedging and Insurance 7. Suppose you are interested in financing your new home purchase. You have your choice of a myriad financing options. You could enter into any one of the following agreements: 8% fixed rate for 7 years, 8.5% fixed rate for 15 years, 9% fixed for 30 years. In addition, you could finance with a 30-year variable rate that begins at 5% and increases and decreases with the prime rate, or you could finance with a 30year variable rate that begins at 6% with ceilings of 2% per year to a maximum of 12% and no minimum. a. Suppose you believe that interest rates are on the rise. If you want to completely eliminate your risk of rising interest rates for the longest period of time, which option should you choose? b. Would you consider that hedging or insuring? Why? c. What does your risk management decision “cost” you in terms of quoted interest rates during the first year? SOLUTION: a. You would choose the 30-year fixed rate at 9%. b. That would be a hedge because you have eliminated both the upside (declining rates) or downside ( rising rates). c. This costs me at least 4% since I could get a variable rate loan at 5%. Instructor’s Manual Chapter 10 Page 128 8. Referring to the information in problem 7, answer the following: a. Suppose you believe interest rates are going to fall, which option should you choose? b. What risk do you face in that transaction? c. How might you insure against that risk? What does that cost you (in terms of quoted interest rates?). SOLUTION: a. You would want one of the variable rate options, in particular the variable loan tied to the prime rate, currently equal to 5%. b. You face the risk of rising rates. c. You could insure against that risk by purchasing the option to have a 12% ceiling on the rate (2% increase per year. This option cost you 1% (the difference between 6% and 5%). 9. Suppose you are thinking of investing in real estate. How might you achieve a diversified real estate investment? SOLUTION: You could own several different buildings in the same general area. You could own several different buildings in different geographic areas. You could sell some of your equity ownership to other owners to lower your own individual exposure to declining market values. 10. Suppose the following represents the historical returns for Microsoft and Lotus Development Corporation: Historical Returns Year MSFT LOTS 1 10% 9% 2 15% 12% 3 -12% -7% 4 20% 18% 5 7% 5% a. b. c. What is the mean return for Microsoft? For Lotus? What is the standard deviation of returns for Microsoft? For Lotus? Suppose the returns for Microsoft and Lotus have normally distributed returns with means and standard deviations calculated above. For each stock, determine the range of returns within one expected standard deviation of the mean and within two standard deviations of the mean. SOLUTION: a. Mean return Microsoft: 8.0%; Lotus: 7.4% b. If you use the formula for the standard deviation based on a sample of size n: 1 n (ri r ) 2 n i 1 You find that the standard deviations are: MSFT: 10.94%; Lotus: 8.357%. However, if you use the formula for the population standard deviation: c. n 1 (ri r ) 2 n 1 i 1 You find that the standard deviations are: MSFT 12.23% and LOTS 9.34%. Range of returns within 1 standard deviation Microsoft: -2.94% to +18.94% Range of returns within 1 standard deviation Lotus: -0.957% to + 15.76% Range of returns within 2 standard deviations Microsoft: -13.88% to +29.88% Range of returns within 1 standard deviation Lotus: -9.31% to + 24.11%