The Act of Special Economic Zones, consolidated text.

advertisement

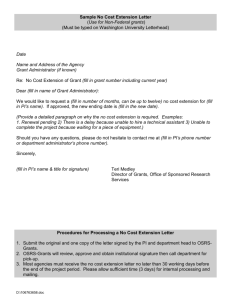

–3– Journal of Laws Item 282 Annex to the notice of the Marshall of the Sejm of the Republic of Poland of 10 February 2015 (item 282) ACT dated 20 October 1994 on special economic zones Chapter 1 General provisions Article 1. The Act sets forth the rules and procedure for establishing special economic zones in the Republic of Poland, managing such zones and special rules and conditions for conducting an economic activity within such zones. Article 2. A special economic zone, hereinafter referred to as the “Zone”, is an uninhabited part of the Republic of Poland separated according to the provisions of this Act where an economic activity may be conducted under the rules determined by the Act. Article 3. The zone may be established in order to accelerate the economic development of part of the territory of the country, particularly by: 1) Developing certain areas of economic activity; 2) Developing new technical and technological solutions and using them in the national economy; 3) Developing export; 4) Increasing the competitiveness of goods produced and services provided; 5) Developing existing industrial assets and economic infrastructure; 6) Creating new jobs; 7) Developing unused natural resources maintaining the rules of environmental sustainability. Chapter 2 Founding, joining, terminating of the zones and modifying their area Article 4.1) 1. Upon the request of the minister in charge of economy matters, the Council of Ministers establishes the zone through a regulation. The regulation shall set down: 1) Name, area and borders of the zone; 2) Zone administrator, hereinafter referred to as the “Zone Administrator”; 3) Period for which the zone is established – taking into consideration the necessity to achieve the objectives referred to in Article 3 in the area covered by the zone. 2. The minister in charge of economy matters shall submit its request referred to in item 1 after it has received an opinion of a provincial board and the consent of a commune council relevant for the location of the zone. 3. The minister in charge of economy matters shall attach to the request referred to in item 1 an analysis of expected social and economic effects of establishing the zone. 4. Through a regulation, the Council of Minister shall determine: 1) Objects of economic activity for which the permit referred to in Article 16(1) will not be issued; 2) Maximum state aid that may be granted to an entrepreneur conducting its economic activity within the zone under the permit referred to in Article 16(1); 3) Conditions for granting state aid to an entrepreneur conducting its economic activity within the zone under the permit referred 1) In the wording set down by Article 1(1) of the Act of 30 May 2008 on amending the act on special economic zones (Journal of Laws No. 118, item 746) which became effective on 4 August 2008. to in Article 16(1); 4) Conditions for qualifying expenditure as expenditure spent on investment within the zone and the minimum amount of such expenditure; 5) Expenditure on investment taken into consideration when calculating the state aid amount for entrepreneurs that obtained the permit referred to in Article 16(1) after 31 December 2000; 6) Method of discounting investment expenditure and state aid amount at the day when the permit referred to in Article 16(1) was obtained – taking into consideration the necessity to ensure the compliance of state aid to be granted with the European Union law. Article 5.1) 1.2) Subject to items 2 and 3, the zone may be established exclusively on the land which is the property of the zone administrator, the State Treasury, a company fully owned by the State Treasury, a local government unit or a municipal association or is under perpetual usufruct of the zone administrator or the company fully owned by the State Treasury. 2. Furthermore, the zone may be established if the acquisition by the zone administrator or local government unit of the title to the land referred to in item 1 arises from an agreement that provides for the establishment of the zone as the only condition for acquisition. 3. Part of the zone may include the land that is the property or under perpetual usufruct of entities other than those listed in item 1, upon the consent given by such entities, in the event that: 1) A certain number of new jobs will be created as a result of the investment within the zone or investment expenditure of a certain amount will be incurred; or 2) As a result of the investment, the activity involving the start of manufacturing of new products or significantly improved goods, processes or services will be carried out; or 3) Investment will involve such services as: 4) a) Research and development; b) Information technology; c) Accounting and auditing of books; d) Bookkeeping, excluding tax declarations; e) Call centres; or It will be necessary to extend the zone area by not more than 2 hectares as a result of the investment that has already been commenced. 4. Through a regulation, the Council of Ministers shall determine detailed criteria for the conditions listed in item 3, taking into consideration the necessity to vary the criteria set down in item 3(1) depending on the unemployment rate in the district relevant for the location of such a zone, and taking into consideration the Polish Classification of Goods and Services. Article 5a. 1.3) Through a regulation, upon the request submitted by the minister in charge of economy matters, the Council of Ministers may, taking into consideration the achievement of the objectives referred to in Article 3, terminate the zone before the period for which it is established expires, change the zone area or join zones, except that the total area of all the zones may not exceed 25,000 hectares. 2. A zone may not be terminated when at least one permit issued under Article 16(1) is still effective. 3. The prohibition referred to in item 2 shall not apply if the area where an entrepreneur carries out its economic activity under the permit is included in the area of another zone, provided that the entrepreneur shall retain its right to tax exemptions under previous conditions. 4. The reduction of a zone area shall not apply to real property where economic activity is carried out under the permit issued according to Article 16(1), unless the entrepreneur that carries out its activity under the permit there gives its consent to it. 5. (repealed). 2) 3) In the wording set down by Article 2(1) of the Act of 22 January 2015 on amending the act on the functioning of hard coal mining sector in the years 2008-2015 and some other acts (Journal of Laws, item 143) which became effective on 4 February 2015. In the wording set down by Article 2(2) of the Act referred to in note 2. –5– Journal of Laws Item 282 Chapter 3 Zone management and tax exemptions Article 6.4) 1. The zone administrator may be only a joint stock company or a limited liability company where the State Treasury or a province government holds the majority of votes to be cast at the General Shareholders’ Meeting. 2. The provisions of Article 19a of the Act of 30 August 1996 on commercialisation and privatisation (Journal of Laws of 2013, item 216, as amended5) and Article 10a(6) of the Act of 20 December 1996 on municipal management (Journal of Laws of 2011 No. 45, item 236) shall not apply to the company referred to in item 1, excluding the companies where the State Treasury holds 100% of shares. 3. The competence of the minister in charge of State Treasury matters defined in Article 2(5) and Article 18(1) of the Act of 8 August 1996 on the rules for exercising the rights of the State Treasury (Journal of Laws of 2012, item 1224), in relation to the companies that manage special economic zones referred to in item 1, excluding the companies where the State Treasury holds 100% of shares, shall be the competence of the minister in charge of the economy matters. Article 6a.6) 1. The function of the member of the management board of a company that is the zone administrator shall not be combined with employment with the entrepreneur conducting its economic activity in the zone, regardless of the legal basis for such employment. 2. The employment referred to in item 1 may not be commenced within a year of the day when the management board member function ceased to be performed at a company which is the zone administrator. Article 7. 1. Not more than 5 persons shall be appointed to the Supervisory Board of a company which is the zone administrator where the State Treasury holds the majority of votes to be cast at the General Shareholders’ Meeting, including: 1) 7) One representative of the minister in charge of economy matters, one representative of the minister in charge of public finance matters and one representative of the President of the Office of Competition and Consumer Protection – as the representatives of the State Treasury; 2) Not more than two representatives of local government units which hold the biggest share in the share capital of this company. 1a. Not more than 5 persons shall be appointed to the Supervisory Board of a company which is the zone administrator where the provincial government holds the majority of votes to be cast at the General Shareholders’ Meeting, including: 1) Two representatives of the provincial government; 2) A representative of the minister in charge of economy matters; 3) Not more than two representatives of local government units, excluding the provincial government, which hold the biggest share in the share capital of this company. 1b. (repealed)8) 2. A person that is a member of the authorities of an entrepreneur carrying out its economic activity in the zone, an employee of an entrepreneur carrying out its economic activity in the zone or is in relationship referred to in Article 11(4)-(8) of the Act of 15 February 1992 on corporate income tax (Journal of Laws of 2014, item 851, as amended9)) with such an economic entity shall not be appointed to the Supervisory Board referred to in items 1 and 1a. Article 8. 1. According to a zone development plan referred to in Article 9, zone regulations referred to in Article 10 and legal provisions, the duties of the zone administrator shall include actions for the development of economic activity conducted in the zone, and in particular: 1) Under an agreement, enabling entrepreneurs that carry out their economic activity in the zone to use and utilise asset components located in the zone, the administrator of which is the owner or dependant user; 2) Utilising facilities of economic and technical infrastructure, as well as other asset components, the administrator of which is the 4) 5) 6) 7) 8) 9) In the wording set down by Article 1(3) of the Act referred to in note 1. The amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2013, item 1643, of 2014, items 598 and 612, and of 2015, item 143. Added by Article 1(4) of the Act referred to in note 1. In the wording set down by Article 1(1) of the Act of 28 November 2014 on amending the act on special economic zones and some other acts (Journal of Laws, item 1854) which became effective on 6 January 2015. By Article 1(5) of the Act referred to in note 1. The amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2014, items 915, 1138, 1146, 1215, 1328, 1457, 1563 and 1662, and of 2015, items 73 and 211. owner or dependent user, so as to facilitate economic activity in the zone; 3) Under an agreement, providing entrepreneurs operating in the zone with services and conditions for providing services by third parties; 4) 5) Undertaking actions which promote taking up economic activity in the zone. 10 Taking up actions leading to the creation of clusters; 6) 10) Collaboration in including the needs of the job market in the zone under the education process: a) With upper-secondary schools referred to in Article 9(1)(3) of the Act of 7 September 1991 on the education system (Journal of Laws of 2004 No. 256, item 2572, as amended 11)), b) With colleges and universities referred to in Article 2(1)(1) of the Act of 27 July 2005, Law on Higher Education (Journal of Laws of 2012, item 572, as amended12)). 2. The zone administrator may dispose of its title to the property and perpetual usufruct of land located in the zone, if it is consistent with the zone development plan referred to in Article 9. The zone administrator shall have the pre-emptive right to purchase the title and perpetual usufruct of properties located in the zone. 3. 13) Fulfilling its duties set down in the development plan referred to in Article 9, the zone administrator does not provide services of universal character. The zone administrator may instruct third parties to perform some duties while keeping transparency and fair competition, in particular through a tender within the meaning of the Act of 23 April 1964, Civil Code (Journal of Laws of 2014, items 121 and 827, and of 2015, item 4). 4. 14) Under the agreement, the competent body under the provisions of the Act of 21 August 1997 on real property management (Journal of Laws of 2014, item 518, as amended 15)) may order the administrator to prepare the real property for the purpose of its sale and to organise and conduct tender to sell such real property. Article 9.16) 1. Through a regulation, the minister in charge of economy matters shall determine a zone development plan, taking account of the analysis referred to in Article 4(3). 2. In particular, the zone development plan shall define the objectives of establishing the zone, actions which aim to achieve such objectives, and the obligations of the zone administrator with regard to the actions for achieving the objectives regarding the zone establishment and time limits to fulfil such obligations. Article 10. 1. The zone regulations shall define how the zone administrator shall manage the zone. 2. The zone regulations shall be issued by the zone administrator. The issuance of and any amendments to the zone regulations shall require the approval of the minister in charge of economy matters. 3. The zone administrator shall deliver the zone regulations to entrepreneurs that carry out their economic activity in the zone upon the conclusion of agreements referred to in Article 8(1)(1) and (3), and shall publish the regulations. Article 11. 1. Entrepreneurs that carry out their economic activity in the zone may form a zone council. 2. The zone council may present its opinions and motions on issues concerning the conducting of activity in the zone and activity development. 3. The organisation of and the procedure how the zone council shall operate shall be defined by the regulations developed and passed by the zone council. 10) 11) 12) 13) 14) 15) 16) Added by Article 1(2)(a) of the Act referred to in note 7. Any amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2004 No. 273, item 2703, and No. 281, item 2781, of 2005 No. 17, item 141, No. 94, item 788, No. 122, item 1020, No. 131, item 1091, No. 167, item 1400, and No. 249, item 2104, of 2006 No. 144, item 1043, No. 208, item 1532, and No. 227, item 1658, of 2007 No. 42, item 273, No. 80, item 542, No. 115, item 791, No. 120, item 818, No. 180, item 1280, and No. 181, item 1292, of 2008 No. 70, item 416, No. 145, item 917, No. 216, item 1370, and No. 235, item 1618, of 2009 No. 6, item 33, No. 31, item 206, No. 56, item 458, No. 157, item 1241, and No. 219, item 1705, of 2010 No. 44, item 250, No. 54, item 320, No. 127, item 857, and No. 148, item 991, of 2011 No. 106, item 622, No. 112, item 654, No. 139, item 814, No. 149, item 887, and No. 205, item 1206, of 2012, items 941 and 979, of 2013, items 87, 827, 1191, 1265, 1317 and 1650, and 2014, items 7, 290, 538, 598, 642,811, 1146, 1198 and 1877. Any amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2012, items 742 and 1544, of 2013, items 675, 829, 1005, 1588 and 1650, and of 2014, items 7, 768, 821, 1004, 1146 and 1198. In the wording set down by Article 1(2)(b) of the Act referred to in note 7. In the wording set down by Article 1(6) of the Act referred to in note 1. The amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2014, items 659, 805, 822, 906 and 1200. In the wording set down by Article 1(7) of the Act referred to in note 1. –7– Journal of Laws Item 282 Article 12. Income earned by legal and natural persons from economic activity carried out in the zone under the permit referred to in Article 16(1) shall be exempted from income tax in line with the rules set down in the regulations on corporate income tax or regulations on personal income tax respectively. The exemption shall be public aid and the amount of that aid may not exceed its maximum amount set down in regulations promulgated under Article 4(4).17) Article 12a.18) 1. Entrepreneurs that use public aid granted under the Act shall be obliged to keep tax registers: they keep the registers and relevant documents; and additionally, entrepreneurs that use public aid granted under the Act, due to creating new jobs, keep the documents related with tax withholding and payment to the state budget as well as state income on special-purpose funds. 2. The registers and documents referred to in item 1 shall be kept until the claims for the return of public aid have become timebarred. Article 12b.18) 1. If the permit referred to in Article 16(1) is revoked, the entrepreneur shall be obliged to return public aid it was granted under the Act. The entrepreneur may not be granted a new permit until it returns the aid. 2. If the permit referred to in Article 16(1) is revoked or declared as expired, the minister in charge of economy matters shall submit a copy of the decision to the head of the tax office relevant for the entrepreneur in terms of income tax, within 14 days starting of the day when the decision became valid. 3. If the permit referred to in Article 16(1) has been revoked, through a decision the head of the tax office mentioned in item 2 sets an amount of the aid to be returned, reduced by the amount of the tax due, calculated under Article 21(5b) of the Act of 26 July 1991 on personal income tax (Journal of Laws of 2012, item 361, as amended19)) or Article 17(5) of the Act of 15 February 1992 on corporate income tax. 4. The amount of aid to be returned, referred to in item 3, shall include interest calculated for outstanding tax. Interest shall be due for the period starting on the day when the aid was granted to the day when returned. Article 12c.18) Any claims for the return of public aid granted under the Act shall be time-barred after 10 years of the end of the calendar year when the entrepreneur used that aid. Article 13. (repealed). Article 14. (repealed). Article 15. 1. Upon the request of the zone administrator, the starost who performs the duties of governmental administration relevant for the location of the zone may, upon the approval of a province head, entrust the zone administrator with handling building law matters which concern the area of the zone, including the issuance of administrative decisions of first instance, and issuance of building permits, transfer of building permits to another party, cancellation of building permits, acceptance of building completion notices, issuance of permits for use of a structure and permits for changing a manner in which such a structure or any part thereof is to be used, ordering inspections of a structure and demanding submission of an expert opinion on the technical condition of a structure. 2. Upon the request of the zone administrator, a commune council relevant for the location of the zone may authorise the zone administrator to issue decisions on the determination of building and land development conditions for the area of the zone. Chapter 4 Permit to conduct economic activity in the zone entitling to use state aid Article 16. 1. The basis for using state aid granted under the Act shall be the permit to conduct economic activity in the zone which entitles an entrepreneur to use state aid, hereinafter referred to as the “Permit”. 2. 20) The permit shall define the scope of economic activity as well as the conditions that apply particularly to: 1) Employing by an entrepreneur a certain number of employees within a specified time in conducting its economic activity in the zone; 2) Making investment in the zone by the entrepreneur of the value which shall exceed a certain amount; 3) The date of investment completion; 17) 18 ) 19 ) 20) The second sentence added by Article 1(3) of the Act referred to in note 7. Added by Article 1(4) of the Act referred to in note 7. The amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2012, items 362, 596, 769, 1278, 1342, 1448, 1529 and 1540, of 2013, items 21, 888, 1027, 1036, 1287, 1304, 1387 and 1717, of 2014, items 223, 312, 567, 598, 773, 915, 1052, 1215, 1328, 1563, 1644, 1662 and 1863, and of 2015, items 73,211 and 251. In the wording set down by Article 1(8) of the Act referred to in note 1. 4) The maximum amount of qualified investment costs and qualified labour costs; 5) The requirements referred to in Article 5(3) and (4) if the investment is implemented on the land which is owned under perpetual usufruct by entities other than those referred to in Article 5(1). 3. 20) The permit may be issued if the undertaking of economic activity in the zone shall contribute to the achievement of objectives defined in the zone development plan referred to in Article 9. 4. The minister in charge of economy matters shall issue, revoke and amend the permit. The permit may be revoked or amended under conditions set down in Article 19(2)-(4). 5. Before taking its decision on issuing, revoking or amending the permit, the minister in charge of economy matters shall request an opinion of the zone administrator. 6. The provisions of the Act of 14 June 1960, Code of Administrative Procedure (Journal of Laws of 2013, item 267, as amended21)) shall apply to the procedure concerning issuing, revoking or amending the permit. Article 17. 1. Entrepreneurs which are to obtain the permit shall be selected in tender or negotiations conducted following public invitation. 1a. With regard to each zone, the minister in charge of economy matters shall issue a regulation determining the procedure, rules and conditions for tender or negotiations, as well as criteria for the appraisal of intentions concerning business ventures to be undertaken by entrepreneurs in the zone, individually for each zone, taking into consideration, in particular, the extent to which the volume, scope and economic nature of business ventures projected by an entrepreneur in the zone as well as conditions for their implementation will contribute to the achievement of objectives regarding the establishment of the zone, determined in the zone development plan. 2. (repealed). 3. (repealed). Article 17a.22) 1. The application for public aid granted under the Act shall be filed in the tender or negotiations referred to in Article 17(1). 2. The application for public aid granted under the Act may also be filed to the minister in charge for economy matters by a large entrepreneur within the meaning of Article 2(24) of the Commission Regulation (EU) No. 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty (OJ L 187 of 26.06.2014, p. 1), intending to undertake the business venture on the land referred to in Article 5(3) not covered by the zone on the date when the application was filed. The entrepreneur shall attach to the application the documentation supporting the incentive effect referred to in Article 6(3) of the Regulation. After the minister in charge of economy matters has confirmed the incentive effect, the entrepreneur may start its business venture on that land. 3. A large entrepreneur shall not be entitled to pursue any claims if the land referred to in item 2 is not incorporated to the zone or it has not obtained the permit to conduct economic activity in that land. Article 18.23) The minister in charge of economy matters shall inspect economic activity conducted by an entrepreneur that has obtained the permit in a scope of and under rules defined in Article 57 and Chapter 5 of the Act of 2 July 2004 on the freedom of economic activity (Journal of Laws of 2013, item 672, as amended24)). Article 19. 1. The permit shall expire upon the elapse of the period for which the zone was established. 2. (repealed) 3. The permit may be revoked or its scope or object of economic activity stated in the permit may be restricted, if an entrepreneur has: 1) Ceased to conduct its economic activity for which it held the permit in the zone; or 2) 3) 21) 22) 23) 24) 25) Grossly neglected the conditions stated in the permit; or 25) Failed to remedy any defects detected by the inspection referred to in Article 18 within the time limit set in the notice of the minister in charge of economy matters to remedy them; or The amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2014, items 183 and 1195, and of 2015, item 211. Added by Article 1(5) of the Act referred to in note 7. In the wording set down by Article 1(6) of the Act referred to in note 7. The amendments to the consolidated text of the Act were promulgated in Journal of Laws of 2013, items 675, 983, 1036, 1238, 1304 and 1650, of 2014, items 822, 1133,1138, 1146 and 1885, and of 2015, item 222. In the wording set down by Article 1(7)(a)(1) of the Act referred to in note 7. –9– Journal of Laws 4) 26) Item 282 Filed an application to revoke the permit or limit the scope or object of activity stated in the permit. 4. 27) Upon the request submitted by the entrepreneur and following the consultation with the zone administrator, the minister in charge of economy matters may amend the permit, however the amendment may not: 1) Reduce the employment level stated in the permit on the day of its issuance by more than 20%; 2) Result in the increase in state aid; 3) Concern the fulfilment of the requirements for the investment implemented on the land which is owned by or under perpetual usufruct of entities other than those referred to in Article 5(1). 5. 28 ) The minister in charge of economy matters shall declare the expiry of the permit upon the application of the entrepreneur that has not used public aid granted under the Act for that permit or the entrepreneur that used public aid granted under the Act and has satisfied all the conditions set down in the permit and conditions for granting public aid referred to in the regulations issued under Article 4(4). 6. 29 ) The entrepreneur shall attach to the application referred to in item 5 a declaration on not using public aid granted under the Act, covered by the permit the application concerns, or a declaration on satisfying the conditions for granting public aid referred to in item 5. 7. 29) The declaration referred to in item 6 shall be made under the pain of criminal liability for making false statements. The declaring entity shall be obliged to include in the declaration the following clause, “I am aware that I will be prosecuted for making a false declaration.” This clause shall replace the instruction of the body on the criminal liability for making false statements. Article 19a. (repealed)30) Article 20. 1.31) Through a regulation, the minister in charge of economy matters may entrust the zone administrator with: 1) Issuing on its behalf permits referred to in Article 16(1); 2) Performing on its behalf inspections of how the permit conditions are fulfilled – taking into consideration the necessity of the zone’s proper functioning. 1a. The zone administrator shall issue the permits referred to in item 1 through a decision. 2. If the zone administrator is entrusted with performing an inspection referred to in item 1(2), it shall be entitled to perform its inspection activities provided for to a licensing authority under the provisions on licensing business activity in the scope set down in the regulation referred to in item 1. 3. The zone administrator shall immediately notify the minister in charge of economy matters that the circumstances referred to in Article 19(3) have occurred and may submit a request to the minister in charge of economy matters for revoking the permit, restricting its scope or the scope of activity set in the permit. Chapter 5 Amendments to the provisions in force. Interim and final provisions Articles 21-23. (omitted) Article 24. 1. When the regulations referred to in Article 4(1) enter into force, the minister in charge of State Treasury matters shall take over actions and rights as to a company designated the zone administrator, performed before that date on behalf of the State Treasury by another government administration authority, provided that the minister in charge of State Treasury matters decides whether or not shares in such a company established after the transformation of a state enterprise subject to the Act of 13 July 1990 on privatisation of state-owned enterprises (Journal of Laws No. 51, item 298, as amended.32 )33)), having obtained the opinion of the minister in charge of economy matters. 26) 27) 28) 29) 30) 31) 32) Added by Article 1(7)(a)(2) of the Act referred to in note 7. In the wording set down by Article 1(9) of the Act referred to in note 1. In the wording set down by Article 1(7)(b) of the Act referred to in note 7. Added by Article 1(7)(c) of the Act referred to in note 7. Added by Article 12 of the Act of 19 December 2008 on amending the act on the freedom of economic activity and amending some other acts (Journal of Laws of 2009 No. 18, item 97) which became effective on 7 March 2009; repealed by Article 1(8) of the Act referred to in note 7. In the wording set down by Article 1(10) of the Act referred to in note 1. The amendments to the Act were promulgated in Journal of Laws of 1990 No. 85, item 498, of 1991 No. 60, item 253, and No. 111, item 480, of 1994 No. 121, item 591, and No. 133, item 685, and of 1996 No. 90, item 405, and No. 106, item 496. 2. Article 17, Article 19(1), second sentence, Article 23(1)-(3), Articles 24, 28 and 29 of the Act on privatisation of state-owned enterprises shall not apply to a company that is the zone administrator, established under the Act on privatisation of state-owned enterprises33). 3. The government administration authority in charge of land management, with regard to the land being the property of the State Treasury, or head of a commune (mayor or a president of a city) with regard to the land being the property of a commune, may contribute to the company that is the zone administrator the ownership title to the land, the perpetual usufructuary of such which is such a company, or the land which remained perpetually usufructed by a state-owned enterprise liquidated, to contribute to a company an enterprise or its organised part. Contribution of the title to the land, which remained perpetually usufructed by a stateowned enterprise in liquidation, shall be made in agreement with the founding body of the enterprise. In cases mentioned in this item, perpetual usufruct expires upon the contribution of the title to the land to a company which is the zone administrator. The minister in charge of State Treasury matters shall represent the State Treasury in a company that is the zone administrator with regards to rights attached to shares acquired by the State Treasury in lieu of the title to the land contributed, as specified in this item. Article 25. 1. The zone administrator shall be exempted from a stamp duty for purchasing or disposing of the title to properties located in the zone. 2. In the regulation referred to in Article 4(1), the Council of Ministers may exempt income of the zone administrator from the corporate income tax, considering expenditure spent in a tax year or the year following it for the purpose of developing a zone, including the zone administrator’s purchase of property or other objects used for economic activity in a zone as well as refurbishment and extension of the economic and technical infrastructure in a zone. Article 26. The Sejm shall be provided by the Council of Ministers with information on the implementation of the Act along with a report on the execution of the budget. Article 27. The Act shall come into force after 30 days from its promulgation34), except for the provision of Article 15 which shall come into force on 1 January 1995. 33 ) 34 ) The Act has become ineffective under Article 74 of the Act of 30 August 1996 on commercialisation and privatisation of state-owned enterprises (Journal of Laws No. 118, item 561) which became effective on 8 January 1997. The Act was promulgated on 23 November 1994.