Monetary LECTURE NOTES 1

advertisement

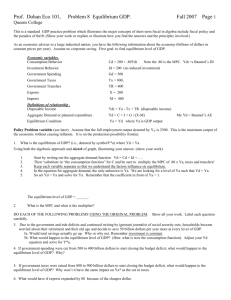

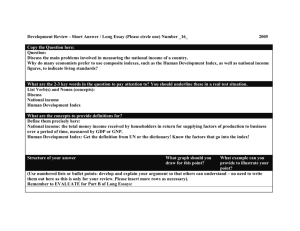

LECTURE NOTES I THE REAL SECTOR OF THE ECONOMY Chapters 5, 6, 7,8,9,10 of Waud =========================================================== = CHAPTER 5 NATIONAL INCOME =========================================================== This can be considered from two sides: receipt of income and its expenditure. ----------------------------------------------------------PART I: RECEIPTS SIDE ----------------------------------------------------------National income is a stock concept. It is taken as the total income over a period of one year. This is an accounting procedure for national income. I.A. CONCEPTS TAKEN AT MARKET PRICE/ MARKET VALUE GDP/ GNP/ NDP/ NNP are always taken at market price, i.e., the market value, unless stated otherwise. 1. Domestic income: Domestic Income = + + + + + + Wages and salaries rents interest dividends undistributed profits (including depreciation or CCA) mixed incomes direct taxes Domestic income is known as GDP. Nothing is counted twice. Therefore, only goods and services bought for final use are considered; i.e., no unfinished goods are considered. 2. National Income or GNP/ GNE/ GNI/ Y: National Income = Domestic Income + net asset income earned from abroad GNP = GNI GNE = = unduplicated (final) value of the flow of goods and services produced by a nation annually. Gross national income Gross national expenditure Note: GNP = GNI = GNE = Y GNP is usually denoted by Y, the national income, and is used in Keynesian economics GNP = GDP + net property income from abroad (X-M) where E = exports, M = imports => GNP = GDP + (E - M) = GDP + X where X is net exports NOTE: GNP > GDP We do a detailed breakup of Y later on. 3. Net increase in capital stock: Depreciation goes towards replacing old stock. Therefore, by removing depreciation from GDP/NDP, we get the new buildup of new capital stock. Of course, to this is added the total output of consumer goods in the year, etc. Therefore, NDP is GDP less depreciation. NNP is GNP less the depreciation. Further, NNP = NDP + (E - M) 4. Net Disposable income NDI If net income paid overseas is subtracted from GNP, then that gives the net income available to the nation, including depreciation, i.e., NDI = GNP - net disposable income. 5. National income NI Out of the NNP, the amount of income received by the country's residents is the national income. This is calculated by removing net income paid overseas from NNP. NI = NNP - net income paid overseas. 6. Personal income PI, or Household income HI: If we subtract undistributed profits from NI, then we are left with the income which normal residents receive. 7. PDI Personal disposable income: or HDI: If we subtract the personal taxes from PI, we are left with PDI. I. B. CONCEPTS TAKEN AT FACTOR COST Not all the market value of goods and services is received by factors of production. Some is paid to government in indirect taxes. At the same time, some subsidies are received from government. E.g., out of our personal income, we pay sales tax, and receive the benefits of subsidised public transportation system. Hence we have actually received Wages - indirect taxes + subsidies. This is what a factor receives, leading to a series of concepts "at factor cost". 1. GDP at factor cost = + 2. GNP at factor cost = + 3. GNP at market prices indirect taxes subsidies NDP at factor cost = 4. GDP at market prices indirect taxes subsidies GDP at factor cost NNP at factor cost: - depreciation = GNP at factor cost - depreciation ----------------------------------------------------------PART II: EXPENDITURE SIDE ----------------------------------------------------------Here we consider how the money which is received is spent. The money spent/ saved must be equal to the money received. Therefore, from either side, national income must be the same. Let C= consumption, I= investment. 1. Two sector economy: Here, there is no government. Only the producers and consumers. Therefore, consumers consume C (and save S), and this goes towards new investment. Simultaneously, producers (use the savings S to) invest I. Y = C + I - (1) Further, if S is savings, then, I = S This is obvious, since producers can only invest what all the consumers save. However, there is a simple proof: Now, Income = expenditure on goods and services + savings (in all three sectors: government, business and household) Therefore, Y = C + S Equating, (1) and (2) C+I = C+S or, 2. I = S Three sector economy: -(2) Here there is government, in addition to producers and consumers. Let G = government spending. Therefore, Y = C + I + G Let T be the taxes. Then, I + G = S + T i.e., the total money available in economy for investment purposes, plus government spending, comes from savings and taxes. Usually, I = S and G = T. 3. Four sector economy: Here, there is interaction with the rest of the world in addition. Let E= exports, M= imports, then: Y = C + I + G + (E-M) or, Y = C + I + G + X Further, (think a bit) I + C + E = S + T + M NOTE: many books use X instead of E to represent exports. =========================================================== = CHAPTER 7 AGGREGATE DEMAND AND SUPPLY =========================================================== = Now we look at the economy. THIS IS THE BEGINNING OF MACROECONOMICS (till now we were just accountants) AGGREGATE DEMAND The Aggregate Demand curve (AD) represents what all the entities in the economy - consumers, businesses, foreigners, and governments - would buy at different aggregate price levels. Thus it shows the relationship between the economy's total demand for output and the price level of that output. It measures the total demand in the economy for goods and services. Who demands? a) b) c) d) e) consumers demand to consume, i.e., C producers demand to invest, i.e., I government demands to spend, i.e., G exporters demand to export, i.e., X importers demand to import, i.e., M Therefore, Aggregate demand D = C + I + G + X-M Obviously, D will depend on the wealth of a country. If a country is rich, it will demand more goods and services, than if it is poor. In other words, consumption C will be higher. Wealth is a "real balance" and this effect is known as the real balance effect. Further, it will depend on the price of money, i.e., the interest rate. If the interest rate is low, there will be a greater demand for investment I. Finally there is foreign purchases effect. If the price level declines, then the domestic goods are cheaper, and there is a demand for exports X. If the price level is high, then foreign goods are cheaper and there is a demand for imports M. It is assumed that the demand for government spending G, will remain constant, irrespective of the price level. The "demanders" keep demanding. But how much can they demand? Obviously the demanders are limited by the size of the national income. Indians cannot demand imports beyond what they can afford; similarly they cannot demand to consume more than their income, and they cannot demand to invest more than the money they have. They cannot also demand to export more than what the foreigners want. The demanders will keep demanding till the limit is reached, i.e., there is equilibrium. Therefore, in equilibrium, D = Y In equilibrium, Demand = Income (I) AGGREGATE SUPPLY Now we come to the output or the supply. The demanders keep on demanding what they want. But obviously, the economy may not be able to fulfil the demand. Consumers may not be willing to save the money required by producers to invest, exporters may not wish to export what foreign purchasers want to purchase, etc. The aggregate supply curve (AS) represents the relationship between the prices businesses will charge and the volume of output they produce and sell. The businesses cannot supply less goods than what is demanded, for that will lead to unused capacity. They will therefore supply more even at the given price level, since they have unused capacity. Therefore real output keeps on increasing at a given price level until the existing capacity is fully utilised (Keynesian range). Further, if there is still some unfulfilled demand, then the suppliers can expand their capacity, but they will demand a higher price. Therefore, at this point the price increases, and output also increases. We assume that this is possible because there is still some unemployed people who can be used to produce these goods. (Intermediate range) However, if there is still unfulfilled demand, then there is a problem. The producers cannot produce more than their maximum capacity (which includes fully employing all possible workers). At this point, it is not possible to supply further, no matter what the demand. The only effect of the demand is that the prices start rising (wages rise first, as there is a competition for workers). At this point the ratchet effect comes into force: nominal wages rise but tend not to fall. (Classical range) A very important Keynesian assumption is that prices tend to rise, but not fall. Upto the point of full employment, all increases in nominal income occur because real income rises, i.e., prices are constant. Beyond the point of full employment, all increases in nominal income occur because prices rise, i.e., real income remains constant. This has been modified by modern Keynesians, through the Philips curve. The curve measures unemployment against the rate of change in prices (or, inflation). The curve shows that at lower levels of unemployment there is more inflation, and this inflation is reduced at higher levels of unemployment. Aggregate supply depends on: * potential output * wage-price behaviour EQUILIBRIUM At the equilibrium, of course a nation can produce only that output which is demanded. Therefore, Demand = Output (II) FUNDAMENTAL IDENTITY OF MACROECONOMICS From (I) and (II), we see that Demand = Income = Output This is the fundamental identity of MACROECONOMICS: =========================================================== = CHAPTER 8 CLASSICAL AND KEYNISIAN THEORIES =========================================================== = TOPIC I: AGGREGATE DEMAND AND SUPPLY See Waud: 194, Fig. 8.2 I.SUPPLY SIDE ANALYSIS BY CLASSICALS: Assumption: Prices and wages are flexible. Classicals think that prices react instantaneously and Say's law holds (i.e., all markets clear and there is no excess of supply of goods and services). Key factor in eqbm: Interest rate: Further, the interest rate is flexible and ensures that savings equal investment. If the savings are less than the demand for investment, then the interest rate rises and people have an incentive to save more. Obviously, interest rate will rise only till the point at which it becomes uneconomical for business to pay more for money. If they can get 16% return from business, they will not borrow at 17%. Full employment: According to the classicals, the wages also adjust instantaneously, and this leads to full employment at all levels of price. In fact, they assume full employment. Equilibrium: The classical supply curve is vertical. If the aggregate demand falls, then the prices fall, but the total output and employment remains the same. Effect of macroeconomic policy: Nil. Macroeconomic policy cannot affect the level of unemployment and output. II. DEMAND SIDE ANALYSIS BY KEYNESIANS: Assumption: Prices and wages are sticky. According to Keynes, Says law is true of a barter economy, but not for an economy in which individuals can hold financial assets such as bonds and money. Key factor in eqbm: Disposable income (Income-expenditure approach): According to Keynes, it is disposable income and not interest that determines savings. It is therefore the aggregate demand that determines employment. Hence this is called the demand side analysis of the economy. Effect of macroeconomic policy: Government can stimulate the economy toward high employment, by increasing aggregate demand. TOPIC II: DETERMINING THE EQUILIBRIUM INCOME A. INCOME EXPENDITURE APPROACH TO EQULIBRIUM Fundamental identity: Savings + consumption = disposable income Consumption function: According to Keynes, consumption is a function of income (sounds obvious). Therefore, C = a + bY, where b = the marginal propensity to consume MPC, i.e., the fraction of any change in GNP that is consumed. This is given by the slope of the consumption schedule i.e., C = C (Y) Savings function: The savings function relates savings to disposable income. The savings and consumption functions are mirror images since MPS = 1- MPC Determinants of consumption (and therefore, savings) * disposable income (current year's income) * permanent income (long-term income) * wealth * other influences * credit conditions * expectations about employment prices and income. Determinants of investment: * overall level of output (GNP) * costs * expectations * the interest rate * technological change and new products Keynesian Cross diagram: A diagram showing the aggregate desired expenditure schedule and a 45 degree line showing equilibrium between desired expenditures and income at each level of income. Determination of equilibrium: This is when E = C + I where E = expenditure At this point, the expenditure line crosses 45 degrees, and equilibrium income is obtainted. At equilibrium, S = I see Waud, diag. on p.206 Multiplier model: v. good diagram: Waud/246 The multiplier M in the economy is equal to: 1 --MPS i.e., = 1 ----1-MPC Change in output = 1/MPS x change in investment This arises due to the chain of spending. When savings are low, i.e., MPS is low, then the multiplier is high. Income which goes into the economy rebounds from one person to the other, as it were, and each time generates more income. This is the paradox of thrift. Paradox of thrift: What is true of the part may not be true of the whole (fallacy of composition). An example is the paradox of thrift, where the more you save, beyond a point, the lower the income falls. Keynes therefore showed that savings is not necessarily a good thing for an economy. On the other hand, we must understand that S = I, and therefore, new investment is closely linked to savings. Therefore, low savings are required to achieve current increase in output and therefore, full employment, but high savings are required to achieve long term increase in output.