File - Garrett Keith

advertisement

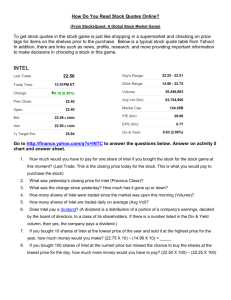

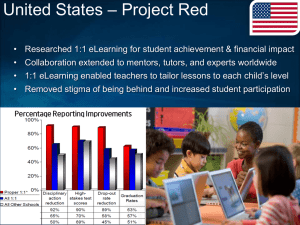

Keith 1 Target Company Project Intel Vs. Texas Instruments (Semiconductors and Other) Garrett Keith Professor Cleveland Financial Management September 20, 2012 Keith 2 Table of Contents Introduction and purpose Pg. 3 Background on Intel (target company) Pg. 3 Background on Texas Instruments (competitor company) Pg. 3-4 Background on the industry Pg. 4 Comparison of important ratios Pg. 4-5 DuPont Simulations Pg. 5-6 Cash Flow Statements Pg. 6 Industry Ratio Comparisons Pg. 6-7 Discussion on Company Articles Pg. 7 Conclusion Pg. 7-8 Introduction and Purpose: Keith 3 The purpose for this report is to compare two leading semiconductor companies (Intel and Texas Instruments) by analyzing the financial statements of the target company (Intel) and the competitor company (Texas Instruments), computing relevant ratios with company with company financial statements, researching relevant articles about the two companies and the industry itself, and researching and analyzing industry statistics. By applying these methods, this report will apply investment evaluation principles to determine which company, Intel or Texas Instruments, is the better performer to invest in its securities. These investment evaluation principles will be achieved by using the following ratios of the companies: These ratios will help determine which company is performing better, additionally a constructed DuPont model and an advanced DuPont Simulation Model will serve to enhance the financial evaluations of both companies through use of their recent financial statements. A critical analysis will then be conducted on the cash flow statements of semiconductor companies to determine their overall performance in the market. Background on Intel (the target company): The target company for this financial project is Intel Inc. In 1968, Bob Noyce and Gordon Moore founded Intel when they left the company Fairchild Semiconductor and later purchased the rights to the name Intel from the company Intelco (Intel, 2012). The two of them went to San Francisco venture capitalist Arthur Rock with a typed, one page idea of what Noyce wanted with his new company (About.com, 2012). Rock was convinced by their idea and raised over $2.5 million in two days by selling convertible debentures. Rock was then named the first chairman of the new company in 1968 (About.com, 2012). Starting in 1969, Intel adopted the Intel logo and from then on started the development of electronics and soon became one of the top electronic and computer software companies in the country and currently is based out of Santa Clara. The industry for the company is Semiconductors and Related Devices Manufacturing with an NAISC code of 334413, and a SIC code of 3674 (Mergent Online, 2012). Currently, Intel employs about 100,100 full time employees on average as of the date December 31, 2011 (Mergent Online, 2012). In the financial filings for the year 2011 the company recorded 53,999,000,000 dollars in net revenue with a net income of 12,942,000,000 dollars (Mergent Online, 2012). Background on Texas Instruments (the competitor company): Texas Instruments, one of the biggest competitors of Intel, designs and makes semiconductors that it sells to electronics designers and manufacturers, whose history is intimately related to the history of the American electronics industry. It was a TI engineer, Jack Kilby, who developed the first semiconductor integrated circuit in 1958, and TI's semiconductor chips helped fuel the modern electronics revolution (Funding Universe, 2012). (Kilby won a Nobel Prize in 2000 for his contributions) After a disappointing performance in the 1980s, the corporation abandoned its long-held, but unfulfilled dream of becoming a consumer electronics powerhouse in favor of specialization in high-tech computer components (Funding Universe, 2012). Texas Instruments' roots can be traced to Geophysical Service, a petroleum-exploration firm founded in 1930 by Dr. J. Clarence Karcher and Eugene McDermott (Funding Universe, 2012). Texas Instruments are based out of Dallas, Texas, with the industry for the target company’s competitor is also Semiconductors and Related Device Manufacturing with an NAISC code of 334413 and with an SIC code of 3674 (Mergent Online, 2012). Total Revenues for Texas Instruments totaled 13,735,000,000 dollars in 2011 and net income totaled 2,236,000,000 dollars in 2011 (Mergent Online, 2012). Background on Industry (Semiconductors and Other): Keith 4 Because of its high correlation with global GDP, the semiconductor group is generally considered a leading barometer of expectations for growth (Armacost, 2012). Over the past year, the S&P 500 Index is up about 2% while the Philadelphia Semiconductor Index (SOX, 405.14 on August 20) is off about 8% (Armacost, 2012). On a year-to-date basis, the S&P Index is up about 11%, while the SOX is up 10% (Armacost, 2012). As we have now moved through Q2 results and Q3 guidance, the SOX has rallied 11% over the past month, about one percentage point higher than the S&P 500, despite the poor Q3 guidance (Armacost, 2012). We believe this signals some optimism of a bottom in semiconductors. Comparison of Important Ratios: With an insight given into the target company, competitor, and the industry itself, there will be comparisons of relevant and important financial ratios. Financial ratios serve to measure the performance of any given company and measures if such company is performing adequately against it’s given competitor in the industry. For this analysis 11 ratios will be discusses to compare Intel and Texas Instruments. These 11 ratios were chosen because they are the most relevant and important ratios that may be used when comparing two competing companies. The first ratio to be discussed includes the current ratio. The current ratio is one the liquidity ratios, which measure how fast a company would be able to pay off its current obligations (Brigham & Houston, 2011). In the case of Intel, their current ratio for 2011 is 2.15 and for Texas Instruments it is 2.24. Although there is not much of a difference between these two companies, the ratio is in millions of dollars so in fact it is a big difference, with Intel actually falling below T.I. The second ratio to be discussed is the accounts receivable turnover ratio (ART). The accounts receivable turnover ratio measures how fast a company is able to eliminate its accounts receivable in a given year (Brigham & Houston, 2011). This ratio is incredibly important because taking the total days in a year of 365, and dividing it by the ART ratio will tell an investor the amount of time it takes a company to collect its account receivables (Brigham & Houston, 2011). The ratio is computed by taking the total sales and dividing it by the total amount of accounts receivable. For the target company Intel, the ART ratio for 2011 is 16.3 and for T.I. is 8.97. In the case of a shortage of cash flow, T.I. would be more prone to ask for short term financing since it is not converting its accounts receivable faster. The third ratio to be analyzed is the net working capital ratio (NWC). The NWC ratio gives an investor the insight of how much cash a company has to operate on (Brigham & Houston, 2011). It is computed by taking the current assets and subtracting the current liabilities (Brigham & Houston, 2011). With Intel, its net working capital for 2011 was $13,844 million and with T.I. it was $4,329 million. Once again Intel has a greater advantage than T.I. for it had more capital to cover its operations. With such a great difference between the NWC, Intel easily overdoes T.I. The fourth ratio to be discussed is the total assets turnover ratio. This ratio analyzes how well a company is using its total assets to produce revenue, which is important when examining a company (Brigham & Houston, 2011). The ratio is calculated by taking total sales/total revenues and dividing it by total assets (Brigham & Houston, 2011). The fifth ratio to be analyzed includes the debt ratio. The debt ratio allows investors to see how much of total assets were financed through debt (Brigham & Houston, 2011). This ratio is calculated by taking total debt and dividing it by total assets (Brigham & Houston, 2011). The sixth ratio to be discussed is the times interest earning ratio (TIE). The TIE ratio is calculated by taking the earnings before income taxes and dividing the earnings by the interest Keith 5 expense (Brigham & Houston, 2011). The TIE ratio tells investors how well a company is using its finance charges to produce income for the business (Brigham & Houston, 2011). The seventh ratio to be analyzed includes the operating profit margin (OPM) ratio. This ratio is calculated by taking earnings before income taxes and dividing it by total revenues (Brigham & Houston, 2011). The ratio depicts how much of sales make its way into EBIT (Brigham & Houston, 2011). The eighth ratio to be discussed is the profit margin ratio. The profit margin ratio compares the net income (loss) to total sales (Brigham & Houston, 2011). This ratio tells investors how much of sales are making its way into net income, which is an incredibly important when analyzing a company’s financials, and measures the efficiency of a firm (Brigham & Houston, 2011). This ratio directly shows how well a company is being managed financially by keeping expenses low to retain the most net income. The ninth ratio to be analyzed is the return on assets ratio. The return on assets ratio measures how efficiently a firm is using its assets to produce net income (Brigham & Houston, 2011). The ratio is calculated by taking net income and dividing it by the total amount of assets that a company has in its balance sheet (Brigham & Houston, 2011). The tenth ratio to be examined includes the return on equity ratio (ROE). The ROE ratio measures how well a company is using stockholders equity to produce net income (Brigham & Houston, 2011). The eleventh and final ratio to be discussed is the price earnings ratio (P/E). The P/E ratio shows how much an investor is willing to pay for each stock in comparison to the dollars of reported profit per stock (Brigham & Houston, 2011). The price earnings ratio is calculated by taking the price per share and dividing it by the earnings per share (Brigham & Houston, 2011). DuPont and Advanced DuPont Simulation: Since all eleven ratios have been calculated and discussed, progression to the DuPont and Advanced DuPont models will be made. The return on equity, profit margin, asset turnover, and return on assets ratio have already been discussed previously, and all of the ratios discussed form a part in calculating the DuPont model. The remaining ratios of the DuPont model to be analyzed include the financing leverage 1 ratio and the DuPont model ROE. The financing leverage 1 is another ratio that compares total liabilities to total asssets. In 2011, this ratio for Intel was 120.36% and Texas Instruments was 120.58%. The financing leverage 1 ratio tells how well a company is using its assets to leverage them and obtain debt for liquidity in business operations. As seen in the ratios, both Intel and Texas Instruments did a fairly equal in 2011 leveraging its assets to obtain debt. The DuPont ROE is similar to the normal ROE in that both are computing how well companies have used owners’ equity to produce income. In 2011, the case for Intel was that it had an ROE of 21.90% while Texas Instruments had an ROE of 13.15%. This ratio suggests that Intel is more valuable, and Intel’s performance is better because it is obtaining a higher DuPont ROE than Texas Instruments (Please note the DuPont model in the appendix pages for further information). The advanced DuPont Simulation model will now be discussed. The first ratio to be discussed is the return on net operating assets (RNOA). This ratio shows an investor how well a company is using its assets to produce income (Brigham & Houston, 2011). In 2011, Intel its RNOA was 20.86% while T.I. was 11.13%. Another important ratio is the spread, which is another finance ratio that measures more in depth how well a company is producing income on its operating assets in comparison to its financial obligations on the balance sheet. In 2011, Intel’s spread was 19.29% and for T.I. it was 9.80%. This ratio shows that the management at Keith 6 Intel is better because they are using their assets more efficiently to produce income which will in turn be able to pay off the debt and obligations in the balance sheet. The last important ratio is the advanced DuPont ROE, which is arguably one of the best ways to measure return on equity and factors in the RNOA, spread, and financial leverage 1. In 2011 Intel had an ROE of 21.66% and T.I. had 13.16%. This ratio proves how much more valuable Intel is than Texas Instruments, for it uses its money more efficiently. Discussion on the Cash Flow Statements: The statement of cash flows will be briefly commented upon and discussed in this section. The cash flow statement is vitally important because it measures the increase and decreases in cash for a company. Industry Ratios: In June 2012, worldwide semiconductor sales totaled $24.38 billion, down 0.1% from $24.4 billion in May, and 2% lower than the June 2011 total of $24.89 billion. The SIA noted, however, that the year-over-year decrease was smaller than it has been since October 2011.In July 2012, the book-to-bill ratio stood at 0.87, indicating that equipment companies received $87 in new orders for each $100 worth of product billed. The three-month average of worldwide bookings stood at $1.28 billion in July 2012, down 10.2% from June 2012 ($1.42 billion) and 1.5% lower than the July 2011 order level of $1.30 billion. It is vital and extremely important to mention that Intel and Texas Instruments are two of the strongest performers in this industry. quick ratio: 1.80 current ratio: 3.70 current liabilities/net worth: 22.50% current liabilities/inventory: 157.50% total liabilities/net worth: 37.40%fixed assets/net worth: 18.50% collection period: 43.80 days sales/inventory: 7.80 times assets/sales: 126.80% sales/net working capital: 1.90 times accounts payable/sales: 6.80% return on sales: 5.10% return on assets: 4.30% return on net worth: 6.10%. Looking at the companies quick and current ratios, Intel has a quick ratio of 1.54 and a current ratio of 2.15 (Key Business Ratios, 2012). Since the industry shows a quick ratio of 1.8 and a current ratio of 3.7, these ratios and statistics show that my current target company Intel is not up to par with the industry because Intel cannot pay off its current obligations as well as the other companies in the industry. Discussion on the Intel and Texas Instruments Articles: In the Intel article, Intel Corp. (INTC) Chief Executive Officer Paul Otellini told employees in Taiwan that Microsoft Corp. (MSFT)’s Windows 8 operating system is being released before it’s fully ready, a person who attended the company event said. Microsoft is eager to get Windows 8, the first version of its flagship software designed for touch tablets, into computers next month to help it vie with Apple Inc. (AAPL)’s iPad during the holiday shopping season. Releasing the operating system before it’s fully baked is the right move, and Microsoft can make improvements after it ships, Otellini told staffers. Intel shares rose 0.5 percent to $22.65 at the close in New York, while Microsoft declined less than 1 percent to $30.17.The publication of this article comes from Bloomberg, which is a major global provider of 24-hour financial news and information. This source, since it is a professional 24-hour news and information resource, has very high quality information and sources. The date this article was published is September 27, 2012, even though it was available on the website on the 26 of September. Since the article was published today I would say that the information presented is incredibly relevant and up to date with the company present day. In the Texas Instruments article, Texas Instruments Incorporated (TI) (NASDAQ: TXN) announced a new low-price, Keith 7 easy-to-useStellaris® LM4F120 LaunchPadevaluation kit. The tool allows professional engineers, hobbyists and university students to begin exploring ARM Cortex-M4F microcontrollers and TI's Stellaris family of microcontrollers for under $5 USD. The core of the new LaunchPad is a Stellaris LM4F120 MCU with best-in-class low power, integrated analog and floating point performance and lends itself to the highly flexible and modular design environment of the LaunchPad with abundant peripherals for real-time digital signal control. The Stellaris LaunchPad brings consumer electronics, human interface control, health & fitness and many more applications to a wider audience of developers. The kit includes all the hardware and software needed for developers, hobbyists and university students to get started in 10 minutes or less. The publication of this article comes form Newsblaze, which is a daily news newspaper that covers world news, finances, etc. This source is a somewhat valid source, considering it is a daily news newspaper. However, since it is not as widely known as Bloomberg, I would say that Newsblaze is not as high quality of material as it could be. The date on the article is September 25, 2012. Since the date is also incredibly recent, I believe that the information presented in the article is still currently relevant to the company. In the two articles, I would say that the research of the information presented in the two articles is somewhat relevant and of some quality. Neither of the articles give a lot of current financial statistics, yet they both appear to give very updated and current news that highly affect the growth and revenues of the companies. I would say that Bloomberg article on Intel provides better and more relevant information than the Newsblaze article on Texas Instruments does. This is because the Bloomberg article gives clear and substantial examples of how the company is doing, as does Newsblaze does with Texas Instruments, yet Bloomberg also compares the article's information to that of Microsoft, who is somewhat of a partner. The financial comparisons between Intel and Microsoft given about the information and news helps relate the target company to other companies, which I feel is extremely relevant and effective. (These two articles are included in the back of this report). Conclusions On Value and Investment Advice: Overall, Intel is the most valuable company in comparison to Texas Instruments. Intel consistently out did T.I. in almost every financial ratio and performance in the year 2011. Moreover, Intel outperformed its competitor in some of the most important ratios including profit margin, ROE, ROA, and all of the advanced DuPont Model. With such a bad turn for Texas Instruments from 2010 to 2011, and such a smooth increase in Intel’s financials from 2010 to 2011, it is obvious which company is the most experienced in this industry. Intel is the best asset and choice in the semiconductor industry. References Brigham F. Eugene & Houston F. Joel. (2011). Fundamentals of Financial Management. Ohio, Mason: South-western Cengage Learning. Keith 8 Armacost, Christian. (2012). Semiconductors: Current Environment. Retrieved September 26, 2012, from S&P Netadvantage website: http://www.netadvantage.standardandpoors.com.vezproxy.stmarys-ca.edu:2048/ NASApp/NetAdvantage/showIndustrySurvey.do?code=sec Reciprocity (2012). In Mergent Online Database. Retrieved from http://www.mergentonline.com//companydetail.php? pagetype=business&compnumber=4396. Reciprocity (2012). In Mergent Online Database. Retrieved from http://www.mergentonline.com.vezproxy.stmarys-ca.edu:2048// pagetype=business&compnumber=8194 companydetail.php? Reciprocity (2012). In Mergent Online Database. Retrieved from http://www.mergentonline.com.vezproxy.stmarys-ca.edu:2048// companyexecutives.php? compnumber=4396 Key Business Ratios. http://www.mergentkbr.com/index.php/reports/industry. Sept. 28, 2012.