Quiz 17 Practice

advertisement

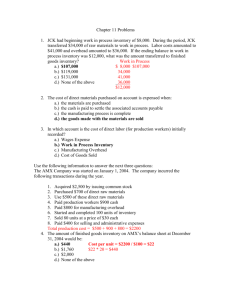

Chapter 17 Practice Question 1 Newton Corporation uses a job order costing system and allocates manufacturing overhead at a rate of $25 per machine hour. During the period, the company used 600 machine hours and actually incurred manufacturing overhead costs of $14,500. (a) Prepare a summary journal entry to record total manufacturing overhead allocated to jobs during the period. Omit the "$" sign in your response. General Journal Work in Process Inventory Debit Credit 15,000 Manufacturing Overhead 15,000 (b) Prepare a summary journal entry to record actual overhead costs incurred during the period (make the credit portion of the entry to "Various Accounts"). Omit the "$" sign in your response. General Journal Manufacturing Overhead Debit Credit 14,500 Various Accounts 14,500 (c) Prepare the journal entry to close the Manufacturing Overhead account directly to Cost of Goods Sold at the end of the period. Omit the "$" sign in your response. General Journal Manufacturing Overhead Cost of Goods Sold Debit Credit 500 500 Question 2 Mayfield Corporation finished job no. 314 on June 1. On June 10, the company sold job no. 314 for $10,000, cash. Total manufacturing costs allocated to this job at the time of the sale amounted to $6,500. (a) Record the transfer of job no. 314 from Work in Process to Finished Goods on June 1. Omit the "$" sign in your response. Date General Journal 6/1 Finished Goods Inventory Debit Credit 6,500 Work in Process Inventory 6,500 (b) Record the sale of job no. 314, and the transfer of its costs from Finished Goods, on June 10. Omit the "$" sign in your response. Date 6/10 Cash General Journal Debit Credit 10,000 Sales 10,000 Cost of Goods Sold 6,500 Finished Goods Inventory 6,500 Question 4 Swanson Corporation applies manufacturing overhead to jobs at a rate of $30 per direct labor hour. During the current period, actual overhead costs totaled $175,000, and 6,000 direct labor hours were worked by the company's employees. Required: (a) Record the journal entry to close the Manufacturing Overhead account directly to Cost of Goods Sold at the end of the period. Omit the "$" sign in your response. General Journal Manufacturing Overhead Cost of Goods Sold (b) Debit Credit 5,000 5,000 Was manufacturing overhead overapplied, or was it underapplied? Omit the "$" sign in your response. Overapplied by $ 5,000 Question 5 Indicate whether job order costing is appropriate for each of the following businesses. a. b. c. d. e. f. g. h. Old Home Bakery, Inc. (a bakery that produces to order). Baxter, Claxter, and Stone, CPAs. Thompson Construction Company. Satin Wall Paints, Inc. Apache Oil and Gas Refinery. Dr. Carr's Auto Body Shoppe. Health-Rite Vitamins. Shampoo Products International. Appropriate Appropriate Appropriate Not Appropriate Not Appropriate Appropriate Not Appropriate Not Appropriate Question 6 For each of the accounts listed below, prepare two summary journal entries. In the first entry, illustrate a transaction that would cause the account to be debited. In the second entry, illustrate a transaction that would cause the account to be credited. Assume that perpetual inventory records are maintained. (a) Materials Inventory Omit the "$" sign in your response. General Journal Materials Inventory Debit XXX Credit XXX Accounts Payable Work in Process Inventory XXX Materials Inventory (b) Direct Labor Omit the "$" sign in your response. General Journal Direct Labor XXX Debit XXX XXX Cash Work in Process Inventory Credit XXX Direct Labor XXX (c) Manufacturing Overhead Omit the "$" sign in your response. General Journal Manufacturing Overhead Debit XXX Credit XXX Cash XXX Work in Process Inventory Manufacturing Overhead XXX (d) Finished Goods Inventory Omit the "$" sign in your response. General Journal Finished Goods Inventory Debit XXX XXX Work in Process Inventory Cost of Goods Sold XXX Finished Goods Inventory Question 7 (a) Production set-up costs The number of set-ups required (or, perhaps, number of production runs) (b) Heating costs The square feet of production space occupied by each product line (c) Machinery power costs The total machine hours required to manufacture each product line (d) Purchasing department costs The number of purchase orders related to each product line (e) Maintenance costs The number of work orders related to each product line Credit XXX (f) Design and engineering costs The number of design or engineering change orders (g) Materials warehouse costs The percent of total square feet in the materials warehouse occupied by each product line (number of component parts per product line) (h) Product inspection costs The number of inspections related to each product line (rate of defects) Question 14 Blue Plate Construction organized in December and recorded the following transactions during its first month of operations: Dec. 2 Dec. 3 Dec. 9 Dec. 15 Dec. 28 Dec. 28 Dec. 29 Dec. 30 Dec. 31 Dec. 31 Purchased materials on account for $400,000. Used direct materials costing $100,000 on job no. 100. Used direct materials costing $150,000 on job no. 101. Used direct materials costing $30,000 on job no. 102. Applied the following direct labor costs to jobs: job no. 100, $9,000; job no. 101, $11,000; job no. 102, $5,000. Applied manufacturing overhead to all jobs at a rate of 300% of direct labor dollars. Completed and transferred job no. 100 and job no. 101 to the finished goods warehouse. Sold job no. 100 on account for $200,000. Recorded and paid actual December manufacturing overhead costs of $78,000, cash. Closed the Manufacturing Overhead account directly to Cost of Goods Sold. (a) Record each of the above transactions as illustrated on pages 775-779. Omit the "$" sign in your response. Date General Journal 12/2 Materials Inventory Debit 400,000 Accounts Payable 12/3 Work in Process Inventory 400,000 100,000 Materials Inventory 12/9 Work in Process Inventory Credit 100,000 150,000 Materials Inventory 12/15 Work in Process Inventory 150,000 30,000 Materials Inventory 12/28 Work in Process Inventory 30,000 25,000 Direct Labor 12/28 Work in Process Inventory 25,000 75,000 Manufacturing Overhead 12/29 Finished Goods Inventory 75,000 330,000 Work in Process Inventory 12/30 Accounts Receivable 330,000 200,000 Sales Cost of Goods Sold 200,000 136,000 Finished Goods Inventory 12/31 Manufacturing Overhead 136,000 78,000 Cash 12/31 Cost of Goods Sold Manufacturing Overhead 78,000 3,000 3,000