Investments - Faculty-Staff Web Server

advertisement

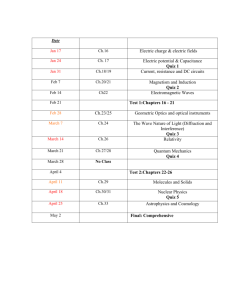

University of Oklahoma Michael F. Price College of Business Investments FIN 4103 - 002 Spring 2008 Tuesday, Thursday 1:30 pm – 2:45 pm PH 2030 Office Hours: Tue, Wed. Office hours by appt. only Evgenia(Janya) Golubeva Office AH252 325-7727 (phone) 325- 7688 (fax) janya@ou.edu Course Overview The Investments course focuses on financial decisions of individual market participants trying to maximize the returns / minimize the risks of their investment portfolio. The course covers several major types of financial instruments, all of which are actively traded in today’s financial markets. Those include stocks, bonds, options, forwards and futures, and swaps. The goal of this course is to introduce you to these securities and discuss their properties and their use, as well as their valuation methods. Prerequisites You must have completed Finance 3303 to receive a grade for this class. Special Accommodations: Any student in this course who has a disability that may prevent him or her from fully demonstrating his or her abilities should contact the instructor personally as soon as possible so we can discuss accommodations necessary to ensure full participation and facilitate your educational opportunities. The University of Oklahoma is committed to providing reasonable accommodations for all students with disabilities. Students with disabilities who require accommodations in this course are requested to speak with me as early in the semester as possible. Students with disabilities must be registered with the Office of Disability Services prior to receiving accommodations in this course. The office of Disability Services is located in Goddard Health Center, Suit 166, phone (405) 325-3852 or TDD only (405) 325-4173. Religious Holidays It is the policy of the University to excuse absences of students that result from religious observances and to provide without penalty for the rescheduling of examinations and additional required class work that may fall on religious holidays. Academic Integrity The University policy on academic integrity will be strictly followed. The information about the policy on academic misconduct is located on the following website: http://www.ou.edu/provost/integrity Attendance I will not check your attendance. You need NOT bring me an excuse note for missing a class UNLESS you miss a quiz or a test. (Read on regarding my policy for missed quizzes / tests.) Textbook The textbook for this course is Investments, seventh edition by Bodie, Kane, and Marcus. Your reading assignment sheet attached to this syllabus states which sections of book chapters and which handouts you should read before each class. Optional book Graham and Dodd, Security Analysis Other materials I shall recommend extra reading from time to time. Access to the Wall Street Journal and to the Internet is important. Although subscription is not required for this course, you are encouraged to check out the student discount subscription options online at http://www.WSJstudent.com Grades The course grade will be determined based on the following: Two homework projects (75 pts each) Five Quizzes (20 pts each) Term Project Midterm I Midterm II (Not comprehensive) Final (Not Comprehensive) TOTAL 150 points 100 points 150 points 200 points 200 points 200 points 1000 points Letter Grades A = 90% or above; B=80-89%; C=70-79%; D=60-69%; F=<60%. No curve shall apply. Quizzes A total of six quizzes shall be given. A quiz missed for an unexcused reason will receive a zero. A quiz missed for a valid reason will receive a score based on the next exam. For example, you are excused from quiz #1 and you receive 160 points for Midterm 1. Then your score for quiz #1 will become (160 / 200) * 20 = 16 points. At the end of the term, the lowest positive of the six scores – except if missed for an unexcused reason – shall be dropped. There will be no make-up quizzes. Make-up Exams An exam missed for a valid reason may be made up within one week. You will need to make arrangements with me regarding the time / location. If you miss the final exam and cannot make it up before the course grades are due you will receive an “I” (for Incomplete), pending your taking the final exam. Homework Assignments are due before class on the due date. Late assignments shall not receive any credit. Homework must be submitted electronically to my graduate assistant. Please save your homework under the following name: ‘your last name _ your first name _ homework # . extension’ (for example ‘smith_john_homework2.xls’). Term Project The description of the project is at the end of this syllabus. Bonus Participation We shall have a guest speaker who is a real-life investment practitioner. The date of his visit is tentatively set to February 19. You have a chance to earn bonus points by asking the speaker interesting questions. You are welcome to email your questions to me in advance (preferred) and I will then pass them on to the speaker, to give him a better chance to prepare. You are also welcome to ask questions directly in class during his visit. Either way, each participating student will receive 10 points bonus credit, and the students whose questions are selected by our quest as the most interesting will receive additional bonus credit. Communication Please check your university email account regularly. The best way to reach me is via email also. Graduate Assistant My graduate assistant is Dong Hyun Kim, email donghyun@ou.edu Class Schedule and Reading Assignments FIN 4103 -002 Spring 2008 Class Topic Readings (Bodie, Kane, and Marcus) Handouts (on http://learn.ou.edu) Jan 15 Introduction No Assignment Jan 15 - 17 Investing Environment Chapters 2, 3 Jan 29 Quiz #1; Team / Stock selection Due Jan 22 Jan 31 Risk and return; Mean-variance mathematics; Diversification; Combining risky portfolio with a default-free security; Sharpe ratio and CAL. Feb 7 Quiz #2; Feb 14 Homework #1 Due Feb 5 - 12 CAPM; Asset pricing and Market Efficiency Chapter 9 Handout 2 Feb 14 Financial Statements Chapter 19 Feb 14 Quiz #3 Feb 19 Guest Speaker. Participation Bonus given Feb 21 MIDTERM EXAM I, Chapters 2, 3, 6, 7, 9 Feb 26 Industry analysis Chapter 17 Feb 29 Mar 6 Equity valuation Chapter 18 Handout: “free cash flow” Mar 11 Mar 11 - 25 Chapters 6-7 (Skip 6.5; 7.5; Appendices) Handout 1 Quiz #4 Options (Introduction) Chapter 20.1-20.3 Mar 18 – 20 SPRING BREAK Mar 27 Apr 3 Arbitrage relationships Determinants of option values Chapter 20.4, 21.1-21.2, Handout 3 Mar 27 Quiz #5 Apr 8 MIDTERM EXAM 2, Chapters 9, 17, 18, 19, 20 Apr 10 - 17 Option pricing April 17 Homework #2 Due April 24 Term Paper Due Chapter 21.3 (744746) 21.4 (750 – 757) Handout 4 (optional) Apri 22 – April 29 Futures Apr 29 Quiz #6 May 1 Reserve (review for the final if all material covered) Chap. 22 Handout 5 FINAL EXAM: NOT COMPREHENSIVE; Chapters 18,20,21,22 As scheduled by the University – Tue May 6 1:30 pm – 3:30 pm, regular classroom Spring 2008 FIN 4103 -002 Homework Assignment Sheet Assignment 1: due Feb 14 Use the example on D2L as your guide in completing the assignment. Please do not use another format – it delays grading. Go to http://finance.yahoo.com and download the weekly adjusted close stock prices for Apple, Inc. (ticker symbol is AAPL) and Schlumberger Limited (SLB) for the period December 31, 2006 through December 31, 2007. You will have 54 weekly prices. (Please make sure all dates download correctly. Sometimes Yahoo will not download one or more of the observations.) I II III IV V VI VII VIII Use the weekly prices to calculate weekly returns for each of the stocks. Calculate returns as log price ratios, that is, Rt = ln(Pt / Pt-1). You will have 53 weekly returns. For each of the stocks, find the average weekly return and standard deviation of returns using the functions AVERAGE and STDEV in Microsoft Excel. Find the correlation coefficient between AAPL and SLB using the function CORREL in Microsoft Excel. Annualize the average returns and standard deviations found in step II. Annualized average return = Weekly average return * 52. Annualized standard deviation = Weekly standard deviation * SQRT(52). The correlation coefficient need not be annualized. From this point onward, you will be working with the annualized numbers only. You will use the annualized numbers as input data for the following steps. Calculate the expected return, standard deviation, and Sharpe ratio for each of the following thirteen allocations between AAPL and SLB: (-1, 2); (-0.75, 1.75); (-0.5, 1.5); (-0.25, 1.25); (0, 1); (0.25, 0.75); (0.5, 0.5); (0.75, 0.25); (1,0); (1.25, -0.25); (1.5, -0.5); (1.75, -0.75); (2, -1). Chart the portfolio opportunity set. Assuming the risk-free rate is 5% per year, use Excel Solver to solve for the optimal portfolio of AAPL and SLB. That is, assuming that ω is the fraction allocated to AAPL, and (1 – ω) is the fraction allocated to SLB, find ω* such that the allocation (ω*, 1-ω*) has the highest Sharpe ratio among all possible allocations between AAPL and SLB. Find the expected return and standard deviation of the optimal portfolio. Mark the risk-free asset, the optimal portfolio, and show the Capital Allocation Line for the optimal portfolio on the chart that you built in step V. End-of-chapter problems: 3.9, 3.10 (a, b) Assignment 2: due April 17 Use the example on D2L to complete this assignment. For this assignment, you need to locate stock and option prices and T-bill quotes in the Wall Street Journal. If you have online access: go to http://online.wsj.com/documents/mktindex.htm (that is the web link to Markets Data Center of the Wall Street Journal online). Once on the Markets Data Center page, look for stock and option quotations under “US Stocks”, and for Treasury quotes under “Bond Markets.” To access WSJ online from the PCB lab, you need to login by typing sooner\4+4 as username. Please consult a lab assistant if you have problems logging in. If you do not have access to the WSJ, you are welcome to use the data provided on D2L for this assignment. The data is old so working with it is less exciting than working with the most recent data; but this exercise is hypothetical anyway. Design three different types of arbitrages with stock options: - Arbitrage exploiting a put-call parity violation, using Index Options; - “Immediate Exercise” arbitrage exploiting a lower bound violation for American Put or American Call, using Listed Options on individual stocks; - “Holding until expiration” arbitrage exploiting a lower bound violation for American Call, using Listed Options on individual stocks. Each of your three strategies should involve trading a “round lot,” that is, should be for 100 shares or for options on 100 shares. For each violation, identify the violation, and record each of the transactions necessary to produce an arbitrage profit. Show what will happen to your position in all possible states of the world. Use T-Bill rates to find the price of risk-free borrowing and lending. Buy bills at the asked price and sell them (or sell them short) at the bid price. The T-Bill bid-asked spread will be the only transaction cost you must consider in your trades. Assume that all of the reported closing prices are correctly reported and are available contemporaneously. Assume that no dividends are paid. End-of-chapter problems: 20.17, 21.2 Spring 2008 FIN 4103 -002 Term Project You will form teams (five students per team). Each team will select a stock and perform a fairly detailed security analysis leading to an analyst recommendation (buy, hold, or sell). Each team should analyze a different stock, so the choice will be on a first come – first serve basis. The objective of the project is to apply the theoretical knowledge on equity valuation and to prepare you better for the Student Investment Fund class. The project will involve all major aspects of security analysis; however it need not be extremely elaborate to receive full credit. I am looking for your ability to identify major risk / growth factors that affect the value of your stock; for your ability to select comparable firms in the same industry and make an educated comparison; and for your ability to estimate intrinsic value at the basic introductory level. Look at the industry issues as well as the firm-specific issues that are relevant to your analysis. Remember that there is not a “right” number for the firm value. I look mainly at how well you are able to justify your assumptions and conclusions. Team list and stock selection for your project is due January 29. The final paper is due on April 24. Not meeting a deadline will result in a penalty of ten points per team member per deadline. Each due item should be submitted electronically to me at janya@ou.edu The length of the final paper should be between ten and 15 double-spaced pages, excluding exhibits. My grading will be based on the following: - content and relevance to the material covered in class - accuracy and clarity of quantitative analysis - support of your assumptions and projections - logic and consistency of your arguments - professionalism and quality of writing