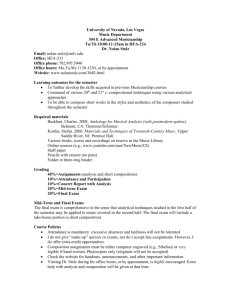

Course Outline/Administrative Matters/Grading Policy

advertisement

EASTERN MEDITERRANEAN UNIVERSITY FACULTY OF BUSINESS AND ECONOMICS DEPARTMENT OF BANKING AND FINANCE AND DEPARTMENT OF BUSINESS ADMINISTRATİON SPRING 2010-2011 COURSE TITLE COURSE TYPE LECTURER FINA/MGMT COURSE 517 LEVEL Corporate Finance Area Core Assoc.Prof.Dr. Cahit Adaoğlu CREDIT VALUE 3 Credit Hrs. COURSE CODE 2nd Semester (Graduate Course) ECTS VALUE 6 I expect that everybody is familiar with basic financial concepts (FINA301) and knows how to use a financial calculator and Microsoft Excel. COREQUISITES None DURATION OF COURSE One Semester (15 weeks) ROOM AND TEL. NO. BE 261 (FBE Building II), 630 2116 or 630 1475 (Secretary) Mondays before class 15.30-16.20/Thursdays before class 10.30-12.20 or feel free to OFFICE HOURS contact for an appointment at other times e-mail: cahit.adaoglu@emu.edu.tr http://www.emu.edu.tr/~cadaoglu (Instructor Web Link) Note: The course website may be moved to http://fbemoodle.emu.edu.tr later in the WEB LINK semester. You will be notified of this change. http://highered.mcgraw-hill.com/sites/0073286982/student_view0/index.html (Textbook Web Link) CATALOGUE DESCRIPTION AIMS & OBJECTIVES The aim of the course is to analyze the primary issues in modern corporate financial theory and practice. The focus will be on the corporate practice (corporate financial policies) that will create value and maximize the wealth of shareholders. We will be concerned with what financial managers do and why, and how the theory of finance explains. The course is designed in line with the subject topics covered in the Chartered Financial Analysts (CFA) Exam (Level I) (see http://www.cfainstitute.org). PREREQUISITES GENERAL LEARNING OUTCOMES (COMPETENCES) On successful completion of this course, all students will have developed knowledge and understanding of: - Corporate Form of Organization - Corporate Governance - Brief Overview of Capital Budgeting - Capital Markets and Capital Structure - Debt Policy - Payout Policy On successful completion of this course, all students will have developed their skills in: - Understanding of the Corporate form of organization and governance - Applying capital budgeting tools and understanding the differences among the tools - Understanding how the corporations finance and the processes - Understanding the factors that affect the capital structure - Understanding the factors that affect the dividend policy On successful completion of this course, all students will have developed their appreciation of and respect for values and attitudes regarding the issues of: - The challenges faced by a financial manager - The complexities and required skills in finance - The importance of investments as a core personal skill in their future careers RELATIONSHIP WITH OTHER COURSES This course lays the foundation for all other finance related courses and must be taken by students interested in finance LEARNING / TEACHING METHOD AND ASSIGNMENTS Class sessions will be devoted to the discussion of readings, chapter assignments/problems, and mini-cases. Chapter assignments/problems from each textbook chapter are announced in the course website. Therefore, please follow the lectures closely and if you miss a lecture, get in touch with one of your classmates or with me. In order for everyone to derive the maximum benefit from the classes, it is important to do the assigned reading and chapter problems. The only way to master this material is by solving problems/practice questions and by doing the assigned reading. Written work will consist of excel applications, mini-cases, and two exams. 1 METHOD OF ASSESSMENT Exam I 35% Exam II 50% Mini-Cases 15% If you do experience difficulty in this course, please contact me as soon as you sense you are having trouble. I will be glad to help you. TEXTBOOK/S R.A. Brealey, S. C. Myers, & F. Allen. Corporate Finance, 9th edition, McGraw-Hill Irwin, 2008. INDICATIVE BASIC READING LIST 1. Selected articles and distributed in class from J. M. Stern and D. H. Chew. The Revolution in Corporate Finance. 4th Ed., Blackwell Publishing, 2003. 2. I strongly recommend that you regularly follow daily financial newspapers such as Dünya (in Turkish) and The Wall Street Journal Europe or The Financial Times. SEMESTER OFFERRED 2010-2011 Spring Semester CONTENT & SCHEDULE Lectures will be held on Mondays (16.30 - 19.00) in BEA3 for FINA517 and Thursdays (12.30 - 15.00) in BEA3 for MGMT517. The lecture topics within the semester are as in the following schedule (Please note that the dates in parentheses are for MGMT517): Lec Date Topic(s) Chapters Wk 21/02/2011 1 Chp. 1: Finance and the Financial Manager (24/02/2011) Introduction to Chp. 2: Present Values, The Objectives of the Firm, and Corporate Corporate Finance 28/02/2011 Governance 2 (03/03/2011) 07/03/2011 Corporate 3 Chapter 34: Governance and Corporate Control around the World (10/03/2011) Governance 14/03/2011 4 (17/03/2011) Chp. 6: Why Net Present Value Leads to Better Investment Capital Budgeting Decisions than Other Criteria 21/03/2011 5 (24/03/2011) 6 7 8 9 10 26/03-06/04/2011 EXAM I (Midterm Exam Period) 11/04/2011 (14/04/2011) 18/04/2011 (21/04/2011) Capital Markets & Corporate Financing Decisions 02/05/2011 (05/05/2011) 09/05/2011 (12/05/2011) 16/05/2011 Holiday 19/05/2010 Debt Policy Payout Policy Chp. 15: An Overview of Corporate Financing Chp. 16: How Corporations Issue Securities Chp. 18: Does Debt Policy Matter? Chp. 19: How Much Should a Firm Borrow? Chp. 25: The Many Different Kinds of Debt (Reading Assignment) Chp. 17: Payout Policy 23/05-07/06 EXAM II (Final Exam Period) PLAGIARISM & MAKE-UPS This is intentionally failing to give credit to sources used in writing regardless of whether they are published or unpublished. Plagiarism (which also includes any kind of cheating in exams) is a disciplinary offence and will be dealt with accordingly. Students who have valid excuses will be allowed to take make-up examinations for all exams. 2