Module 7 (doc file) - Department of Economics

advertisement

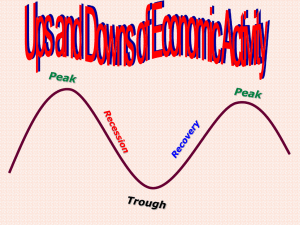

1 Module 7 - Step 4: Perception Versus Reality – Economic Health Jenna Watkins – jrw27 Department of Economics The University of Akron Fall 2011 Abstract The Department of Economics of the University of Akron has tasked students in its Computer Skills for Economic Analysis course to find 30 respondents each to a non-scientific survey. The survey asked a variety of economically relevant questions about demographics, opinions, and consumer behaviors in 2009, 2010, and 2011. The purpose of the survey was to illustrate how perceptions are different than reality. One result was that the average respondent’s perceptions of economic health are not so different from reality. This was done by comparing two of the survey questions, “How do you think the economy is doing now?” and “What do you think the economy will do in the next year?” with the National Bureau of Economic Research’s Business Cycle Dating Committee’s determination of recession and expansion in the U.S. business cycle during the time frame the survey was administered. 2 Introduction: The Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) announces alternating dates of peaks and troughs in U.S. economic activity. This timeline illustrates recession and expansion of the U.S. business cycle. During a recession, the period between a peak and a trough, there is a significant decline in economic activity for more than a few months. Conversely, during an expansion, the period between a trough and a peak, there is a significant increase in economic activity for several years. The committee primarily measures changes in economy-wide activity through observations of real Gross Domestic Product (GDP) and real Gross Domestic Income (GDI) from the Bureau of Economic Analysis’ (BEA) National Income and Product Accounts (NIPA); monthly GDP from the private forecasting firm, Macroeconomic Advisers; monthly GDP, monthly GDI, and an average index of the two based on independent research by Business Cycle Dating Committee members, James Stock and Mark Watson; and/or payroll employment based on the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES) survey of employers. These changes are further analyzed with observations of aggregate weekly hours of work in the total private industries from the BLS; employment estimates based on the BLS’s Current Population Survey (CPS); real personal income less transfer payments from the BEA; the Federal Reserve Board’s index of industrial production; real manufacturing and wholesale-retail trade sales from the Census Department; and/or real manufacturing and trade sales from the BEA. Data and Analysis: Although early movements of NIPA’s real GDP in 2008 showed no clear peak, the NIPA real GDI, an adjacent measure, peaked in the third quarter of 2007. The CPS’s employment measures peaked in November 2007 and the CES’s payroll employment, the number of filled jobs in the economy, peaked in December 2007. Similarly, personal income less transfer payments, inflation adjusted with an 3 interpolated GDP deflator, peaked in December 2007. Industrial production of goods, excluding government production, peaked in January 2008. Real manufacturing and wholesale-retail trade sales of goods, which included imports and were also inflation adjusted with an interpolated GDP deflator, reached its peak in June 2008. As a result of these observations, on December 1, 2008, the Business Cycle Dating Committee announced that a recession had begun in December 2007. The announcement was revised on December 11, 2008 to include real sales from the BEA, but the determination of the peak month was unchanged. The Macroeconomic Advisers' monthly GDP, the Stock-Watson index of monthly GDP, the StockWatson average of their monthly GDP and GDI indexes, the BEA’s real manufacturing and trade sales, and the index of industrial production troughed in June 2009. The Stock-Watson index of monthly GDI reached its trough in July 2009. Lagging indicators of expansion reached their upturns much later in the year, a typical effect of the earlier rise in GDP and GDI, with real personal income less transfers and aggregate hours reaching troughs in October 2009 and the CPS and CES reaching their troughs in December 2009. In an announcement released April 12, 2010, the Business Cycle Dating Committee reported that they had met and discussed these observations but concluded that a trough date could not be determined at that time. On September 20, 2010, after NIPA revisions were released in July and August 2010, further analysis of the preliminary data led the committee to announce that an expansion had begun in June 2009. This identified the end of an 18 month recession, the U.S.’s longest recession since World War II. Although this announcement marked the start of an expansion, the Business Cycle Dating Committee was careful to clarify that this did not mean that “economic conditions since [June 2009] have been favorable or that the economy has returned to operating at normal capacity.” Instead, the determination of the trough showed when economic activity would begin a slow upward crawl towards 4 levels of activity that were still well below normal. In fact, after the first year of the expansion, the average of real GDP and GDI were still 1.3% below their peak levels. Students in Computer Skills for Economic Analysis surveyed 490 individuals in the 2009 academic year about how they thought the economy was doing now and what they thought the economy would do in the next year (Table 1). With the recession was still underway throughout the first six months of the survey, it seems fitting that 42.25% of respondents answered that they thought the economy was currently contracting or in a recession and that 49.59% felt the economy was slowly growing or showing no growth. Interestingly, 77.96% responded that they thought the economy would slowly grow or not grow over the next year, which is in line with the determination of the June 2009 trough in economic activity. In 2010, 504 respondents were surveyed with the same questions (Table 2) and 62.5% of individuals felt the economy was slowly growing or showing no growth and only 33.73% still felt the economy was currently contracting or in a recession. The majority of those holding onto notions that economic activity was still low were likely individuals surveyed before the April 2010 announcement and September 2010 confirmation that the recession had reached its end. Additionally, 81.35% responded that they thought the economy would slowly grow or not grow over the next year and 35.12% of all respondents felt that the economy had both slowly grown and would continue to slowly grow. Of the 446 individuals surveyed in 2011 (Table 3), the shift of perception towards reality mirrored that of 2010, with 63.9% feeling the economy was slowly growing or showing no growth, 76.46% thinking the economy would slowly grow or show no growth over the next year, and 30.49% responding that the economy had been and would continue to slowly grow. Additionally, a compilation of all of the respondents throughout 2009-2011 was examined to see how greatly economic knowledge affected survey responses. When individuals who were students in the Computer Skills for Economic 5 Analysis course answered these questions (Table 4), 65.45% correctly answered that the economy had been slowly growing and would continue to slowly grow. Although a significantly lesser percent of individuals with college level economics education and economics work experience (Table 5) felt that the economy had been and would continue to slowly grow (26.59%), this was still the majority response. Surprisingly, 28.24% of individuals with no economics education or experience (Table 6) had the same majority response. Conclusion: Although many respondents to the survey were not aware of the real levels of economic activity, the majority were correct in their responses throughout the administration of the survey. When considering the fact that the National Bureau of Economic Research Business Cycle Dating Committee, experts on the matter of economic health, took 15 months to announce the expansion after it had begun, it appears that the average individuals’ perception of economic health is reasonably in line with reality. 6 Table 1 The SAS System The FREQ Procedure: 2009 Key Frequency What do you think the economy will do in the next year? Percent Row Percent Column Percent *Frequency Missing = 2* Growing at a high pace Slowly growing No growth How do you think the economy is Contracting doing now? In a recession In a depression Total Grow at a high pace 10 2.04% 71.43% 28.57% 19 3.88% 12.26% 54.29% 4 0.82% 4.55% 11.43% 2 0.41% 4.55% 5.71% 0 0% 0% 0% 0 0% 0% 0% 35 7.14% Slowly grow 1 0.20% 7.14% 0.33% 125 25.51% 80.65% 41.39% 44 8.98% 50% 14.57% 20 4.08% 45.45% 6.62% 100 20.41% 61.35% 33.11% 12 2.45% 46.15% 3.97% 302 61.63% Not Grow Contract 1 0.20% 7.14% 1.25% 8 1.63% 5.16% 10% 21 4.29% 23.86% 26.25% 15 3.06% 34.09% 18.75% 31 6.33% 19.02% 38.75% 4 0.82% 15.38% 5% 80 16.33% 0 0% 0% 0% 1 0.20% 0.65% 4.35% 6 1.22% 6.82% 26.09% 5 1.02% 11.36% 21.74% 8 1.63% 4.91% 34.78% 3 0.61% 11.54% 13.04% 23 4.69% Be in a recession 2 0.41% 14.29% 4% 2 0.41% 1.29% 4% 13 2.65% 14.77% 26% 2 0.41% 4.55% 4% 24 4.90% 14.72% 48% 7 1.43% 26.92% 14% 50 10.20% Total 14 2.86% 155 31.63% 88 17.96% 44 8.98% 163 33.27% 26 5.31% 490 100% 7 Table 2 The SAS System The FREQ Procedure: 2010 Key Frequency What do you think the economy will do in the next year? Percent Row Percent Column Percent *Frequency Missing = 0* Growing at a high pace Slowly growing No growth How do you think the economy is Contracting doing now? In a recession In a depression Total Grow at a high pace 8 1.59% 88.89% 36.36% 8 1.59% 4.02% 36.36% 4 0.79% 3.45% 18.18% 0 0% 0% 0% 1 0.20% 0.66% 4.55% 1 0.20% 10% 4.55% 22 4.37% Slowly grow 1 0.20% 11.11% 0.32% 177 35.12% 88.94% 56.01% 64 12.70% 55.17% 20.25% 6 1.19% 33.33% 1.90% 67 13.29% 44.08% 21.20% 1 0.20% 10% 0.32% 316 62.70% Not Grow Contract 0 0% 0% 0% 7 1.39% 3.52% 7.45% 39 7.74% 33.62% 41.49% 4 0.79% 22.22% 4.26% 40 7.94% 26.32% 42.55% 4 0.79% 40% 4.26% 94 18.65% 0 0% 0% 0% 4 0.79% 2.01% 15.38% 5 0.99% 4.31% 19.23% 3 0.60% 16.67% 11.54% 13 2.58% 8.55% 50% 1 0.20% 10% 3.85% 26 5.16% Be in a recession 0 0% 0% 0% 3 0.60% 1.51% 6.52% 4 0.79% 3.45% 8.70% 5 0.99% 27.78% 10.87% 31 6.15% 20.39% 67.39% 3 0.60% 30% 6.52% 46 9.13% Total 9 1.79% 199 39.48% 116 23.02% 18 3.57% 152 30.16% 10 1.98% 504 100% 8 Table 3 The SAS System The FREQ Procedure: 2011 Key Frequency What do you think the economy will do in the next year? Percent Row Percent Column Percent *Frequency Missing = 5* Growing at a high pace Slowly growing No growth How do you think the economy is Contracting doing now? In a recession In a depression Total Grow at a high pace 4 0.90% 33.33% 21.05% 6 1.35% 3.31% 31.58% 0 0% 0% 0% 4 0.90% 7.02% 21.05% 4 0.90% 5.33% 21.05% 1 0.22% 5.88% 5.26% 19 4.26% Slowly grow 5 1.12% 41.67% 2.18% 136 30.49% 75.14% 59.39% 52 11.66% 50% 22.71% 15 3.36% 26.32% 6.55% 18 4.04% 24% 7.86% 3 0.67% 17.65% 1.31% 229 51.35% Not Grow Contract 0 0% 0% 0% 29 6.50% 16.02% 25.89% 43 9.64% 41.35% 38.39% 20 4.48% 35.09% 17.86% 16 3.59% 21.33% 14.29% 4 0.90% 23.53% 3.57% 112 25.11% 1 0.22% 8.33% 2.94% 4 0.90% 2.21% 11.76% 6 1.35% 5.77% 17.65% 16 3.59% 28.07% 47.06% 4 0.90% 5.33% 11.76% 3 0.67% 17.65% 8.82% 34 7.62% Be in a recession 2 0.45% 16.67% 3.85% 6 1.35% 3.31% 11.54% 3 0.67% 2.88% 5.77% 2 0.45% 3.51% 3.85% 33 7.40% 44% 63.46% 6 1.35% 35.29% 11.54% 52 11.66% Total 12 2.69% 181 40.58% 104 23.32% 57 12.78% 75 16.82% 17 3.81% 446 100% 9 Table 4 Class Responses Key Frequency What do you think the economy will do in the next year? Percent Row Percent Column Percent *Frequency Missing = 0* Growing at a high pace Slowly growing No growth How do you think the economy is Contracting doing now? In a recession In a depression Total Grow at a high pace 0 0% 0% 0% 3 5.45% 7.32% 75% 1 1.82% 20% 25% 0 0% 0% 0% 0 0% 0% 0% 0 0% 0% 0% 4 7.27% Slowly grow 1 1.82% 100% 2.27% 36 65.45% 87.80% 81.82% 2 3.64% 40% 4.55% 3 5.45% 60% 6.82% 2 3.64% 66.67% 4.55% 0 0% 0% 0% 44 80% Not Grow Contract 0 0% 0% 0% 1 1.82% 2.44% 20% 1 1.82% 20% 20% 2 3.64% 40% 40% 1 1.82% 33.33% 20% 0 0% 0% 0% 5 9.09% 0 0% 0% 0% 0 0% 0% 0% 1 1.82% 20% 100% 0 0% 0% 0% 0 0% 0% 0% 0 0% 0% 0% 1 1.82% Be in a recession 0 0% 0% 0% 1 1.82% 2.44% 100% 0 0% 0% 0% 0 0% 0% 0% 0 0% 0% 0% 0 0% 0% 0% 1 1.82% Total 1 1.82% 41 74.55% 5 9.09% 5 9.09% 3 5.45% 0 0% 55 100% 10 Table 5 College Level Economics Course Taken and Economics Work Experience Key Frequency What do you think the economy will do in the next year? Percent Row Percent Column Percent *Frequency Missing = 0* Growing at a high pace Slowly growing No growth How do you think the economy is Contracting doing now? In a recession In a depression Total Grow at a high pace 12 4.49% 80% 52.17% 7 2.62% 7.95% 30.43% 2 0.75% 3.45% 8.70% 1 0.37% 4.35% 4.35% 1 0.37% 1.30% 4.35% 0 0% 0% 0% 23 8.61% Slowly grow 3 1.12% 20% 2.01% 71 26.59% 80.68% 47.65% 26 9.74% 44.83% 17.45% 9 3.37% 39.13% 6.04% 37 13.86% 48.05% 24.83% 3 1.12% 50% 2.01% 149 55.81% Not Grow Contract 0 0% 0% 0% 7 2.62% 7.95% 13.46% 20 7.49% 34.48% 38.46% 7 2.62% 30.43% 13.46% 16 5.99% 20.78% 30.77% 2 0.75% 33.33% 3.85% 52 19.48% 0 0% 0% 0% 2 0.75% 2.27% 10% 3 1.12% 5.17% 15% 4 1.50% 17.39% 20% 10 3.75% 12.99% 50% 1 0.37% 16.67% 5% 20 7.49% Be in a recession 0 0% 0% 0% 1 0.37% 1.14% 4.35% 7 2.62% 12.07% 30.43% 2 0.75% 8.70% 8.70% 13 4.87% 16.88% 56.52% 0 0% 0% 0% 23 8.61% Total 15 5.62% 88 32.96% 58 21.72% 23 8.61% 77 28.84% 6 2.25% 267 100% 11 Table 6 No Economics Education or Experience Key Frequency What do you think the economy will do in the next year? Percent Row Percent Column Percent *Frequency Missing = 0* Growing at a high pace Slowly growing No growth How do you think the economy is Contracting doing now? In a recession In a depression Total Grow at a high pace 7 1.08% 53.85% 24.14% 11 1.70% 4.85% 37.93% 4 0.62% 2.90% 13.79% 3 0.46% 4.92% 10.34% 3 0.46% 1.65% 10.34% 1 0.15% 3.70% 3.45% 29 4.48% Slowly grow 2 0.31% 15.38% 0.54% 183 28.24% 80.62% 49.33% 76 11.73% 55.07% 20.49% 16 2.47% 26.23% 4.31% 86 13.27% 47.25% 23.18% 8 1.23% 29.63% 2.16% 371 57.25% Not Grow Contract 0 0% 0% 0% 22 3.40% 9.69% 16.54% 45 6.94% 32.61% 33.83% 21 3.24% 34.43% 15.79% 40 6.17% 21.98% 30.08% 5 0.77% 18.52% 3.76% 133 20.52% 1 0.15% 7.69% 2.70% 2 0.31% 0.88% 5.41% 6 0.93% 4.35% 16.22% 16 2.47% 26.23% 43.24% 8 1.23% 4.40% 21.62% 4 0.62% 14.81% 10.81% 37 5.71% Be in a recession 3 0.46% 23.08% 3.85% 9 1.39% 3.96% 11.54% 7 1.08% 5.07% 8.97% 5 0.77% 8.20% 6.41% 45 6.94% 24.73% 57.69% 9 1.39% 33.33% 11.54% 78 12.04% Total 13 2.01% 227 35.03% 138 21.30% 61 9.41% 182 28.09% 27 4.17% 648 100% 12 References Business Cycle Dating Committee. “Statement of the NBER Business Cycle Dating Committee on the Determination of the Dates of Turning Points in the U.S. Economy.” The National Bureau of Economic Research. Web. 20 Oct. 2011. <http://www.nber.org/cycles/general_statement.html>. Business Cycle Dating Committee. “US Business Cycle Expansions and Contractions1.” The National Bureau of Economic Research. Web. 20 Oct. 2011. <http://www.nber.org/cycles/cyclesmain.html>. Business Cycle Dating Committee. "Determination of the December 2007 Peak in Economic Activity." The National Bureau of Economic Research. 1 Dec. 2008 (revised 11 Dec. 2008). Web. 20 Oct. 2011. <http://www.nber.org/cycles/dec2008.html>. Business Cycle Dating Committee. “NBER Committee Confers: No trough Announced.” The National Bureau of Economic Research. 12 Apr. 2010. Web. 20 Oct. 2011. <http://www.nber.org/cycles/april2010.html> Business Cycle Dating Committee. The National Bureau of Economic Research. 20 Sept. 2010. Web. 20 Oct. 2011. <http://www.nber.org/cycles/sept2010.html>. University of Akron. Computer Skills for Economic Analysis. “Survey for Computer Skills for Economic Analysis”. SAS Data Created 19 Oct. 2011.