Accounting for Receivables

advertisement

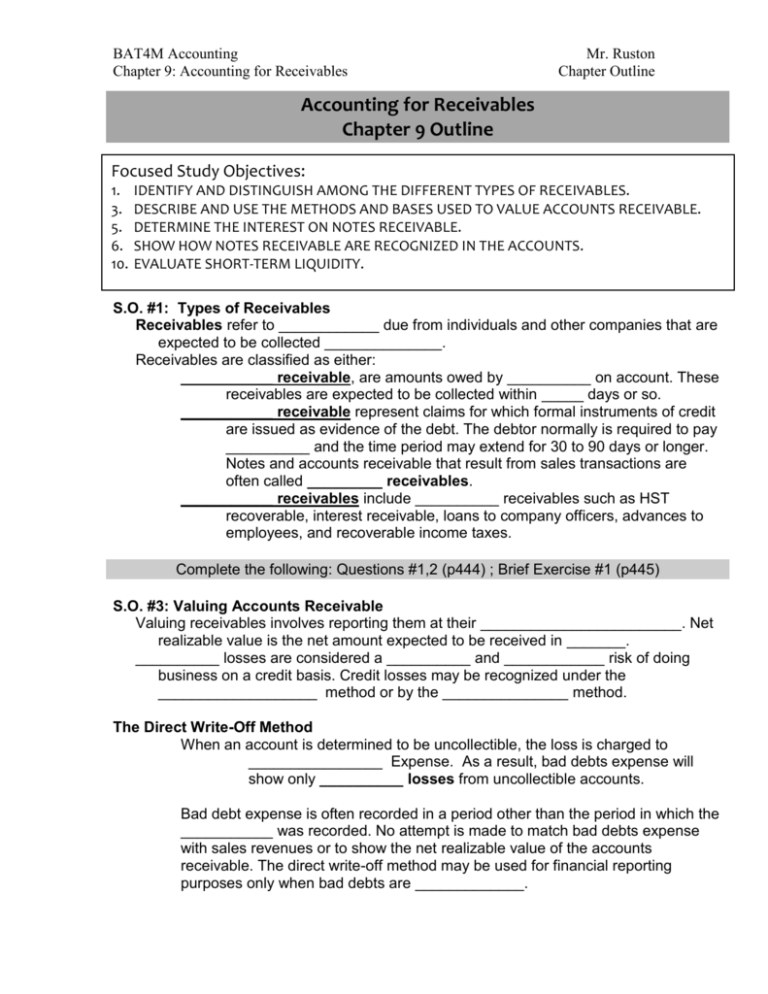

BAT4M Accounting Chapter 9: Accounting for Receivables Mr. Ruston Chapter Outline Accounting for Receivables Chapter 9 Outline Focused Study Objectives: 1. 3. 5. 6. 10. IDENTIFY AND DISTINGUISH AMONG THE DIFFERENT TYPES OF RECEIVABLES. DESCRIBE AND USE THE METHODS AND BASES USED TO VALUE ACCOUNTS RECEIVABLE. DETERMINE THE INTEREST ON NOTES RECEIVABLE. SHOW HOW NOTES RECEIVABLE ARE RECOGNIZED IN THE ACCOUNTS. EVALUATE SHORT-TERM LIQUIDITY. S.O. #1: Types of Receivables Receivables refer to ____________ due from individuals and other companies that are expected to be collected ______________. Receivables are classified as either: ___________ receivable, are amounts owed by __________ on account. These receivables are expected to be collected within _____ days or so. ___________ receivable represent claims for which formal instruments of credit are issued as evidence of the debt. The debtor normally is required to pay __________ and the time period may extend for 30 to 90 days or longer. Notes and accounts receivable that result from sales transactions are often called _________ receivables. ___________ receivables include __________ receivables such as HST recoverable, interest receivable, loans to company officers, advances to employees, and recoverable income taxes. Complete the following: Questions #1,2 (p444) ; Brief Exercise #1 (p445) S.O. #3: Valuing Accounts Receivable Valuing receivables involves reporting them at their ________________________. Net realizable value is the net amount expected to be received in _______. __________ losses are considered a __________ and ____________ risk of doing business on a credit basis. Credit losses may be recognized under the ___________________ method or by the _______________ method. The Direct Write-Off Method When an account is determined to be uncollectible, the loss is charged to ________________ Expense. As a result, bad debts expense will show only __________ losses from uncollectible accounts. Bad debt expense is often recorded in a period other than the period in which the ___________ was recorded. No attempt is made to match bad debts expense with sales revenues or to show the net realizable value of the accounts receivable. The direct write-off method may be used for financial reporting purposes only when bad debts are _____________. BAT4M Accounting Chapter 9: Accounting for Receivables Mr. Ruston Chapter Outline The Allowance Method The allowance method is required for financial reporting purposes when bad debts are material in amount. Under this method: Uncollectible accounts receivable are _____________. This estimate is treated as an expense and is matched against ________ in the same accounting period in which the sales occurred. Estimated uncollectibles are ___________to Bad Debts Expense and ___________ to Allowance for Doubtful Accounts through an adjusting entry at the end of each period. Actual uncollectibles are debited to Allowance for Doubtful Accounts and credited to Accounts Receivable at the time the specific account is written off. Occasionally, a company collects from a customer after the account has been written off as uncollectible. The entry made in writing off the account is reversed to reinstate the customer’s account. The collection is journalized in the usual manner. Two bases are used to determine the amount of the expected uncollectibles: They are: ___________________________ and _______________________ Under the percentage of sales basis, management establishes a percentage relationship between the amount of credit sales and expected losses from uncollectible accounts. The percentage is based on past experience and anticipated credit policy, and is usually applied either to total credit sales or net credit sales of the current year. This basis of estimating uncollectibles emphasizes the __________ of expenses with revenues (income statement viewpoint). When the adjusting entry is made, the existing balance in the Allowance for Doubtful Accounts is disregarded. Under the percentage of receivables basis, management establishes a percentage relationship between the amount of receivables and expected losses from uncollectible accounts. This percentage can be applied to _______ receivables or to groupings of receivables by _______. This basis produces a better estimate of net realizable value (balance sheet viewpoint). An aging schedule is often used to determine the _________ balance in the allowance account at each balance sheet date. When the adjusting entry is made, the amount of bad debt expense is the difference between the required balance and the existing balance in the allowance account. Complete the following: Questions #4, 5, 6, 7 (p444); Brief Exercises #3, 4, 5, 6 (p445); Exercises #2, 3, 4 (p446-7); Problems #2, 4, 5 (p. 447-9) BAT4M Accounting Chapter 9: Accounting for Receivables Mr. Ruston Chapter Outline S.O. #5 Interest on Notes Receivable A __________ note is a written promise to pay a ___________ amount of money on demand or at a definite time. Promissory notes may be used: When individuals and companies lend or borrow money. When the amount of the transaction and the credit period exceed normal limits. In settlement of an open account. Notes receivable gives the holder a stronger _______ claim to assets than accounts receivable and can be readily ______ to another party. The formula for calculating interest is _____________ X ________________ X _________ in terms of one year. Time is the number of months within the period (not to exceed a year) divided by 12. Complete the following: Question #12 (p444); Brief Exercise #8 (p445); Exercises #7, 8 (p 447) S.O. #6 Recognizing Notes Receivable Recognition occurs when the note is ____________. The note is recorded at its face value by ___________ Notes Receivable and _____________ Accounts Receivable. No interest __________ is recorded when the note is received. Interest will be earned and recorded as time passes. Complete the following: Question #13 (p444) ; Brief Exercise #9 (p445) S.O. #10 Evaluate Short-term Liquidity Collection of trade receivables has a significant impact upon a company’s ______ position. Four ________ assist in evaluating short-term liquidity: The ________ ratio (Current _______ ÷ Current ___________) measures a company’s ability to satisfy its ______-term debts. The _________ ratio (or _______ ratio) measures a company’s ability to satisfy its shortterm debts immediately. (Cash + Temporary investments + Accounts receivable) ÷ Current liabilities The receivables ____________ is a useful measure for assessing a company’s efficiency in converting _______ sales into cash. The ________ the ratio, the more liquid are the company’s receivables. Net credit sales ÷ Average accounts receivable The ________ period is determined by dividing 365 days by the receivables turnover ratio. Complete the following: Questions #16, 17 (p444) ; Brief Exercise #12 (p445); Exercise #12 (p448); Problem #10 (p451)