exercise5-5_key

advertisement

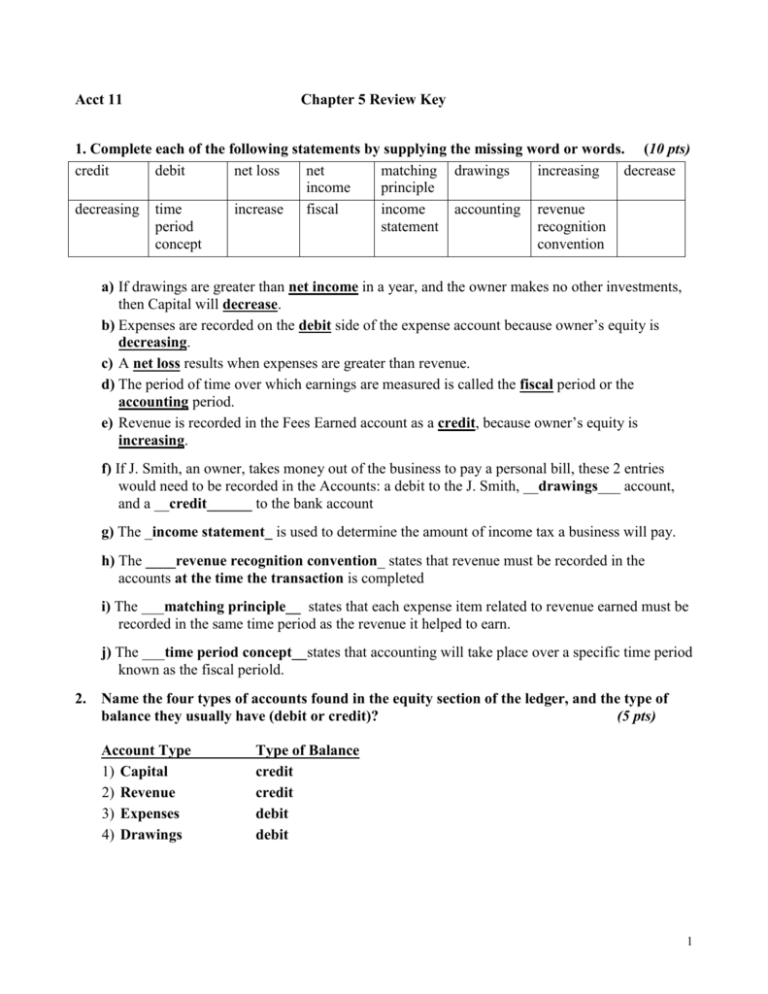

Acct 11 Chapter 5 Review Key 1. Complete each of the following statements by supplying the missing word or words. (10 pts) credit debit net loss net matching drawings increasing decrease income principle decreasing time increase fiscal income accounting revenue period statement recognition concept convention a) If drawings are greater than net income in a year, and the owner makes no other investments, then Capital will decrease. b) Expenses are recorded on the debit side of the expense account because owner’s equity is decreasing. c) A net loss results when expenses are greater than revenue. d) The period of time over which earnings are measured is called the fiscal period or the accounting period. e) Revenue is recorded in the Fees Earned account as a credit, because owner’s equity is increasing. f) If J. Smith, an owner, takes money out of the business to pay a personal bill, these 2 entries would need to be recorded in the Accounts: a debit to the J. Smith, __drawings___ account, and a __credit______ to the bank account g) The _income statement_ is used to determine the amount of income tax a business will pay. h) The ____revenue recognition convention_ states that revenue must be recorded in the accounts at the time the transaction is completed i) The ___matching principle__ states that each expense item related to revenue earned must be recorded in the same time period as the revenue it helped to earn. j) The ___time period concept__states that accounting will take place over a specific time period known as the fiscal periold. 2. Name the four types of accounts found in the equity section of the ledger, and the type of balance they usually have (debit or credit)? (5 pts) Account Type 1) Capital 2) Revenue 3) Expenses 4) Drawings Type of Balance credit credit debit debit 1 3. Indicate which accounts you would debit and credit for the following transactions for Splinters Building Supplies. Write complete account titles. (10 pts) September 3 Issued a bill for $560 to W. Thomson for services performed on account. 9 Issued a cheque for $200 to the owner, P. Schelling, for his personal use. 12 Received a bill from Imperial Garage for repairs to the company car. 14 Received a memo from the owner stating the bank had reduced the bank loan by $500. 16 Issued a cheque for $80 in payment of the telephone bill. 19 Received cash from a customer for services performed. 20 Issued a cheque for $400, the wages of an employee. 22 Received a cheque from W. Thomson for $300 in partial payment of his account balance. 24 Purchased supplies on account from Home Hardware, $380. 27 Issued Cheque No. 3 to Comeau Hardware on account. Debit Account A/R—W. Thomson P. Schelling, Drawings Credit Account Fees Earned Car Expense Bank A/P—Imperial Garage Bank Loan Bank Telephone Expense Bank Bank Fees Earned Wages Expense Bank Bank Supplies A/P—Comeau Hardware A/R—W. Thomson A/P—Home Hardware Bank 4. P. Simpson began business as an engineering consultant on October 1, 2005. He set up the following chart of accounts to be used in his business: 101 Bank 110 111 120 125 130 210 A/R—R. Arthur A/R—J. Morrison Supplies Equipment Automobile A/P—Ace Finance Co. A/P—Grand’s 211 Stationers 212 A/P—Star Oil Co. 2 301 P. Simpson, Capital P. Simpson, 302 Drawings 401 Fees Earned 505 Car Expense 510 Office Expense 515 Rent Expense 520 Wages Expense a) work out the changes for the transaction and record these changes in the T-accounts (20 pts) b) Calculate and record the account balances. (10 pts) Transactions 1. On October 1, 20—, Mr. Simpson started his business with the following assets and liabilities: Bank $4 651; Equipment $2 465; Automobile $8 460; A/P—Ace Finance Co. $2 850; and A/P—Grand’s Stationers $1 000. 2. Performed a service for S. Stewart and received $200 cash in payment. 3. Received a bill from Grand’s Stationers for $400 of supplies purchased on account. 4. Issued a cheque to O. Mack for wages, $500. 5. Received a bill from Star Oil Co. for gasoline and oil used in the business car, $60. 6. Issued a cheque to Ace Finance Company for regular monthly payment, $400. 7. Issued a cheque to J. Mahoney for the rent for the month, $700. 8. Issued a bill to J. Morrison for services performed, $500. 9. Issued a cheque for postage stamps, $30. 10. Issued a cheque for car repairs, $120. 11. Received a cheque from J. Morrison on account, $300. 12. Issued a cheque to R. Gordon for cleaning the office, $100. 13. Issued a cheque to P. Simpson, the owner, for personal use, $800. 14. Issued a bill to R. Arthur for services performed, $1 000. 3 ASSETS Bank 1 2 11 5 151 2 501 Supplies 3 A/R—R. Arthur 101 4 651 200 300 500 400 700 30 120 100 800 2 650 4 6 7 9 10 12 13 14 8 1 000 120 Equipment 1 400 A/R—J. Morrison 110 1 000 400 111 300 11 500 200 125 Automobile 1 2 465 2 465 130 8 460 8 460 LIABILITIES AND EQUITY A/P—Ace Finance Co. 6 400 A/P—Grand’s Stationers 210 2 850 1 2 660 P. Simpson, Capital P. Simpson, Drawings 1 13 11 726 Car Expense 5 10 505 180 Wages Expense 4 500 500 4 5 272 302 Fees Earned 401 200 500 1 000 800 2 101 30 100 130 520 212 60 800 Office Expense 9 12 60 120 1 3 1 611 301 11 726 A/P—Star Oil Co. 211 1 000 400 510 Rent Expense 7 700 700 515 2 8 14 c)Balance the ledger of P. Simpson by means of a trial balance dated October 31, 2005. (10 pts) P. Simpson Trial Balance October 31, 20— Accounts Debits Bank 2 501 A/R—R. Arthur 1 000 A/R—J. Morrison 200 Supplies 400 Equipment 2 465 Automobile 8 460 Credits A/P—Ace Finance Co. 2 450 A/P—Grand’s Stationers 1 400 A/P—Star Oil Co. 60 P. Simpson, Capital P. Simpson, Drawings 11 726 800 Fees Earned 1 700 Car Expense 180 Office Expense 130 Rent Expense 700 Wages Expense 500 17 336 17 336 5 d) Prepare an income statement for P. Simpson as of October 31, 2005. (20 pts) P. Simpson Income Statement Month Ended October 31, 20— REVENUE Fees Earned $1 700.00 EXPENSES Car Expense $ 180.00 Office Expense 130.00 Rent Expense 700.00 Wages Expense 500.00 Total Expenses 1 510.00 NET INCOME $ 190.00 d) Prepare the equity section of the balance sheet for P. Simpson as of October 31, 2005. (10 pts) P. Simpson, Capital Balance October 1 Net Income Drawings Decrease in Capital Balance October 31 6 $11 726.00 $ 190.00 800.00 ( 610.00) $11 116.00 5. Mrs. D. Reynolds started a business on January 1, investing $10 000 cash in it at this time. During the year, the business had revenues of $50 000 and expenses of $38 000. Mrs. Reynolds withdrew $15 000 for her personal use and invested an additional $4 000. a) What is the net income of the business for the year? Show your calculations. Net Income was $12 000 ($50 000 – $38 000). b) What is the equity balance of the business at the end of the year? Show all calculations. January 1st = $10 000 December 31st = $11 000 ($10 000 + $12 000 – $15 000 + $4 000) c) What caused the increase or decrease in capital during the year? Capital increased because even though there was a net loss, 4 000 was invested in the business. 6. The balance in the Capital account of O.K. Suppliers on January 1, 2005, was $26 000. The balance in this account was $27 500 at the end of the year. Net income for the year was $5 000. Explain why the balance in the Capital account was not $31 000. The owner withdrew $3 500 during the year for personal use. 7. Complete the following schedule. Each row is a separate business. Net Income or Opening Capital Net Loss (–) Drawings Ending Capital a) $35 000 $22 000 $18 000 $39 000 b) 51 000 76 000 52 000 75 000 c) 32 000 18 000 15 000 35 000 d) 40 000 –5 000 20 000 15 000 e)120 000 –30 000 20 000 70 000 7