Relocation Policy Handbook

SEALED AIR CORPORATION

North American Relocation Policy for Internal Transfers

& Experienced New Hires

(Including Officers)

JUNE 2008

Introduction

Objective

Eligibility

Relocation Provisions at Origin

Marketing Assistance Program

Choice of Agent

Home Sale Assistance Plan

Amended Sale Program

Equity Payment

Home Sale Bonus

Equity Loan Provision

Selling Costs

Equity Loss

Lease Cancellation

In Transit

House Hunting

Home Finding

Rental Assistance

Shipping Your Household Goods

Packing Your Goods

Storage

Moving Your Car

Travel to the New Location

Relocation Provisions at Destination

Incidental Expense Allowance

Temporary Living (Employee Only)

Return Trips Home

Interim Living (Employee and Family)

Cost of Living Adjustments

Home Purchase Closing Costs

Duplicate Housing

Spouse Career Counseling

Expense Report Processing

Tax Regulations

Income Tax Coverage

Contents

3

3

3

7

7

8

8

4

4

5

6

8

9

9

10

10

10

10

11

11

11

11

12

13

13

14

15

12

12

13

13

15

16

16

17

2

Introduction

Objective

The Sealed Air relocation program is designed to provide assistance to employees who transfer, at the Company's request, from one location to another within the United States or Canada. Accepting employment or a new job assignment that requires a move to a new location is important to the Company and to you. It provides new challenges and opportunities for career development and personal growth. We recognize, however, that relocation may also be a significant change for you and your family.

A corporate transfer is a partnership between you and Sealed Air for the mutual benefit of both. Sealed Air will provide professional assistance to you and assist with reasonable expenses for your move. You, in turn, are charged with managing your move in a cost-effective manner.

Your Client Services Consultant at our selected relocation company, Cartus, will assist you with the relocation provisions. However, for your own benefit, we encourage you to read this handbook thoroughly before you incur any expenses. Your Client Services Consultant will be able to assist you with any questions you may have. The relocation benefit program may be revised at the discretion of the Company.

Eligibility

Sealed Air’s full-time active employees (i.e., internal transfers and experienced new hires, including Company

Officers), who are requested to relocate from one North American location to another, who meet the government relocation criteria (i.e., minimum of 50 miles), and whose relocation requires a change in residence, are eligible for relocation assistance as authorized by Sealed Air. Your move to a new home must take place within 12 months after the effective date of transfer or date of hire.

When a husband and wife are both employed by the Company and are both transferred to the same geographic location, relocation assistance is applicable to only one of the two employees.

3

Relocation Provisions at Origin

Marketing Assistance Program

If you are a homeowner, Sealed Air has arranged for Cartus to provide comprehensive services to help you sell your current primary residence. The Marketing Assistance Program aids you in finding a buyer for your residence. The company requests that you begin the Cartus marketing program and actively market your property for 30 days before beginning the appraisal process. Many sales are generated in the first 30 days of marketing, especially if the property is priced correctly relative to the market. If an acceptable sale is obtained within this 30-day period, Cartus will accept the sale on your behalf and release all available equity. (See Amended Sale Program for a more detailed description of this program.) Generation of a sale during this 30 days will release you from arranging numerous appraisal and inspection appointments and will contribute to reducing relocation costs.

Your Client Services Consultant will arrange for a representative from a qualified real estate firm to visit your home in order to establish a range of value and a 60-day sales strategy. The Client Services Consultant is your advocate and should be utilized to assist you with all offers and buyer negotiations. All offers to purchase your home should be shared with your Client Services Consultant, regardless of the offer amount.

You are expected to do all that is possible to sell your home through this program, and any repairs necessary for optimum marketing will be your responsibility. The Company requests that you not list your home for a price greater than

107% of the probable sales price as stated in the Broker's Market Analysis (BMA). If you are successful in finding a buyer, you can assign that offer to Cartus for closing to expedite the receipt of equity and reduce your tax liability on reimbursement of closing costs.

Do not accept the offer, a deposit or down payment until you speak with your Client Services Consultant. Under no circumstances should you sign any agreement. By assigning the sale to Cartus, you are released from handling closing arrangements and related costs, some of which will be taxable income to you if you do not assign the sale to Cartus. If you fail to assign the sale to Cartus, the Company will provide no tax assistance on the resulting taxable income.

4

Choice of Agent

When listing your home through the Marketing Assistance Program, you will either use an agent recommended by

Cartus, or notify your Client Service Consultant of an alternative choice, before you make any listing arrangements.

Sealed Air does not require its transferees to work with a Cartus-recommended broker. Your Client Services Consultant will make sure that your broker of choice is aware of all necessary procedural requirements and will provide to the agent a copy of the "listing exclusion clause" which must be made a part of your listing agreement.

When signing the listing agreement with your broker, it is required that it contain the following exclusion clause, so that you will be able to either accept the Cartus offer or assign a sale to Cartus:

Listing Exclusion Clause

"This addendum shall override any other conflicting clauses or statements in the Listing Agreement:

1. The owners hereby reserve the right: (a) to sell this property directly to Cartus at any time and in such event to cancel this listing agreement with no obligation for payment of any commission or the continuation of any listing thereafter, and (b) to assign any acceptable written offer to Cartus for closing with payment of commission being the obligation of

Cartus, the commission being earned upon successful closing of the sale of the home.

2. In consideration of the broker receiving this listing as a consequence of the Seller's employment-related relocation, the listing broker agrees to pay to Cartus a referral fee equal to thity-five percent (35%) of the referral portion of the transaction, which is based on the total commission paid to and received by the listing agent on account of the sale and purchase of the real property. The listing agent authorizes the closing agent to deduct the referral fee from the commission moneys due at the closing and to pay Cartus directly."

5

Home Sale Assistance Plan

If your home has not sold within the initial 30-day marketing period, Cartus will begin the Home Sale Assistance appraisal process. The Home Sale Assistance Plan is available to you if your home is a one or two-family dwelling that is your primary residence. This includes condominiums, but excludes cooperative apartments and mobile homes. Also excluded are:

· Vacation or second homes

· Investment property

· Homes with excess acreage for the area

· Uninsurable, and/or unfinanceable and/or unmarketable homes

· Homes/property contaminated with toxic substances

The following are the general procedures and services of the Home Sale Assistance program: Cartus will offer to purchase your home based on its appraised value, as determined by independent appraisers (Guaranteed Offer). You will choose two appraisers from a list of qualified and authorized appraisers provided by Cartus. If the appraisal values are within five percent of each other, the guaranteed offer is calculated by averaging the two values. If the appraisals are not within five percent, you will choose a third appraiser. The average of the two closest appraisals will then be used to determine the Guaranteed Offer amount

Appraised Values.

Cartus will then deliver to you a Guaranteed Offer in the amount of the Appraised Value, and a Contract of Sale (in duplicate). You will have 60 days from the date of the Guaranteed Offer to either accept the offer or assign an outside sale that has been negotiated through the Marketing Assistance Program.

Sealed Air requests, however, that you market your home through the Marketing Assistance Program for a minimum of 60 days (beginning on the date you list your home) before accepting the Guaranteed Offer.

6

Amended Sale Program

If you secure a genuine and acceptable outside offer prior to or within 60 days of the receipt of the guaranteed offer, you can arrange with Cartus for an Amended Value Sale as described below. Notify Cartus of the outside offer so you can take full advantage of your relocation benefits. Cartus will relieve you of the legal procedures normally required during a sale and closing of the property.

Once you succeed in obtaining an outside offer for the home that you want to accept:

1. Get the offer in writing.

2. Do not accept the offer, a deposit or down payment, or sign any agreement until you speak with your Client Services

Consultant. Sealed Air 's Amended Sale Program is structured to adhere to the rules which allow the transaction

(closing) costs to be nontaxable to you . If you sign the agreement, all closing costs become taxable income; they will be reported to the IRS as compensation and you will be responsible for all federal, state, local and FICA taxes!

There will be no Company assistance with this tax obligation.

3 . Cartus will verify the buyer's financial ability to complete the deal. Cartus does not accept offers with contingencies

(such as the contingency that the purchaser can sell his or her existing home prior to buying). If the buyer has stipulated a closing date, Cartus will accept that date and the normal 60-day vacating period will not apply.

4. If the outside offer proves to be bona fide, once inspection contingencies have been removed, Cartus will contract with you for the price obtained. If you already have an outstanding Guaranteed Offer from Cartus, you will be instructed to write in the higher figure, sign the Contract of Sale, have it notarized and return it to them.

5. The Contract of Sale must be signed and returned to Cartus within ten days.

Equity Payment

Your equity payment will be prorated based on the vacating date or the date Cartus signs the Contract of Sale, whichever is later, and will be disbursed to you within seven days of receipt of the signed Cartus Contract of Sale.

Important note: If the buyer has been qualified by Cartus and, for good reasons, is unable to complete the transaction, you need not be concerned. Cartus has purchased your home at the Amended Value sale price and you have no further legal responsibilities.

7

Home Sale Bonus

If, at any time during the marketing period, you are successful in selling your home on your own for an amount equal to or greater than the Guaranteed Offer, a Home Sale Bonus of two percent of the sales price (not to exceed $10,000) will be paid to you. If you receive an offer from a qualified outside buyer that is less than, but at least 97% of, the Guaranteed

Offer you will receive the Guaranteed Offer amount plus the two percent Home Sale Bonus. If you receive an offer that is less than described above, you will receive the Guaranteed Offer but not the two percent Home Sale Bonus. Applicable taxes will be withheld from the bonus payment.

Equity Loan Provision

In order to afford you maximum marketing opportunity, Cartus will provide an equity loan based upon the Guaranteed

Offer for a maximum of 60 days for use as all, or a portion of, the purchase price required to purchase a home in your new location. The equity loan will be interest free to you. The maximum loan amount will be equal to 98% of the

Appraised Value of the current home, less all outstanding encumbrances on the property.

The loan is due and payable at the time you accept the Guaranteed Offer; assign a sale to Cartus; upon the expiration date of your Guaranteed Offer from Cartus; or within 60 days, whichever comes first. Your Client Service Representative will make all arrangements for the equity loan.

Selling Costs

To assist you in the sale of your departure home, the Company will cover certain costs. The following selling costs will be covered by Sealed Air:

Real estate broker's commission (normal & customary for the area, maximum of seven percent)

Closing costs (normal & customary for the area)

Title insurance policy costs are covered only if customarily paid by the seller in the location where the sale occurs.

Disposition of any properties other than the primary residence are considered your responsibility and are not covered under these provisions.

8

Equity Loss

When an employee is in an equity loss situation, the Company will have the option to assist with that loss. The maximum equity loss payment will be $50,000 gross and may include certain capital improvements. For those employees, who find a buyer for their home, the Company will cover 75 percent of the loss, up to a maximum of $50,000.

However, when an employee elects to accept the Guaranteed Offer, only 50 percent of the loss will be covered, up to the

$50,000 maximum. Any payments under the equity loss provisions of this policy must have the prior written approval of the Vice President of People & Performance and must be properly documented for reimbursement.

Payments will not be grossed up.

For purposes of this policy, equity loss assistance will be considered when the transferee sells their property for less than the original purchase price. In addition, certain capital improvements made to the property will be considered.

Capital improvements must add value to the property, substantially add to the useful life of the property, or adapt it for a different use. Examples of covered capital improvements would be addition of a room or garage, deck, or patio; complete renovation of a kitchen or bathroom; new plumbing, wiring or windows. General repairs and routine maintenance are not included.

Requests for reimbursement should be accompanied by copies of the HUD statements at time of purchase and sale; and original receipts for capital improvements.

Lease Cancellation

If you are renting your primary residence at the time of relocation and cannot cancel a lease arrangement without being assessed a penalty, you shall be reimbursed by the Company for a penalty of up to three months' rent for canceling the lease. A copy of the lease agreement, indicating the penalty, and a paid receipt are required for reimbursement. When a lease is signed for rental property in the new location, a 60-day cancellation clause should be included in the lease. A typical "metropolitan" clause follows:

“In the event the tenant is transferred by his/her employer outside the metropolitan area, the tenant may terminate this lease without penalty by giving the landlord written notice sixty (60) days prior to termination.”

9

In Transit

House Hunting

To assist you in finding suitable housing, Sealed Air will assume the associated reasonable costs for up to two trips to your new location to purchase or lease a new home. Your expenses, along with those of one other person, will be reimbursed for up to a total of ten days while making the selection of the new home. Covered expenses include:

Airfare - tickets (coach) should be booked at least seven days in advance through the company’s travel service.

Rental car - mid-sized

Lodging - reasonable

Meals - reasonable

Reasonable child care and kennel fees - paid to non-relatives

For maximum benefit, Sealed Air requests that you establish your mortgage pre-qualification with Cartus Home Loans or another lender before taking your house hunting trip.

Home Finding

Cartus Destination Services will be available to assist you with the following:

- School information through National School Reporting Service

- Availability & cost of housing

- Availability of various community services

- Information on housing markets/real estate specialists

Rental Assistance

Cartus Destination Services will be available to assist you with the following:

· School information through National School Reporting Service

· Availability & cost of rentals/Apartment finding service if available for the area

· Availability of various community services

10

Shipping Your Household Goods

Sealed Air will coordinate and select the carrier that will be utilized for the shipment of your household goods. The company pays for the cost of moving personal belongings, including packing, unpacking and crating on a standard basis; routine disconnections, preparation for moving and servicing of appliances to the extent of making them ready for shipping as well as uncrating and plug-in at destination; and insurance for loss/damage protection in transit at Full

Replacement Value. Not included are costs incurred in packing and/or transporting unusual items such as firewood, boats, animals, food and other items beyond the normal capability of the moving company; costs of repairs or installation at the new location of gas or electric lines, venting, etc. Employees who wish to have the movers perform special services must arrange with the mover to be billed for such services separately.

Packing Your Goods

Sealed Air prefers that you do no packing yourself. The moving company will not be responsible for breakage or damage unless negligence with packing or handling on their part can be shown. Furthermore, if the moving company must unpack and repack items you have already packed, additional costs will be incurred at your expense.

Movers and Sealed Air are not liable for loss or damage to documents, currency, money, jewelry, watches, precious stones or articles of extraordinary value, which are not specifically listed on the inventory sheet. If these type items are shipped, be sure they are inventoried. Then check carefully on arrival to see that these items have been delivered. Any missing item must be noted on the inventory sheet before the driver leaves. If possible, such valuable items should be taken with you personally rather than shipped. You should also take with you your family heirlooms, photographs and small articles of special value, which could not be replaced if lost or damaged by the movers.

Storage

If unavoidable, Sealed Air shall pay storage for a maximum of 60 days for homeowners and 30 days for renters.

Moving Your Car

The Company will ship one car to the new location. A second car will be shipped if the distance to the new location is greater than 400 miles. For moves of less than 400 miles, the transferee will be required to drive and standard mileage reimbursement will be paid for the second car.

11

Travel to the New Location

Sealed Air will pay reasonable expenses for you and your family to travel from your current home to your new work location. Reasonable lodging, tolls, mileage and meals will be covered.

Relocation Assistance at Destination

Incidental Expense Allowance

It is expected that there may be unanticipated costs associated with moving which cannot be predicted in advance. To help pay for these incidental expenses, Sealed Air provides a single lump sum payment in the amount of one month's salary (maximum of $6,000 gross) for miscellaneous items. Applicable taxes will be withheld from this payment.

Some of the items the Incidental Allowance is intended to cover include:

Cable TV removal & installation

Cleaning expenses (old home & new home)

Contract termination/penalty costs (excluding lease cancellations)

Driver & automobile license

Lawn service

Lost insurance premiums

Lost tuition fees

Non-refundable club dues, license fees, service contracts, membership fees, etc.

Pet shipment/care/boarding

Postage/express mail charges

Security & utility deposits

Telephone removal & installation

Tips and/or meals for movers

Additional taxes incurred due to the relocation not specifically covered under the tax assistance provision of this policy

12

Other unforeseen miscellaneous expenses not included on this list

You are not required to give an accounting of how the Incidental Allowance is spent, and you should not include items such as those mentioned above on an expense report for reimbursement.

Temporary Living (Employee Only)

If you report for work at the new location prior to finding a new permanent residence, and while still incurring living expenses at the old location, reimbursement will be made for temporary living for a maximum period of 60 days. Living expenses will include:

Lodging - Accommodations that offer kitchen facilities must be utilized in all areas where this is available. If not available, hotel accommodations will be approved.

Automobile - If you are unable to drive a car to the new location for use during temporary living, you will receive reimbursement for a rental car. However, gas for the rental car is not reimbursable. Also, arrangements should be completed as soon as possible to ship or drive a personal car to the new location.

Meals and miscellaneous - An allowance of $25/day has been established to assist with the cost of food and other miscellaneous costs if you are in accommodations with kitchen facilities. Otherwise, reasonable costs for meals will be covered.

Return Trips Home

During the period of time when you are in temporary living quarters at the new location, your reasonable travel expenses to visit your family every other weekend (one trip per week if within driving distance) will be reimbursed.

Interim Living (Employee and Family)

Interim living provisions may apply to your family under certain circumstances, i.e., awaiting shipment of household goods, extended closing date on new home, etc. Under these types of circumstances, reasonable meals and lodging for you and your dependents will be reimbursed for a period of up to seven days.

Cost of Living Adjustments

Internal transfers (current employees) moving to certain areas of the country may find the difference in the cost of housing an obstacle to purchasing a new home or leasing a new apartment. If a current employee’s new job is in an area with a cost of living that is significantly higher than their current work location, they may be eligible to receive a cost-of-living adjustment. The Sealed Air Relocation Manager will work with the officer in charge of the business or functional unit to determine if this provision applies to a specific internal move.

13

Home Purchase Closing Costs

This section applies to you only if you currently own a personal or family residence and you purchase a home at the new location within one year of your effective date of transfer or date of hire. A current renter or first-time buyer of a personal or family residence is not covered by this section.

Reimbursements for home closing costs will be based on the following:

Reimbursable

Application fee

Loan origination fee - Maximum of 1 point

Appraisal fee - if local custom

Credit report fee

Escrow fees

Attorney/closing agent fees: Lender & Borrower

Title insurance

Title search/other statutory title fees

Recording/filing fees

Transfer taxes: County, City & State

Non-Reimbursable

Mortgage insurance (PMI/escrow)

Flood/hazard insurance

Taxes due/escrow

Intangible tax

Prepaid taxes

Prorated rent

Pest treatment or damage repair

Bridge loan interest

Prorated mortgage interest

Improvement assessments

Survey cost, if required by lender

Prorated utilities

Inspections - any required inspections plus one elective inspection.

If defect uncovered, one re-inspection fee covered.

Home or component warranties

Notary fee

Express mail

Messenger fees

VA or FHA points

Home owners' association (HOA) dues or condo fees

New construction extra expenses: interim financing; additional attorney fees other than for closing costs; separate land/ lot closing costs.

All other expenses not listed as reimbursable

14

Duplicate Housing

For homeowners: After you close on your new residence, and if you are still paying a mortgage on your former home, Sealed Air will reimburse you in an amount equal to the interest portion of the lesser of the two monthly mortgage payments. Reimbursement will be for a period of up to 60 calendar days from the date of closing on the new home.

Whether or not you had a mortgage on your home, the Company will also reimburse you for real estate taxes, property insurance and utility expenses on your former residence. This reimbursement is also available for a period up to 60 calendar days from the date of closing on the new home.

For renters: If you lease or rent a new residence while still paying rent on your former residence, Sealed Air will reimburse you for the lesser of the two monthly payments for up to 30 days.

You cannot receive duplicate housing reimbursements for any period of time you are also covered in temporary living accommodations.

Spouse Career Counseling

When an employee with a working spouse is transferred, the spouse finding a job at the new location is very important to the success of the move. Therefore, in order to facilitate the relocation process, Sealed Air provides the assistance of an outside organization specializing in job search counseling. While this program cannot guarantee that your spouse will find a job, it is designed to equip spouses with the tools necessary to effectively carry out the job search process in order to secure a new position. This comprehensive program includes:

Career assessment

Job market research

Resume development

Communication package

Ongoing telephone consultations

Please contact the Sealed Air Relocation Manager if you would like to receive spouse career counseling.

15

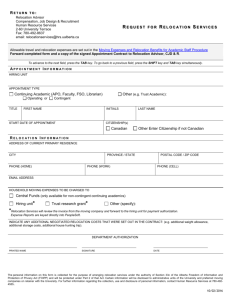

Expense Report Processing

Expenses incurred under this plan are relocation expenses, and they must be kept separate from normal business travel expenses. Actual receipts for all expenses (except the per diem and meals under $25) must be submitted with a

Relocation Expense Report Form to be considered for reimbursements. To receive reimbursements for your relocation expenses, complete the Relocation Expense Report Form, attach the receipts and forward to the Sealed Air Relocation Manager in the Duncan, South Carolina, office at the address below. Only the signature of the transferee is required on this form.

Sealed Air Corporation

P. O. Box 464

Duncan, SC 29334

If you have any questions, please call your Cartus Client Services Consultant or the Sealed Air Relocation Manager.

Tax Regulations

Current U.S. tax regulations require the Company to segregate reimbursable moving expenses into two categories:

1. Those moving expenses that qualify for exclusion from your gross income and

2. Those moving expenses to be included in your gross income.

To be excluded from gross income the following requirements must be met:

1. The distance between your new place of employment and former residence must be 50 miles greater than the distance between your former place of employment and former residence.

2. You must be a full-time employee for at least 39 weeks in the 12-month period following the move. This requirement is waived, however, if you are transferred again for the benefit of Sealed Air, or in the case of death, disability or involuntary separation from work.

Reimbursable moving expenses excluded from gross income for U.S. federal tax purposes are limited to the following: a) movement of household goods & personal effects b) the cost of travel from the old to the new residence, including any reimbursed lodging costs, but excluding any reimbursed costs for meals. This lodging can include one night in departure area and one night in destination

16

area as well as lodging en route. In addition, per IRS regulations, a portion of some mileage reimbursements received will be excludable from income; the balance will be considered taxable.

NOTE: The above information is pertinent to U.S. federal taxes only. Many U.S. states do not follow federal guidelines and may view reimbursements in a different manner .

Income Tax Coverage

To assist in offsetting your tax liability, relocation expenses deemed to be non-deductible (taxable) will be grossed-up for applicable federal, state, FICA and local taxes, assuming an applicable tax rate calculated with respect of the sum of:

Your base salary as of 30 days after relocation, annual incentive compensation, Sales incentive commissions/bonus, Home

Sale Bonus, less standard deduction and personal exemptions. Local tax is determined by your work city at your new location. The Home Sale Bonus, Incidental Allowance and the interest portion of Duplicate Housing payments are not eligible for gross-up treatment.

You should remember that you bear the ultimate responsibility in determining tax liability on reimbursed expenses.

Sealed Air advises all employees to consult with their own tax advisors to determine personal deductibility unique to their situation.

17