Sample Payroll Deduction Policy

advertisement

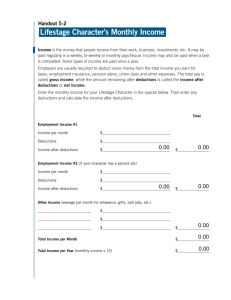

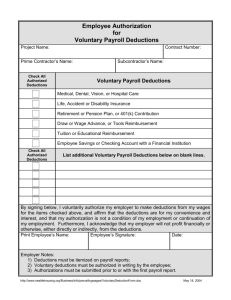

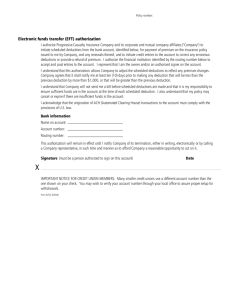

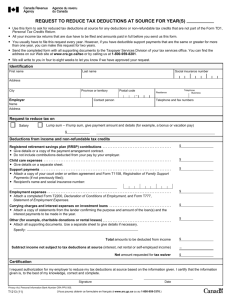

Deductions from Pay SAMPLE POLICY General Policy All deductions from an employee’s wages shall be in accordance with applicable law and, when required, the employee’s consent. Procedures Deductions will be made from employees’ wages in the following order: 1. Social Security taxes 2. Federal and state income taxes 3. Amounts owed to the Company 4. Child support 5. Garnishment 6. Assignment of wages (if allowed under state law) Employees are to be notified of deductions due to court orders, such as child support or garnishments, in accordance with such orders. No deduction from an employee’s wages for any period shall cause the employee’s wages for any such period to be less than the wage required to be paid by the company pursuant to applicable law. No deductions from exempt employees’ salaries are permitted, except as allowed by applicable law. The permitted exceptions are: The items listed in item 2 above. When the employee has signed a written consent (see item 10 on following page) Deductions when an exempt employee: --Is absent from work for 1 or more full days for personal reasons other than sickness or disability --For absences of 1 or more full days due to sickness or disability if the deduction is made in accordance with the company’s policy of providing compensation for salary lost due to illness To offset amounts employees receive as jury or witness fees, or for military pay For penalties imposed in good faith for infractions of safety rules of major significance; For unpaid disciplinary suspensions of 1 or more full days imposed in good faith for infractions of workplace conduct rules. • The full salary in the initial or terminal week of employment is not paid if the exempt employee does not work a full week. Instead it will be prorated. • The fully salary of an exempt employee is not paid for weeks in which the exempt employee takes unpaid leave under the Family and Medical Leave Act. Instead, it will be prorated. Examples of improper deductions include: Any deductions from the employee’s compensation for absences caused by the company or by the operating requirements of the business If the employee is ready, willing, and able to work, any deductions made for time when work is not available Any deduction for a partial-day absence, such as attending a parent-teacher conference Deducting three days of pay because the employee was absent from work for jury duty, rather than merely offsetting any amount received as payment for the jury duty 4. Deductions not taken for any pay period may be carried over to succeeding pay periods and deducted from the wages due in the succeeding pay period to the extent allowed by law. 5. Because assignment of wages is not permitted in this state, no deductions shall be made for such an assignment. 6. Deductions for the United Way will be permitted after the employee completes the required form. 7. Payroll deductions shall not be authorized for the purpose of collecting dues for membership or participation in any organization. 8. Employees are to be notified of all deductions. 9. Employees who object to any deduction, such as deductions due to an absence, deductions for an advance, a garnishment, or child-support order, are to contact the Human Resources director. If the employee and the Director cannot resolve the matter, the dispute will be referred to the legal department. The company will promptly correct any deductions made in error or not permitted by applicable law. 10. Employees must consent in writing to the following deductions: — Payment of group health insurance — Contributions to a retirement plan — Repayment of purchases made on credit from the company — Repayment of payroll advances and/or overpayments — Educational loans 11. Employees shall be required to complete all applicable forms necessary for deductions as may be required by law; such forms include the federal W-4. If an employee does not complete form, e.g., the federal W-4, then deductions will be made in accordance with applicable law. Employees are expected to report to the Human Resources director any violations of this policy. Improper deductions are a violation of company policy and may result in discipline up to and including termination. This policy will be provided to all new hires, placed in the employee handbook, and posted on the company’s bulletin boards and intranet. This policy will be revised and applied so that the company is always in compliance with applicable law. The Human Resource director will review this policy at least annually (and upon notice that the law has changed) to ensure compliance with applicable law. ALTERNATIVE OR ADDITIONAL POLICIES Assignment of wages is permitted in this state. The employee is expected to furnish the company with a copy of the assignment at the time it is executed. The company has a payroll practices to deduct partial day absences from exempt employees accrued leave accounts. All employees are required to sign the following consent to payroll deductions: POINTS TO COVER • General statement of policy. Include a general statement of your policy concerning deductions. Such a statement can contain your goal of making only those deductions that are lawful and consented to by the employee. State that errors will be promptly corrected. • Illegal deductions. Include a statement that you will not make deductions that are unlawful. Examples of such deductions include: reducing an employee's wages below the minimum wage because of damage to a vehicle, lost merchandise, or cash handling errors. • Complaint policy. Establish a mechanism for employees to complain about improper deductions and to promptly correct them. • Taxes. State that you will make tax deductions from an employee’s wages based on applicable law and instructions from the employee. As an example, require each employee to complete a W-4 form for withholding federal income taxes. If an employee fails to complete a W-4, then your policy should state that you will withhold in accordance with applicable federal law, which generally requires withholding as if the individual was single with no dependents. • Benefit deductions. Describe how you make deductions for benefit payments such as group health, dental, pension deductions, and the like. As an example, if there are insufficient funds in any one paycheck, perhaps due to a child support order, is the employee to pay for the benefit or will you simply advance the money and deduct the advance from the next paycheck? • Garnishment. Describe the steps for withholding money from employees’ wages when they are garnished. Among these steps, include notice to the employees of the fact that garnishment has occurred. There are a growing number of statutes, both state and federal, that permit garnishment. State that you will comply with applicable garnishment laws. These laws can also prohibit taking any action against an employee based on the fact of a garnishment. Additionally, these laws may permit you to charge a small fee to cover some of the costs of the paperwork involved. • Child support. While child support deductions are similar to garnishment, there may be some differences. As an example, child support payments may need to be deducted prior to a garnishment by a creditor. Additionally, the amount subject to a child support deduction may vary greatly from the amount subject to garnishment. • Payroll advances and loans. If your company makes loans or payroll advances to employees, coordinate that policy with your policy concerning deductions from payrolls. As an example, you may want to require the employee to repay any advance through payroll deductions, and the advance deduction may need to be placed ahead of benefit deductions. Generally, you should obtain written consent from employees to deduct payroll advances or loans from their paychecks. • Order of deductions. Detail in your policy the order in which deductions are to be made. As an example, will you require the employee to first repay loans to you before the employee can make a contribution to a retirement plan? • Bad checks. If you permit employees to cash checks through your accounting department, coordinate that policy with your deductions from wages. For example, if a check from an employee should turn out to be a bad one, you may want to require that it be deducted from the next paycheck. • Purchases from employers. Many times employers permit employees to purchase merchandise at a discount. If you permit the employee to do so on credit, consider including in your policy a provision for deducting that purchase price from wages. Again, care must be taken in designing such a procedure so as not to violate the minimum wage laws. • Assignment of wages. Some states permit an employee to make an assignment of his or her wages. Essentially, this assignment works just like a garnishment. But, instead of a court order requiring the payment of money to a creditor, the employee simply makes a contractual agreement with the creditor that the money is to be paid directly by the employer to the creditor. Consider whether you will comply with such a request. Moreover, you will need to consult with counsel concerning applicable state law that may require you to comply or to ignore such an agreement. • Overpayment of wages. Occasionally, an employer will find that it overpaid an employee. As an example, the employer requests a transfer from a second shift to a day shift. After the transfer, the payroll department fails to eliminate the premium pay for working a second shift. The employee continues to receive it for several weeks. Under those circumstances, state in your policy the method by which you recover that overpayment. Obtain the employee’s written authorization prior to making the deduction. • Charitable contributions. Employers often permit employees to use payroll deductions to donate a portion of their wages to charity. Cover this topic if you follow this practice. Please keep in mind that such a practice can permit a labor organization to require that payroll deductions be made for union dues. • Written consent. Generally, your policy should provide for written consent for routine deductions as part of the package of material completed upon hiring. Subsequently, for any specific deduction you should again obtain written permission to deduct money from an employee's paycheck. For example, if you make a specific loan to an employee, grant a particular payroll advance or permit a particular purchase, each of these transactions should be documented separately. • Vacation or sick day advances. At times you may permit an employee to take vacation or a sick day before it is earned. Care should be taken to document this transaction as a “payroll advance” with written consent from the employee to deduct this advance from future compensation. In this fashion you protect yourself if the employee quits the following week. LEGAL POINTS • Fair Labor Standards Act. This federal law general governs the payment of wages to most employees. Exempt employees are to be paid a “salary.” An employee is not paid on a salary basis if deductions from the salary are made for absences occasioned by the employer or by the operating requirements of the businesses. If the employee is ready, willing, and able to work, deductions may not be made for time when work in not available. Improper deductions can cause exempt employees to be entitled to overtime. • Payroll practice. The following payroll practices generally do not cause exempt employees to be entitled to overtime under the FLSA: --Deductions from exempt employees accrued leave accounts --Requiring exempt employees to report their hours worked --Requiring exempt employees to work a specific schedule --Implementing bona fide, across-the-board schedule changes Note: Some government regulators and some courts may disagree about whether the deduction is lost when deductions are made from accrued leave accounts. • Improper deductions. Improper deductions that can cause an exempt employee to be entitled to overtime under the FLSA include: deductions from pay for a partial-day absence to attend a parent-teacher conference; deduction of a day of pay because the employer was closed due to inclement weather or lack of work; deduction of three days of pay because the employee was absent from work for jury duty, rather than merely offsetting any amount received as payment for the jury duty; or deduction for a 2-day absence due to a minor illness when the employer does not have a bona fide plan, policy, or practice of providing wage replacement benefits for these types of absences. • Proper deductions. Proper deductions from exempt employees under the FLSA include: deductions for an absence from work for 1 or more full days for personal reasons, other than sickness or disability; deductions for an absence from work for 1 or more full days due to sickness or disability if the deductions are made under a bona fide plan, policy or practice of providing wage replacement benefits for these types of absences; deductions to offset any amounts received as payment for jury fees, witness fees, or military pay; deductions for penalties imposed in good faith for violating safety rules of “major significance;” unpaid disciplinary suspension of one or more full days imposed in good faith for violations of workplace conduct rules; proportionate adjustments of part of an employee’s full salary time actually worked in the first and last weeks of employment; and deductions for unpaid leave taken pursuant to the Family and Medical Leave Act. • Safe harbor. A “Safe Harbor” exists that will keep an exempt employee under the FLSA from being classified as not exempt even when improper deductions are made. The exemption will not be lost if the employer: has a “clearly communicated” policy prohibiting improper deductions, which includes a complaint mechanism; reimburses employees for any improper deductions; and, makes a good faith commitment to comply in the future. Evidence of a “clearly communicated policy” is a written policy that is distributed to employees prior to the improper pay deductions by providing a copy of the policy to employees at the time of hire; placing the policy in an employee handbook; or placing the policy on the employer’s intranet. • Court orders. Failure to make deductions in accordance with court orders, such as child support or garnishments, may cause the employer to become liable for the amount not deducted. • State laws. State laws may set a different standard for deductions, especially deductions from employees exempt from overtime. BLR’s Quick Guide to Employment Law provides summaries of federal employment law and state laws. THINGS TO CONSIDER 1. Administration of your deduction policy. Have one person or one department responsible for administering this policy to ensure consistency in resolving problems. Moreover, that unanticipated event can then be covered in the next revision of the policy. 2. Review of your policy. Review your deduction policy at least annually to ensure compliance with applicable law. 3. Coordination with other policies. There are a variety of policies that must be coordinated with your payroll deductions. These include benefits, payroll advances, purchases from the company, check cashing, garnishment, wage assignments, and the like. Be certain that you have considered all policies that may potentially interact with your deductions from employees’ paychecks. SAMPLE FORMS On the following pages are sample forms for: Consent to payroll deductions A relocation agreement A training expense agreement Consent to Payroll Deductions Note: Your execution of this form evidences your consent to deductions from your wages. Please read it carefully. ABC Company (Employer) is hereby authorized to deduct from any sums due Employee, including Employee’s wages, the following deductions (to the extent allowed by applicable law): 1. All charges for items purchased by Employee from Employer 2. Supplementary uniforms purchased by Employee 3. Group insurance premiums/contributions 4. Payroll advances, including vacation or sick day advances, overpayment of wages or other funds 5. Returned checks signed by Employee 6. Market value of all items issued to Employee (e.g., training materials, aprons, uniforms, tools, etc.) damaged or not returned by Employee 7. Amounts paid by Employer on Employee’s behalf No deduction from Employee’s wages for any period shall cause Employee’s wages for any such period to be less than the wage required to be paid by the Employer pursuant to applicable law. The deductions not taken for such period may be carried over to succeeding pay periods and deducted from the wages due in succeeding pay periods to the extent allowed by law. ______________________ __________________________________ Date Employee (signature) ______________________ __________________________________ Social Security # Employee (printed name)