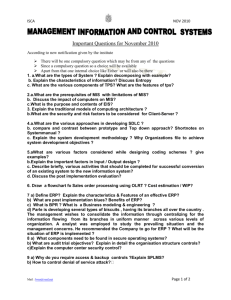

INTRODUCTION to ERP

advertisement