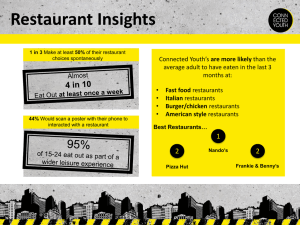

Restaurants and Takeaways

advertisement