Phase3Rpt.Mar06 - Waterberg District Municipality

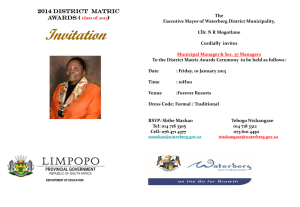

advertisement