Reported Net Worth = $ 150000 - Florida Department of Financial

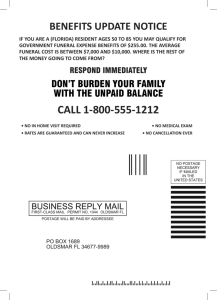

advertisement