COCC to Move Check Processing Clients to Image

advertisement

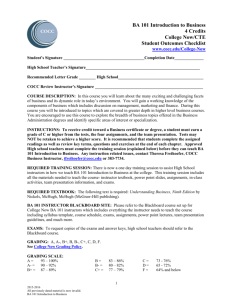

For Immediate Release Contact: Robert Bessel Public Relations COCC 860.674.7214 bessel@cocc.com Image Innovation Continues COCC to Move Check Processing Clients to Image Inclearing AVON, Conn., June 21, 2007 – COCC, the region’s leading provider of next generation technology services for financial institutions, today unveiled plans to convert a majority of its check processing clients to FedReceipt® Plus, the Federal Reserve Bank’s image inclearing product. The upgrade to image inclearing will move COCC’s clients ahead of the pack as paper check volume continues its dramatic decline. “The advantages of image inclearing are so strong that we could see no reason not to convert our remaining paper-based check processing clients,” said Joseph D. Lockwood, COCC’s Senior Vice President and Chief Technology Officer. “This is where the industry is moving. This is where COCC’s open technology shows its advantage. This is the time to show our check processing clients what we can do for them.” COCC has led the industry in image exchange implementations since Check 21 became law in 2004. The company has been imaging every check it processes since 2001 and offers a robust image archive for all check processing clients. The advent of branch capture and other image exchange services has helped COCC extend its check processing footprint beyond southern New England to New York, Pennsylvania, Ohio and Illinois. COCC currently supports “all image” processing for outgoing cash letters, inclearing, returns, and statements. As of this release, 40% of COCC’s outgoing cash letter clients exchange images electronically, and 16% utilize image inclearing. COCC’s current pipeline of image implementations will bring the percentage of clients who use image exchange to 55% of the total. This goes a long way toward increasing the overall percentage of interbank check image collections in the northeast, according to Mike Stewart, Regional Sales Manager for the Federal Reserve Bank of Boston. “Through Check 21 business relationships like this one between the Federal Reserve Banks and COCC, the check payment system is being transformed from one that has been largely paper-based, to one that is all electronic, thereby improving both service and reliability of payments for our customers,” remarked Stewart. The Federal Reserve has regularly reported the decrease of paper-based payments, most recently showing a 30% decrease in the use of checks between 2004 and 2007. During that time, the Fed has reduced its number of check processing centers from 45 to 22, with an additional four planned by 2Q2008. Experts predict increasing costs for paper payments as the transportation network stretches to fewer check processing sites. In addition to declining check volume and the increasing costs associated with it, financial institutions are also seeing advantages in the accelerated posting, earlier returns processing and new fraud prevention tools available through image-based systems. Mr. Lockwood said that the number of fraud prevention tools more than doubles when a client transitions to image processing. “The move to FedReceipt Plus brings COCC full circle in its image exchange implementations,” said Lockwood. “We made a strategic decision several years ago to adopt an image platform as a means to improve the package of services offered to our clients. Image inclearing offers big improvements in client efficiency and a better means for recovering from weather and other disasters,” he said. “Plus, our clients will be contributing to the greater acceptance of image exchange, which is good for the industry as a whole.” ##### ABOUT COCC COCC is one of the fastest growing data processing companies in the nation. Established in 1967, this client-owned company provides complete enterprise processing solutions to financial institutions using the latest open systems. COCC was one of the first data processors to provide end-to-end image processing and was recognized by Cornerstone Advisors’ Gonzobanker newsletter for migrating all of its clients to an open, relational system built on an Oracle data base. Open systems and client-driven support make COCC the better data processor. For more information, please call 860.678.0444 or visit www.cocc.com. ABOUT THE FEDERAL RESERVE BANKS The Federal Reserve Banks offer a full range of financial services including Cash, Check, FedImage®Services, FedACH®, Fedwire ® Funds Service, Fedwire Securities Service and National Settlement Service. In addition, the Fed offers services designed to support the use of Financial Services, including Account Management Information and Service Charge Information. For more information about the Federal Reserve Banks’ products and services, visit www.frbservices.org.