Taxation-1-Prof-Duff-Spring-2009-Audrey-Lim-Gina

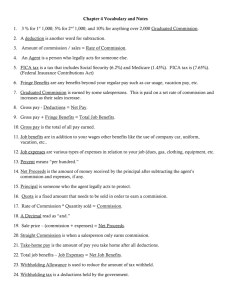

advertisement