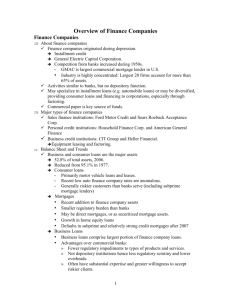

Securitizations of Financial Assets and Bank Risk

advertisement