client logo - Walsall Council

advertisement

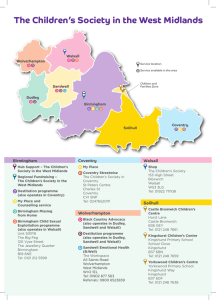

Black Country Enterprise Action Plan 2008-2011 19th September 2007 Black Country Enterprise Action Plan CONTENTS Executive Summary and Next Steps 2 THE BIG PICTURE The Strategic Context for the Action Plan 1 The Strategic Overview 3 2 The Key Priorities 7 MAKING IT HAPPEN The Enterprise Action Plan 2008-2011 3 Project Prioritisation in the Action Plan 11 4 Delivering the Key Projects 12 5 Implementation, Linkages and Governance 15 Appendix 1: The Enterprise Champions Group Appendix 2: The Project Details 1 Black Country Enterprise Action Plan BLACK COUNTRY ENTERPRISE ACTION PLAN EXECUTIVE SUMMARY AND NEXT STEPS The key economic development partners in the Black Country through a “Champions” group have developed the Black Country Enterprise Action Plan. It has been written in the context of the new Regional Economic Strategy, the Black Country Study, the emergent Business Link West Midlands and Local Economic Strategies and LAA targets. It focuses on the key economic challenges facing the sub-region while recognising its important strengths. The Action Plan identifies activities that will assist in closing the output gap between the Black Country and the national average. It covers the period 2008-2011. The Action Plan recognises that to achieve its goals, there needs to be engagement with all communities in the Black Country, particular those from traditionally “disadvantaged” backgrounds while also helping people to exploit high value growth agendas. The Action plan identifies three related strategic priorities. Within these priorities are programme areas and within these 16 projects have been identified in the first instance to be implemented within the three year period. Seven Projects have been identified as “Green Light” whilst the remaining requires considerable development. The three priorities are: o o o Creating an enterprise culture –raising the profile of enterprise and entrepreneurial behaviour. Examples of projects include the Enterprise Partnership Centre at IKEA in Walsall and a scheme to assist graduates to develop social enterprises to support other Black Country businesses. Enterprise in our communities –encouraging more people from the Black Country to become entrepreneurs. Examples of projects include new community asset developments, the forging of links between the voluntary and private sectors and franchise developments. Enterprise development and innovation –encouraging the development of strategic centres to focus the knowledge economy. Examples of projects include incubation and managed workspace facilities at Wolverhampton Science Park, the Performance Arts Centre at Walsall, the Glass House in Amblecote and the South Black Country Innovation Campus. Next Steps To achieve maximum impact it is recommended a series of further key actions need to take place by March 2008, namely: Wider partner consultation and endorsement e.g. Local Authorities, Local Strategic Partnerships, Community and Voluntary Sector, Chamber of Commerce Programme and priority alignment with other emerging resources e.g. LABGI and ERDF Coordination of dedicated support to ensure that “Green Light” projects become operational and the remaining projects are brought forward quickly Analysis of total projects investment requirements, leverage and impact of outcomes and outputs to meet Black Country Study targets Identification of amendments and refinements to the Action Plan to address issues arising from consultation 2 Black Country Enterprise Action Plan THE BIG PICTURE The Black Country Enterprise Strategy 1. THE STRATEGIC OVERVIEW The Black Country Vision – A “we can do it” place 1.1. Successful places are dependent on a range of factors – economic vitality and diversity, a skilled workforce, good connectivity, strong institutional capacity and leading edge innovation – and excellent quality of life. A vibrant local economy underpinned by high levels of enterprise is a key factor in creating successful places. This is essential to enabling people to realise their aspirations, and to the longer-term sustainability of communities. 1.2. The Black Country Study embraced these attributes in setting out an ambitious and bold agenda for change in its 30-year Vision. The Vision identified a confident and prosperous Black Country with thriving urban centres each offering a distinct and wide range of shopping, leisure and cultural facilities, modern employment opportunities and a choice of quality housing. 1.3. The prosperous and ambitious place described in this Vision will require a step-change in the way the Black Country embraces enterprise in its widest sense. It will be essential to build an enterprise culture that extends to every community, create more new businesses and harness the entrepreneurial potential of every existing business. The key targets for the Black Country 1.4. The Black Country Study identified a £2.6bn annual output gap between the Black Country and the English average, measured in Gross Value Added (GVA). It is estimated by partners that this gap is now £3.2bn in summer 2007. The Black Country Study set the following targets for the sub-region over a 30-year period to help close the existing productivity gap with the rest of the country. Jobs: 63,000 more people into work to achieve the Government target of 80% employment rate (Effect on GVA - £2.0bn) Skills: 52,000 more people educated to degree level (Effect on GVA - £0.8bn) New Firms: create some 900 more new VAT-registered businesses a year (Effect on GVA - £1bn) The 2005 Black Country Incubation Strategy also found that effective incubation could create 17,000 jobs over 30 years in over 1,500 new firms; and that these incubated firms would have much higher levels of GVA per employee (Effect on GVA - £1.6bn) 3 Black Country Enterprise Action Plan The national, regional and sub-regional strategic fit 1.5. This Enterprise Action Plan sets out the key areas of enterprise activity required to contribute to these transformational changes, and the programmes and projects which will deliver this. The Action Plan also aims to identify leadership, potential resource streams, timelines and impact for each programme. 1.6. It is consistent with other approaches to economic regeneration and enterprise within the Black Country, including: 1.7. the Regional Economic Strategy with its key themes of Business, Place and People the Black Country Study the work of the Regeneration Zone local economic frameworks the emerging Business Link activities the developing Block 4 LAAs for each local authority area. The Action Plan brings together priorities stated in the Black Country’s LEGI application, the Future Foundation/Arc of Opportunity Enterprise Framework 2006, the Black Country Incubation Strategy 2006/08 and the enterprise projects included in the 2007/10 ZIP. Agreeing terms… The new RES describes it as “a driver of productivity and a route to creating employment and driving regeneration”. For the purposes of this Action Plan, “Enterprise” is defined broadly to encompass all activity aimed at making the Black Country’s people, communities and businesses more enterprising, more likely to think and act entrepreneurially and more innovative in how they go about their business. Quite simply “Enterprise” is about responding to the big challenges of a changing economy - manufacturing restructuring, globalisation and competitiveness, the knowledge economy, individual and community ambition, exploiting ideas and opportunities, and building the “we can do it” culture throughout the Black Country. In terms of public sector support this can involve: enterprise education programmes and awareness campaigns guidance about entrepreneurial opportunities and preparing to start a business practical support and facilities to help create the business and get it established tailored support and innovation services for business with the potential to grow In particular it must involve strong partnership working between the key public sector partners who must embrace the concept of enterprise in everything they do. 1.8. It is vital that the Black Country Enterprise Action Plan harnesses the resources and expertise of all stakeholders whether they are working at a Regional, sub-regional or local level. Regionally delivered activities such as the new Business Link business brokerage service will provide a standard service level across the West Midlands and it is essential that this provision is defined and comes on stream with some urgency. 4 Black Country Enterprise Action Plan 1.9. However the fact that most generic programmes for business support are national or regional means that the particular challenges faced by the Black Country will only be addressed by a collaborative and joined-up approach to partnership working. The subregional and local partners must be encouraged to bring their insight and local expertise to sit alongside and supplement the Regional funders and delivery agents in key areas such as innovation support for SMEs with real growth potential. Rationale for action on enterprise 1.10. The evidence of the need to intervene to develop enterprise in the Black Country is clear. This Action Plan sets out some of the key challenges being faced by the Black Country as well as a number of real opportunities for economic growth through enterprise creation and development. Enterprise challenges 1.11. The Black Country Study shows that the comparative lack of business starts is the biggest factor in the Black Country’s output gap – explaining at least £1bn of the £3.2bn output gap. Some of the challenges we must address are outlined below. Lack of pervasive culture of enterprise and dynamism, evidenced by low rates of business formation and business stock The need for 900 additional new VAT-registered businesses a year Large numbers of young people with limited skills and low aspirations for work, with almost two-thirds of young people in some wards having no qualifications at all A shortage of people with degree level qualifications A large number of working age people on worklessness benefits – over half of whom are under 50 A reliance on business sectors that are firmly in the slow lane – and also a low level of productivity in all sectors, suggesting a generic weakness in skills, productivity and innovation A low paid, low wage economy Enterprise opportunities 1.12. However the Black Country also has some major strengths, which can act as a platform for building an enterprise culture and a much higher level of business start-up activity. These opportunities include: 5 Black Country Enterprise Action Plan 1.13. Substantial progress already made in regeneration and changing the image of the Black Country Work being done to establish a Black Country Incubation Network in support of the Incubation Strategy Evidence of a collaborative way of working between the local authorities, public agencies and private sector leaders – vital in the light of the recent Review of Subnational Economic Development and Regeneration The establishment of the Enterprise Champions Group who have overseen the development of this Action Plan (membership shown at Appendix 1) The active participation of global business partners such as Microsoft and IKEA An active voluntary and community sector contribution to enterprise, helping reach potential entrepreneurs who might not otherwise engage Real commitment from the University of Wolverhampton and the creation of the ground-breaking Colleges Consortium The alignment between our emerging enterprise proposals and the emerging Business Support Simplification Model, evidenced by the participation of Black Country SBS in developing this Action Plan A business start up programme, supported by Business Link West Midlands, managed by BCSBS, with delivery from the University and local partners and involvement of the key Black Country stakeholders Therefore the rationale is clear. The market failure with respect to enterprise and entrepreneurship – linked to low productivity and poor skills and economic participation – points to a need to intervene. And the presence of a range of positive factors means that there is a strong platform for building effective public sector initiatives, supported by some major global private sector players. Working together to achieve success 1.14. This Action Plan for the first time brings together activity planned or anticipated within the Wolverhampton and Telford Technology Corridor, the Regeneration Zones and the Black Country Inspired LEGI application. We are committed to ensuring now and in our future actions we retain this process of joint and integrated working to achieve alignment and avoidance of duplication 6 Black Country Enterprise Action Plan 2. THE KEY PRIORITIES 2.1. This section sets out the principles of the Enterprise Action Plan and defines the key themes that it encompasses. These themes are fully interlinked and mutually supportive. 2.2. Working closely with a range of private and public sector partners, we aim to create 10,000 new businesses by 2017. These businesses will range from simple self-employment, to thriving social and community enterprises and right up to high-growth, innovative companies supported through incubation. The creation of 10,000 new VAT-registered businesses by 2017 will increase GVA by at least the £1bn a year identified in the Black Country Study. Scope and focus 2.3. Achievement of the business start-up, jobs and GVA targets will require a broad approach covering every community in the Black Country. Our efforts will need to focus on three key groups, using methods appropriate to each: the general public throughout the Black Country, to raise their awareness and offer support for taking ideas forward those people in disadvantaged areas or groups which currently experience an “enterprise deficit” compared with the rest of the Black Country community people with high potential enterprise ideas including spinouts and existing companies wishing to exploit new opportunities. 2.4. In line with the emerging new West Midland Economic Strategy we will focus a significant proportion of our enterprise resources on young people and on under-represented communities and groups such as certain BME groups, women and people who are economically inactive. Key thematic priorities 2.5. The interactive process of consultation that has led to the development of this Enterprise Strategy identified three key strategic priorities for enterprise in the Black Country. Creating an Enterprise Culture Enterprise in Our Communities Enterprise Development and Innovation These themes are closely linked. They form an unbroken continuum that stretches from changing attitudes to enterprise and business throughout the Black Country; to supporting the establishment of new businesses in every community; and right through to assisting new and existing small businesses to grow, innovate and prosper. Theme A: Creating an Enterprise Culture 2.6. This is an innovative theme designed to raise the profile of enterprise and entrepreneurial behaviour throughout the Black Country but with a particular emphasis on young people and graduates. The activity will aim to engage learners, at all educational stages from Key Stage 1 to higher education, in a series of interventions that will introduce them to enterprise and entrepreneurship and help foster a long-term entrepreneurial ethos. The theme will add 7 Black Country Enterprise Action Plan value to the current mainstream provision, improve educational attainment levels and increase the total entrepreneurial activity throughout the Black Country. 2.7. 2.8. Activities will include: Children and Education – We will work with Education Business Links partnerships, schools and with key employers to develop enterprise education and to provide practical experience of business for young people throughout the Black Country. Graduates – Graduates are recognised as a major source of potential entrepreneurs, and a group more likely to develop high-growth and high-value businesses. We will work with the University of Wolverhampton to provide support and mentoring for enterprising graduates. Disengaged Young People – Enterprise has been shown to be an effective subject for helping re-engage young people who are otherwise hard to reach. We will provide practical and motivational experience for young people and incorporate computer games skills in an enterprise programme. General Awareness Building – Campaigns to raise awareness of enterprise opportunities amongst the wider population – linked to Theme B. However, the nature of cultural change is that it takes time. This is not a quick fix with readymade outputs and outcomes. But it is an absolute pre-requisite of an Enterprise Strategy. To raise hard measures like the business start-up rate to national levels will require work at grass-roots with young people and with the target communities outlined above, over a period of years to create the right environment for enterprising behaviours. Theme B: Enterprise in Our Communities 2.9. This programme is concerned with encouraging more people to become Black Country entrepreneurs. We will develop a focused range of techniques to engage with enterprising individuals, groups and communities. Activities will include: Facilitation – We will develop successful enterprise facilitation and animation models, working with specific client groups and using outreach in innovative ways in target communities to promote self-employment as a career option. Franchising - Business format franchising is an acknowledged model for investment in business creation and growth. There are 34,000 franchisees in the UK, employing 370,000 people and the average initial investment is £50,000. We will work with the British Franchise Association and others to support successful take-up. Mentoring – Talking to experienced entrepreneurs has been shown to be a useful support activity. They may have faced similar problems and can offer guidance, support and act as role models. We wish to build on existing valuable mentoring schemes that are available for young people and other specific groups. Social Enterprise Creation – Social enterprises are run for a beneficial community purpose and invest their surpluses back into that community purpose. They include social firms, mutual organisations such as co-operatives and large-scale organisations operating nationally or internationally. There are 55,000 in the UK providing a turnover of £27bn. We are already having some real success in developing social enterprises in the Black Country. Community Asset Development - The benefits of the transfer of public assets to community organisations are well known. The recent Quirk Review outlined the 8 Black Country Enterprise Action Plan benefits and set out a framework for community asset development. We will work with key community-based partners in the Black Country to create a small network of community assets aimed at supporting enterprise and community businesses and building community confidence. 2.10. Public sector partners will work closely with the voluntary and community sector and also with dynamic private sector employers and sponsors. The interventions will be aimed at creating hard outputs in terms of businesses created and sustained, jobs created and skills gained. In addition they will generate outcomes in the development of social enterprises and community assets, and in entrepreneurship in the target groups and communities. Theme C: Enterprise Development & Innovation 2.11. This important strand of activity is incorporated in the Enterprise Strategy because it is essential to view the enterprise process as a continuum. This starts with creating a culture of enterprise and opportunity; extends towards seizing the opportunities and taking the plunge into self-employment or business creation; and then continues into the application of enterprise and innovation in established businesses to maximise their contribution to productivity and GVA growth. 2.12. The Enterprise Development & Innovation strand incorporates the work-taking place throughout the Black Country to bring the 2005 Black Country Incubation Strategy to fruition. National policy emphasises the important role of an integrated incubation process, designed to nurture growth-hungry, knowledge-based new businesses in developing competitiveness at home and in export markets. Fostering new business formation, supporting growth and increasing the survival of young businesses achieve this. The Black Country Study calls for the creation of a “strategic centres-led knowledge economy”. 2.13. The activities will include: Black Country Enterprise Innovation Network – The development of a series of inter-linked physical enterprise centres, with incubation and innovation facilities on-site supported by innovation advisory services and linked closely to existing and refreshed managed workspace facilities. Additional Business Support - The provision of targeted business support services provided by a range of collaborative regional and local partners and linked to the Enterprise Innovation Network. These services will probably focus on two groups: those people who are not ready for the portfolio of business support services provided by Business Link West Midlands and the provision of specialist or technical services that are outside of the scope of Business Link West Midlands services. In all aspects of service development, we will work closely with Business Link West Midlands to ensure there is understanding and agreement on actions. The Key Black Country enterprise projects 2.14. After a process of project assessment the Black Country Enterprise Champions Group has identified sixteen initiatives that they aim to take forward over the next 10 years to contribute towards the enterprise objectives of the Black Country Study and to move towards the various LAA targets and objectives for the sub-region. 2.15. We recognise and support the ambitious longer term proposals that compliment and enhance our plan for example, the proposed Offsite Manufacturing Hub, the Walsall 9 Black Country Enterprise Action Plan Gigaport and the Wolverhampton Creative Industries Quadrant. partners to assess progress and make any revisions as necessary. We will work with our 2.16. Equally, a major contributor to the Black Economy is made by BME owned businesses. The current regional business support model is exploring how targeted support can be given. We will monitor this situation and ensure that this key group is fully engaged in our plans. The Plan will also be supported by actions included within the Microsoft partnership proposals the Black Country Education Challenge. 2.17. These projects are outlined briefly below but will be explored in more detail in the following chapter, which make up the Enterprise Action Plan for delivery over the next three years. The 16 Priority Projects Key Outputs & Impacts Theme A: Creating an Enterprise Culture A1 Enterprise Partnership Centre A2 Enterprising Graduates A3 Bridging Enterprise A4 Enterprise in Further Education A5 Enterprise Training for Teachers Early outputs in graduate employment, business creation, and businesses engaging with the knowledge base and skills development. But mainly working towards longer-term impacts in terms of attitudes to enterprise and levels of educational attainment and ambition amongst young people – from primary school to graduates. Theme B: Enterprise in Our Communities B1 Community Asset Development - Walsall B2 Franchising Development B3 Social Enterprise & Disadvantaged Areas B4 Community Asset Development -Sandwell B5 Mentorprise B6 Enterprise Facilitation Outputs in new businesses created, social enterprises created, jobs created. All of these with successes in disadvantaged areas and target groups. Wider impacts in attitudes to enterprise in deprived communities, the development of role models, and engagement of private sector mentors and creation of the “we can do it” ethos in the Black Country. Theme C: Enterprise Development & Innovation C1 Wolverhampton Science Park Phase 4 C2 Performance Arts Business Centre C3 Glass House – Ruskin Mill C4 South Black Country Innovation Campus – Phase 1 C5 South Black Country Innovation Campus – Phase 2 Outputs in new businesses created, jobs, businesses assisted and engaging with the knowledge base, skills development, brownfield land and growing GVA. Wider impacts in economic diversification, high quality employment, graduate retention and attraction, inward investment, profile and image. Supporting activity alongside the specific projects 2.18. These projects form the key activities of the Enterprise Action Plan but they are not the whole story in terms of public sector investment in the economic development and regeneration of the Black Country. 2.19. The scope of the new Business Link West Midlands business and skills brokerage is currently being established. This Action Plan has been drawn up on the assumption that the brokerage service will provide a volume and quality of support that meets the needs of mainstream business throughout the Black Country. Other key activities include the work of the Prince’s Trust and a wide range of voluntary and community organisations which will continue to deliver results alongside the named projects in the Action Plan. 10 Black Country Enterprise Action Plan MAKING IT HAPPEN The Enterprise Action Plan 2008-2011 3. PROJECT PRIORITISATION IN THE ACTION PLAN 3.1. The Enterprise Champions Group has established a three-part categorisation of the 17 projects to provide clarity about where partners’ resources should be focused during the first three years of the Enterprise Action Plan between 2008/09 and 2010/11. The categorisation is based on the traffic light system: Green Light – On track: projects that have been approved or are near to approval and are moving towards implementation. Green Light – Taking shape: projects that need some more business case development work before they can be submitted for approval. Amber Light – Real work still to do: projects that will require a considerable amount of project development work and which may not be ready for implementation for at least two years. Red Light: The process of strategy development has obviously eliminated any potential “Red Light” projects. GREEN LIGHT – AND ON-TRACK A1 Enterprise Partnership Centre B1 Community Asset Development – Walsall C1 Wolverhampton Science Park Phase 4 C2 Performance Arts Business Centre C3 Glass House – Ruskin Mill GREEN LIGHT – AND TAKING SHAPE A2 Enterprising Graduates C4 South Black Country Innovation Campus – Phase 1 AMBER LIGHT – REAL WORK STILL TO DO A3 Bridging Enterprise A4 Enterprise in Further Education A5 Enterprise Training for Teachers B2 Franchising Development B3 Social Enterprise & Disadvantaged Areas 3.2. B4 Community Asset Development – Sandwell B5 Mentorprise B6 Enterprise Facilitation C5 South Black Country Innovation Campus – Phase 2 The 16 projects are set out and discussed in the following sections and in Appendix 2. 11 Black Country Enterprise Action Plan 4. DELIVERING THE KEY PROJECTS Theme A: Creating an Enterprise Culture 4.1. This theme acknowledges the importance of embedding enterprise culture into mainstream education from an early age. It seeks to introduce children and young people to enterprise through a variety of Social and Community interventions from Key Stage 1 onwards. Actions to create an enterprise culture directly address the lack of ambition and confidence, especially within our deprived communities. 4.2. Creating an Enterprise Culture includes six key projects. These interventions will use certain resources already committed and seek new resources in order to enhance current provision. They will also aim to influence the use of existing resources, such as the schools’ own enterprise budgets. The key projects are: A1 Enterprise Partnership Centre - Facility being developed in partnership with IKEA in a new store extension in Walsall. A Hub for enterprise training, it will enable school students to learn about, and experience, enterprise and business, and develop employability skills in an enterprising environment with an international reputation. Start 2007/08 A2 Enterprising Graduates - A ground-breaking scheme where a multidisciplinary team of graduates are mentored and supported to create social enterprises which in turn will provide specialist services to Black Country businesses to improve their performance, innovation and sustainability. Start 2008/09 A3 Bridging Enterprise - Addressing shortcomings in existing enterprise education by focusing on entrepreneurship. Driven by the education sector but with business-centred elements including networking, inspirational mentors and Enterprise Challenge aimed at meeting local business needs. Start 2009/10 A4 Enterprise in Further Education - Six colleges have come together to develop and implement an enterprise curriculum across the Black Country. They will develop a range of flexible programmes from short courses to NVQ Level 2 and beyond that will be available to over 10,000 young people and residents of target communities. Mentors and role models will also be used. Start 2009/10 A5 Enterprise Training for Teachers - Accredited framework of CPD for teachers and providers engaged in enterprise education. Teachers released for up to one week a year to work in business. Business mentors will work with schools to bring practical experience to enterprise education. Start 2009/10 £230,000 £1.63m £230,000 £500,000 £575,000 Theme B: Enterprise in Our Communities 4.3. The rationale for this theme is based on ensuring access to enterprise opportunities through project activities delivered at the local level. Evidence from Sirolli, Bizz Fizz and other locally based and delivered programmes suggest that organically developed and delivered activities can provide a much greater community focus to enterprise stimulation than some traditional ‘top-down’ approaches. 12 Black Country Enterprise Action Plan 4.4. In conjunction with activities to promote franchising as an attractive self-employment and business growth option, this strand of action will build on the enterprise culture work and seek to increase the rate of business creation in the Black Country, particularly in more disadvantaged communities. B1 Community Asset Development – Walsall - A new building to provide a high profile centre for young people with a strong focus on enterprise. The activity will focus on developing social enterprises in conjunction with major private companies such as IKEA and B&Q. Start 2007/08 B2 Franchising Development- To promotes franchising as an accessible route to enterprise through events and workshops. Then to progress enterprising people into demand-led training by specialist facilitators from the British Franchise Association and other bodies. Participants will be introduced to the mainstream business support brokerage service. Start 2008/09 B3 Social Enterprise & Disadvantaged Areas - Creating and growing social and community businesses. Rolling out the Walsall experience across the Black Country, the scheme will forge links with private business – including IKEA - and with mainstream business support. Engaging private sector companies through organisations like BITC to champion enterprise development in deprived areas. Start 2009/10 B4 Community Asset Development – Sandwell - Refurbished and extended a community facility to create units for enterprise development and incubation, with linkages to Business Link, and local colleges. Anticipating a mix of commercial and social enterprises. Build 2008/09 B5 Mentorprise – Working with organisations such as the Princes Trust and existing models, to recruit and train a pool of highly motivated business mentors to provide new entrepreneurs with a dedicated mentor for their first year of trading. Development will include an induction pack and Mentorprise training. Start 2008/09 B6 Enterprise Facilitation - Programme of grass-roots enterprise facilitation to assist people wanting to start their own business. Building on the Sirolli and Bizzfizz approaches, with a strong community focus and a dedicated facilitator based in the heart of the community. Start 2009/10 £1.93m £990,000 £1.8m £2.3m £500,000 £1.225m Theme C: Enterprise Development & Innovation 4.5. In order to create and sustain innovative new businesses, we must ensure access to the right type of environment and added value services that new businesses require. Such support might include pre-incubation services; physical incubation services; virtual incubation; access to finance, linkages to grow-on provision; and linkages to wider enterprise initiatives. 4.6. The Black Country Incubation Strategy (BCIS) sets out the key priorities for providing the physical accommodation and complementary business support services required by Black Country businesses. It aims to deliver an “integrated best of class incubation system, actively helping the Black Country achieve its 30 year vision by raising productivity and 13 Black Country Enterprise Action Plan entrepreneurial activity”. The BCIS highlights the importance of a co-ordinated approach to incubation, one that supports the Black Country’s wider enterprise efforts. C1 Wolverhampton Science Park Phase 4 - A major development of Incubation and managed workspace for high-growth start-ups building upon an already successful model. This proposal directly addresses the need for high value added activity in the Black Country Start 2008/09 C2 Performance Arts Business Centre - A new economic development unit within Walsall Campus of the University, combining incubation with tailored business support for performing arts businesses, accredited management courses, workforce development and graduate courses. Start 2008/09 C3 Glass House – Ruskin Mill – Create world-class glass centre, with opportunities for graduates, local businesses and young people. Innovation workshops and business development centre with incubation and grow-on space. Double existing cluster of studio-based glassmakers. Start 2008/09 C4 South Black Country Innovation Campus – Phase 1 - The Campus will combine innovation management support and mainstream business support through the business brokerage. It will include space for local colleges to deliver an enterprise curriculum to including a Level 2 qualification. Start 2009/10 C5 South Black Country Innovation Campus – Phase 2 – A potential new build facility designed to grow from the phase one development and link with the other facilities to create effective and integrated network. Linked to refreshing the Managed Workspace Portfolio programme of investment in Sandwell’s existing managed workspace estate to bring it up to modern business needs. Start 2010/11 £8.0m £16.0m £15.9m £30.0m £6.6m 14 Black Country Enterprise Action Plan 5. IMPLEMENTATION, LINKAGES AND GOVERNANCE Linkages with other activities 5.1. The Action Plan identifies activities that contribute to closing the output gap between the Black Country and the national average. This includes retaining the key elements of the original LEGI bid – i.e. through a focus on disadvantage – as well as ensuring that we support those who may have more skills and personal resources to set up and grow their businesses. The achievement of the Black Country Study objectives and targets will require such a broad and all-encompassing approach to enterprise. 5.2. The focus for the Action Plan is primarily on key enterprise-related projects that can be delivered by those in the core operational group that will drive the implementation of the Action Plan. However the Action Plan also links with activities to which it will need to be aligned such as the new Business Link mainstream business support service. 5.3. Our activities focus first and foremost on increasing the vibrancy of our economy by supporting the creation of new enterprises, from the thought to the idea, to pre-start planning and starting up. This focus is on working with young people to create an enterprise culture, creating opportunities for people to develop their business idea and providing supported incubation premises. However we also recognise the importance of linking this start-up support with the wider business support offer, irrespective of the form this eventually takes. Partners must be aligned to provide a seamless service to all prospective and established businesses. 5.4. The main thrust of support services to existing businesses is through WMBS. However, enterprise and start-up services will be subcontracted to local providers on geographical and specialist criteria. BCSBS, the former franchisee for Business Link in the Black Country, is leading a consortium comprising the University of Wolverhampton and specialist communitybased support agencies in a contract with Business Link West Midlands to deliver enterprise services in the sub-region. The outcome of this tender is anticipated in summer 2007. If the tender is successful, then a contract, possibly up until March 2010, will be issued. If the BCSBS-led bid is unsuccessful, then the Black Country partners will need to open discussions with a new provider. There is also the possibility that services for the Black Country could be contracted with several organisations, dealing perhaps with specific client groups. 5.5. From a Black Country perspective, there may be a need to examine the development of services over and above that offered through the Business Link West Midlands contract if there is a perceived need. Needs could arise from requirements to target specific groups, increasing the level of services available to clients or specific services allied to proposed incubation facilities. Through funding arising from local area agreements, BCSBS is leading, in conjunction with other partners, the delivery of additional (to Business Link) enterprise services in Sandwell, Walsall and Wolverhampton. 5.6. A range of business support services is either already in place or being developed. These include: Manufacturing Advisory Service; support for medium-sized businesses; Netbus; the ‘M’ Institute; and free advice services from Microsoft. Other activities are also in place or being progressed in areas such as succession planning, development of Innovation Labs and tackling business crime. 15 Black Country Enterprise Action Plan 5.7. The Action Plan recognises the importance of these activities and - as a consequence of future business support developments - we would anticipate changes to some elements of the programme to ensure strong linkages with the emerging business support offer. Funding requirements and sources 5.8. This Action Plan includes 16 key projects that will be taken forward over the next three years – 2008/09 until 2010/11. Full details of investment leverage outcomes and outputs will be completed in more detail during the coming months. 5.9. The projects will seek access and align funding from a range public sector sources together with ensuring that private sector leverage and investment is encouraged. 5.10. The approach is priority led identifying the changes and actions required to drive forward the Black Country Economy and then sourcing appropriate resources Contribution to the Black Country Study targets 5.11. While recognizing that many of the projects in this Enterprise Action Plan are still at a formative stage, we believe that the proposed programme will directly contribute to the longterm targets set out in the Study 5.12. Outputs an Outcomes achieved will: raise the number of people starting business through either self employment of franchising ; raise awareness of enterprise and entrepreneurship within schools to encourage future growth; retain and attract more graduates to start their own businesses; provide high quality facilities and integrated innovation support measures to grow the number of business start ups; increase the number of high value added businesses in the Black Country ; increase the number of social enterprise as viable business models to access procurement opportunities. Governance, Implementation and Next Steps 5.13. 5.14. The Strategy and Action Plan seeks to deliver and to influence three categories of project: Those that are ‘mission critical’ – the 16 initiatives, which are, included in this Action Plan and which will be driven directly by members of the Champions Group. Those which have a strong influence on delivering the aims of the plan and over which the Champions Group members will seek to exert influence at key stages – for example those incubation projects and business support services not included in this Action Plan. Those which will underpin the Black Country’s enterprise success but which are a key part of other, wider efforts at improvement. The Champions Group will seek to influence these developments wherever possible, for example the Building Schools for the Future programme. The primary driving force behind the delivery of the action plan is the Champions Group, which will provide the key operational and co-ordination role for the delivery of the Action Plan. The Champions Group will provide updates to both the Black Country Economy Group and the Black Country Delivery Group. Ultimately these will feed back to the Consortium’s Guarantee Members via the Board. 16 Black Country Enterprise Action Plan APPENDIX 1 THE BLACK COUNTRY ENTERPRISE CHAMPIONS GROUP Bill Fryer (Chair) Black Country Consortium Mike Bushell Black Country SBS Andy Bywater Sandwell MBC Danny Edwards Walsall MBC Justin Haywood Dudley MBC Karen Johnson University of Wolverhampton Mike Norris Wolverhampton Telford Technology Corridor Louise Powell Walsall MBC Peter Rowlands Advantage West Midlands Chris Tompkins Dudley MBC Kevin Westwood Wolverhampton City Council Ian Richardson (Adviser) Shared Intelligence Mike Chadwick (Adviser) Shared Intelligence Other representatives of the partner organisations attended and participated in the Champions Group on various occasions together with on going dialogue with Steve Gallagher and Nigel Goulty from GOWM. The outcome of the discussions with GOWM will impact directly and positively on our future actions 17 Black Country Enterprise Action Plan APPENDIX 2 PROJECT DETAILS 18 Black Country Enterprise Action Plan GREEN LIGHT – ON TRACK PROJECTS GREEN LIGHT – ON-TRACK A1 ENTERPRISE PARTNERSHIP CENTRE Description A new facility being developed in partnership with IKEA in a new store extension in Walsall. A Hub for enterprise training across the Black Country, it will enable school students to learn about, and experience, enterprise and business, and develop employability skills in an enterprising environment with an international reputation. Lead partners Education Business Partnerships Investment needs AWM Coverage/Location Entire Black Country Other public Private Outputs/Impacts Status Total £230,000 Improvement in enterprise education Engagement of private sector in enterprise education Contribution to the reduction of NEETS across the Black Country Increase in the number of young people engaged in enterprise education The creation of a sustainable Hub for Black Country enterprise training Planning stage. GREEN LIGHT – ON-TRACK B1 COMMUNITY ASSET DEVELOPMENT - WALSALL Description A new building alongside Vine Trust’s existing facility to provide a high profile centre for young people with a strong focus on enterprise. The enterprise activity will focus on developing social enterprises in conjunction with major private companies such as IKEA and B&Q as well as supporting faith-based social enterprises. Lead partners Vine Trust Coverage/Location Investment needs AWM £750,000 Other public £850,000 Private £330,000 Total £1,930,000 Outputs/Impacts Status Planning stage. Walsall 26 jobs created and 200 people assisted to get a job 6 businesses created 34 people assisted in skills development Community asset and social enterprise development C1 WOLVERHAMPTON SCIENCE PARK PHASE 4 GREEN LIGHT – ON-TRACK Description Incubation and managed workspace for high-growth start-ups. Lead partners Univ of Wolverhampton, WCC, WTTC Investment needs AWM Coverage/Location Wolverhampton Other public Private Total £8,000,000 capital Outputs/Impacts Status Taking full AWM application forward and Stage D design being sought. Businesses and jobs created Brownfield land Knowledge based businesses – design and creative industries 19 Black Country Enterprise Action Plan GREEN LIGHT – ON-TRACK C2 PERFORMANCE ARTS BUSINESS CENTRE Description A new economic development unit within Walsall Campus of the University. It will combine incubation with tailored business support for performing arts businesses in conjunction with Business Link. In addition it will provide accredited management courses, workforce development and graduate courses. Lead partners University of Wolverhampton Investment needs AWM Coverage/Location Entire Black Country Other public Private Total Outputs/Impacts Status Awaiting outline AWM approval. £16,000,000 capital Businesses assisted and created Jobs created Businesses engaging with the Knowledge Base, creative industries Brownfield land Skills, leadership, workforce development, graduate retention C3 GLASS HOUSE – RUSKIN MILL GREEN LIGHT – ON-TRACK Description The Trust will redevelop its Stourbridge site into a world-class glass centre, providing opportunities for glass graduates, local businesses and young people. It will include innovation workshops, a business development centre with incubation and grow-on space, an environmental technology centre, and exhibition and performance space and visitor facilities. It will allow a doubling of the existing cluster of studio-based glassmakers. Lead partners Ruskin Mill Educational Trust Coverage/Location Investment needs AWM £9,185,000 Other public £4,919,000 Private £1,767,000 Total £15,872,000 capital and revenue Outputs/Impacts Status Full AWM application submitted. Entire Black Country 261 jobs created or safeguarded 1700 businesses assisted 1.7ha brownfield land brought into use 20 Black Country Enterprise Action Plan GREEN LIGHT – TAKING SHAPE PROJECTS A2 ENTERPRISING GRADUATES GREEN LIGHT – TAKING SHAPE Description A groundbreaking scheme where a multi-disciplinary team of graduates are mentored and supported to create social enterprises, which in turn will provide specialist services to Black Country businesses to improve their performance, innovation and sustainability. Lead partners University of Wolverhampton Investment needs AWM Coverage/Location Entire Black Country Other public Private Outputs/Impacts Status Total £1,630,000 Businesses created and SMEs assisted Jobs created and GVA generated Graduate employment and retention Increase in knowledge based businesses Planning stage. C4 SOUTH BLACK COUNTRY INNOVATION CAMPUS – PHASE 1 GREEN LIGHT – TAKING SHAPE Description The 65,000 ft² Innovation Campus will combine specialist innovation management support and mainstream business support through the business brokerage. It will include space for local colleges to deliver a dedicated enterprise curriculum to young people and all residents, including a Level 2 qualification in Enterprise Capability. Lead partners Dudley and Sandwell MBCs Investment needs AWM Coverage/Location South Black Country Other public Private Outputs/Impacts Status Total £30,000,000 capital and revenue Businesses created and assisted Jobs created 30 incubation units Brownfield land – 3.6ha in Phase 1 Knowledge based businesses, environmental technologies Land secured and business plan being commissioned. 21 Black Country Enterprise Action Plan AMBER LIGHT PROJECTS A3 BRIDGING ENTERPRISE AMBER LIGHT – REAL WORK STILL TO DO Description Addressing shortcomings in existing enterprise education by focusing on entrepreneurship. It will be driven by the education sector but will incorporate businesscentred elements including networking, inspirational mentors and an Enterprise Challenge aimed at meeting local business needs. Lead partners Education Business Links Consortium Investment needs AWM Coverage/Location Entire Black Country Other public Private Outputs/Impacts Status Total £230,000 Provide a framework for enterprise education in the Black Country Encourage adoption of innovative enterprise education in all schools Embed the delivery of enterprise into the curriculum Developmental stage. A4 ENTERPRISE IN FURTHER EDUCATION AMBER LIGHT – REAL WORK STILL TO DO Description Six colleges have come together to develop and implement an enterprise curriculum across the Black Country. They will develop a range of flexible programmes from short courses to NVQ Level 2 and beyond that will be available to over 10,000 young people and residents of target communities. Mentors and role models will also be used. Lead partners Black Country Colleges Consortium Investment needs AWM Coverage/Location Entire Black Country Other public Private Total Outputs/Impacts Status Developmental stage. £500,000 10,000 beneficiaries receiving a qualification at NVQ level 2 or equivalent 750 people undertaking enterprise training 250 people achieving a qualification A5 ENTERPRISE TRAINING FOR TEACHERS AMBER LIGHT – REAL WORK STILL TO DO Description An accredited framework of CPD for teachers and other providers engaged in enterprise education. Teachers will be released for up to one week per year to work in business. Business mentors will work with participating schools to bring practical experience to enterprise education. Lead partners University of Wolverhampton Investment needs AWM Coverage/Location Entire Black Country Other public Private Total Outputs/Impacts Status Developmental stage. £575,000 Teachers and mentors improve skills Improvement in the enterprise delivery framework 22 Black Country Enterprise Action Plan B2 FRANCHISING ACADEMY AMBER LIGHT – REAL WORK STILL TO DO Description Promoting awareness of franchising as a credible and accessible route to enterprise. Events and seminars and proceeding to the Academy - a delivery programme to progress enterprising people into self-employment, comprising demand-led training workshops undertaken by specialist facilitators from the British Franchise Association and other bodies. Participants will be introduced to the mainstream business support brokerage service. Lead partners Local authorities Investment needs AWM Coverage/Location Entire Black Country Other public Private Total over 3 years Outputs/Impacts Status Planning stage £990,000 90 businesses and 270 jobs created Improved attitudes to enterprise B3 SOCIAL ENTERPRISE & DISADVANTAGED AREAS AMBER LIGHT – REAL WORK STILL TO DO Description Creating and growing social and community businesses rooted in local communities. Local residents will be actively involved and this will provide effective capacity building. Rolling out the Walsall experience across the Black Country, the scheme will forge links with private business – including IKEA - and with mainstream business support. Engaging employers as champions AND MENTORS for enterprise in deprived areas. Lead partners Walsall MBC, Vine Trust, Breathing Space Investment needs AWM Coverage/Location Entire Black Country Other public Private Total £1,800,000 Outputs/Impacts Status Planning stage – building on newly started Walsall pilot. 40 new social enterprises 200 jobs created for local residents Employment opportunities for NEET groups Champions trained Improved attitudes to enterprise B4 COMMUNITY ASSET DEVELOPMENT - SANDWELL AMBER LIGHT – REAL WORK STILL TO DO Description Refurbishment and extension of existing facility to create 12 units for enterprise development and incubation, with linkages to Business Link, BITC and local colleges. Anticipating a mix of commercial and social enterprises. Lead partners North Smethwick Development Trust Investment needs AWM Coverage/Location Smethwick Other public Private Total capital £2,300,000 Outputs/Impacts Status Discussions with funders taking place. Construction in 2008/09 and planned opening early 2009/10. 12 business or incubation units 36 new businesses created 72 jobs created over 3 years Increase in enterprise activity and community capacity building 23 Black Country Enterprise Action Plan AMBER LIGHT – REAL WORK STILL TO DO B5 MENTORPRISE Description Recruit and train a pool of highly motivated business mentors to provide all registered new entrepreneurs with a dedicated mentor for their first year of trading. A high-quality induction pack will be developed for prospective mentors and the NVQ accredited Mentorprise training will be developed by Princes Trust and professional providers. Lead partners BITC, Princes Trust and Providers Investment needs AWM Coverage/Location Entire Black Country Other public Private Total Outputs/Impacts Status Planning stage £500,000 100 mentors recruited and trained Businesses and jobs created Greater and ore effective business engagement and leverage Improved attitudes to enterprise AMBER LIGHT – REAL WORK STILL TO DO B6 ENTERPRISE FACILITATION PROGRAMMES Description An integrated programme of grass-roots enterprise facilitation to assist people who wish to start their own business. Building on the successful models developed in recent years by organisations such as Sirolli or Bizzfizz. These approaches provide a strong community focus and provide a dedicated facilitator based in the heart of the community. Up to 15 Black Country local panels will be established and 3-5 taken forward to full delivery status over 2½ years. Lead partners Dudley MBC and delivery partners Investment needs AWM Coverage/Location Entire Black Country Other public Private Total over 3 years Outputs/Impacts Status Developmental stage. £1,225,000 New businesses and jobs created Skills developed and worklessness reduced Improved attitudes to enterprise C5 SOUTH BC INNOVATION CAMPUS – PHASE 2 AMBER LIGHT – REAL WORK STILL TO DO Description Incubation and move-on facilities in a high specification site, which is in the process of being identified. This will link with the separate but related proposed programme of Refreshing Sandwell’s Existing Portfolio of Managed Workspace – evidence of the clear linkages between innovation, incubation and managed workspace within the enterprise agenda in the Black Country. Lead partners Sandwell MBC Funding AWM Coverage/Location Sandwell Other public Private Outputs/Impacts Status Total £6,600,000 capital 65 new businesses (325 over 20 years) 135 jobs created (675 over 20 years) Improved attitudes to enterprise Planning stage. High specification site to be identified. 24