Cash and Bank Transactions

advertisement

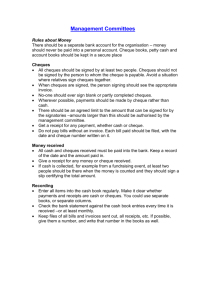

Chapter 7 Cash and Bank Transactions Definition and importance of cash Cash consists of coins and currency on hand and in bank accounts, cheques, bank drafts and money orders received from customers and other sources. Cash balances are presented in the Balance Sheet as current assets. Cash is an important item for business entities because at some stage most transactions involve movement of cash. This could be collections from customers, payments to creditors for purchases or meeting of operating expenses like salaries and wages. Business entities therefore, must ensure they have sufficient cash balances in order to meet: a) b) c) needs of current operations, maturing obligations as they fall due, and any unforeseen contingencies. However, business entities should not have excessive cash balances such that cash is idle. Idle cash earns no return and in fact its value is eroded by inflation. Therefore adequate balances should be maintained where there is no shortage or excess of cash. Cash budgets are prepared to project cash flows and plan for eventual deficiencies or surpluses. There are also more complex financial modeling techniques that are employed in determining cash balances. Cash is the most liquid asset; it can be transferred easily and is susceptible to theft and misappropriation. Therefore, sound cash management involves setting up of administrative and accounting procedures to safeguard cash. These procedures are known as internal controls over cash. Internal controls Internal control procedures adopted for cash follow the general internal control framework that could be applied for other assets of the business, like debtors, investments and fixed assets. Following are the most important internal control procedures over cash: Employment Procedures At the time personnel are employed hiring procedures should be able to establish competency and trustworthiness of an applicant. Seeking references and conducting historical investigations are some of the avenues employed to verify an applicant’s record. 128 Introductory Financial Accounting Insurance Because employee behavior and future events cannot be guaranteed it is wise to take out fidelity guarantee insurance cover on employees handling cash. Use of bank accounts The use of a bank account is a major control device over cash. Maximum benefits are obtained from the use of a bank account if all cash collections are banked intact as received and all payments are made by cheque. This means there will be no payments made out of daily collections. Adequate documentation, approval and authorization procedures Adequate supporting documents should be maintained for all cash transactions. Transactions should be checked for completeness and approved by relevant officers before they are effected. Setting of authorization limits is one of the general control tools. Separation of duties Separation of duties is achieved when no single individual has control over a complete cycle of a transaction. The purpose of separation of duties is such that another can check each person’s work. A cashier for example, should not be recording the Cash Receipts Journal. Use of physical, mechanical and electronic devices Access to sensitive locations where cash and sensitive documents ought to be restricted and controlled. Such access control could employ physical, mechanical or electronic devices. Also certain devices like an electronic cash register at a sales counter reinforce internal control. A cash register, for example, will produce a receipt and automatically accumulate total collections for a day. The daily running total can then be checked with remittances made by the cashier. This may prevent pilferage and enhance accuracy of records. Bank reconciliation When all cash receipts are deposited with the bank and all payments are made by cheque the cash book becomes a mirror image of the account maintained by the bank. For every deposit made the business will debit the bank account in its books, whereas the banker will credit the business (depositor’s) account. It should be possible to compare the balance of the cash book with the balance as per the banker's books. Since the bank is an external independent entity, bank reconciliation is a very reliable control procedure. Use of Petty Cash Fund It is not always practical to make all payments by cheque. A taxi driver dropping an executive at the main gate in the morning does not expect a company cheque. For certain payments it is practical, cost effective and convenient to pay in currency and coin. The Petty Cash Fund is a pre-determined amount retained in the office to handle payments of such miscellaneous items. Cash and Bank Transactions 129 Not all firms employ all internal controls all the time, as these control procedures, although desirable, they cost money and there is a limit as to what entities can afford. The basic rule is that generally, controls should be adopted as long as the benefits derived from their use justify the costs. Impact of Electronic Technology on Internal Control Advances in electronic technology allow keyless access to restricted locations using electronic codes or electronic readable identity cards. It is now even possible to install facial recognition facilities to restrict access to certain locations in office premises. Electronic surveillance of premises and offices through covert and overt cameras is a common aid in observing activities of employees, customers and other individuals in office premises. Finally on a routine operational scale computers using integrated accounting packages can undertake most of the processing of accounting information. Computing technology has its advantages and disadvantages in the area of control. On one hand, computers are reliable, accurate and consistent. On the other hand certain control procedures like separation of duties are difficult to institute in a computer environment. Computer fraud results from breakdown of such control. New developments are successfully containing incidences of fraud by instituting input, processing and output controls. Operating a bank account A bank account is an arrangement with a bank where on the basis of funds deposited the depositor is permitted to withdraw money and authorize payments. An account retains a unique number identifying it, known as the account number. An entity can therefore, operate more than one bank account at one or more branches of a bank. There are many types of accounts, but the current and savings account are the most basic types. The current account allows the account holder to issue an order to the bank by using cheque leaves to authorize payments. Cheques A cheque is a written order signed by the depositor ordering the bank to pay a sum of money to a designated person. The writer of the cheque is known as a drawer. The person to whom payment is made is known as a payee. Cheques are normally printed by banks and issued to account holders. It is not unusual however for some account holders to have customized cheque books. Cheques are always pre-numbered sequentially to facilitate internal control by the account holder and the banker. A sample cheque leaf is shown on Fig. 7.1. Paying-In Slip When an account holder deposits cash with a bank she has to record details of cash and cheques deposited on a printed form supplied by the bank. This form is known as a paying-in slip. It is prepared and filled by the depositor in duplicate. A copy is stamped and initialed by the bank teller (cashier) and given back to the depositor as a receipt. A sample pay-in slip is as shown on Fig. 7.1. 130 Introductory Financial Accounting Bank Debit and Credit Notes Banks will occasionally decrease or increase a depositor's account before the depositor is made aware of that action. Usually banks will charge a service fee for maintaining a bank account by deducting bank charges from a depositor's account balance at a certain date, normally the end of a month. The bank then sends a debit note to notify the depositor of the deduction. Similarly a bank may collect amounts from third parties on behalf of the depositor. On receipt of these amounts the bank will increase a depositor's account balance. Afterwards, the bank sends a credit note to inform the depositor of the increase. Bank Statement At the end of each month or less, a bank will usually prepare, in a statement format, all entries made in a depositor's account in chronological order. This document known as a Bank Statement is sent to the depositor, as desired. A bank statement usually contains the following information:a) An opening balance at the beginning of the month. A good balance in a depositor's account is shown as a credit balance. This is because the bank is keeping the depositor’s money, which may be taken out on demand. Therefore, a depositor is a creditor in the banker's books. b) All cheques paid during the month as debits to the depositor's account. c) All deposits made during the month as credits to the depositor's account. d) Any other debits, which include items like bank charges, ledger fees and reversal entries for dishonored cheques. e) Any other credits which include bank interest income, credit transfers and other items. Credit transfer is a facility where a bank receives money directly on behalf of an account holder. A debtor for example could pay the amount owing directly to a supplier's bank account. f) Closing balance at the end of the month. If the bank has effected all transactions during one month appearing in an entity’s Cash Book in the same month, the closing balance of the bank statement must be the same as the closing balance of the Cash Book. However, this rarely happens because there will normally be differences between transactions effected by the bank and those appearing in an entity's Cash Book. The purpose of bank reconciliation is to reconcile the two balances to full agreement. Bank reconciliation Bank reconciliation is the process of comparing and bringing into agreement the closing balance shown in the cash book and the closing balance as reported on the bank statement. Bank reconciliation is an important part of internal control because through comparison between a depositor's transactions and bank's transactions errors and irregularities can be found and corrected. Cash and Bank Transactions 131 Sound internal control requires a bank reconciliation to be undertaken by an employee who is not a custodian of cash or records cash transactions. There are four main reasons for the disagreement between the Cash Book and Bank Statement balances. These are as follows: Time lag differences A bank will record deposits, cheques drawn and other items on the date they are received at the bank, which may be different from the date when they were recorded in the depositor's accounting records. For example, Ado wrote a cheque to Biye on 20th November and Biye presented the cheque to the bank for payment on 5th December. Biye's cash book will show a payment on 20th November but the bank will record that payment on 5th December. At the end of November that outstanding cheque will result in a difference between closing balance of the bank and that of Ado's cash book. Time lag differences occur with deposits as well. Other debits and credits in bank books The bank would have made certain entries but without being communicated to the depositor until the date the bank statement is issued. Examples are bank charges, dishonored cheque entries, credit transfers, etc. Errors in depositor's books In the course of recording cash transactions in the Cash Book errors may be committed. These will be reflected in a difference between the bank statement and cash book closing balances. Usually these errors will be corrected before a reconciliation statement is prepared. Errors in bank records Sometimes banks make errors in recording transactions in a depositor's account. The depositor cannot correct such errors but should notify the bank of the errors and include the errors in a reconciliation statement as reconciling items. The process of preparing bank reconciliation The following boxes summarise six steps that are usually taken in preparing bank reconciliation. Steps in Bank Reconciliation Step One Compare deposits as shown in the Bank Statement with deposits according to the Cash Book. Tick off items recorded in both records and establish if there are any deposits in transit for the current month. Normally, deposits in transit at the end of the previous month will show up in the bank statement on the first few days of the current month. Tick off these ones as well, because although they caused a difference in the previous month, they cease to have an effect by their appearing on the Bank Statement. 132 Introductory Financial Accounting Step Two Compare cheques paid as per the Bank Statement with cheques written during the month and recorded in the Cash Book. Find out if there are outstanding cheques. These are cheques issued which the payees have not yet presented to the bank. Verify that outstanding cheques during the previous month have cleared through the bank during the current month, otherwise they remain outstanding cheques. Reference to cheque numbers will guide as to which ones remain outstanding. Step Three Find if there are any credits on the Bank Statement not recorded in depositor's Cash Book. Enumerate these. For example, credit transfers, bank interest income, etc. Step Four Find if there are any debits on the bank statement not in depositor's books. Enumerate these as well. Step Five Record all items appearing on the Bank Statement which ought to be recorded in the depositor's Cash Book. All items except those resulting from time difference and errors by bankers must be adjusted in the books of the depositor before a bank reconciliation statement is prepared. This step will result in a Cash Book with an adjusted balance. Step Six Prepare a Bank Reconciliation Statement. A bank reconciliation statement contrasts the Cash Book balance with the balance as per Bank Statement Items which explain the difference between the Cash Book balance and the Bank Statement balance are known as reconciling items. If all adjustable items have been recorded in the depositor’s books, the only reconciling items will be those resulting from time difference and errors by bankers. It is not unusual however, for examiners to require the preparation of a bank reconciliation statement before adjustments have been made in the Cash Book. In such circumstances, all items including adjustable items become reconciling items. A bank reconciliation statement must have a title with the following components: the name of the business, the title of the statement, in this case “Bank Reconciliation Statement”, and the period covered by the statement, such as “for the month ending 31st July, 20X1”. Cash and Bank Transactions 133 The format of a bank reconciliation statement is as follows: Bank Reconciliation Statement for the month ending 31st May 20X2 Amount Shs Shs 400,000 Balance as per Adjusted Cash Book add: Cheques drawn not presented 75,000 Masoli, A 125,000 Masele,B 200,000 less: Deposits in transit Balance as per Bank Statement 300,000 300,000 Example: Kibibi Bamkuu, who runs a food stall at Ferry – Magogoni - renown for her pilau has provided the following information. On advice by the Small Business Section of CRDB she opened a bank account towards the end of April. Summaries of her records show the following: Date Details 1-May Balance as per Cash Book Amount 10,000 2-May 5-May 16-May 16-May 21-May 22-May 30-May Deposits Deposit Deposit Deposit Deposit Deposit Deposit Deposit 31,800 26,500 19,200 45,930 38,780 3,640 260 3-May 5-May 11-May 15-May 19-May 21-May 29-May Payments Cheque no. 50 Cheque no. 51 Cheque no. 52 Cheque no. 53 Cheque no. 54 Cheque no. 55 Cheque no. 56 12,610 27,920 19,000 59,450 75,410 190 19,490 The following bank statement has been received from CRDB for the month of May: 134 Introductory Financial Accounting Date 1-May 2-May 2-May 4-May 5-May 5-May 5-May 16-May 21-May 21-May 12-May 22-May 22-May 25-May 29-May Bank Statement Account No. JX 69325 Kibibi Bamkuu Azikiwe Branch Details Debits Credits Balance 15,000 Balance 31,800 46,800 Deposit 4,000 50,800 Deposit 12,610 38,190 Cheque no. 50 9,000 29,190 Cheque no. 49 27,920 1,270 Cheque no. 51 26,500 27,770 Deposit 65,130 92,900 Deposit 19,000 73,900 Cheque no. 52 59,450 14,450 Cheque no. 53 38,780 53,230 Deposit 190 53,040 Cheque no. 55 3,640 56,680 Deposit 40,000 96,680 Direct Credit - Business Loan 200 96,480 Bank charges Note: All entries in the bank statement are correct and there are no errors. In order to prepare a bank reconciliation statement the following must be done: a) Calculate the Cash Book balance before adjustments, that is, before taking account of the effect of entries found in the bank statement. This is found by adding all deposits during the month to the opening balance and then deducting all cheque payments made during the month, thus 10,000 + 166,110 - 214,070 = -37,960. On initial examination this is an overdrawn balance. b) Compare deposits as per Kibibi's books with those of the bank statement. The following deposit is found to be in transit: Deposit of 30 May c) shs. 260. Compare cheque payments made by Kibibi during the month with those presented at the bank. The following cheques appear to be outstanding; Cheque no. 54 of 19th May Cheque no. 56 of 29th May d) shs. 75,410. shs. 19,490. Examine the debit column of the bank statement for items which have not been ticked such as the following: Cheque no. 49 Bank charges shs. 9,000. shs. 200. Cash and Bank Transactions 135 But notice that cheque No. 49 was written in April; therefore it must have been outstanding since April 30. As such it simply needs to be ticked off now that it has been presented and ceased to be a reconciling item. e) Examine the credit column of the bank statement for items which have not been dealt with, such as the following: 2nd May, Deposit shs. 4,000. 25th May Business Loan – direct credit shs. 40,000. The deposit on 2 May must have been in transit since the end of April. Now that it has been entered in the bank statement, it is simply acknowledged and ticked off. f) Now that comparison of the two records is complete, items that need adjustment in the Cash Book can be identified and recorded in the Cash Book. These are: i) ii) Bank charges, shs. 200. Business Loan, shs. 40,000. Journal entries to record these would be as follows: Date Description Folio 20X2 May 29 Bank charges Debit Credit 200 200 Cash at Bank To record bank charges for May Cash at Bank Business Loan To record a business loan advanced directly through the bank account 40,000 40,000 After the journal entries are posted an adjusted cash book balance can be established as follows: Cash at Bank Account 20X2 May29 20X2 Business Loan 40,000 May30 Balance b/f Bank charges Balance c/f 40,000 37,960 200 1,840 40,000 136 Introductory Financial Accounting A bank reconciliation statement is prepared as follows: Kibibi Bamkuu Bank Reconciliation Statement for the month ending 31st May 20X2 Amount shs shs 1,840 Adjusted Balance as per Cash Book Add: Cheques drawn not presented 75,410 Cheque no. 54 19,490 Cheque no. 56 less: Deposits in transit Balance as per Bank Statement 94,900 260 96,480 It is tempting to memorize the format of a bank reconciliation statement. However, it is more beneficial to understand the guiding criteria in treatments of the reconciling items in the reconciliation statement. Depending on which balance one begins with, all reconciling items which make the balance at the top of the statement (e.g. Cash Book balance) look smaller when compared to the balance at the bottom (e.g. Bank Statement balance) are added to the balance at the top. This explains why outstanding cheques are added back to the Cash Book balance. On the other hand, all reconciling items, which make the balance at the top of the statement (e.g. Cash Book balance) look larger when compared to the balance at the bottom (e.g. Bank Statement balance), are deducted from the balance at the top. This explains why deposits in transit are deducted from the Cash Book balance. Bank Overdraft Situations In a bank overdraft situation where the cash book shows a credit balance a bank reconciliation format is the complete opposite of the illustrated format. All items which are usually added to a good balance would now be deducted and all items, which are usually deducted, would now be added to an overdraft balance. Such a statement would look as follows: Cash and Bank Transactions 137 Bank Reconciliation Statement for the month ending 31st May 20X2 Amount Shs shs 400,000 Overdraft per Adjusted Cash Book 300,000 Add: Deposits in transit Less: Cheques drawn not presented 75,000 Masoli, A 125,000 Masele,B 200,000 Balance as per Bank Statement 500,000 The reconciling items have been dealt with, consistent with the guiding criteria. Outstanding cheques make an overdraft balance look larger so they are deducted as reconciling items, when the balance at the top is the Cash Book balance. Similarly, deposits in transit make an overdraft balance look smaller so they are added as reconciling items, when the balance at the top is the Cash Book balance. If one does not want to reverse the bank reconciliation statement format, all that needs to be done is to record the overdraft as a negative amount and continue with the bank reconciliation as if it were a good balance. In the Balance Sheet an overdraft is shown as current liability and should not be netted off against good balances. Dishonored and stale cheques When a cheque is received from a debtor it is debited in the Cash Book and sent to the bank. The bank will credit the depositor's account with the amount of the cheque. The cheque clearing system takes normally a minimum of three days. The drawer’s banker for a number of reasons may not honor a cheque. Some of the reasons for a cheque to be dishonored are: a) Errors on the cheque itself in date, name of payee, signature differences and amount variance between figures and words, etc. b) Lack of sufficient funds in the account of the drawer. In Tanzania it is unlawful to write a cheque which is not supported by funds in the bank. c) Stale cheques are also automatically dishonored. A cheque goes stale after six months have elapsed from the date indicated on the cheque. When a cheque is dishonored, the depositor's balance is decreased by the amount of that cheque. The banker debits the depositor’s account to effect the decrease which cancels the earlier credit made when that cheque was deposited. 138 Introductory Financial Accounting Example On 1 November Dudu & Co received a cheque of shs. 100,000 from Bum Enterprises on account of a two year old debt. It was banked on the same day. On the fourth day after the banking, a debit note was received attached to the cheque marked "Refer to Drawer - Insufficient Funds". The following general journal entries would be made in the books of Dudu & Co. Date Description Folio Debit Credit 20X2 Nov 1 100,000 Cash at Bank Debtors – Bum Enterprises To record receipt of cheque in settlement of a debt. Nov 5 Debtors – Bum Enterprises Cash at Bank To record a cheque from Bum Enterprises dishonored. 100,000 100,000 100,000 Note that the 5th November entry is a reverse of the 1st November entry. Cash at Bank and Bum Enterprises accounts will look as follows in the ledgers: Bum Enterprises Account 20X2 20X2 Jan 1 Balance b/f 100,000 Nov 5 Cash at Bank 100,000 Nov 1 Cash at Bank Balance c/f 200,000 100,000 200,000 Cash at Bank Account 20X2 Nov 1 Bum Enterprises 100,000 20X2 100,000 Nov 5 Bum Enterprises 100,000 Petty Cash Fund Payments of relatively small sums by cheque may be cumbersome resulting in delay and inconvenience. For such transactions a petty cash fund system is a cost effective and flexible approach of making payments. Based on experience of past payments and future expense projections, management decides on an amount that shall be a petty cash fund. The significance of this step is that the petty cash at any one time should not exceed the set amount, also known as a ceiling. Special management consent would be required for increase of the fund. Cash and Bank Transactions 139 Management will also select an employee who will be a custodian of the fund. The custodian maintains record of every payment made to enable categorization and summarization of the payments. Petty cash payments are made on the basis of a petty cash voucher that normally is approved by a designated officer before a payment is made. A Petty Cash Voucher contains the following details: date of the transaction, a serial number, name of person paid amount paid in number and words, expense category, approval signature, and acknowledgement of receipt by payee, usually by signature. Accounting entries for petty cash transactions There are four events that require attention for recording purposes in maintaining a petty cash fund. These are: i) ii) iii) iv) The establishment of the petty cash fund, Payments through the petty cash fund, Replenishment of the fund, and Recording of expenses in the general ledger. Establishing the petty cash fund On the date a fund is established a cheque is drawn in order to take out money from the bank for the petty cash fund. This entry will normally be recorded in the Cash Payments Journal or the Cash Book. If a general journal were used the entry would be as follows: Date Description Folio Debit Credit 20X2 Jan 1 Petty Cash Cash at Bank To record establishment of a petty cash fund. 100,000 100,000 Making payments through the petty cash fund When payments are made the petty cash voucher is filled with details and any supporting documents like taxi receipts, etc. if available. Petty cash vouchers are accumulated and categorized by major expense groups. Depending on complexity of an organization’s accounting system the accumulation and categorization could be a few envelopes each containing petty cash vouchers of an expense group. Alternatively this process may involve maintaining a Petty Cash Book which then becomes a 140 Introductory Financial Accounting book of original entry similar to a Cash Book. The Petty Cash Book however, records only miscellaneous payments and has only one source of receipts - the main cash book. A petty cash book format is as shown on Table 7.1. Table 7.1: Petty Cash Book Format Receipts Fol. Date Details Voucher No. Total Transport Postage Overtime General Similar to a Cash Book, a petty cash book has the receipts and payments sides. It also has columns for categorization of expense groups. This format is what makes what is known as the columnar petty cash book. Replenishment and posting of the petty cash book When payments are made out of petty cash, the fund gets exhausted and periodically it needs replenishment. Since the fund has a maximum limit, the amount of replenishment will always be equal to the total of amounts paid up to the date of replenishment. A cheque will be drawn for this amount. On the replenishment date, all expense categories are summed and totals are posted to relevant expense accounts in the general ledger. The entry to record replenishment of the petty cash fund is, in principle, similar to the entry made to establish the fund, except that the amounts are different. In general journal form the entry would be as follows: Date Description Folio Debit Credit 20X2 Jan 7 Petty Cash Cash at Bank To record replenishment of the petty cash fund. 90,000 90,000 Posting of the petty cash book Totals of the different expense groups are posted as debit entries to the expense accounts in the general ledger. The credit entry was completed when recording in the petty cash book. If the recording of expenses were to be recorded in a general journal form, it would be as follows: Cash and Bank Transactions 141 Date Description Folio Debit Credit 20X2 Jan 7 Expenses[various accounts] Petty Cash To record expenses paid by petty cash in the ledger. 90,000 90,000 Taking together the general journal entries for replenishment and recording of expenses we notice Petty Cash was debited and credited with the same amount. This has often been a basis for compounding the two entries into one. Example: The following are transactions undertaken by Mama Mora, custodian of the petty cash fund of Biashara Institute. 1992 Nov 1 Received shs. 30,000 to set up the petty cash fund. 2 3 5 7 9 13 15 21 25 30 Paid for Dean's entertainment expenses shs. 3,500. Photocopy charges shs. 300. Postage stamps shs. 1,000. Overtime paid to messenger shs. 2,000. Office tea shs. 3,600. Photocopy charges shs. 600. Taxi fares refunded to the Dean shs. 15,000. Overtime paid to messenger shs. 2,000. Postage stamps shs. 1,200. Received replenishment for the amount spent during the month. The above transactions would be recorded in a columnar petty cash book as follows: 142 Introductory Financial Accounting Columnar Petty Cash Book Receipts 30,000 Fol. Date Details CB01 Nov1 Cash at Bank 01 Voucher No. Total Transport CB02 Overtime General 2 Entertainment 01 3,500 3,500 3 Photocopy 02 300 300 5 Postage stamps 03 1,000 7 Overtime 04 2,000 9 Office tea 05 3,600 3,600 13 Photocopy 06 600 600 15 Taxi fare 07 15,000 21 Overtime 08 2,000 25 Postage stamps 09 1,200 29,200 29,200 Postage 30 Cash at Bank 30 Balance c/f 1,000 2,000 15,000 2,000 1,200 15,000 2,200 4,000 8,000 GL42 GL43 GL44 GL45 30,000 59,200 59,200 30,000 Dec1 Balance b/f Posting to the general ledger General ledger accounts would be as follows: Cash at Bank Date Details Fol. Account no. 01 Debit Date Details Credit 20X2 20X2 400,000 Balance c/f Nov1 Petty Cash PC01 30,000 30 Petty Cash PC01 29,200 Transport Expense Date Fol. Details Account no. 42 Fol. Debit PC01 15,000 20X2 Nov30 Petty Cash Date Details Fol. Credit Cash and Bank Transactions 143 Postage Expense Date Details Fol. Account no. 43 Debit Date Details Fol. Credit 20X2 Nov30 Petty Cash PC01 2,200 Overtime expense Date Details Fol. Petty Cash PCJ01 Account no. 44 Debit Date Details Fol. Credit 20X2 Nov30 4,000 Office expense Date Details Fol. Petty Cash PC01 Account no. 45 Debit 20X2 Nov30 8,000 Date Details Fol. Credit 144 Introductory Financial Accounting Appendix I: Reconciliation of Opening and Closing Cash balances It is possible to prove that items appearing on the bank statement on the first few days of a new month are reconciling items from the preceding month. This is done by preparing a bank reconciliation of opening balances. In the example of Kibibi Bamkuu on page ??, cheque no. 49 shs. 9,000 was observed to be outstanding from April. Deposit in transit shs. 4,000 which appeared in the Bank Statement on 2 May was also observed to be a reconciling item from April. The reconciliation statement of opening balances will be as follows: Kibibi Bamkuu Opening Balance Bank Reconciliation Statement 1st May 20X2 Amount shs shs 10,000 Adjusted Balance as per Cash Book Add: Cheques drawn not presented 9,000 Cheque no. 49 4,000 less: Deposits in transit 15,000 Balance as per Bank Statement Cash and Bank Transactions 145 Review questions 1. Define cash and indicate items you would include under cash. 2. Why is cash given so much attention in the design of internal control systems? 3. List the essential internal controls over cash. 4. Why should a person maintaining the cash book not prepare the bank reconciliation? 5. Under what circumstances would additional internal control measures become undesirable? 6. Why does a bank credit a depositor's account when a deposit is made? 7. State four reasons for differences between the Cash Book and Bank Statement closing balances. 8. When a bank reduces an account holder's balance for bank charges, it sends the account holder a debit note. Why is the note called a debit note when the Cash Book is always credited for such an item? 9. What is the purpose of preparing a bank reconciliation statement? 10. If the balance as per bank statement agrees with the balance as per Cash Book when the statement is received, do you think bank reconciliation will be necessary? Explain your position. 11. At the time when bank reconciliation is prepared, there are usually more outstanding cheques than there are deposits in transit. Why? 12. What is the purpose of petty cash? How is it related to a Cash Book? 13. Why is it necessary for management to set up a ceiling for a petty cash fund? 14. What account or accounts are debited and credited when: a) Establishing a petty cash fund? b) Replenishing a petty cash fund? 146 Introductory Financial Accounting Exercises 1. 2. For each of the following items indicate the required adjustment to correct the cash at bank account by writing the word "increase" or "decrease" followed by the amount by which the cash balance should be increased or decreased. If no adjustment is required, write the words "no entry". a) A shs. 45,000 deposit was recorded in the books as shs. 54,000. b) A shs. 60,000 deposit made on the last day of the month does not appear on the Bank Statement. c) A shs. 450 bank charges appears on the bank statement but has not been recorded in the books. d) A customer's cheque for shs. 8,500 that had been deposited was returned by the bank marked "Refer to Drawer - Insufficient Funds". e) Cheque No. 2037 of shs. 4,600 was not among cheques presented to the bank. Mambula Furniture Mart has manufacturing facilities in several towns and has cash on hand on several locations, as well as several bank accounts. The general ledger at the end of 20X2 showed the following accounts: Headquarters: Tanga Office: Mwanza Office: Arusha Office: Petty Cash NBC City Branch Cash on Hand Petty Cash NBC Ngamiani Petty Cash CRDB- Mwanza NBC Fixed deposit Petty Cash NBC Bank Overdraft shs. 50,000 shs. 570,000 shs. 10,000 shs. 10,000 shs. 400,000 shs. 60,000 shs. 2,000,000 shs. 1,000,000 shs. 40,000 shs. 2,000,000 Required: How would cash balances of Mambula Furniture Mart be reported in the Balance Sheet at the end of 20X2? 3. Make general journal entries to record the following events: May 1 30 Established a shs. 15,000 petty cash fund. Replenished the petty cash fund for May payments as follows: Travel expenses shs. 4,900. Postage expenses shs. 1,800. Cash and Bank Transactions 147 Entertainment expenses shs. 2,700. 4. The following information relates to Kiazi Adventures' bank reconciliation at May 30: a) b) c) d) e) Deposits in transit at May 30 shs. 28,000. There was an unrecorded bank charge of shs. 150. Outstanding cheques shs. 37,000. Shs. 96,000 cash sale was wrongly recorded as shs. 69,000. Shs. 49,000 payment to a supplier of canned goods was recorded in error as shs. 94,000. Required: Make adjusting journal entries to correct the company's Cash Book. 5. Use the following information to calculate the correct balance in the cash at bank account: a) b) c) d) e) f) 6. Cash at bank July 31, before adjustments, shs. 118,400. Deposits in transit, shs. 12,000. Outstanding cheque, shs. 8,500. Unrecorded bank charges, shs. 110. Cheque No. 110 recorded as shs. 8,900 instead of shs. 9,800. Credit transfer made by a customer of the company, shs. 50,000 not yet recorded in the depositor’s books. Babujinga & Co. is a young business that has grown rapidly. The company's bookkeeper, who was hired two years ago left town suddenly after the owner discovered that money had been disappearing over the past eighteen months. An audit disclosed that the bookkeeper had routinely written and signed cheques made payable to his cousin, and then recorded the cheques as salaries expense. The cousin, who cashed the cheques but had never worked for the company, left town with the bookkeeper. As a result, the business incurred a loss of shs. 3,600,000. On reporting to the police, it was revealed to the owner that the bookkeeper was wanted by the police for a similar offence with a previous employer. Required: Evaluate Babujinga & Co.'s internal controls over cash, indicating the principal controls which you think have been ignored and make recommendations for improvement. Problems 1. During an interim audit at 31st December 1989, you are instructed by your principal to reconcile the bank balance shown in the books of accounts with the balance shown in the bank statement. From the particulars, prepare a reconciliation statement. 148 Introductory Financial Accounting - Balance per bank statement as at 31st December 1989 shs. 85,110 dr Cheques drawn as on 31st December 1989 but not cleared until January 1990: Cheque no. C001 Cheque no. C012 Cheque no. C0211 Cheque no. C0111 shs. 20,000 shs. 15,190 shs. 14,300 shs. 35,620 - Bank overdraft interest at 20th December 1989 not entered in the Cash Book is shs. 1,257. - Sum received on 30th December 1989 but not lodged in the bank till 3rd January 1990 shs. 165,980. - A bank debit for shs. 50 being cost of cheque book in November 1989 was entered in the Cash Book twice in error. - A bill receivable due on 29th December 1989 was passed to the bank for collection on 28th December 1989, and was entered in the Cash Book forthwith, whereas the proceeds of shs. 25,000 were not credited to the bank statement till 1st January 1990. - Bill stamps amounting to shs. 31 had been debited in the bank statement, but no entries were made in the Cash Book. - Dar es Salaam Chamber of Commerce subscription of shs. 5,000 paid by banker's order on 1st Dec. 1989 had not been entered in the cash book. Note: Assume that you do not alter the Cash Book balance at 31st December, 1989; all entries being made in January 1990. (NABOCE, May 1991) 2. A Trading, Profit and Loss Account of Malimali & Company for the year ended 31 May 20X1, showed a net profit of shs. 246,800. The balance at the bank at 31 May 20X1, according to the cash book was shs. 32,200. You are informed that:a) Cheques from customers, amounting to shs. 24,900 which were entered in the Cash Book on 31 May were not credited by the bank until after June, 20X1. b) Cheques written by Malimali & Co. on 28 May, in favor of creditors amounting to a total of shs. 37,100 were not paid by the bank until after May 31. c) On 15 May Ngosha, a customer had paid shs. 11,700 into Malimali's bank account in full settlement of a debit balance of shs. 12,000 in Malimali's Debtors ledger. No entry had been made in Malimali & Co. books of this payment. Cash and Bank Transactions 149 d) On 1 April 20X1 the bank paid, in accordance with a standing order from Malimali, shs. 18,000 for the rent of business premises from where Malimali operates. The payment was for the three months to 30 June 20X1. No entry for this payment had been made in the books. e) A cheque for shs. 4,200 from Mami, a former customer had been paid into the bank by Mami and credited by the bank on 20 May. Mami had lost his business some years ago and went into a serious drinking problem. Malimali had written off whatever balance he owed to the company. Mami intends to revive his business. f) On 30 May a cheque for shs. 2,400 was received from a customer in settlement of a sales invoice for shs. 2,400. The cheque was paid into Malimali's bank and both the sale of the goods and the cheque were entered in the books. On May 31 the customer returned the goods to Malimali and instructed his bank not to pay the cheque but no entries in respect of these matters have been made in the books. Moreover, the returned goods which cost shs. 1,600, were not included in Malimali's closing stock. Required: 3. a) Make all necessary corrections and adjustments in the cash book and show the adjusted cash book balance as at 31 May. b) Prepare a statement reconciling the adjusted cash book balance with the balance shown by the bank statement. c) Re-state Malimali's net profit for the year ending 31 May 20X1, taking account of all items in the body of the question. On examining the bank statement of Kigogo Company it is discovered that the balance shown on December 31, 1990, the closing date of the company's financial year differs from the bank balance shown by the cash book. On that date the cash book showed an overdraft balance of shs. 493,500. From a detailed examination of the entries in the Cash Book it is found that: i) Cheques drawn on 24.12.90 amounting to shs. 44,500 were cashed by the bank on 2.1.91. ii) Cash and cheques amounting to shs. 15,500 deposited with the bank on 29.12.90 were cleared by the bank on 2.1.91. iii) According to the standing orders, the bank has, on 30.12.90, paid shs. 9,200 as a monthly installment to THB in respect of a housing loan owed by Kigogo Company. On the same day the bank also paid quarterly insurance premium for shs. 1,600. No entries were made in the cash book of the company in respect of these transactions. iv) The bank also received shs. 9,500 from the insurance company being an amount of insurance claim recovered by Kigogo Company. A bank commission of shs. 150 on this transaction was charged by the bank. No entry has been entered in the cash 150 Introductory Financial Accounting book for these amounts. Shs. 16,000 in respect of a dishonored cheque appears in the bank statement but not in the cash book. Required: a) Show the necessary corrections in the cash book of Kigogo Company. b) Prepare a statement reconciling the cash book balance as corrected, with the balance which should appear in the bank statement as at 31.12.90. (ATEC- I, May 1991). 4. Listed below are nine errors or problems which might occur in the processing of cash transactions. Also shown is a separate list of internal control procedures. Possible Errors or Problems: a) In serving customers who do not appear to be attentive, a sales clerk often records a sale at less than the actual sales amount and then removes the additional cash collected from the customer. b) Jani who has prepared bank reconciliation for Kibibi & Co. for several years has noticed that some cheques issued by the company are never presented for payment. Jani therefore, has formed the habit of dropping any cheques outstanding for more than six months from the outstanding check list and removing a corresponding amount of cash from the cash receipts. These actions taken together have left the ledger account for cash in agreement with the adjusted bank balance and have enriched Jani substantially. c) A voucher was circulated through the system twice, causing the supplier to be paid twice for the same invoice. d) Koba, an employee of Mabogini & Co. frequently has trouble in getting the bank reconciliation to balance. If the book balance is more than the bank balance, she writes a cheque payable to cash and cashes it. If the book balance is less than the bank balance, she makes an accounting entry debiting cash and crediting cash surplus account. e) Without fear of detection, the cashier sometimes takes cash forwarded to him from the registry or the sales department instead of depositing these collections in the company's bank account. f) All cash received from Monday through Thursday was lost in a burglary on Thursday night. g) The official designated to sign cheques is able to steal blank cheques and issue them for unauthorized purposes without fear of detection. Cash and Bank Transactions 151 Internal Control Procedures: i) Periodic reconciliation of bank statements to accounting records. ii) Adequate separation of duties iii) Depositing each day's cash receipts intact in the bank. iv) Use of electronic cash registers equipped with optical scanners to read magnetically coded labels on merchandise. v) Immediate preparation of a daily control list when cash is received, and the comparison of this list to daily bank deposits. vi) Cancellation of paid vouchers marking them "PAID". vii) Requirement that a voucher be prepared as advance authorization of every payment. viii) None of the above control procedures can effectively prevent this type of error from occurring. Required: Match the letters (a through g) designating each possible error or problem with the roman numeral indicating the internal control procedure that should prevent this type of error or problem from occurring. 5. Wared Consultants Ltd. operates a petty cash account on the cash imprest system. The maximum cash float allowed is shs. 12,000 and re-imbursements are done immediately after 80 percent of the cash float is expended. During June 20X1, Monica made the following payments:31/5/X1 1/6/X1 1/6/X1 1/6/X1 3/6/X1 4/6/X1 7/6/X1 8/6/X1 10/6/X1 11/6/X1 12/6/X1 15/6/X1 15/6/X1 15/6/X1 16/6/X1 Petty cash balance Re-imbursement Ruled paper shs. Daladala fare Postage stamps Accountant Journal magazine Business magazine Correcting fluid Ball pens Typewriter ribbons Meal allowance Daily News and Uhuru newspapers Parcel postage Paper clips Repair of typewriter shs. 3,390 shs. ? 2,350 shs. 1,030 shs. 1,755 shs. 670 shs. 1,200 shs. 1,770 shs. 1,628 shs. 669 shs. 2,000 shs. 2,250 shs. 2,500 shs. 1,260 shs. 3,000 152 Introductory Financial Accounting 17/6/X1 18/6/X1 20/6/X1 20/6/X1 23/6/X1 23/6/X1 25/6/X1 25/6/X1 25/6/X1 26/6/X1 27/6/X1 30/6/X1 Loan to a friend Tea bags for office Office cleaning Best worker prize Cello tape Hand bag for owner’s wife Photocopy paper Typing paper Rubber band Meal allowance Daily News, Uhuru newspapers Casual labour wages shs. 2,020 shs. 654 shs. 3,050 shs. 5,000 shs. 1,566 shs. 2,250 shs. 4,340 shs. 1,980 shs. 798 shs. 2,000 shs. 2,250 shs. 3,250 Required: 6. a) Open the firm's Petty Cash Book and record payments for the month of June 20X1. b) Analyse the expense items individually into suitably labeled columns. c) Post the Petty Cash Book to the general ledger. The CRDB Azikiwe Branch Theft Case Problem. Gang robs bank 1.4m dollars in Dar Saturday, November 16, 2002. By Ramadhani Kabale Acting with lightning speed, an armed gang of three smartly dressed men yesterday morning robbed 1.4million US dollars (1.4bn/-) from the CRDB Azikiwe Branch in Dar es Salaam, in what can only be described as “drama in real life.” The incident, which had all the hallmarks of a Hollywood thriller movie, took place at about 7 a.m. According to the Dar es Salaam Regional Police Commander (RPC), SACP Alfred Tibaigana the whole drama started when the bank’s branch staff were reporting for duty. The three men apparently sneaked into the bank premises unnoticed by taking advantage of the relaxed and tranquil atmosphere through a rear door exclusively used by staff and sometimes customers who take large sums of money. The RPC revealed that after getting into the bank, one of the robbers ordered all staff to lie on the ground face down. At the same time, another of the robbers took the branch manager at gunpoint ordering him to identify strong-room key-keepers and lead them into the cash room. “At gunpoint, the manager or supervisor identified as Mhango, appealed to Boaz, Cash and Bank Transactions 153 a strong-room key-keeper to stand up and lead the gangsters into the strong-room to save the lives of other staff,” explained Tibaigana. He added that after the CRDB officials opened the cash room, the armed robbers further ordered them open a cash box containing 1m US dollars brought at the bank on Thursday. As if the gunmen knew about dollars being kept in the strong room, they further collected an extra 400,000 dollars from a shelf before taking unspecified bundles of Tanzania shillings. “According to the bank staff, the armed men were talking in Kenyan like Kiswahili accent. However we are not sure if they are actually Kenyans or that they just imitated the accent to conceal their identity,” noted Tibaigana. He requested people to volunteer information about people handling an unusual amount of dollars. When asked to give his views on whether the theft was a possible in-house job, police negligence or failure to employ proper security measures at the bank, Tibaigana said it was not easy for police to ensure adequate security measures at the bank because the building also housed several other offices besides the bank. “It is not negligence on the part of the police force. The point is, as the building houses several other offices, it is difficult to restrict the movement of people,” he said, adding that given the situation, the robbers could have driven in and out like any other tenants of the building. Tibaigana conceded that yesterday’s incident had demonstrated that bankers sharing buildings with other tenants have to be careful. Otherwise the banking sector in the country might risk similar attacks. Asked if anyone was injured during the robbery Tibaigana said no single shot was fired and neither did anyone get injured during the 15 or so minutes drama. “The robbers carried out their operation so swiftly that no one outside the building knew what was happening inside the bank until they saw me and the Director of Criminal Investigations (DCI) Adadi Rajabu arriving at the bank,” added Tibaigana. When The Guardian visited the bank at 9.00 some people who were present during the drama conceded that the robbers were smart. “I was here chatting with someone for quite a long time before getting into my office when I saw a vehicle coming in and later on leaving the building only to be told it was the robbers’ vehicle. I think if the police force has to succeed in preventing such a type of crime they need extra training and equipment,” pointed out a middle aged man who preferred anonymity. The CRDB Managing Director, Dr Charles Kimei has meanwhile appealed to the public to volunteer information about anyone they suspect to be party to yesterday’s bloodless robbery. A reward of 25m/- in cash would be given to such a person. “Today’s incident has proved CRDB right on urging CRDB customers and non-customers to make use of the recently introduced TemboCard which even if stolen the customer’s money will be safe. The card is protected by CRDB PIN number,” explained the MD. He assured the Bank’s customers of continued services at the branch, saying every thing is in order and the bank would soon open for business after police complete their enquiries. Source: http://ipp.co.tz/guardian/2002/11/16/guardian1.asp Required: a. Having read this news item and taking account of your knowledge of accounting, identify and discuss aspects of internal control that you find as lacking at CRDB Azikiwe Branch at the time of this robbery. b. Suggest measures that will prevent future loss of money as incurred by CRDB Azikiwe Branch.