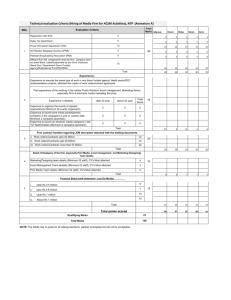

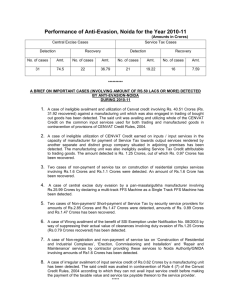

An Analytical Report on Central Excise with Graphs

advertisement