glow_footprint

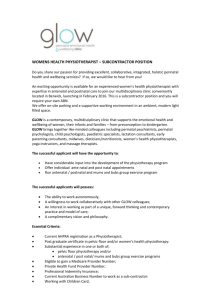

advertisement

Given the breadth and depth of experience Glow Networks has built over the past 9 years, and given the inroads Glow has to most of the major telecom vendors, the company is well positioned to capture business from the growing trends in outsourcing and from the technological evolution of the telecom market. The deterrents to rapid growth at this time are access to capital; and the company size. With access to capital, Glow can go after bigger opportunities without the fear of running out cash to fund rapid growth. On the other hand, Glow’s ability to bid on larger outsourcing projects is limited due to lack of proof points that will convince customers that Glow can handle the sheer size of the opportunities being presents. Glow is actively involved in expanding its business into new areas both in terms of technologies/services and in terms of new customer relationships. 5.1 Telecom Market Growth The demand for video is reshaping mobile and fixed telecom infrastructure investment. Based on the current trends, the future of telecommunication market could evolve in one or all of the following three scenarios: 1. Networks evolve using fixed line telephony — In this scenario circuit switched telephony will still be regarded as gold standard, spurring significant growth in the Optical Transport capabilities, both in the metro and long-haul arena, to deliver the required bandwidth. 2. Networks evolve using Wireless telephony— In this scenario, the bandwidth is delivered via wireless, providing an alternative to fixed line telephony and also giving customer’s mobility. The emergence of WiMAX and LTE is seen as the future to deliver bandwidth wirelessly. 3. Network’s evolve using enterprise based Unified Communications for voice and data. Glow Networks is geared up to leverage growth in all of the above scenarios. 5.1.1 Optical Transport Glow is focused on technologies that will enable bandwidth expansion, such as: GPON / 10GPON GigE DWDM ROADM MPLS We are currently working with multiple vendors to support them in deployment of optical networks end to end. Following are a few areas of focus: Fiber Characterization Network design, MOP and development of test plans End to end deployment SME support for network migration to major Service Providers Post deployment support Glow Networks India has an expansive pool of engineers that are trained and experienced in optical technologies supporting major vendors and service provides in the APAC. This team can be used to augment our existing team in North America to support sudden needs in Optical deployments worldwide. 5.1.2 Wireless Glow has been an active player in the wireless space supporting multiple technologies like WiMAX, LTE, GSM / UMTS, CDMA / EvDO and microwave access for our vendor / service provider partners. With 4G deployments on the rise across North America, we are set up very well to support the deployments. We are preferred partners for WiMAX deployments for a few vendors and have supported some trials for LTE deployment as well. Following are the focus areas for 4G deployment support: Network planning and design o IP backhaul design o Capacity planning o RF planning and design Deployment support o Site engineering o Network engineering o Integration o RF data collection o RF optimization o Project Management Post deployment support o RF Optimization o Rehomes to optimize capacity o NOC, TAC, retrofit support and software upgrades We have invested significantly in RF tools to support the growth in the wireless space. We are also investing in training our engineers to perform RF planning and design engineering and integration of 4G networks over the past 2 years. 5.1.3 Unified Communications With a strong Telecom Network Engineering/Deployment basis, Glow is well positioned to support our current customers that have a strong Enterprise Network Customer Base as they pursue the option of Unified Communications. As the Enterprise Networks become more complex in terms of the amount of voice/data that is being transmitted internally/externally, locally and globally that their business is dependant upon – large Enterprise Customers are looking more and more to their suppliers such as Nortel/Cisco or Service Consulting companies such as IBM for support services. As a result these companies are expanding their service capabilities to support them including target services such as – Network Design and Migration Strategies, Optimization, Security Audits and Capacity/Performance Monitoring. Many times these services include multi-vendor equipment already deployed in the Enterprise Customer’s network. Glow is leveraging its capabilities in providing similar services for Non Enterprise Networks to our customers, key resources with multi-vendor capabilities and a integrated on-shore, low cost off-shore resource strategy to win business in this area. Glow has recently won a significant contract to provide Security Audit and Capacity/Monitoring services for multiple vendor equipment for a large global enterprise through one of the Equipment Providers. Other areas Glow is actively pursuing in the Enterprise Space include services surrounding migration of Lines and Features as Enterprise Customer upgrade to SoftSwitch based Networks. In addition Glow is well positioned on the Wireless Enterprise space given our RF Services background. We are actively involved in pursuing Wireless LAN deployment services for large enterprise customers of our customers and we see significant opportunity in this area. 5.2 Glow’s Customers Strategically Glow has in the past refrained doing business directly with service providers and instead focused purely on telecom equipment vendors for revenue. Working with equipment vendors provided Glow the knowledge and insight into its customer’s products. Given the knowledge of various equipment vendor’s products gives Glow the ability to provide vendor agnostic professional services capabilities to customer’s professional services teams. Opportunities with major customers are explored in the following sections. 5.2.1 Alcatel-Lucent Glow has experienced consistent growth with Alcatel-Lucent over the past 8 years. Prior to the merger of Alcatel and Lucent Glow had direct relationship with both companies. The merger helped Glow cement this relationship and see significant growth. We have penetrated into several area of this account to provide high-end consulting services to become their trusted partner. With ALU, Glow has been exposed to major carriers in the United States, to the extent that some end customers of ALU request ALU to work only with Glow on their projects. This relationship can be extended if we decide to go after work directly with carriers without competing with our existing telecom equipment vendor customers. Alcatel-Lucent has nominated Glow as the Diversity Vendor of the year consistently in the last 3 years. 5.2.2 Nortel Nortel has been the anchor account for Glow since inception. The relationship with Nortel is deep and wide and at all levels of management. Glow has helped Nortel positioned its products with end customers. Glow acted as a trusted partner in bring over $150 million in Nortel product sales over the last 8 years. The account has grown significantly this year and in projected to grow further next year. Give the nature of work Glow has done for Nortel over the years; we are in a very good spot to leverage more business from Nortel. The revenue growth with Nortel in Fiscal Year 2008 is projected to be more than 150% compared to FY2007. Given its current status with Nortel, Glow has the ability to penetrate deeper and wider into services that we are currently providing Nortel. Glow was ranked the best quality vendor for engineering services consistently since Glow started doing this business with Nortel in 2000. Nortel awarded Glow the Diversity Supplier of the Year, 2005. 5.2.3 Cisco Glow Networks is one of the 5 preferred vendors for Cisco’s Service Provider organization; and one of the only 2 preferred vendors for its Optical Service provider organization. Although Cisco is a relatively new account, it has already show significant promise for growth over the years. The indication is evident from the number of RFP responses Glow has worked on over the last 6 months after becoming one of the preferred partners. Given Glow relationship with Cisco’s management at all levels, there is significant pull from the customer to capture more business. 5.3.4 Other Equipment Vendors Glow has either preferred or approved vendor status with Motorola, Tellabs, Ericsson, Tekelec, Samsung, Nokia-Siemens Networks, Fujitsu and many other smaller equipment vendors.