AP Macroeconomics

advertisement

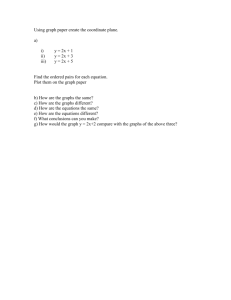

AP Macroeconomics Course Syllabus AP® Macroeconomics course is designed as an initial college-level course in macroeconomics and as foundation for possible future study in economics or business. The course emphasizes economic principles as applied to the economy as a whole. Lessons include an analysis of national income and its components, economic indicators, inflation and unemployment, money and banking, stabilization policies, and the United States and world trade. Students will learn to analyze graphs to determine effects of economic policy. In May, students will take the Advanced Placement exam given by the College Board. Successful achievement on the exam allows the student to earn college credit. Fundamental Objectives Help students master the principles essential for understanding the economizing problem, specific economic issues, and the policy alternatives. Help the student understand and apply the economic perspective and reason accurately and objectively about economic matters. Promote a lasting student interest in economics and the economy. Textbook Economics: Principles, Problems, and Policies, 17/e Campbell R. McConnell, University of Nebraska Stanley L. Brue, Pacific Lutheran University ISBN: 0073126632 Copyright year: 2008 Supplements Morton, John. Advanced Placement Economics: Macroeconomics Student Activities, 2003, 3rd edition Additional Resources Local newspaper articles Magazine articles The Economist, Business Week, Federal Reserve publications, the Wall Street Journal, the New York Times. Professional journals Videos: Economics U$A Economics, 3rd Ed Timothy Taylor "Commanding Heights: The Battle for the World Economy" (2002) Summer Readings Naked Economics I Pencil Federal Reserve publications Homework Assigned throughout the year to correspond with the unit of study - assigned readings from textbook - various questions, problems, graphing, and activity worksheets distributed throughout the year - additional readings on current issues in economics as they become available from magazines, newspapers, and web sites Course Outline Unit 1: Basic Economic Concepts (8-12%) (4 weeks) McConnell and Brue Chapters 1-5 Morton Student Activities 1-8 I. Basic Economic Concepts A. Scarcity: What is it? Why is it so important to economic thought? B. Opportunity Cost: Define and compute it. Why can it never be avoided? C. Production Possibilities: Construct and interpret production possibilities schedules, and graphs; relate production possibilities curves to the issues of scarcity, choice and cost. Explain the shape of the PPC D. Comparative Advantage and Absolute Advantage: Define and calculate E. Economic Questions 1. Answering the questions: What to produce? How to produce? For whom to produce? 2. Define ways societies determine allocation and efficiency II. Demand, Supply, and Price Determination A. Demand: Define and illustrate demand through schedules and graphs. 1. Distinguish between change(s) in quantity demanded and change(s) in demand. 2. Examine the inverse relationship existing between quantity demanded and price. Evaluate the Law of Demand. 3. Identify and explain the variables that cause a change in demand. 4. Illustrate graphically a change in demand versus a change in quantity demanded B. Supply: Define and illustrate supply through schedules and graphs. 1. Distinguish between change(s) in quantity supplied and change(s) in supply. 2. Examine the direct relationship existing between quantity supplied and price. Evaluate the Law of Supply. 3. Identify and explain the variables that cause a change in supply. 4. Illustrate graphically a change in supply versus a change in quantity supplied. C. Equilibrium Price and Quantity: Define and illustrate equilibrium through schedules and graphs. 1. Define and illustrate surpluses and shortages. 2. Define the effects of surpluses and shortages on prices and quantities. 3. Interpret the effects of a price floor and price ceiling on equilibrium price and quantity. 4. Introduction to market failures: lack of competition, externalities, and public goods. III. Graphs A. Production possibilities curve B. Demand and supply curves showing equilibrium C. Demand and supply curves showing shifts in demand and supply Note: Proper graphing techniques (generating, labeling, etc.) will be taught at this stage and will be reinforced throughout the year. IV. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 2: Measurement of Economic Performance (12-16%) (4 weeks) McConnell and Brue Chapters 6, 7, 8 Morton Student Activities 9-18 I. Gross Domestic Product and National Income Concepts A. Measuring GDP, Four-Sector Circular Flow Model, and Flow versus Stock 1. Expenditure approach [C+I+G+(Xd-Im)] where: C = Consumption Spending I = Investment Spending G = Government Spending and Investment Xn (Xd-Im) = Net Exports (exports – imports) 2. Income approach (W+R+I+P) where: W = Compensation of Employees R = Rental Income of Persons I = Net Interest P = Profits (Non-income adjustments) B. Problems with calculating GDP: Non-market transactions, distribution, kind and quality of products. C. Changing Nominal GDP (GDPn) to real GDP (GDPr). 1. How and why? 2. GDP deflator price index D. Other national accounts: net national product (NNP), national income (NI), personal income (PI), and disposable income (DI). II. Inflation A. The Meaning and Measurement of Inflation B. The Consumer Price Index (CPI) and How It Is Computed C. Problems with the CPI D. Other Indexes: Producer Price Index E. Consequences of Inflation: shrinking incomes, changes in wealth, effect on interest rates F. Demand-Pull and Cost-Push Inflation III. Unemployment and Business Cycles A. The four phases of the business cycle B. Total Spending and How It Affects the Business Cycle C. Unemployment: Defined D. Problems with the Unemployment Rate: Who is counted and who isn’t? E. Types of Unemployment 1. Frictional, structural, cyclical, seasonal 2. Which will affect the unemployment rate and why? F. Full Employment (Natural Rate of Unemployment): What is it? What are the implications if achieved? G. The GDP Gap: Explaining lost potential IV. Graphs / Diagrams / Formulas A. Circular Flow B. Phases of the Business Cycle C. GDPn, GDPr, GDP deflator price index, CPI, rate of inflation V. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 3: National Income and Price Determination (10-15%) (5 weeks) McConnell and Brue Chapters 9, 10, 11 Morton Student Activities 19-33 I: Aggregate Demand and Supply; National Income and Price Determination A. Aggregate Demand Curve: Reasons for Its Shape (Real balances effect, Interest rate effect, Net export effect) B. Determinants of Aggregate Demand C. Aggregate Supply Curve (SRAS and LRAS) 1. Classical view, Keynesian view 2. Changes in equilibrium price and quantity with the three ranges D. Determinants of Aggregate Supply E. Macroeconomic equilibrium II. Fiscal Policy/Public Sector A. Discretionary Fiscal Policy 1. Changes in government spending and tax rates 2. Balanced-budget multiplier B. Supply-Side Policies D. Government Size and Growth 1. Financing budgets 2. Government expenditure patterns E. Types of Taxation (Progressive, Proportional, Regressive) F. Federal Deficits and the National Debt 1. The Federal Budget-Balancing Act 2. Should we worry about deficits or the debt? III. Aggregate Expenditure, the Keynesian Theory: An Introduction A. The Role of the Consumption Function B. Marginal Propensities to Consume and Save C. Why the Consumption Function Shifts and How It Affects Aggregate Demand D. The Role of the Investment Function E. Why is Investment Demand Unstable? (Expectations, Technological change, Capacity utilization) F. Investment as an Autonomous Expenditure G. Graphing the Aggregate Expenditure Function H. The Keynesian Multiplier: the math and its effects I. Recessionary and Inflationary Gaps IV. Graphs / Diagrams / Formulas A. Investment Demand curve B. Aggregate Demand, Aggregate Supply, Long Run Aggregate Supply C. Keynesian Cross D. MPC, MPC, Keynesian Multiplier V. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 4: Financial Sector (15-20%) (4 weeks) McConnell and Brue Chapters 12-14W Morton Student Activities 34-42 I. Money, banking, and financial markets A. Three Functions of Money B. What Stands Behind the U.S. Dollar? C. The Three Money Supply Definitions 1. M1: most narrowly defined money supply 2. M2: adding near monies to M1 3. M3: adding large time deposits to M2 D. Financial assets: Money, Stocks, Bonds 1. Time value of money (present and future value) 2. Banks and creation of money (balance sheets) 3. Money demand 4. Money market 5. Loanable funds market E. The Money Multiplier: Theory versus reality (potential expansion of the money supply) II. The Federal Reserve System (FED) and Monetary Policy A. Origins and organizational structure B. Powers of the FED 1. controlling the money supply 2. clearing checks 3. supervising and regulating the banks 4. loaning currency to banks 5. acting as the bank for the U.S. government C. Tools of the FED to change the money supply 1. open market operations 2. discount rate 3. reserve requirement D. Monetary Policy Shortcomings 1. Money multiplier inaccuracies 2. Lags in policy effects E. Monetary Policy 1. The demand for money and how it may affect interest rates 2. How monetary policy affects prices, output, and employment 3. The Monetarist view of money (MV=PY) 4. A comparison of views: Monetarist, Keynesian and classical economists III. Graphs / Diagrams / Formulas A. Money Market B. Loanable Funds C. Interest rates / Investment Demand D. Money Multiplier, Reserve Ratio, Excess Reserves IV. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 5: Inflation, Unemployment, and Stabilization Policies: Monetary and Fiscal Policies Combinations in the real world (20-30%) (3 weeks) McConnell and Brue Chapters 15, 16, 17 Morton Student Activities 43-46, 48 I. Monetary and Fiscal Policy A. Monetary and fiscal policy working together B. Loanable funds market and relationship to the money market C. “Crowding out” and the interest rate effects of fiscal policy II. Inflation and unemployment A. Types of inflation 1. Define and graph demand-pull inflation 2. Define and graph cost-push inflation B. What is the Phillips Curve? 1. Inflation and unemployment relationship 2. In the short run 3. In the long run C. Rational Expectation Theory III. Reasons for disagreements among economists about macroeconomic policies and effects of the policies IV. Graphs (revisiting some graphs from previous units with new ones) A. Aggregate demand / aggregate supply model B. Money market C. Interest rates / Investment demand D. Phillips curve IV. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 6: Economic Growth and Productivity (5-10%) (1 week) McConnell and Brue Chapter 24 Morton Student Activities 47 I. Raising Productivity: Real Output and Capital Formation A. Human Capital Formation B. Physical Capital Accumulation C. Research and Development, Technological Progress D. Public Policy and Long-Run Economic Growth II. Graphs (revisiting some graphs from previous units) A. Productions possibilities curve B. Aggregate demand / aggregate supply model III. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 7: International Trade and Finance (10-15%) McConnell and Brue Chapters 5, 35, 36 Morton Student Activities 49-55 I. International Trade and Finance A. Why Nations Trade at All B. Comparative and Absolute Advantage C. Free Trade versus Protectionism 1. Arguments for free trade 2. Arguments against free trade D. The Balance of Payments 1. Current account 2. Capitol account 3. International debt of the United States E. Exchange Rates 1. Supply and demand for foreign exchange 2. Current fluctuations a. appreciation and depreciation b. graphing currency changes II. Comparative Economic Systems (3 weeks) A. Basic Types of Economic Systems 1. Traditional, command, and market economies - defined and analyzed 2. The mixed economy of today 3. Capitalism and socialism: basic tenets 4. Comparing the systems B. Comparing Developed and Developing Countries 1. Classifying countries by GDP per capita a. problems with classification 2. How to sustain economic growth in developing countries a. national resources b. policy making 3. Implications for a changing world III. Graphs A. Exchange rates B. International trade IV. Assessment: Two (2) days A. Day 1: Full period multiple choice exam B. Day 2: Free Response Question Unit 8: AP Exam Review (3 weeks) I. Practice exam A. Multiple Choice divided over 2 days B. Free Response Questions – 2 days 1. Day 1 - sample #1 format question 2. Day 2 – sample #2 and #3 format questions II. Review by unit: recalling topics, graphs, and formulas by unit III. Student created PPTs will cover major concepts IV. Review Book(s)