The US earned income tax credit, its effects, and possible

advertisement

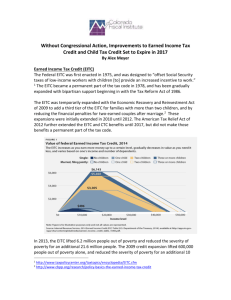

THE U.S. EARNED INCOME TAX CREDIT, ITS EFFECTS, AND POSSIBLE REFORMS by BRUCE D. MEYER 17 May 2008 INTRODUCTION This paper was prepared for the “From Welfare to Work” conference organized by the Economic Council of Sweden, May 7, 2007. It has been published by the IFAO, the institute for labour market policy evalutation. Firstly the author focuses on what the EITC is, how it works and who its recipients are. In fact it discusses some empirical works that deal with the effects of the EITC on income distribution, poverty, labour supply and its negative effects on hours of work, marriage and compliance. Secondly he proposes some solutions. THE EITC The EITC is the most efficient anti-poverty programme that has been improved in the US since 1975. Its aim is to transfer income to targeted people while encouraging them to work. Sometimes this tax system doesn’t assolve the secoond task: in paragraph 4 it will be explained why in some cases the EITC discourages work. The receivers of this policy are the families that satisfy three criteria. The first one is that at least one of the family component has to work. The second one: the family must have a very low income. The third criteria: the applicant family has to have resident children; furthermore, since 2007, also childless individuals have been allowed to receive a small EITC. Therefore the credit can be received also by those who do not have a tax liability. Considering all this criteria, the target that comes out are single mothers. These women are eligible because they have children and the fact of being alone usually entails that they don’t have high income rate. Single mothers are most eligible candidates, but are not the only ones. The following data reported in Table 1 show the percentage of tax credit that goes to each category of candidates. Single parents with children and married couples with children get the 94% of the total credit and this reflects the programme design to provide a larger credit to parents of resident children. A review by Diana Tania Fiorillo 1 The data of the following Table 2 are different from those of the schedule above but lead to roughly similar conclusions. From this we can understand that recipients are older and less educated than the nonrecipients and have also more and younger children. Ultimately CPS data show that a quite higher amount of payments goes to families with two or more children. This statement is supported by next graph. A review by Diana Tania Fiorillo 2 It is a schedule for single parents with children. The result is that for those with one child there are somewhat lower earnings subsidies, credits and implicit taxes. A large credit is provided at the beginning in the phased-in. Here the credit changes with the increasing of earnings. On the plateau phase, the amount of payment received doesn’t change until the last phase in which the receipt starts decreasing. Most recipients are on plateau or phase-out sections of the credit schedule, but while on the plateau section there is a negative income effect and no substitution effect, since marginal rates are unaffected, on the other hand, on the phase-out portion, income and substitution effects are both negative. EITC ON INCOME DISTRIBUTION What this US anti-poverty does is to reduce poverty rate, infact in 2007 EITC lifted 3.7 milion people above the poverty line. The problem is that the effects of the credit are concentrated only around the poverty line. In the US there are other policies better targeted at very lowest income, like Food Stamps that provides directly food assistance or TANF (Temporary Assistance for Needy Families ) that is a temporary flow of cash for single parents. Anyway, as we can see from next chart, due to the welfare reform, these two helps have smaller effects at all income cutoffs. The EITC remains the best programme. A review by Diana Tania Fiorillo 3 EITC AND WORK: PROS AND CONTROS On this part the author concentrates the studies on single parents, with emphasis on single mothers. EITC increases the gains unequivocally and makes them higher for the single who work. This incentive was expecially high for low-skilled sigle mothers situated on the phase-in or plateau phase of the schedule. As it is possible to see from Table 6, in the 19901997 period the EITC had its largest expansion and accordingly occurs also the largest employment rate increase. Unfortunately, since 1999, the credit had a downward trend and people were encouraged to reduce their hours due to three main reasons. First reason - the inability of workers to freely vary their hours because of employer preferences for certain hours. Second reason - the measurement errors in hours: most of the recipients do not fill in the form themselves and those who do it for them are not wise to which their hour levels are. Third reason – there is a general imperfect perception of marginal tax rate due to the complexity of the instructions to apply for elegibility; this is easy to understant also considering that the target of the candidates has a low education. Further negative aspects of the EITC are those on marriages. Infact, as single know that they can reicive a higher income rate by working and, contemporary, being single, these mothers A review by Diana Tania Fiorillo 4 will prefer to stay unmarried. Marriages for childless are discouraged as well. In order to increase their tax credit, sometimes people will also divorce. Moreover something occurs too: the non compliance effect. It means that people don’t pay taxes intentionally or unintentionally and a lot of money are claimed in error expecially due to uneligible child claimant families. REFORMS AND MY CONCLUSIONS There are still substantial opportunities for reforms along several dimensions. What the author suggests is a higher tax credit for 3-child and childless families, reduction of marriage penalities, simplified elegibility criteria. The effects of the expansions of the EITC in the US have been evaluated through different time periods and different empirical methods and identifying strategies have been used.The results are rather efficient. The EITC seems to stimulate labor supply and reduce poverty. Moreover, the potentially negative effects from the EITC on work hours of those already working and participation among the second income earners in the family can be easily solved. Improving the EITC we can encourage work again. There are thus reasons to believe that an EITC-type policy will be also good for employment in other countries, because income and poverty issues exist everywhere. A review by Diana Tania Fiorillo 5