Final Report Paper

advertisement

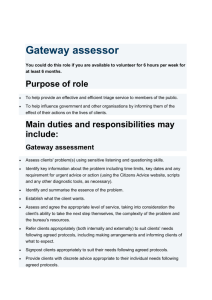

L701: Strategic Competitive Analysis Group Project: Final Report Gateway, Inc. Brett Bartlett, Dan Fink, Tina Neal August 17, 2003 Partnering for Success Gateway is a technology solutions provider which has experienced a significant decline in personal computer (PC) sales over the past three years. This report will demonstrate how forging a partnership with retailer OfficeMax will help Gateway recapture its lost market share. Under our plan, OfficeMax provides space in their retail stores for a limited variety of Gateway PC models displayed on the sales floor, and the OfficeMax stores maintain no inventory of Gateway PCs. Customers would order customized Gateway PCs directly from the OfficeMax sales floor with the assistance of an OfficeMax sales representative, affording customers the dual benefit of being able to touch the merchandise prior to the purchase and the ability to order exactly what they want and have it built just for them. OfficeMax would also provide post-sale repair service for Gateway computers in their stores. Reasons for choosing Office Max as the retailer of choice OfficeMax is the correct retailer for Gateway because of blah, blah blah. <Wants to grow to be a player w/ Staples & Office Depot, has sizable number of stores across the US (971).> All of these things mean that Gateway could most easily make a deal with OfficeMax because the partnership would create mutual benefits. Additional traffic in OfficeMax stores would create more revenue from incremental selling, while Gateway could extend its domestic scale and proximity to the customer without a huge increase in its fixed cost base. In fact, we recommend that Gateway close the remainder of its stores to lower its cost base and enable itself to become more able to compete on price. Reasons for partnering in the first place Since 2000, Gateway has been getting its ass kicked by just about every PC manufacturer on the face of the earth. It couldn’t even gain ground on Dell when that annoying, pot-smoking dickhead, Steven, was selling Dell PCs with his moronic line, “Dude, you’re getting a Dell!” Gateway countered with a lower price and an ad which asked, “Dude, you still getting a Dell?” Judging from the comparative financial performance, the obvious answer was a resounding yes. <Talk about the competitive environment here & GW’s place in it; perhaps a much shorter version of these sections from report #2> Gateway’s place in the PC industry The SWOT analysis depicted in exhibit 2 and the GE business screen shown in exhibit 3 provide a good idea of how Gateway fits into the PC industry. Gateway has many strengths, but ultimately is a medium strength business in an industry which is above average in attractiveness. The Porter’s Five Forces model in exhibit 4 demonstrates how each force affects the PC industry from Gateway’s perspective. One notable area of this example is the substitutability of products, as the PC market has evolved into being largely a commodity market. This means all substitution forces are negative from Gateway’s perspective, so finding a way to differentiate Gateway’s PC offering would help protect them from these forces. Exhibit 5 shows the Gateway, Inc. value chain. Gateway’s infrastructure gives them a strong physical presence in the US, due to it 192 stores.1 Its e-commerce and order processing systems provide value to customers by allowing them to custom-build PCs tailored to the customer’s needs. Key partnerships with suppliers provide Gateway lowcost sources of inputs, while the outbound logistics are handled largely by Federal Express. Marketing has built a strong brand for Gateway, as everyone knows the cow stands for Gateway. Unfortunately for Gateway, a weak point of the value chain, as noted in the SWOT analysis, is substandard technical support. This weakness is amplified by the fact that Gateway PCs require more repairs than its competition.2 Gateway’s core competencies are marketing, direct sales and manufacturing of customized PCs. Competitor Analysis Exhibit 6 shows the competitive analysis of Gateway and its main competitors in the PC industry. Dell:3 Founded in 1984, Dell’s marketing strategy is based around its “Direct” to consumers model. Dell PCs are not available in physical retail locations, but only by phone or Internet order. However, this model hasn’t held them back from being the leading PC retailer worldwide with approximately 40,000 employees around the globe and revenue of nearly $37 billion for the last four quarters. Their focus on capturing and utilizing consumer information has allowed them to react quickly to market trends and better compete in a highly competitive industry. Dell provides desktop and notebook computers, as well as accessories and peripherals to consumers and businesses. Dell is also known for providing top-notch service. 1 Gateway, Inc. 2002 Annual Report, p. 5. http://abclocal.go.com/wls/news/consumerreports/120502_cr_computers.html 3 http://www.dell.com 2 IBM:4 Formed over 100 years ago, IBM has a long-standing reputation for producing the most innovative business tools in the market. IBM was one of the first movers in the computer industry and uses its reputation to its advantage by commanding higher prices. They offer a full array of computing and networking machinery to the business and consumer markets. With a focus on R&D and innovation, IBM has been able to maintain a diversified global revenue base by meeting the needs of many different markets. Sony:5 Sony was a late entrant into the PC market, but it has proved to be a sleeping giant. Their untarnished reputation for quality electronic products has helped them crack a highly competitive market with high speed. Moreover, Sony’s high-quality reputation has allowed them to do this while commanding a premium price. Sony is a Japanese company, but operates on a global scale and offers a wider array of electronic products than all of its competitors. However, Sony’s products are mostly based in the consumer markets, rather than the business markets. HP / Compaq:6 The recent merger of HP and Compaq has created a computer and technology giant with 140,000 employees in 160 countries. Revenues for the combined companies were $72 billion for the fiscal year that ended October 31, 2002. Similar to IBM, HP has always stood for innovation in business machinery. HP and Compaq are priced in the middle of the pack of major PC brands. As well, HP & Compaq computers are available with both Intel and AMD processors, giving them a larger product line and more price points than most of the competitors in the PC market. eMachines:7 eMachines is the low cost leader of the market. They use less expensive AMD chips to help reduce costs and they focus almost entirely on the consumer market over the business market. They operate on an international basis, but they are a U.S. based company. As shown in the resource based view in exhibit 7, although it has several value-creating activities, Gateway currently has no sustainable competitive advantages. As shown in exhibit X, only 17% of computer and electronics sales occur via ecommerce, so the market for people who want to touch and feel the merchandise is substantial. 4 http://www.ibm.com http://www.sony.com 6 http://www.hp.com 7 http://www.emachines.com 5 Exhibit 1. Key Issues facing Gateway, Inc. in order to remain competitive in the PC industry. Issue/Hypothesis Subissue/Hypothesis What is Gateway's place the current competitive environment? Poor What are Gateway's strengths, weaknesses, opportunities & threats? TBD Will Gateway's current strategy for the PC industry be successful? No Data Sources End Product Responsibility Gateway website & annual reports Table & Description Neal & Bartlett 2-Aug What are Gateway's core competencies? TBD Analyses SWOT Analysis, GE Business Screen Value Chain Analysis Due Date Gateway website & annual reports Table & Description Neal & Bartlett 2-Aug What are the factors influencing the profitability of the PC industry? Marketing, low-cost producer Porter’s 5 Forces Industry Analysis Company, industry, & government websites Table & Description Bartlett 2-Aug Who are Gateway's primary competitors? IBM, Dell, HP Competitive Analysis Company websites, annual reports Table & Description Fink 2-Aug Where are the competitors' weaknesses? Value added services Competitive Analysis Company websites, annual reports Table & Description Fink 2-Aug How do the product attributes affect industry profitability? Commodities, low profitability Competitive Product Analysis Company websites Table & Description Fink 2-Aug What are Gateway's current areas of sustainable competitive advantage? None ResourcedBased Analysis Company, industry, & government websites Table & Description Bartlett 9-Aug What are the areas where Gateway can create and capture sustainable competitive advantage? Value added services Review all analyses Previous analyses Text All 9-Aug What changes to Gateway's strategy are necessary? Better value-added services Review all analyses Previous analyses Text All 9-Aug Exhibit 2. SWOT Analysis for Gateway, Inc. Gateway, Inc. SWOT Analysis Internal Strengths 1. Direct Model of business - selling direct to customers provides distinct advantages in the areas of distribution costs, inventory control, messaging, and customer care and feedback. 2. Purchasing strategy & expertise - Gateway makes large commitments to key suppliers to ensure a market advantage. 3. Manufacturing - Gateway's manufacturing process is designed to provide custom-configured products to its customers. 4. Leveraging suppliers in research and development - Gateway is relieved of the responsibility of developing technology. 5. Physical proximity to the customer - Gateway stores around the country. 6. Strong brand recognition. External Opportunities 1. Improve technical support 2. Offer proprietary technologies 3. Improve product quality 4. Offer PCs with AMD chips 5. Enter a partnership Internal Weaknesses 1. Technical support and customer service Gateway has a reputation for poor technical support. 2. Lack of corporate business base - Majority of sales are to individual consumers, small businesses, and educational institutions. Gateway has not been successful in selling to large and midsize companies. 3. Late entry into servers and workstations Gateway has not been able to surpass its competitor, Dell, in entering this market. 4. Poor quality product - requires more repairs than competitors. External Threats 1. Price wars - Gateway is disadvantaged due to Dell's low fixed cost base (GW has stores, Dell doesn't). 2. Economic cycle vulnerability - less geographically diversified 3. Competitors may develop exclusive partnerships Sources: http://www.wgss.com/profiles/gateway.htm http://news.com.com/2100-1040-949018.html http://abclocal.go.com/wls/news/consumerreports/120502_cr_computers.html Exhibit 3. GE Business screen for Gateway, Inc. GE Business Screen - Gateway, Inc. Business Strength Medium Low Medium Low Industry Attractiveness High High Classification Strategic Thrust High Overall Attractiveness Invest / Grow Medium Overall Attractiveness Selectively Improve / Defend Low Overall Attractiveness Harvest / Divest Industry Attractiveness Factors Absolute market size Market Potential Market Growth Rate Competitive Structure Financial Economic Technological Social Political Environmental Positive Business Strength Factors Neutral Size of SBU Market Share Positioning Comparative Advantages Brand Strength Human Resources R&D Capacity Manufacturing Process Quality Marketing Learning Capability Negative Exhibit 4. Porter’s Five Forces on the PC Industry and how each affects Gateway, Inc. Porter's Five Forces on PC Industry Structure Legend: how each force impacts Gateway, Inc. Positive Neutral Negative Entry Barriers Rivalry Determinants Economies of scale Proprietary product differences Brand identity Switching costs Capital requirements Access to distribution Absolute cost advantages Proprietary learning curve Access to necessary inputs Proprietary low-cost product design Government policy Expected retaliation Industry growth Fixed (or storage) costs / value added Intermittent overcapacity Product differences Brand identity Switching costs Concentration and balance Informational complexity Diversity of competitors Corporate Stakes Exit barriers Bargaining Power of Suppliers New Entrants Threat of New Entrants Industry Competitors Suppliers Bargaining Power of Buyers Buyers Intensity of Rivalry Determinants of Supplier Power Differentiation of inputs Switching costs of suppliers and firms in the industry Presence of substitute products Supplier concentration Importance of volume to supplier Cost relative to total purchases in the industry Impact of inputs on cost or differentiation Threat of forward integration relative to threat of backward integration by firms in the industry Determinants of Buyer Power Threat of Substitutes Substitutes Determinants of Substitution Threat Relative price performance of substitutes Switching costs Buyer propensity to substitute Bargaining Leverage Price Sensitivity Buyer concentration vs firm concentration Buyer volume Buyer switching costs relative to firm switching costs Buyer information Agility to backward integrate Substitute products Pull-through Price / total purchases Product differences Brand identity Impact on quality/ performance Buyer profits Decision makers' incentives Exhibit 5. The Gateway, Inc. Value Chain. Firm Infrastructure: Plant, Corporate, Gateway Stores Margin Human Resource Management: Recruiting, Training Technology: e-commerce, order processing system Purchasing & Inbound Logistics Operations: PC assembly, finishing & shipping Distribution & Outbound Logistics Marketing & Sales Service: Tech Support & Repairs Exhibit 6. Competitive Analysis of the PC market. Gateway Dell Sony IBM HP Compaq (HP) eMachines Direct to consumers with high quality customizable PCs & unparalleled support Direct to consumers with high quality customizable PCs & unparalleled support Top quality PCs at a premium price Innovative high quality PCs at a premium price Innovative high quality PCs at a good price Quality PCs at a good price Low cost high quality PCs $869 $732 $1,009 $969 $675 $627 $499 Available at physical locations? Yes / No NO Yes Yes Yes Yes Yes Chip Band Intel Intel Intel Intel Intel / AMD Intel / AMD AMD Online Purchasing Available? Yes Yes Yes Yes Yes Yes Yes PC Customization Capabilities? Yes Yes Yes Yes Yes Yes Yes Online & Phone Support? Yes Yes Yes Yes Yes Yes Yes Peripherals & Accessories Available? Yes Yes Yes Yes Yes Yes Yes Country USA USA Japan USA USA USA USA Positioning Price Comparison (for comparable machines) Sources: http://www.gateway.com http://www.dell.com http://www.sony.com http://www.ibm.com http://www.hp.com http://www.emachine.com Exhibit 7. Resource Based View of Gateway, Inc. Tests Resource Competitive Superiority Direct Sales Model Purchasing Expertise Manufacturing Outsourced R&D Proximity to Customer Brand Identity Legend: Green = passes the test Red = fails the test Inimitability Durability Appropriability Substitutability Sustainable Competitive Advantage