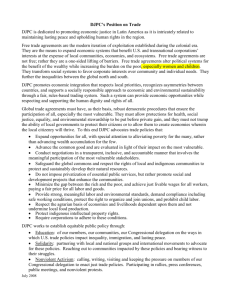

financial agreements - The North Queensland Law Association

advertisement

ANNUAL NORTH QUEENSLAND LAW ASSOCIATION CONFERENCE DELIVERED BY THE HONOURABLE JUSTICE ROBERT BENJAMIN FAMILY COURT OF AUSTRALIA HOBART ENTITLED “FINANCIAL AGREEMENTS” AT THE GRAND MERCURE HOTEL MACKAY, QUEENSLAND 30-31 MAY 2008 SATURDAY 31 MAY 2008 April 2008 – © FINANCIAL AGREEMENTS Robert Benjamin INTRODUCTION In December 2000 Part VIIIA of the Family Law Act 1975 (Cth) came into effect via the Family Law Amendment Bill 2000 (Cth). This was a significant change to the law and was designed to enable parties to enter into binding financial agreements. In the explanatory memorandum accompanying the first reading of the Family Law Amendment Bill 1999 (Cth) (as it then was), the policy behind the agreements was said to be: Currently, under the Act people can make “pre-nuptial” and “postnuptial” settlements about their properties. In recent years the use of these has been limited because they are not binding and the court is able to exercise its discretion over property with which these settlements deal. This was one of the major problems identified by the Joint Select Committee and in a number of other reviews of the existing law about family law property. The Bill will make provision for financial agreements dealing with all or any of the parties’ property to be made before or during marriage or on marriage breakdown, setting out how such property is to be divided. People will be encouraged, but not required, to make financial agreements. For these agreements to be binding, each party will be required to obtain independent financial advice as to the financial effect of the agreement or independent legal advice as to legal effect of the agreement before considering their agreement, or both. Because the parties will have obtained prior advice, the court will only be able to set aside an agreement in certain limited circumstances, for example if it was obtained by fraud, duress or undue influence or where there was a significant change in the circumstances that would make it unfair to give effect to the agreement. The further revised supplementary explanatory memorandum to the Family Law Amendment Bill 2000 (Cth) goes on to say: The grounds for setting aside [agreements] include all common law and equitable grounds … 1 A court will also be able to set an agreement aside where there is a material change in the circumstances relating to the care, welfare and development of a child that would make it unfair to give effect to the agreement. The manner in which the agreements were given power was by inserting s 71A into the Family Law Act 1975 (Cth) which provides: This Part does not apply to certain matters covered by binding financial agreements (1) This Part does not apply to: (a) financial matters to which a financial agreement that is binding upon the parties to the agreement applies; or (b) financial resources to which a financial agreement that is binding on the parties applies. Thus, the effect of a financial agreement that is binding upon the parties is to exclude the jurisdiction of a court exercising powers with regard to property and spousal maintenance under Part VIII of the Act. This does not preclude a court exercising jurisdiction under the Family Law Act 1975 (Cth) from determining questions as to whether a financial agreement or determination agreement is valid, enforceable or effective which may be done according to s 90KA. In the second reading speech when the Bill came before the Senate, Senator Patterson observed: The aim of introducing binding financial agreements is to encourage people to agree about how their matrimonial property should be distributed in the event of, or following separation. Agreements will allow people to have greater control and choice over their own affairs in the event of marital breakdown. Financial agreements will be able to deal with all or any of the parties’ property and financial resources and also maintenance …. People will be encouraged, but not required, to make financial agreements. For these agreements to be binding, each party will be required to obtain independent legal advice before concluding their agreement. The provider of the advice will certify, on the agreement, that the advice has been given. Requiring the parties to obtain independent legal advice will mean that couples will be aware of the implications of the agreements that they are entering and will not unknowingly enter into an agreement that is not in their best interests. 2 Because parties will have obtained prior advice, the court will only be able to set aside agreements in certain limited circumstances reflecting the contractual nature of the agreement. Sections 90B, 90C and 90D of the Family Law Act 1975 (Cth) provide that the agreements can be entered into before marriage, during marriage or after divorce. Interestingly there seems to be no legislative distinction between agreements entered into after marriage but before failure of the marriage and those which are entered into after marriage but after breakdown of the relationship. There are consequences in terms of Superannuation, Stamp Duty and Capital Gains Tax. CHALLENGES TO FINANCIAL AGREEMENTS Variation, discharge, termination and setting aside of binding financial agreements If an agreement is entered into, it can be varied or discharged by entering into a termination agreement under s 90J or set aside by a court under s 90K(1). Section 90K provides that an agreement may be set aside as follows: (1) A court may make an order setting aside a financial agreement or a termination agreement if, and only if, the court is satisfied that: (a) the agreement was obtained by fraud (including non-disclosure of a material matter); or (aa) either party to the agreement entered into the agreement: (i) for the purpose, or for purposes that included the purpose, of defrauding or defeating a creditor or creditors of the party; or (ii) with reckless disregard of the interests of a creditor or creditors of the party; or (b) the agreement is void, voidable or unenforceable; or (c) in the circumstances that have arisen since the agreement was made it is impracticable for the agreement or a part of the agreement to be carried out; or (d) since the making of the agreement, a material change in circumstances has occurred (being circumstances relating to the care, welfare and development of a child of the 3 marriage) and, as a result of the change, the child or, if the applicant has caring responsibility for the child (as defined in subsection (2), a party to the agreement will suffer hardship if the court does not set the agreement aside; or (1A) (e) in respect of the making of a financial agreement - a party to the agreement engaged in conduct that was, in all the circumstances, unconscionable; or (f) a payment flag is operating under Part VIIIB on a superannuation interest covered by the agreement and there is no reasonable likelihood that the operation of the flag will be terminated by a flag lifting agreement under that Part; or (g) the agreement covers at least one superannuation interest that is an unsplittable interest for the purposes of Part VIIIB. For the purposes of paragraph (1)(aa), creditor, in relation to a party to the agreement, includes a person who could reasonably have been foreseen by the party as being reasonably likely to become a creditor of the party. Setting aside a financial agreement pursuant to s 90K(1) assumes the agreement is in fact binding. The first take in making or challenging such agreements is to determine if it is binding. Valid binding financial agreements Another basis upon which a financial agreement may be attacked is its own validity. A financial agreement will only be considered to be valid and binding if the requirements of s 90G are fulfilled. This section provides: (1) A financial agreement is binding on the parties to the agreement if, and only if: (a) the agreement is signed by both parties; and (b) the agreement contains, in relation to each party to the agreement, a statement to the effect that the party to whom the statement relates has been provided, before the agreement was signed by him or her, as certified in an 4 annexure to the agreement, with independent legal advice from a legal practitioner as to the following matters: (i) (ii) the effect of the agreement on the rights of that party; the advantages and disadvantages, at the time that the advice was provided, to the party of making the agreement; and (c) the annexure to the agreement contains a certificate signed by the person providing the independent legal advice stating that the advice was provided; and (d) the agreement has not been terminated and has not been set aside by a court; and (e) after the agreement is signed, the original agreement is given to one of the parties and a copy is given to the other. Note: For the manner in which the contents of a financial agreement may be proved, see section 48 of the Evidence Act 1995 [(Cth)]. (2) A court may make such orders for the enforcement of a financial agreement that is binding on the parties to the agreement as it thinks necessary. In Australian Securities and Investments Commission and Rich & Anor (2003) FLC 93-171 O’Ryan J said in relation to these s 90G requirements: [64] Section 90G sets out the requirements that must be met for a financial agreement to be binding upon the parties. All the requirements must be satisfied for the agreement to be binding. These requirements are justified because the effect of a valid agreement is to oust the jurisdiction of the [c]ourt. However, there is no requirement of registration in the [c]ourt or approval by the [c]ourt of a financial agreement. Further, I am of the view that the requirements of s 90G are not stringent. All that is required is that the agreement be signed by both parties, include a statement addressing the matters in s 90G(1)(b) and attach a certificate from a legal practitioner. Essentially s 90G(1) imposes the following requirements necessary for a binding financial agreement. The agreement must: Be in writing and signed by both parties; 5 Contain a statement in accordance with s 90G(1)(b) that each of the parties has received independent legal advice from a legal practitioner as to the effect of the agreement, the rights of that party and the advantages and disadvantages at that time that the advice was provided to the party making the agreement; Have annexed to it a certificate signed by the legal practitioner stating that the advice was provided; Not have been terminated or set aside by the court; and After being signed, the original agreement is given to one of the parties and a copy given to another. This form of certificate and these requirements are very similar to those provided under the Property (Relationships) Act 1984 (NSW) which has operated with regard to de facto relationships in New South Wales from 1984 onwards. What is remarkable is that there has been little or no litigation in relation to those de facto agreements in New South Wales over that period which is now well in excess of twenty years. Interpretive approaches There seems to be two approaches with regard to interpretation of s 90G of the Family Law Act 1975 (Cth). In J & J [2006] FamCA 442 (unreported) Collier J dealt with a financial agreement. When that case came before his Honour it was asserted that the agreement had two deficiencies, namely that it did not contain a statement to the effect that the party to whom the statement related had been provided with the requisite independent legal advice, and the certificate contained incorrect wording. His Honour said: [20] Something approaching full compliance, or something that if looked at in a less than strict light, might come close to compliance, is not enough. Justice Collier was of the view that s 90G should be strictly interpreted and any failure to comply with that section deprived the agreement of being binding upon the parties. His Honour said: [19] To my mind, the words that appear in s 90G(1) “if and only if” are words of real significance. They have a meaning. They import a requirement for a level of compliance, if the agreement is to be binding, that is clearly a standard or level above or beyond what might be described as substantial compliance… 6 Compliance must therefore be full compliance satisfying the statutory requirements. I took a somewhat different approach in Black & Black [2006] FamCA 972. In that case the parties entered into a financial agreement during the course of their marriage in circumstances where the husband had a belief that the wife was going to succeed in a personal injury claim where she would receive about $200,000, half of which would fall to him under the agreement. This was a short marriage with a small pool of assets of approximately $300,000. Most of these assets came from the husband’s contributions. The wife’s claim was settled for $40,000 and not the $200,000 which the husband had foreseen. The husband had been advised by his solicitor not to enter into the agreement and not to count on a significant settlement. The husband sought to have the agreement set aside under s 90G relying essentially on two propositions. The first was that there was a change in the terms of the agreement after the certificate was given. What had happened was that once the agreement had been completed and signed by the husband and a certificate given by his solicitor, the wife’s solicitor wanted a change to a clause of the agreement. This was done. The husband went to see his solicitor and while his solicitor explained the change to him, did not issue a new certificate. The second basis was that the certificate needed to be annexed to the agreement and there needed to be included in the body of the agreement a statement in accordance with s 90G(1)(b). I considered the decision of J & J (above) and I said: [110] The intention of Part VIIIA is to enable ordinary people to enter into financial agreements which will deal with property and spousal maintenance and avoid the necessity of court proceedings. The agreement can be made before marriage and after marriage, whilst the relationship subsists or they can be made following the breakdown of marriage. The explanatory memorandum observes that it is the legislative intent to encourage the use of financial agreements under this Part of the Act. To enable such agreements to be binding the legislation requires that each of the parties to the agreement must have independent advice. If courts require strict interpretation of the legislation this will have the effect of making such agreements less available to the broader community. It would positively discourage the use of financial agreements and would limit the pool of legal practitioners who are equipped and willing to draft and/or advise in relation to such agreements. Such strict and inevitably narrow construction would add to the cost of such 7 agreements and may put the costs to prepare and advise them on them outside the financial means of the general community. That is not the legislative intent. The legislation does intend that legal advice should be available Australia wide through the broad church of legal practitioners, whether specialist or not, whether in major capital cities, or in suburbs or in the regions. Courts should not make legal practitioners and the parties cross all of the “T’s” and dot all of the “I’s” to enter into and give effect to financial agreements. The form should not defeat the substance. The Act does not create a regime of strict compliance and there is a requirement on courts to give purpose to the legislation. Accordingly, I will not be adopting a strict interpretive approach in terms of both the construction of the legislation and construction of the terms of the agreement. I will adopt the objective approach. The underlying jurisprudential conflict is whether the strict approach suggested by Collier J ought to be adopted or whether the objective approach ought to be adopted. Both arguments have significant weight. Justice Collier’s view is that Part VIIIA takes away the jurisdiction of a court and therefore the rights of citizens to apply to the court for property orders, and as such should be strictly interpreted. In Black & Black (above) I considered the High Court decision of Toll (FGCT) Pty Ltd v Alphapharm Pty Ltd and Others (2004) 219 CLR 165 which considered the approach regarding contracting parties. In a joint judgment, Gleeson C J, Gummow, Hayne, Callinan and Hayden JJ stated: [42] Consistent with this objective approach to the determination of the rights and liabilities of contracting parties is the significance which the law attaches to the signature (or execution) of a contractual document. In Parker v South Eastern Railway Company 1877 2 CPD 416 at 421, Mellish LJ drew a significant distinction as follows: In an ordinary case, where an action is brought on a written agreement which is signed by the defendant, the agreement is proved by proving his signature, and, in the absence of fraud, it is wholly immaterial that he has not read the agreement and does not know its contents. The parties may, however, reduce their agreement into writing, so that the writing constitutes the sole evidence of the agreement, without signing it; but in that case there must be evidence independently of the agreement itself to prove that the defendant has assented to it. 8 [43] More recently, in words that are apposite to the present case, in Wilton v Farnworth (1948) 76 CLR 646 at 649 Latham CJ said: In the absence of fraud or some other of the special circumstances of the character mentioned, a man cannot escape the consequences of signing a document by saying, and proving, that he did not understand it. Unless he was prepared to take the chance of being bound by the terms of the document, whatever they might be, it was for him to protect himself by abstaining from signing the document until he understood it and was satisfied with it. Any weakening of these principles would make chaos of everyday business transactions. [44] In Oceanic Sun Line Special Shipping Company Inc v Fay (1988) 165 CLR 197 at 228, Brennan J said: If a passenger signs and thereby binds himself to the terms of a contract of carriage containing a clause exempting the carrier from liability for loss arising out of the carriage, it is immaterial that the passenger did not trouble to discover the contents of the contract. [45] It should not be overlooked that to sign a document known and intended to affect legal relations is an act which itself ordinarily conveys a representation to a reasonable reader of the document. The representation is that the person who signs either has read and approved the contents of the document or is willing to take the chance of being bound by those contents, as Latham CJ put it, whatever they might be. That representation is even stronger where the signature appears below a perfectly legible written request to read the document before signing it. I went on to say: [95] The agreements to which parties to a marriage or relationship enter into should be subject to the same principles of law and equity that govern ordinary contracts. Agreements under Part VIIIA already have a protective provision, that being 90G. The solicitors who give advice to such agreement need to be aware that the general law applies so that they are able to give advice that the Act requires. In terms of the purposive approach, I set out the following: [106] The preferred purposive approach was noted by Dawson J in the High Court case of Mills v Meeking (1990) 169 CLR 214 at 235, regarding the Victorian Interpretation legislation: 9 [T]he literal rule of construction, whatever the qualifications with which it is expressed must give way to a statutory injunction to prefer a construction which would promote the purpose of an Act to that which would not… The requirement that a court look to the purpose or object of the Act is thus more than an instruction to adopt the traditional mischief or purpose rule in preference to the literal rule of construction… The approach required by s 35 [Interpretation of Legislation Act 1984 (Vic)] needs no ambiguity or inconsistency; it allows a court to consider the purposes of an Act in determining whether there is more than one possible construction. Reference to the purposes may reveal that the draftsman has inadvertently overlooked something which he would have dealt with had his attention been drawn to it and if it is possible as a matter of construction to repair the defect, then this must be done. However, if the literal meaning of a provision is to be modified by reference to the purposes of the Act, the modification must be precisely identifiable as that which is necessary to effectuate those purposes and it must be consistent with the wording otherwise adopted by the draftsman. Section 35 requires a court to construe an Act, not to rewrite it, in the light of its purposes. [107] Pearce and Geddes [(p 26, para 2.9)] suggest that Dawson J’s comments in Mills v Meeking (above) indicate that the interpretation legislation provisions have displaced both the literal and purposive common law approaches outlined above and that “[i]t is therefore unhelpful to treat those approaches as representing anything more than stages in the development of the principle of interpretation that have current statutory force”. [108] The High Court stated in Kelly v The Queen (2004) 218 CLR 216 at [98] (citations omitted): Purposive construction Purposive construction is the modern approach to statutory construction. Legislative enactments should be construed so as to give effect to their purpose even if on occasions this may require a “strained construction"” to be placed on the legislation. The literal meaning of the legislative text is the beginning, not the end, of the search for the intention of the legislature. As Learned Hand J famously pointed out: Of course it is true that the words used, even in their literal sense, are the primary, and ordinarily the most reliable, source of interpreting the 10 meaning of any writing: be it a statute, a contract, or anything else. But it is one of the surest indexes of a mature and developed jurisprudence not to make a fortress out of the dictionary; but to remember that statutes always have some purpose or object to accomplish, whose sympathetic and imaginative discovery is the surest guide to their meaning. [109] The High Court in Adams v Lambert (2006) 225 ALR 396 stated in relation to bankruptcy law as follows: [34] That view of legislative purpose is persuasive. The effect of the majority view in Lewis(2000) 109 FCR 33 is to attribute to the legislation an overwhelming preference for form over substance. That should not be done. An appeal of Black & Black (supra) was heard before the Full Court, comprising of Faulks DCJ, Kay and Penny JJ, on the 24 January 2008. The husband appealed on numerous grounds but the matter turned only on one issue which required an interpretation of s90G of the Family Law Act 1975 (Cth) (“the Act”) and the provisions of the agreement itself. 1 The husband argued that the trial judge had erred in rejecting the proposition that the statutory requirements should be strictly interpreted. The husband contented that the Act: “(a) required his solicitor at the time he signed the final amended version of the financial agreement on or about 6 September 2002 to re-certify in accordance with s 90G(1)(c), which the solicitor failed to do despite making notes about the changes; and (b) required the agreement to be in accordance with the wording then used in s 90G(1)(b).”2 The Full Court said at paragraph 40: “The Act permits parties to make an agreement which provides an amicable resolution to their financial matters in the event of separation. In providing a regime for parties to do so the Act removes the jurisdiction of the court to determine the division of those matters covered by the agreement as the court would otherwise be called upon to do so in the event of a disagreement. Care must be taken in interpreting any provision of the Act that has the effect of ousting the jurisdiction of the court. The amendments to the legislation that introduced a regime whereby parties could agree to the ouster of the 1 2 Black & Black [2008] FamCAFA 7 at page 2. Ibid at page 5. 11 court’s power to make property adjustment orders reversed a long held principle that such agreements were contrary to public policy “. The Full Court went onto say at paragraph 42: “The underlying philosophy that had guided the courts in enunciating that principle was seen to place too many restrictions on the right of parties to arrange their affairs as they saw fit. The compromise reached by the legislature was to permit the parties to oust the court’s jurisdiction to make adjustive orders but only if certain stringent requirements were met.” The agreement entered into by the parties did not specifically refer to the requirements, although the certificate did.3 Their Honours said that although “recital R and clause 29 of the agreement dealt predominately with advice in relation to the legal implications of the agreement and each party’s rights and obligations”4, the statements did not meet the requirements of s 90G(1)(b). The Full Court adopted a strict approach, in giving effect to the agreement, as taken by Collier in J and J (above) and said that “we are of the view that strict compliance with the statutory requirements is necessary to oust the court’s jurisdiction to make adjustive orders under s 79”.5 The Court (Faulks DCJ, Kay and Penny JJ) found “the agreement itself was flawed and did not meet the statutory requirements”.6 The Full Court did not think it was necessary to determine whether or not the certificate prepared by the husband’s solicitor’s pre dated the amendments to the agreement because it did not satisfy the statutory requirements and was therefore not binding upon the parties. The appeal by the husband was successful, the effect of which was to set aside the financial agreement. ADVICE TO PRACTITIONERS In light of this decision precedents for financial agreement should be checked to ensure strict compliance with the legislation. Also practitioners will need to take great care when; advising their clients, drafting and finalising agreements. There are some important factors which should be kept in mind when drafting a financial agreement: 3 Ibid at paragraph 44. Ibid at paragraph 45. 5 Ibid. 6 Ibid at paragraph 46. 4 12 1 When you are asked to draft the agreement ensure that your precedents are up to date and that you have kept up to date with all new developments in this area. Check the latest version of the Act to ensure that all of s90G has been complied with. 2 When you are asked to draft the agreement ensure: (a) that you do not see the client in the presence of the other party and; (b) that the other party is properly and independently represented. Avoid referring them to someone you know. It may be wiser to refer to the Law Society or a list of Accredited Specialists. 3 When someone comes in a few weeks in advance of the wedding – send them away, by that time it is too late or alternatively warn them of the risks (in writing) and see the client after the happy day. 4 You should seek independent expert advice from an accountant, tax and stamp duty advice where appropriate, and ensure that this advice is kept on the file. 5 Draft a decent letter of advice, well in advance, making sure that: (a) your client is informed of his/her obligation to make full and frank disclosure as well as the matters referred to in s90G– otherwise the whole exercise is wasted. (b) you have set out the basis of setting aside agreements and; (c) your advice given for the certificate. (d) your advice refers to the latest version of the agreement, including any amendments you may have made. (e) if your advice has been covered in more than one letter provide a final letter of advice and refer to the previous letters and annex copies of those letters to the copy of the final letter of advice. 7 6 Have your client sign a copy of your advice and keep it on your file. 7 Make sure the agreement contains a statement about the advice given and refers to the matters listed in s90G. Do not just rely on the s90G certificate. Justin Dowd and Alexandra Harland in their article “Bound by Strict Compliance” An examination of recent Family Court decisions on binding financial agreements recommend that “for abundant caution, repeat the wording of the s90G certificate”.7 Law Society Journal (2008) 46 at page 63. 13 8 8 Include a recital in the agreement which provides a warranty by each party and solicitor that the advice was given and the certificate signed before the agreement was signed. 9 Finish all negotiations and have the final form of the document agreed before you give your s90K(1)(b) advice, which should be in writing. 10 It would be prudent to have your client and the other party both agree that the agreement is finalised. Do not make last minute handwritten amendments at the meeting you have arranged for everyone to sign the agreement. Incorporate the changes into the one document and have everyone sign it. If you do not the risk is the agreement may be set aside on the basis it was altered after the advice was given. 11 Agree on a date for signing the agreement with your client and arrange a meeting with the other solicitor and your respective clients. 12 The solicitors should sign the certificates first. It would be prudent to record the date as well as the time the certificates were signed. 13 If in doubt do not sign the certificate. 14 Then have both client’s sign the original agreement and record the date and time the document was signed. Ensure the certificates are attached. Make sure it is the right certificate – not the early form. Justin Dowd and Alexandra Harland in their article (supra) say despite the fact that the current certificate has been in operation since January 2004, “somewhat surprisingly it is not unusual to see the wrong certificates attached to the agreement”.8 15 Make copies of the agreement and mark the original agreement as the ‘the original’ and the others as ‘the copy’ as there can only be one original (s90g (1)(e)). Hand the original to your client and the copy to the other party. Also ensure that you hand a copy of the agreement to the other party’s solicitor and have them acknowledge on your copy that they have received same. 16 Better still, have a meeting. Both solicitors each sign their respective certificates on one original agreement. Then and only then have each party sign the agreement have each signature witnessed and then date the agreement. Copy the original give a copy to one party Ibid. 14 and the original to the other. agreement and diarised by you. Have this process noted in the 17 Get the whole file with your copy of the agreement (remember your client has the original) all relevant correspondence and put it in a safe place – marked “not to be lost or destroyed”. It is important that you keep your file indefinitely rather than for just the period required by statute. A claim for professional negligence may be made against you in the future. 18 Finally if a client comes to you and says “we have agreed on what we want, I just want you to witness this” (as some have done already), DON’T !9 CONCLUSION The difficulty caused by the differing approaches adopted by myself and Collier J in the different financial agreement cases was the subject of a paper prepared by Martin Bartfeld QC10. In that paper Mr Bartfeld rightly observed the practical reality for legal practitioners advising on financial agreements. He said: “Interesting as this debate may be, these two cases demonstrates some very important principles: 9 1. It is necessary for the Act to be complied with no matter which case correctly states the laws. Your client won’t thank you if he or she has to go to court to argue about the validity of the agreement, even if they win on a technicality. It is not hard to comply with the statutes. The words can be copied and incorporated into the precedent, good precedents for the agreement are contained in the CCH Family Law Service; 2. Office precedents must be kept up to date; 3. An agreement can be avoided by the person who is responsible for the error rendering it non-binding. Usual legal principles that a tortfeasor cannot benefit from his own negligence seems not to apply in circumstances where a party (or their solicitor) is responsible for the error which deprives the agreement of statutory validity. For example, if the certificate was signed by a clerk rather Olyvia Nikou SC “Essential Elements of Binding Financial Agreements” (2001) CLF at page 12. “Financial Agreements Evolution and Change” May 2007. 10 15 than a legal practitioner, the agreement would not be binding, even if that meant that the guilty party was to benefit form the error. Therefore every practitioner must be as vigilant about the other side’s compliance and their own; and 4. The consequence of an agreement failing because of incorrect drafting will have professional negligence consequences with the attendant cost and 11 embarrassment.” I can only agree with the common sense approach adopted by Mr Bartfeld in his paper in that regard and say the difficulties faced by Mr Bartfeld in respect of the two differing approaches has now been resolved by the Full Court decision of Black and Black. It is sometimes said that a process looks easy, but as is always the case the devil is in the detail. 11 Ibid at pages 11-12. 16