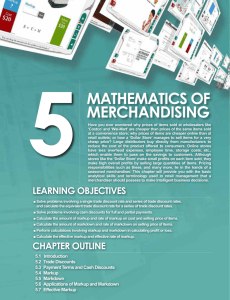

Chapter 11 Marketing and BreakEven

advertisement

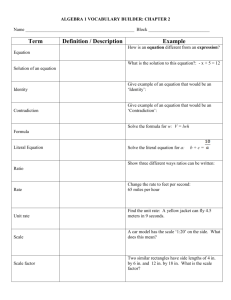

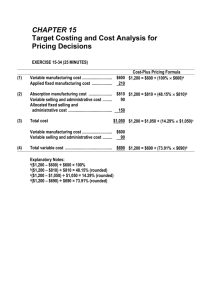

Chapter 11 Marketing and Breakeven Math Cost + Markup = Selling Price CDs cost us $8.00. We have determined that to pay all our expenses and make a reasonable profit, we must markup the CDs by adding $7.00 to the cost. Cost of $8.00 + Markup of $7.00 = Sales Price of $15 Markup Percentage = Markup Sales Price $7.00 = .46666666 or 46.7% $15.00 Out of every dollar of revenue, $.467 will be gross profit. Out of this, we will pay rent, utilities, and all other costs. We of course hope, plan that there will be profit as well. We would say that this company has a 46.7% markup based on selling price. C + M = SP Replace M with .467(SP) C + .467(S) = SP Combine and simplify C + .467(S) - .467(SP) = SP - .467(SP) Rule of Algebra: do the same thing to both sides of the equation. C = .533(SP) Now divide both sides by .533 .533(SP) C = .533 .533 C .533 (SP) = .533 .533 C = SP .533 Replace C with $8.00 $8.00 = SP .533 $15 = SP 1 Examples 1. Determine the sales price of an item that cost you $10, and you add $5 as Markup. 2. Determine the sales price of an item that cost you $15, and you add $8 as Markup. 3. Determine the Markup of an item that cost you $8 and your selling price is $20. 4. Determine the Markup of an item that cost you $8 and your selling price is $20. 5. Determine the cost of an item that your markup is $5 and your selling price is $12. 6. Determine the cost of an item that your markup is $5 and your selling price is $22. 7. The markup on an item is $5 and the selling price is $12. What percent of the Selling price is the markup. 8. Determine the sales price of an item that cost you $10, and you want to sell it with a 46.7% based on Selling Price. 9. Determine the sales price of an item that cost you $15, and you want to sell it with a 46.7% based on Selling Price. 10. Determine the sales price of an item that cost you $19, and you want to sell it with a 46.7% based on Selling Price 2 Break Even point in Units Total fixed costs Price - Variable costs Price – Variable costs is the Contribution Margin (CM) Using the CD example from above, and determining our fixed costs as $100,000, we would have the following: $100,000 $15 - $8 $100,000 = 14285.71429 CDs $7 Rounded to 14,286 full CDs Profit equation: Profit = Total Revenue – (Total Fixed cost + Total Variable cost) Revenue) $214,290 = 14,286($15) Total Fixed Costs = $100,000 (Total Variable Costs) $114,288 = 14,286($8) 0 Profit = $214,290 – (100,000 + 114,288) Example: Suppose that a small publisher selling to book distributors has fixed operating costs of $600,000 each year and variable costs of $3.00 per book. How many books must the firm sell to break even if the selling price is $6.00? 3 $600,000 $6 - $3 They must sell 200,000 books to break even. Answer: Given the following: Required Sales to generate desired Profit Break Even Point Sales Fixed costs Desired Profit Contribution Rate Fixed costs 0 Profit Contribution Rate CM : Contribution Margin : the difference between the sales price(revenue) and all variable costs. Contribution Rate: 1- Variable Rate Variable Rate: Variable Costs Sales Unit Contribution Margin: Unit CM, is equal to the Unit Selling Price minus its unit variable costs. Break Even Sales (Units) = Fixed Costs Unit CM 1. Unit selling price is $25; Fixed costs are $90,000; Unit Variable Cost is $15. What is the break-even point in units. 2. Unit selling price is $17.40; Fixed costs are $164,065.60; Unit Variable cost is $5.85. What is the break-even point in units? 3. Fixed costs are $113,231.64; Contribution Margin is $2.28. What is the break-even in units? 4. Determine the dollar sales needed to achieve the following: Annual profit of $20,000 in an operation with fixed costs of $95,422 and an average variable rate of .545. 5. Fixed costs are $48,337.80; contribution Rate is .60. Find the Break-even point. 6. Fixed Costs are $155,410.31; variable rate is .45. Find the Break even point 7. Fixed costs are $416,250; variable rate is .435. Find the Break even point. 4