case_study_-_ian_abrams_final.

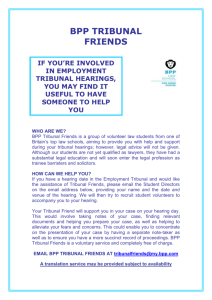

advertisement

Ian Abrams is a Fee-paid Lay Member of the Upper Tribunal, Tax and Chancery Chamber. He is a former stockbroker and investment banker and continues to sit on a number of boards in the financial services sector. The Tax and Chancery Chamber of the Upper Tribunal hears appeals from the Tax Chamber and General Regulatory Chamber of the First-tier Tribunal. It also hears references of various decisions taken by the Financial Services Authority, the Pensions Regulator, the Bank of England and HM Treasury. These references are known as financial services cases. I always planned that when I reached my mid 50s I would do something different. I had been working in the City since I was 21 starting out by spending three-and-a-half years qualifying as an actuary and then moving into stockbroking. I spent the rest of my career in broking and investment banking. In my early 50s, I was a Managing Director of a Japanese Investment Bank and I broached the subject of working for the tribunal with the company’s President. He was extremely enthusiastic. He felt that it was good for the company’s reputation and also showed “good citizenship”. Although, at that stage, I was working full-time as Managing Director, I was confident that I could find the time. The tribunal role played to all my experience - from quite a young age I had moved into management, becoming responsible for business organisation, infrastructure and regulatory issues, which were all relevant to the tribunal position. I was appointed in 2000 and was one of the original members of the Financial Services and Markets Tribunal as it was then. I believe panel members perform a really useful role for the tribunal. It is our job to say ‘this is how someone from the sector would look at this, these are the responsibilities that a particular individual would have and this is what would be expected of them ’. This is particularly important for financial services cases as the judge may often not be familiar with how financial markets work as, for someone who does not work in financial services, it can be difficult to understand the nuances. For example, I have had practical experience of the responsibilities, the decision making and of all of the various associated pressures. As a former Chief Executive, I know exactly what the Financial Services Authority (FSA) believes falls within the responsibility of that position. Typical financial services cases may involve hearing appeals against penalties handed down by the FSA for such things as market abuse, mis-selling and insider dealing. Cases may also involve approvals which have been withdrawn by the FSA from both companies and individuals for not running a fit and proper business. There are quite often rather sad cases involving small advisory companies, which are not being run properly, or have not co-operated with the regulator. My mathematical background, which led me initially to become an actuary, also led to my being approached to sit on tax cases. A case involving a large pharmaceutical company came up which involved a lot of economic modelling. The tribunal needed the help of a mathematician to assist with analysing the evidence of the expert witnesses. The case settled in the end, but I started being asked to sit on other tax cases. It did not take me long to understand the everyday taxation cases and the fact that the tribunal gave me this opportunity is indicative of the fact that they are interested in developing people. This year has been busy with a lot of cases coming through. Prior to this year there had been a period of about 18 months when I was not needed for any, but this year I will hear three – two long cases, which can each take around three weeks, and one short one which lasted three days. The most challenging and important aspect of the role is the making of fair, correct and proportionate decisions without jumping to any pre-conceived conclusions. There is no science about this, but you cannot allow sentiment and emotion to creep in, and sometimes in court it takes a lot of patience and a long time for the full story to come out - especially when the appellant is not professionally represented. I really enjoy the preparation – reading myself into the cases can be like reading a novel. I also enjoy the interaction with my colleagues on the tribunal, particularly working with the judges who are genuinely interested to hear the opinions of the members and are never patronising to us! To be considered suitable as a panellist, I believe that candidates need to demonstrate that they can keep themselves current - particularly if they have retired. Practices and standards change rapidly (when I started out in the 1970’s insider trading was not a crime!). Candidates also need to think through the time commitment. While you are not expected to be available for every case a reasonably high level of acceptance is expected.