Test one - practice over personal finance - Tekamah

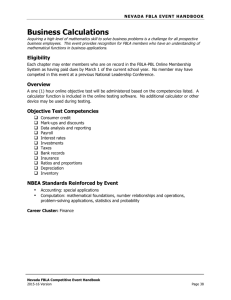

advertisement

STATE FBLA PERSONAL FINANCE 2009 PLEASE DO NOT OPEN THIS TEST UNTIL DIRECTED TO DO SO Test Directions 1. Complete the information requested on the answer sheet. PRINT YOUR NAME on the “Name” line. PRINT the name of the event, PERSONAL FINANCE on the “Subject” line. PRINT the name of your CHAPTER on the “DATE” line. 2. All answers will be recorded on the answer sheet. Please do not write on the test booklet. Scrap paper will be provided. 3. Read each question completely before answering. With a NO. 2 pencil, blacken in your choices completely on the answer sheet. Do not make any other marks on the answer sheet, or the scoring machine will reject it. 4. You will be given 60 minutes for the test. You will be given a starting signal and a signal after 50 minutes have elapsed. 5. Tie will be broken using the last 10 questions of the test. NYS FBLA SLC 2009 PERSONAL FINANCE 2 1. The fixed yearly amount of money earned by an employee is known as a. an expenditure. c. a bonus. b. a wage. d. a salary. 2. Money subtracted from an employee’s gross earnings is called a. an exemption c. a deduction b. a discount d. compensation 3. A payee’s signature on the back of a check is known as a. an exemptions. c. a deduction. b. an endorsement. d. a reconciliation 4. The Wage and Tax Statement showing the wages an individual earned for the year and the amount of income tax that is withheld is a a. 1040 form. c. W-2 form. b. 1099 form. d. W-4 form. 5. The record of deposits and withdrawals for a checking account is kept in a a. checkbook register. c. credit report. b. credit bureau. d. certified check. 6. To build a good credit history, a person needs to a. pay bills on time. c. move frequently. b. be ambitious. d. switch jobs often. 7. When applying for a credit card, the credit card company will consider which fact most important in establishing her credit rating a. age c. ability to drive b. health d. capacity to repay 8. If you only sign your name to the back of a check, this type of endorsement is called a. special. c. restrictive. b. full. d. blank. 9. A form used to place money into a checking or savings account is called a. a withdrawal slip. c. a deposit slip. b. a register. d. an overdraft. 10. An outstanding check is a check that a. has been cashed by the payee. b. has not been endorsed. c. has not been returned to the drawer’s bank. d. has been rejected by the bank. 11. Most financial experts agree that families should set aside at least, ______ percentage of their disposable income each pay period. a. 10. c. 20. b. 15. d. 25. 2 NYS FBLA SLC 2009 PERSONAL FINANCE 3 12. A personal property inventory is most commonly used for a. proof of loss from a fire, theft, or property c. a credit card application. damage. b. a car loan application. d. an employment application 13. The Truth in Lending Act limits your liability when a credit card is lost or stolen to the first ________, unless the card is reported lost or stolen before it is used. a. $10.00 c. $50.00 b. $25.00 d. $100.00 14. The act known for its provisions requiring full disclosure of all charges in a credit transaction is called the a. Fair Credit Reporting Act c. Truth-In-Lending Act b. Fair Credit Billing Act d. Equal Credit Opportunity Act 15. The formula I = P x R x T is for computing a. annual percentage rate c. simple interest b. compound interest d. costs of loans 16. Which of the following is a savings plan whereby an individual sets aside a certain amount of money for retirement? a. Savings account c. IRA account b. Checking account d. Money market account 17. Finance companies charge higher rates of interest on loans because a. they are small and have less money to c. they take more risk lend b. they have lenient loan policies d. they compete with banks and savings and loan institutions for business 18. Which type of credit option still remains after bankruptcy? a. credit card debt c. student loans b. car loans d. business loans 19. Credit may not be denied because a. you are not employed. b. you receive public assistance. c. your work is temporary. d. you have filed for bankruptcy in the past. 20. If your credit card bill is wrong, you should a. tear it up. c. write a letter within 60 days to explain. b. refuse to pay it. d. cancel the card. 21. An example of a flexible expense is a. car payments. b. rent. c. clothing costs. d. insurance payments. 22. As you move toward adulthood, your financial responsibility a. increases. c. stays the same. b. decreases. d. is not important anymore. 3 NYS FBLA SLC 2009 PERSONAL FINANCE 4 23. Your financial plans may require change if you a. get married. c. experience inflation or a recession. b. change jobs. d. all of the above. 24. The best time to start saving for your retirement is a. when you become eligible for Social c. when you start a family. Security. b. as soon as possible. d. when interest rates are low. 25. Writing checks for more money than you have will result in your account being a. endorsed. c. registered. b. reconciled. d. overdrawn. 26. Credit allows you to buy something now a. that you can't afford. b. and pay for it later. c. and receive a credit limit. d. and become a member of a credit bureau. 27. Some auto insurance companies give discounts to people who a. take driver education classes. c. lower their deductibles. b. pass no-fault tests. d. report accidents promptly. 28. Payments citizens make to the government to pay for government services are called a. returns. c. taxes. b. deductions. d. audits. 29. If your employer withheld more money from your paychecks than you owe on your tax return, a. you will be audited. c. you will owe extra tax. b. you will receive a tax refund. d. your employer will have to pay a fine. 30. Which credit rating is earned by a customer who pays bills on the due date or within the 10-day grace period? a. excellent c. fair b. good d. poor 31. One expense that is considered a utility is your a. rent. c. electricity. b. mail. d. security deposit. 32. Unlicensed lenders who charge illegally high interest rates are a. financiers. c. pawnbrokers. b. loan sharks. d. GMACs. 33. Having a category for ____________ in your budget will help you put away money for an emergency or a special purchase. a. savings c. mortgage expense b. utility expense d. vehicle expense 4 NYS FBLA SLC 2009 PERSONAL FINANCE 5 34. A likely first step in starting to use credit is to a. apply for a credit card c. open a savings account b. have parents co-sign for a loan d. pay cash for all purchases 35. What strategy lowers the selling price of a stock and encourages more stock purchasing? a. stock split c. dollar-cost averaging b. dividend reinvestment d. P/E analysis 36. Which of the following is the largest organized exchange in the United States? a. the American Stock Exchange c. the New York Stock Exchange b. the NASDAQ d. they are all the same 37. An example of a fixed expense is a. concert tickets b rent and car payments c. clothing and magazines d. medical costs 38. Financial records are only useful to you if they are a. hand written c. computerized b. filed alphabetically in accordion files d. up-to-date 39. Your income should be a. less than or equal to your expenses b. twice as high as your expenses c. equal to or more than your expenses d. half as much as your expenses 40. Your financial plans may require change if you a. get married. c. experience inflation or recession. b. change jobs. d. all of the above. 41. A good source of free financial information is a. government agencies. c. accountants. b. lawyers. d. financial planners. 42. A not-for-profit financial institution similar to a bank is a a. mutual fund company. c. credit union b. Individual Retirement Account d. credit bureau 43. Choosing a longer investment period when you buy a certificate of deposit (CD) a. often ensures a higher interest rate. c. has no effect on the interest rate. b. often ensures a lower interest rate. d. often decreases the dividend you receive. 44. An electronic funds transfer (EFT) occurs when you a. write a check. c. use a debit card. b. purchase a money order. d. pay cash. 45. Secured loans are guaranteed by an asset of the borrower, known as a. collateral. c. a certificate of deposit (CD) b. credit. d. a dividend. 5 NYS FBLA SLC 2009 PERSONAL FINANCE 6 46. The easiest way to compare different credit costs is to compare a. down payments. c. installments. b. annual percentage rates. d. credit ratings. 47. One factor that makes prices go up and down is a. inflation. c. the gross domestic product. b. economics. d. supply and demand. 48. An example of consumer fraud is a. taking advantage of discount stores. b. timing purchases. c. misleading prize notifications. d. searching for a good consumer deal. 49. Producers and consumers a. must be geographically far apart b. can be geographically far apart c. must do business in the same place d. can fluctuate because of three main factors 50. The movement from good economic times to bad and back to good is know was a. the business cycle c. the Consumer Price Index b. inflation d. the standard of living 51. When unemployment is low, a. a lower standard of living can result b. it is a sign that the economy is not doing well c. personal difficulties for families can be more common d. fewer people are looking for work 52. The government agency that enforces rules about labeling and advertising is the a. Consumer Product Safety Commission c. Federal Trade Commission b. Food and Drug Administration d. Better Business Bureau 53. Production costs and competition a. apply to goods but not to services b. are to common types of consumer fraud 54. An example of a producer of a service is a a. pet-sitter b. T-shirt maker help make up a country’s gross domestic product d. are factors that cause prices to go up and down c. c. farmer d. worker in an automobile industry 55. Losses or risks that an insurance policy will not cover are called a. deductibles c. exclusions b. premiums d. claims 56. One good way to keep down insurance costs is to a. Comparison shop c. Ask for no-fault insurance b. Cancel your auto insurance d. Lower your deductible 6 NYS FBLA SLC 2009 PERSONAL FINANCE 57. Liability insurance covers a. Property damage to your car and your injuries b. Your injuries, and protection for your dependents if you die 7 c. Fire, theft, and vandalism for your car d. Damage to other cars or injuries to other people you are responsible for 58. Some auto insurance companies give discounts to people who a. Take driver education classes c. Lower their deductibles b Pass no-fault tests d. Report accidents promptly 59. A preferred provider organization (PPO) offers a. Lower costs than an HMO, but less choice c. of doctors b. Higher costs than an HMO, but more d. choice of doctors Lower costs than major medical coverage, but more choice of doctors Higher costs than major medical coverage, but more choice of doctors 60. In a health maintenance organization (HMO), members usually pay a small a. deductible c. copayment b. coinsurance d. claim 61. The person most likely to need life insurance is a(n) a. Unmarried person c. Married person without children b. Unemployed person d. Married person with children 62. A type of insurance that lets you borrow against a reserve of money is a. Term life insurance c. Disability insurance b. Whole life insurance d. Liability insurance 63. Your taxable income is your income after a. You have paid all your taxes b. You have subtracted certain permitted amounts c. You have listed your exemptions d. withholding 64. One way to influence city, state, and national tax laws is to a. Refuse to pay them c. Withhold more on your paycheck stubs b. Include letters with your tax returns d. vote 65. Social Security provides benefits for a. People age 65 or older only b. Retired people only 66. Self-employed people a. Are not eligible for Social Security b. Do not have to pay Social Security tax 67. Two state-run social insurance programs are a. Medicare and Social Security b. Unemployment insurance and worker’s compensation c. People of all ages d. People who have purchased work credits c. Do not have to earn work credits d. Must pay both the employee’s and the employer’s share of Social Security Social Security and worker’s compensation d. Unemployment insurance and Medicare c. 7 NYS FBLA SLC 2009 PERSONAL FINANCE 68. The first step in making a budget is to a. Rent an apartment b. Decide on your goals 8 c. Increase your income d. Decrease your expenses 69. On your paycheck, the box labeled FICA shows taxes you have paid to support a. Social Security c. Fire and police protection b. The Internal Revenue Service d. Education and transportation 70. If you lose your job, you should first a. Find out about your benefits for exiting employees b. Express your anger and sadness to your supervisor Tell your supervisor you won’t come back if asked d. Prepare a personal budget c. 71. An amount of money deposited for a fixed amount of time at a stated interest rate is called a a. Certificate of deposit (CD) c. Dividend b. Stock certificate d. Secured loan 72. Because downsizing and the global market have placed greater demands on workers, many companies spend money on a. Pension plans c. Severance pay b. Natural resources d. Employee training 73. An economic system in which individuals or companies can buy and sell and set prices with little government interference is called the a. Business cycle system c. Free-enterprise system b. Consumer Price Index System d. Standard of Living System 74. Those who believe the global economy is good for the United States argue that a. Exports create jobs c. Service jobs will decline b. Goods-producing jobs will go overseas d. Goods produced in other countries are better 75. The largest part of most people’s earnings is used to pay for a. Food c. Entertainment b. Transportation d. housing 76. Banks that lend money to people to start a new business require a business description and a(n) a. Income statement c. Partnership agreements b. Financial plan d. Guarantee of success 77. A disadvantage of bankruptcy is that a. Debts are erased b. Exempt assets are retained c. The cost is small d. Credit is damaged 78. The amount of credit above what you already owe, and which could be used to charge purchases is called a. Earned c. Used b. Unearned d. Unused credit 8 NYS FBLA SLC 2009 PERSONAL FINANCE 9 79. The state of the economy that can affect you ability to repay debt is called a. Collateral c. Capital b. Capacity d. Conditions 80. Which of the following is closed-ended credit? a. Revolving account c. Installment purchase agreement b. 30-day credit account d. Retail store account 81. Which of the following is open-ended credit? a. Revolving account c. b. Installment purchase agreement d. Installment cash loan Service credit 82. A disadvantage of credit is a. Higher costs b. Increased buying power Deferred billing Proof of purchase c. d. 83. Which of the following is not a common cause of bankruptcy? a. Business failure c. Emotional spending b. Low-paying job d. Catastrophic injury or illness 84. Which of these investment strategies is a short-term technique? a. Buying on margin c. Dollar-cost averaging b. Buy and hold d. Direct investment 85. Which of these investment strategies is a long-term technique? a. Buying on margin c. Buy and hold b. Selling short d. All of the above 86. A percentage of the home’s selling price that is paid to the real estate agent a. Purchase offer c. School tax b. Real estate commission d. Closing costs 87. A table showing how much principle and interest is paid for each mortgage payment made. a. Principle c. Amortization b. Mortgage d. Escrow 88. A professionally managed group of investments bought using a pool of money from many investors a. Mutual fund c. Certificate of Deposit (CD) b. Common stock d. Preferred Stock 89. Insurance the lender buys in case the borrower defaults on the mortgage a. Homeowners insurance c. Mortgage insurance b. Public mortgage insurance d. Private mortgage insurance 90. The letter “s” next to a stock in the stock listings would mean a. No stock sold c. Stock split b. Common stock d. No dividends 9 NYS FBLA SLC 2009 PERSONAL FINANCE 91. Which of the following is true? a. You can buy and sell stocks online b. Most major stockbrokers have Websites that allow online transactions 10 c. d. You can use internet sites to follow stock prices All the these are true 92. What represents the cost of dividends as a percentage of the current price? a. P/E Ratio c. Yield b. Par value d. Net change 93. What is a long-term investment technique where investors buy stock directly from a corporation? a. Dividend reinvestment c. Direct investment b. Stock split d. Buy and hold 94. A savings plan whereby an individual sets aside a certain amount of money for retirement a. Put and take account c. IRA b. Systematic investment d. Emergency fund 95. A form used to withdrawal money from a savings account a. Deposit slip c. Overdraft slip b. Withdrawal slip d. Payment slip 96. The amount of money borrowed to purchase a property a. Principle c. Interest b. Escrow d. Mortgage 97. The fees that must be paid at the closing of buying a house: down payment, agent fees, points, attorney fees, and taxes a. County tax c. Escrow b. Abstract d. Closing costs 98. When you make a mortgage payment every two weeks a. Monthly c. Bi-weekly b. Bi-monthly d. Every week 99. A real estate agent that looks out the interests of the home buyer a. Seller’s agent c. Real estate agent b. Buyer’s agent d. Personal agent 100. As a credit user you have responsibilities to a. Yourself and your creditors c. b. Your parents d. The creditors only Yourself only 10 NYS FBLA SLC 2009 PERSONAL FINANCE 11 Answer Key 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. D C B C A A D D C B A A C C C C C C B C C A D B D B A C B B C B A 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60 61. 62. 63. 64. 65. 66. 67. 68. 69. C A C B D C D A C A C A B D C B A D C D A C A D A B C D B B D C D B B A 70. A 71. A 72. D 73. C 74. A 75. D 76. B 77. D 78. D 79. D 80. C 81. A 82. A 83. B 84. A 85. C 86. B 87. C 88. A 89. D 90. C 91. D 92. C 93. C 94. C 95. B 96. A 97. D 98. C 99. B 100.A 11