income tax circular - Power Grid Corporation of India Ltd

advertisement

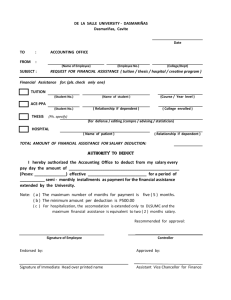

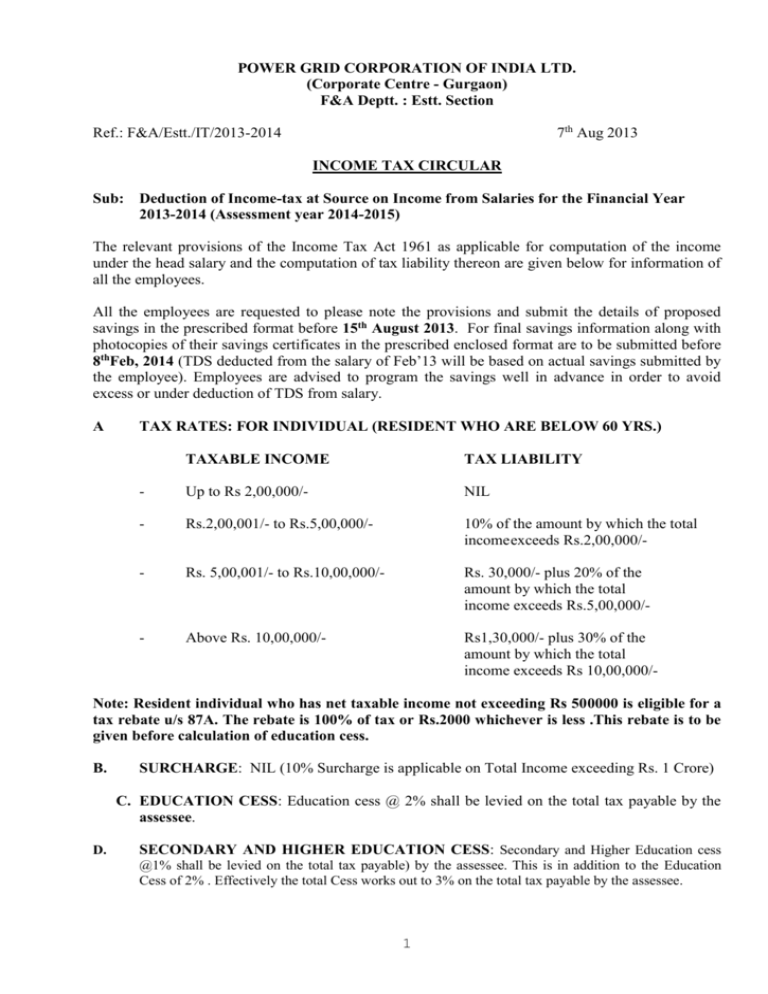

POWER GRID CORPORATION OF INDIA LTD. (Corporate Centre - Gurgaon) F&A Deptt. : Estt. Section 7th Aug 2013 Ref.: F&A/Estt./IT/2013-2014 INCOME TAX CIRCULAR Sub: Deduction of Income-tax at Source on Income from Salaries for the Financial Year 2013-2014 (Assessment year 2014-2015) The relevant provisions of the Income Tax Act 1961 as applicable for computation of the income under the head salary and the computation of tax liability thereon are given below for information of all the employees. All the employees are requested to please note the provisions and submit the details of proposed savings in the prescribed format before 15th August 2013. For final savings information along with photocopies of their savings certificates in the prescribed enclosed format are to be submitted before 8thFeb, 2014 (TDS deducted from the salary of Feb’13 will be based on actual savings submitted by the employee). Employees are advised to program the savings well in advance in order to avoid excess or under deduction of TDS from salary. A TAX RATES: FOR INDIVIDUAL (RESIDENT WHO ARE BELOW 60 YRS.) TAXABLE INCOME TAX LIABILITY - Up to Rs 2,00,000/- NIL - Rs.2,00,001/- to Rs.5,00,000/- 10% of the amount by which the total income exceeds Rs.2,00,000/- - Rs. 5,00,001/- to Rs.10,00,000/- Rs. 30,000/- plus 20% of the amount by which the total income exceeds Rs.5,00,000/- - Above Rs. 10,00,000/- Rs1,30,000/- plus 30% of the amount by which the total income exceeds Rs 10,00,000/- Note: Resident individual who has net taxable income not exceeding Rs 500000 is eligible for a tax rebate u/s 87A. The rebate is 100% of tax or Rs.2000 whichever is less .This rebate is to be given before calculation of education cess. B. SURCHARGE: NIL (10% Surcharge is applicable on Total Income exceeding Rs. 1 Crore) C. EDUCATION CESS: Education cess @ 2% shall be levied on the total tax payable by the assessee. D. SECONDARY AND HIGHER EDUCATION CESS: Secondary and Higher Education cess @1% shall be levied on the total tax payable) by the assessee. This is in addition to the Education Cess of 2% . Effectively the total Cess works out to 3% on the total tax payable by the assessee. 1 Rule 3 of the Income Tax Rules is yet to be amended and following are the valuations of perquisites as applicable as on the date of issue of this circular. A. VALUATION OF PERQUISITES 1. Medical Reimbursement Medical reimbursement to an employee for the treatment of employee and his family members in excess of Rs.15000/- is taxable as perquisite in the hands of employee Section 17(2) Explanation 4 (viii)(v) of Income Tax Act 1961. The reimbursement by the employer of expenditure incurred by the employee on his medical treatment or treatment of any member of his family in any hospital maintained by the Government, Local authority or in a Hospital approved by the Government for its employees shall not be treated as perquisite. Payment made by the employer directly (or reimbursement of the expenditure to the employee) to a Hospital which is approved by the Chief Commissioner having regard to prescribed guidelines in connection with the medical treatment of the employee or any member of his family for treatment of prescribed diseases or ailments subject to condition that employee shall attach with his return of income a certificate from the approved hospital specifying the prescribed diseases or ailments for which hospitalization was required and the receipt of the amount paid to the hospital shall not the treated as perquisite Medical treatment of parents-in-law of the employee is taxable in full without any basic exemption because family as per explanation to section 10(5) does not include parentsin-law. 2. LTC As per Section 10(5), subject to rule 2B, of the IT Act, Leave Travel Concession paid for proceeding on LTC to any place in India, amount over and above the amount exempted as given below is taxable as perquisites in the hands of employee. Different situations Where the journey is performed by air Amount exempted Amount of air economy fare of the National Carrier by the shortest route or the amount spent, whichever is less where the journey is performed by rail Amount of air-conditioned First class rail fare by the shortest route or the amount spent, whichever is less Where the places of origin of journey Amount of air-conditioned First class rail fare and destination are connected by rail by the shortest route or the amount spent, and journey is performed by any other whichever is less mode of transport Where the places of origin of journey and destination (or part thereof) are not connected by rail. i) where a recognised transport exists public First class or deluxe class fare by the shortest route by a recognised Public Transport system 2 or the amount spent whichever is less. ii) where no recognized transport exists public Air-conditioned first class rail fare by the shortest route (as if the journey has been performed by rail) or the amount spent, whichever is less. Exemption is available in respect of two journeys performed in a block of four calendar years commencing from 1986. The different blocks are: 2006-2009 (i.e. 01.01.2006 to 31.12.2009) 2010-2013 (i.e. 01.01.2010 to 31.12.2013) If an assessee has not availed LTC during any of the specified four years block period on one of the two permitted occasions(or on both occasions), exemption can be claimed in the first calendar year of the next block(but in respect of only one journey). 3. Valuation of Residential Accommodation ( i.e. private sector or other than Central and State Government Employees) The value of residential accommodation provided by the employer during the previous year shall be determined on the basis provided in the Table below: [Table I] Sl. No. Circumstances Where accommodation is unfurnished Where accommodation is furnished (1) (2) (3) (4) (1) Where the accommodation is provided by any other employer and— (a) where the accommodation is owned by the employer, or (b) where (i) 15% of salary in cities having population exceeding 25 lakhs as per 2001 census; (ii) 10% of salary in cities having population exceeding 10 lakhs but not exceeding 25 lakhs as per 2001 census; (iii) 7.50% of salary other cities, in respect of the period during which the said accommodation was occupied by the employee during the previous year as reduced by the rent, if any, actually paid by the employee. the Actual amount of lease 3 The value of perquisite as determined under column (3) and increased by 10% per annum of the cost of furniture (including television sets, radio sets, refrigerators, other household appliances, airconditioning plant or equipment or other similar appliances or gadgets) or if such furniture is hired from a third party, by the actual hire charges payable for the same as reduced by any charges paid or payable for the same by the employee during the previous year. The value of perquisite as accommodation is rental paid or payable by the taken on lease or rent employer or 15% of salary whichever is lower as by the employer. reduced by the rent, if any, actually paid by the employee. (3) Where the accommodation is provided by the employer specified in serial number (1) or (2) above in a hotel (except where the employee is provided such accommodation for a period not exceeding in aggregate 15 days on his transfer from one place to another) Not applicable. determined under column (3) and increased by 10% per annum of the cost of furniture (including television sets, radio sets, refrigerators, other household appliances, airconditioning plant or equipment or other similar appliances or gadgets) or if such furniture is hired from a third party, by the actual hire charges payable for the same as reduced by any charges paid or payable for the same by the employee during the previous year. 24% of salary paid or payable for the previous year or the actual charges paid or pay- able to such hotel, which is lower, for the period during which such accommodation is provided as reduced by the rent, if any, actually paid or payable by the employee :] Provided that nothing contained in this sub-rule shall apply to any accommodation provided to an employee working at a mining site or an on-shore oil exploration site or a project execution site, or a dam site or a power generation site or an off-shore site which,— (i) being of a temporary nature and having plinth area not exceeding 800 square feet, is located not less than eight kilometers away from the local limits of any municipality or a cantonment board; or (ii) is located in a remote area, “remote area”, for purposes of proviso to this sub-rule means an area that is located at least 40 kilometres away from a town having a population not exceeding 20,000 based on latest published all-India census; Provided further that, where on account of transfer from one place to another, the employee is provided with accommodation at the new place of posting while retaining the accommodation at the other place, the value of perquisite shall be determined with reference to only one such accommodation which has the lower value with reference to the Table above for a period not exceeding 90 days and thereafter the value of perquisite shall be charged for both such accommodations in accordance with the Table. Salary definition Includes the Basic salary, DA, if terms of employment so provide, allowances, bonus or commission payable monthly or otherwise, fees or other taxable allowances (excluding amount not taxable) or any monetary payment (by whatever name called) from one or more employers as the case may be , but does not include 4 (a) D.A. or Dearness Pay unless it enters into the computation of superannuation or retirement benefits of the employee concerned (b)Employers contribution to the P.F. Account of the employee ( c )Allowances which are exempt from payment of tax and (d)The value of perquisites specified in sub-section (2) of section 17 of I.T. Act (e)Any payment or expenditure specifically excluded under provision to sub-clause (III) of clause (2) or provision to clause (2) of section 17. 4. Interest free or concessional loan The value of the benefit to the assessee resulting to the provision of interest free or concessional loan made available to the employee or any member of his household during the relevant previous year by the employer or any person on his behalf shall be determined as the sum equal to the interest computed at the rate charged per annum by the SBI as on 1st day of relevant previous year in respect of loans for the same purpose advanced by it on a maximum outstanding monthly balance as reduced by the interest if any , actually paid by him or any such member of his household. For the financial year 2013-14 the rate of interest of SBI are as follows. Interest rates as on 1st April, 2013 on various loans in Personal Segment advances are as under 1. Home Loans Loan amount Interest rate 2. Cars For New Car only Upto Rs.30 lacs Above Rs. 30 lacs 9.95% 10.10% 10.45% 3. Two wheeler 17.95% 4. Education loans SBI Student Loans* upto Rs.4 Lac – 13.20% Loans above Rs.4 Lac and upto 7.50 lacs – 13.45% Loans above Rs.7.5. Lac- 11.45% 5. Personal loans 18.20% * 0.50% additional concession for girl students w.e.f. 02.03.2009 5. Use of any movable asset The value of any benefit to the employee resulting from the use by the employee or any member of his household of any moveable asset (other than assets already specified in this rule and other than laptops and computers) belonging to the employer or hired by him shall be determined at 10% p.a. of the actual cost of 5 such asset or the amount of rent or charge paid or payable by the employer, as the case may be , as reduced by the amount, if any, paid or recovered from the employee for such use. 6. Transfer of any movable asset The value of benefit to the employee arising from the transfer of any moveable asset belonging to the employer directly or indirectly to the employee or any member of his household shall be determined to be the amount representing the actual cost of such asset to the employer as reduced by the cost of normal wear and tear calculated @ of 10% of such cost for each completed year during which such asset was put to use by the employer and as further reduced by the amount , if any, paid or recovered from employee being the consideration for such transfer. Provided that in case of Computers and Electronic items the normal wear and tear would be calculated @ 50% and in case of Motor Car @ 20% by the reducing balances methods. 7. Valuation of Perquisite in respect of a Sweeper, a Gardener, a Watchman or a Personal Attendant The value of benefit to the employee or any member of his household resulting from the provision by the employer of services of a sweeper, a gardener, a watchman or a personal attendant shall be the actual cost to the employer. The actual cost in such a case shall be the total amount of salary paid or payable by the employer or any other person on his behalf for such services as reduced by any amount paid by the employee for such services. 8 The value of the benefit to the employee resulting from the supply of Gas Electric Energy or Water The value of the benefit to the employee resulting from the supply of gas, electric energy or water for his household consumption shall be determined as a sum equal to the amount paid on that account by the employer to the agency supplying the gas, electric energy or water. Where such supply is made from resources owned by the employer, without purchasing them from any other outside agency the value of the perquisite would be the manufacturing cost per unit incurred by the employer. Where the employee is paying any amount in respect of such services the amount so paid shall be deducted from the value so arrived at. 9. Valuation of Perquisites in respect of free education The value of benefit of the employee resulting from the provision of free or concessional educational facilities for any member of his household shall be determined as the sum equal to the amount of expenditure incurred by the employer in that behalf & not taxable to the extent of Rs. 100/- per month per child.(for a maximum of two children),hostel expenditure per child does not exceed Rs. 300/- p.m (for a maximum of two children). The remaining amount is taxable in all cases or where the educational institution is itself maintained and owned by the employer or where free education facilities for such member of employees household are allowed in any other educational institution by reason of his being in employment of that employer, the value of the perquisite to the employees shall be determined with reference to the cost of such education in a similar institution in or near the locality. Where any amount is paid or recovered from the employee on that account, the value of benefit shall be reduced by the amount so paid or recovered. Provided that where the educational institution itself is maintained and owned by the employer and free educational facilities are provided to the children of the employee or where such free educational facilities are provided in any institution by reason of his being in employment of that employer, 6 nothing contained in this sub-rule shall apply if the cost of such education or the value of such benefit per child does not exceed Rs. 1000/- p.m 10. Amendment of section 17(2) As per Sub-clause (vii) of Section 17(2) , any contribution to an approved superannuation fund by the employer in respect of an employee to the extent it exceeds Rs. 1 Lakh will be treated as perquisites in the hands of the employees. F. EXTERNAL INCOME/SALARY INCOME: 1) 2) Any employee who is in receipt of salary income from any other employer in the Financial Year 2013-2014 may also furnish the details of salary income and tax deducted thereon in Form No.12B of IT Rule 1969 (Ref. Section 192(2) and rule 26A) As per Section 192(2b), if any employee, in addition to salary has received any income chargeable under any other heads of income not being a loss under that head (except loss in case of income from house property), may furnish the particulars of that income and tax deducted at source on such income in a simple statement which should be properly verified by the tax payers in the following form as per rule 26B. FORM OF VERERIFICATION I, ___________________(name of assessee), do declare that what is stated above is true to the best of my information and belief. G. INCOME FROM HOUSE PROPERTY Let out property : Employee having income / Loss under the above head must furnish the following documents duly filled up A simple statement which should be properly verified by the tax payers in the same manner as prescribed by rule 26B as above. Computation sheet of House property along with the following certificates / Receipts. a ) Taxes paid to Local authority during the financial year. b) Certificate of interest on borrowed capital separately each for construction period ( if claimed ) and for current year. Self Occupied : Employee has to furnish the following documents duly filled up A simple statement which should be properly verified by the tax payers in the same manner as prescribed by rule 26B as above. Computation sheet of House property along with the following certificates. a) Certificate of interest on borrowed capital separately each for construction period ( if claimed ) and for current year. It is to be noted that for the loans taken prior to 01/04/99 the deduction of interest is limited to Rs. 30,000/- only and the loans on or after 01/04/99 will carry deduction of Rs. 1,50,000/- only subject to the condition that acquisition or construction is completed within 3 years from the end of the financial year in which the capital was borrowed. 7 When an employee occupies more than one house, only one house as per his choice is treated as Self Occupied and all other houses will be treated as Let Out or Deemed to be Let Out. Joint Ownership : Where residential property is owned by two or more persons and their respective shares are definite and ascertainable , the shares of each such person in the Income from the House Property as computed in accordance with section 22 to 26 of the income tax act shall be included in his total income . As such it is for the employee to declare the definite share in the property in case of joint ownership. Deduction on account of Interest on borrowed capital and Municipal Taxes will be allowed in the same proportion as that of definite and ascertainable share in the House Property. 4. Interest on a fresh loan taken to repay the original loan : Interest on a fresh loan taken to repay the original loan is allowed as deduction under Section 24 (i) (iv) of IT Act, if the second borrowing has really been used merely to repay the original loan and this fact is proved to the satisfaction of ITO. In this regard, employee has to produce documentary evidence for replacement of existing loan (principal amount only) by a fresh loan. H. DEDUCTIONS FROM GROSS SALARY (1) House Rent allowance (Section 10(13A) received by the employee will not be exempt from tax, in case the residential accommodation occupied by the employee is owned by him, or the employee has not actually incurred expenditure on payment of rent. Exemption in respect of house rent allowance is regulated by Rule 2A. The LEAST of the following is exempted from tax, for the employees, who are in receipt of HRA against production of the rent receipt in proof of actual payment. I) An amount equal to 50% of salary, if residential house is situated at Bombay, Calcutta, Delhi or Madras and an amount equal to 40% of salary if residential house is situated at any other place; ii) HRA received by the employee in respect of the period during which residential accommodations occupied by the employee during the previous year; or iii) The excess of rent paid over 10% of salary. Salary for the purpose of computation of exemption of HRA means basis pay + DA + Spl.Pay. For getting HRA exemption Rent Receipt regarding rent paid is to be submitted otherwise whole HRA will be taxable. The amount computed under the provisions mentioned above shall be reduced from gross salary DEDUCTION FROM GROSS TOTAL INCOME 1. Section 80 C: The Provisions are given below:Deduction from Gross total income – Under section 80 C deduction would be available 8 from gross total income. Individual/HUF – only an individual or a Hindu undivided family can claim deduction under Section 80C. Qualifying investment – The investments eligible for deduction under Section 80C are life insurance premium, contribution to provident fund, payment in respect of schemes for non-commutable deferred annuity, Contibution towards 15 year Public Provident Fund, Subscription to National Savings Certificates VIII issue, Contribution to unit linked insurance plan, purchase of infrastructure bonds, payment of tuition fees, repayment of principal amount of housing loans, amount deposited in a fixed deposit for 5 years or more with a scheduled bank in accordance with a scheme framed and notified by the central Govt. , Subscription to any notified bonds of NABARD etc. However, in order to minimize distortions, there are no sectoral caps in the new section and assessee is free to invest in any one or more of the eligible instruments within the overall ceiling specified. With effect from the F.Y.2008-09 the following investments made by the assessee, during the previous year, shall also be eligible for deduction under section 80 C within the overall ceiling of Rs. 1 Lac : a) 5 year time deposit in an account under Post Office Time Deposit Rules, 1981. b) Deposit in an account under Senior Citizens Saving Scheme Rules, 2004. Further it is provided that where an amount is withdrawn by the assessee from such account before the expiry of 5 years from the date of deposit, the amount so withdrawn shall be deemed to be income of the assessee of the previous year in which the amount is withdrawn and is liable to be taxed. Investment out of chargeable income not necessary – Amount invested in these investments would be allowed as deduction regardless of the fact whether (or not) these investable are made out of income chargeable to tax. However, the aggregate deduction under Sections 80C to 80U cannot exceed gross total income. Changes in respect of Life Insurance Premium : For policies issued before 01.04.2012, premium can not exceed 20% of sum assured. And for the policies issued after 01.04.2012 premium can not exceed 10% of the sum assured. However this percentage of 10% has been increased to 15% for policy issued ( on or after 01.04.2013 ) in respect of person: (i)with disability or aperson with severe disability as referred to in section 80U ;or (ii) suffering from disease or ailment as specified in the rules made under section 80DDB Amount deductible under Section 80C – Amount deductible under section 80C is equal to (a) 100 per cent of the “qualifying investment” or (b) Rs.1 lakh whichever is lower. Interest accrued in respect of NSC VIII-Issue – Accrued interest of first 5 years in respect of NSC VIII issue will be part of gross qualifying amount under Section 80C. Interest of NSCs VIII issues which is deemed investment, calculated at the following rates:- 9 AMOUNT OF INTEREST (Rs.) ACCURING ON CERTIFICATE OF Rs.100 DENOMINATION The year for If NSC(VIIIwhich Issue) is interest purchased after accrues 28th Feb,2001 but before March 01,2002 First Year Second Yr. Third Year Fourth Year Fifth Year Sixth Year 9.72 10.67 11.71 12.85 14.10 15.47 If NSC(VIIIIssue) is purchased on or after March 01,2002 but before March 01,2003 If NSC(VIIIIssue) is purchased on or after March 01,2003 but before December,2011 9.20 10.05 10.97 11.98 13.09 14.29 8.16 8.83 9.55 10.33 11.17 12.08 If NSC(VIIIIssue) is purchased on or after December 1, 2011 but before April 1,2012 8.58 9.31 10.11 10.98 11.92 n.a If NSC(VIIIIssue) is purchased on or after April 1,2012 8.78 9.56 10.40 11.31 12.30 n.a. (2) U/s 80 CCC a deduction is allowed to an employee for any amount deposited by him in an annuity plan of LIC of India or an Insurer other than LIC for receiving pension. The deduction is restricted to Rs.1,00,000/-. Deduction under Section 80 C, 80CCC and 80 CCD cannot exceed Rs.1,00,000/-. (3) U/s 80 CCD – deduction in respect of contribution to pension scheme notified or as may be notified by the Central Government. Section 80 CCD is applicable to the following conditions are satisfied:a. b. c. d. The tax payer an individual He is employed by the Central Govt. or any other employer, on or after January 1, 2004. He has in the previous year paid or deposited any amount in his account under a pension scheme notified by the Central Government. The deduction against employee contribution is restricted to 10% of salary of the employee. Deduction under Section 80 C, 80CCC and 80 CCD cannot exceed Rs.1,00,000/-. Deduction U/s 80CCG in respect of Rajiv Gandhi Equity Savings Scheme (RGESS) [Investment Plan Head:- 585] The Finance Bill 2013-14 proposes liberalisation of the Rajiv Gandhi Equity Savings Scheme (RGESS) that was launched in FY 2012-13. The first time investors will now be allowed to invest in mutual funds as well as listed shares. This investment can be done not in one year alone, but in three Consecutive years. The deduction would be available to a new investor whose GTI for the relevant assessment year does not exceed Rs 12 lacs. The existing provisions of section 80CCG, inter-alia, provide that a resident individual who has acquired listed equity shares in accordance with the scheme notified by the Central Government, 10 shall be allowed a deduction of fifty per cent of the amount invested in such equity shares to the extent that the said deduction does not exceed twenty five thousand rupees. With a view to liberalize the incentive available for investment in capital markets by the new retail investors, it is proposed to amend the provisions of section 80CCG so as to provide that investment in listed units of an equity oriented fund shall also be eligible for deduction in accordance with the provisions of section 80CCG. It is proposed to provide that “equity oriented fund” shall have the meaning assigned to it in clause (38) of section 10. It is further proposed to provide that the deduction under this section shall be allowed for three consecutive assessment years, beginning with the assessment year relevant to the previous year in which the listed equity shares or listed units were first acquired by the new retail investor whose gross total income for the relevant assessment year does not exceed twelve lakh rupees. Maximum deduction of Rs. 25,000/- shall be allowed to the First Time Investor on case to case basis, subject to fulfillment of condition prescribed in section 80CCG as amended in Finance Bill, 2013. (4) Under Section 80 D – An individual is allowed the deduction upto Rs.15,000/against the insurance premium for medi-claim policy taken on the health of self, spouse, dependent, parents or dependent children paid out of the income chargeable to tax with the scheme framed in this behalf by the General Insurance Corporation of India or any other insurer and approved by the Insurance Regulatory & Development Authority. Insurance premium paid in relation to senior citizen are eligible for deduction of Rs. 20,000/-. However, the payment of premium made by any mode other than cash shall be eligible for deduction under this section. The above limit of Rs 15000 and Rs 20000 includes Rs 5000 towards preventive health check up and the payment for that can be in any mode including cash. Additionally, from F.Y. 2008-09 a deduction of upto Rs. 15,000 is allowed to an assessee on any payment made to effect or keep in force an insurance on the health of his parents whether dependent on him or not. If the parents are Senior citizen than the amount of deduction allowed is upto Rs. 20,000.The deduction is in addition to existing deduction available to the assessee on medical insurance for himself, his spouse and dependent children.( for more detail refer to section 80D of Income Tax Act) (5) Under section 80 DD deduction of a sum upto Rs.50,000/- shall be allowed (a)for the expenditure incurred by the employee on medical treatment (including nursing), training and rehabilitation of a handicapped dependent or (b) amount paid or deposited under the approved scheme of LIC or UTI or any other Insurer which is approved by the Insurance Regulatory & Development Authority for the maintenance of a handicapped dependent suffering from a permanent physical disability or mental retardation which is to be certified by a physician, surgeon, occultist or psychiatrist of a Government Hospital .Where such dependant is a person with severe disability , the deduction is allowed up to Rs. 1,00,000/- “ person with severe disability”(increased from Rs. 75,000/- till F.Y. 2008-09) means a person with eighty per cent or more of one or more disabilities, as referred to in sub-section (4) of section 56 of the Persons with Disabilities (Equal Opportunities , Protection of Rights and Full Participation) Act, 1995 (1 of 1996 ) (6) Section 80 DDB provides for a separate deduction to a resident assessee being an individual or a HUF for expenditure actually incurred for the medical treatment for an individual himself or wholly/mainly dependent husband/wife, children, parents, brothers and sisters of the tax payers in respect of diseases or ailments which may be 11 specified in the rule the deduction shall be allowed for the amount actually paid or Rs.40000/- whichever is less. The assessee has to submit a certificate in the prescribed form from a prescribed authority (i.e. any doctor registered with the Indian Medical Association with post graduate qualification working in a govt. hospital). Where the expenditure is in respect of the assessee or his dependent relative or any member of HUF of the assessee and who is senior citizen (i.e. atleast 60 years of age at any time during the previous year), then a fixed deduction of Rs.60,000/- or actual expenditure whichever is lower will be available. If any amount is received from an insurer for the treatment for the person mentioned above, then the amount so received shall be deducted from the deduction otherwise available. (7) Deduction under Section 80 E – An individual assessee is allowed deduction in respect of amount paid by him out of his income chargeable to tax by way of interest on loan taken from any financial institutions for the purpose of pursuing higher education (full time studies) for himself or for his “relatives”. “Relatives” has been defined so as to mean spouse and children of the individual. Children may be dependent or independent. The deduction is available for a maximum period of 8 years. From the current F.Y.2009-10, scope of section 80 (E) has been amended to cover all fields of studies (including vocational studies) pursed after passing the Senior Secondary Examination or it’s equivalent. The scope of the expression “relative” has also been extended to cover the student for whom the taxpayer is he legal guardian. (8) Deduction Under Section 80 G is available to any taxpayer for Donation made to any of the institution/fund recognised by Income Tax authority for this purpose. Certain donations are eligible for Deduction @ 100% of net qualifying amount e.g. Donation to PM Relief Fund. Deduction on account of donation to National Children Fund was available up @ 50 % of donation which has been increased to 100 % from FY 201314. (9) Under section 80 GG a deduction in respect of expenditure towards payment of rent for the accommodation occupied by him for the purpose of his own residence, provided the following conditions are satisfied (Employees eligible for deduction under this section may collect declaration form from Estt. Section). He should not be in receipt of HRA at any time during the previous year. He or his spouse, or minor child or the HUF of which he is a member should not own any residential accommodation at the place he resides, performs the duties of his office or he owns any residential accommodation at any other place and the concession in respect of self-occupied house property is not claimed by him in respect of such accommodation. The amount deductible under this section is the least of the following amounts. Rs.2000/- per month. 25% of total income arrived at, before making any deduction for any expenditure under this section. The excess of actual rent paid over 10% of total income(before making any deduction under this section.) (i) (ii) (a) (b) (c) (10) Income Tax Deduction in respect of interest on deposits in savings account under Section 80TTA of Income Tax Act, 1961. For giving additional income tax deduction 12 on Interest on Saving Bank Account new section 80TTA under Income Tax Act,1961 was introduced through Finance Act, 2012. This additional deduction u/s 80TTA is applicable only to individual and HUF on interest income from bank saving account .i.e this deduction is not applicable on interest received on time deposit/term deposit. (11) Under Section 80 U: Deduction upto Rs.50,000/- is available to an employee who (at the end of previous year) is suffering from a permanent physical disability(including blindness) or is subject to mental retardation, being a permanent physical disability or mental retardation specified in the rules made in this behalf, which has the effect of reducing considerably such employee's capacity for normal work. Where such person is with severe disability, the deduction is allowed up to Rs. 1,00,000/- “ person with severe disability” means a person with eighty per cent or more of one or more disabilities, as referred to in sub-section (4) of section 56 of the Persons with Disabilities (Equal Opportunities , Protection of Rights and Full Participation) Act, 1995 (1 of 1996 ). The employee who is claiming for the first time, shall be required o claim this deduction from the assessing officer in the first year. Relief under Section 89 where salary includes arrears or advance of salary Where salary includes arrears of salary, relief under Section 89(1) can be claimed for apportionment of arrears in the respective earlier years. This can be claimed by providing necessary information in Form 10E along with copy of Income tax return and Form 16 for respective years. Duty of Person deducting tax and to furnish prescribed returns to Income Tax authorities As per Provisions Section 200 (3) any person deducting any sum on or after the first day of April, 2005, after paying the tax deducting to the credit of Central Government within the prescribed time, prepare quarterly statements in Form No.24Q & submit to the prescribed Income Tax Authority. Quarters ending Due date th 30 June 15th July 30th September 31st December 15th October 15th January 31st March 15th May In view of the above, employees are requested to submit tax saving details in time so that correct tax is deducted and deposited with income tax authorities and in case of refund the employees have to approach income tax authorities since TDS in respect of salary of each employee is finalized quarterly. For any clarification, please contact DGM. (Fin-Estt)) / Dy. Man(Fin-Estt). (A Sethi) DGM (FIN-ESTT.) Distribution : All Employees of Corporate Centre 13 Pl. Submit before 15th Sep, 2013 POWER GRID CORPORATION OF INDIA LTD. PROPOSED SAVINGS FOR INCOME – TAX COMPUTATION FINANCIAL YEAR 2013-14 (ASSESSMENT YEAR 2014-2015) Following are the details of my proposed savings other than PF/VPF/Pension/LIC being deducted through salary for financial year 2013-2014. PARTICULARS OF SAVING (A) Amount in Rs. Savings u/s80 C 1) LIC ___________ 2) NSC (VIII-Issue) ___________ 3) NSC INTEREST ___________ 4) PPF ___________ 5) ULIP ___________ 6) Equity linked Saving Schemes ___________ 7) Repayment of HBA – Principal (completion of the House should be before 31/03/2009) ___________ 8) Tuition Fee ( Amount paid less Amount reimbursed) ( Maximum up to two children) ___________ Any other Savings u/s 80 C (Please specify) ___________ Infrastructure Bonds/Shares u/s 80 CCF ____________ Pension Scheme of LIC or other Insurer eligible for deduction U/S 80 CCC ____________ (C) Any other deduction/savings other than above (please specify section) ____________ (D) EMPLOYEES DRAWING HRA ( Furnish Actual Rent Receipt with declaration for HRA rebate) (E) Income from other sources _____________ (F) Income / Loss from house property (in case of loss attached computation sheet as per format enclosed) _____________ 9) 10) (B ) Employees joined at Corporate Centre after 01.04.2013 are requested to fill in the following details pertaining to the Financial Year 2013-2014 starting from 01.04.2013. 1. 2. 3. 4. 5. Salary Income (from previous employer/place of posting PF/VPF Contribution to Contributory Pension Scheme IT paid Medical Reimbursement ____________________ ____________________ _____________________ _____________________ _____________________ I hereby declare that proofs for actual savings shall be submitted to Finance Establishment Section by 08.02.2014. The above may be considered for computation of Tax. Date : Place: P&T/Rax NO. ______________________ Signature_________________ Name____________________ Emp.No._____________________ Designation /Dept._____________ PAN No. _______________ 14 Form for sending particulars of Income under section 192(2B) for the year ending 31st March, 2014 1. 2. 3. 4. Name & Address of the Employee Permanent Account No. Residential Status Particulars of income under any head of income other than “Salaries” (not being a loss under any such head other than the loss under the head “Income from house property”) received in the financial year. (Rs.) i) ii) iii) Income from House Property _______________________ (in case of loss, enclosed computation thereof) Profits and gains of Business & Profession _______________________ Income from other sources (Rs.) a) Dividends ________________ b) Interest ________________ c) Other Income (specify) ________________ Total 5. 6. Rs. Aggregate of sub item(I) to (iv) of item 4 (in figures and words) _______________________ ______________________ Tax deducted at source (enclose certificates issued u/s 203) _______________________ (SIGNATURE OF EMPLOYEE) Date: Place: VERIFICATION I, ___________________________,do hereby verify that what is stated above is true to the best of my knowledge and belief. Verified today, the __________ day of ______________ ( SIGNATURE OF THE EMPLOYEE) Date: Place: P&T/RAX No. Emp.No. Designation/Deptt. 15 COMPUTATION OF INCOME FROM HOUSE PROPERTY Name of Assessee : Name of the owner : Percentage of definite share of owner ( In case of Joint Owner ) Address of Property Type of Property ( Tick for which is claimed) Let Out Self Occupied Deemed to be Let Out Amount 1. Annual Value ( In case of Let out Property take 100 % Value as reduced by the vacant period ) ( In case of Self Occupied property Annual Value will be NIL 2. Less : 3. Municipal Taxes as levied by Local authority and paid for the above property Net Annual Value 4. Less : Standard Deduction @ 30% of net annual value 5. Less : Interest on Borrowed capital * Please specify if interest is being claimed Date of Completion /Possession ___________ Date of Loan and Amount taken before 31/03/99 __________ Date of Loan and amount taken after 31/03/99 ___________ 6. Income/Loss from House property This is to certify that the particulars furnished above has been based on documentary evidence and are correct. It is also certified that the loan is taken for construction/purchase of the property to the extent of the definite share( as declared above) and is being repaid by me on which the interest is being claimed . In case of any error I shall be responsible for any wrong calculation /deduction of Income Tax for the Financial Year 2013-2014. Signature Name Employee No. DesignationDeptt. P&T/Rax No. Note : 1. Please enclosed all the relevant documents in support of Annual Value, Taxes, and Interest on Borrowed capital. 2. Executives availing Self lease must also furnish this format. 3. In case of more than one House Property, separate computation to be submitted for each house *In case of Joint Ownership, deduction on account of Interest on borrowed capital and Municipal Taxes will be allowed in the same proportion as that of definite and ascertainable share in the House Property. 16 Pl. Submit before 8th Feb., 2014 POWER GRID CORPORATION OF INDIA LIMITED CORPORATE FINANCE ESTABLISHMENT DETAILS OF SAVINGS FOR INCOME TAX CALCULATIONS FOR THE FINANCIAL YEAR 2013-2014 NAME ______________________________ EMP.NO. _____________________________ DESIGNATION _______________________ DEPTT. ______________________________ RAX/PHONE NO.______________________ PAN_No. _____________________________ RESIDENTIAL ADDRESS______________________________________________________ 1. LIC PREMIUM (Other than salary deduction) Policy No. Sum Assured Premium Amount 1. ______________ ______________ ___________________ 2. ______________ ______________ ___________________ 3. ______________ ______________ ___________________ 4. ______________ _______________ ___________________ Total 2. PUBLIC PROVIDENT FUND _ 1. Account No. ______________ Amount __________________ 2. ______________ ___________________ 3. ______________ ___________________ 4. ______________ ___________________ Total 3. 805 806 UNIT LINKED INSURANCE PREMIUM Policy No. _ Amount 1. ______________ __________________ 2. ______________ ___________________ 3. ______________ ___________________ Total 17 807 4. NSC VIII issue 1. Certificate No. ______________ Issue Date _____________ Amount __________________ 2. ______________ _____________ ___________________ 3. ______________ ______________ ___________________ 4. ______________ ______________ ___________________ Total 5. INTEREST ON NSC VIII Issue Certificate No. Purchased Date Totall NSC’s Accrues Intt. per Rs.1000/- ______________ 2. ___________ ________ __________ __________ ______________ 3. ___________ ________ __________ __________ ______________ 4. ___________ ________ __________ __________ ______________ 809 EQUITY LINKED SAVING SCHEME/ MUTUAL FUND Deposit date Bank/Intt. Amount 1. ______________ _____________ __________________ 2. ______________ _____________ ___________________ 3. ______________ ______________ ___________________ 4. ______________ ______________ ___________________ Total 7. Total Interest 1. ___________ ________ __________ __________ Total 6. 808 TUITION FEES Amount Paid 811 Amount Reimbursed Net Amount 1. Child Name ______________ _____________ ___________________ 2 Child Name ______________ _____________ ___________________ (Maximum for two Children) Total 8. (JEEVAN DHARA, Jeevan Akshay) 1. Account No. ______________ Sum assured _____________ Amount ___________________ 2. ______________ _____________ ___________________ Total 9. 819 814 DEPOSIT UNDER NHB SCHEME Account No. Deposit Date 1. ______________ _____________ ___________________ 2. ______________ _____________ ___________________ Total 18 815 Amount 10. Payment made for purchase/ Purchase/Completion construction of house Construction Date (In case of completion of construction of House is before 31.3.2009) Total 11. Amount invested in eligible shares/ Debentures (Infrastructure bonds of IDBI, ICICI etc.) No. and Date Amount __________________ ________________________ __________________ ________________________ Total 12. Amount deposited under Annuity Plan for Pension (80 CCC) Deposit Date ______________ 813 A/c No. _____________ __________________ Total 13. 803 Amount _________________ ________________________ 812 Subscription to long-term Infrastructure Bonds (80 CCF) Total 14. 15. 16(a). (b) (c). 17. Payment for Medi Claim (80 D) Total 820 Total 821 Total 703 Total 704 Payment of interest on education loan (80 E) Amount withdrawn from NSS IT Deducted on NSS Any other Details (e.g. U/S 80DD,80DDA, 80GG, 80U (Attach separate sheet if necessary) ____________________________________________ Income/Loss from House Property Income 712 Loss 712(-) (Please attach Computation) 19 Employees joined at CC on Transfer/Fresh after 01.04.2013 are requested to fill in the following details for the period before joining Corporate Centre pertaining to the Financial Year 2013-2014 starting from 01.04.2013 Name of the employee (For those whose joined after 01/04/2011 at CC) 1. 2. 3. 4. 5. _____________________________ Salary Income (From previous employer/place of posting) Total 701 Total 818 Total 801 Total 704 Total 753 PF & VPF Contribution to Contributory Pension Scheme IT Paid Total Medical Reimbursement This is to certify that:No one else has claimed deduction in respect of savings shown above which have been made in names other than myself. Where the payment for savings mentioned above has been made by cheque my bank account has been debited for that. The house against which the rebate is being claimed was completed on ____________as per the completion/possession certificate. I have availed an amount of Rs.________________ as LTC for 3rd child born after 01.10.1998 and that journey was performed after 1.04.08. The particulars furnished in this form are true and correct and in case of any error, I shall be responsible for any wrong calculation/deduction of Income Tax for Financial Year 2013-2014. SIGNATURE :____________________________________ PLACE: DATE: NAME__________________________________________ (IN BLOCK LETTERs) 20 To, Deputy General Manager (Finance/Establishment) Power Grid Corporation of India Limited Gurgaon Dear Sir, I __________________________________________________ _________________________ hereby declare that :- employed as I am in receipt of House Rent Allowance during April, 2013 to March, 2014. I have paid rent @ Rs.______/- p.m. for the period from ____________ to ___________ and shall be paying the same till March, 2014 in respect of House No.______________________________________________ ______________________________ occupied by me and the same house is not owned to me or my spouse / dependent. I may be allowed house rent rebate for the period from April, 2013 to March, 2014 under the Income Tax Act. Signature Name Employee No. Designation / Deptt. P&T/Rax No. Date: This is to certify that the particulars furnished above has been based on documentary evidence and are correct. In case of any error I shall be responsible for any wrong calculation /deduction of Income Tax for the Financial Year 2013-2014. Signature:____________________ Name_______________________ Date: Emp.No._____________________ Designation____________________ Deptt._______________________ P&T &Rax No.________________ PAN No. _________________ Note : 1. Please enclose the Rent Receipts 21 FORM NO.10E (See rule 21 AA) Form for Furnishing Particulars of Income under Section 192(2A) for the year ending 31 st March, 2014 for claiming relief under Section 89(I) by a Government servant or an employee in a Public Sector Undertaking Name & Address for the Employee…………………………………………………………………… ……………………………………………………………………………………………………………. Permanent Account Number ………………………………………………………………………….. ……………………………………………………………………………………………………………. Residential status……………………………………………………………………………………….. Particulars of Income referred to in rule 21A of the Income Tax Rules, 1962 during the previous year relevant to Assessment year………………….. 1 (a) Salary received in arrears or in advance in accordance with the provision of sub-rule (2) of rule 21-A (b) Payment in the nature of gratuity in respect of past services, extending over a period of not less than 5 years in accordance with the provisions of sub-rule(3) of rule 21A (c) Payment in the nature of compensation from the employer or former employer at or in connection with termination of employment after continuous service of not less than 3 years in accordance with the provisions of sub-rule (4) of rule 21A. (d) Payment in commutation of pension in accordance with the provisions of Sub-rule (5) of rule 21A 2. Detailed particulars of payments referred to above may be given in Annexure I,II, IIA III or IV as the case may be. …………………………………………….. Signature of the employee VERTIFICATION I ……………………………….do hereby declare that what is stated above is true to the best of my knowledge and belief. Verified today the ………………… day of ………………….. …………………………………………….. Signature of the employee Place…………….. Date…………….. 22 ANNEXURE-I (See rule 2 of Form No.10E) ARREARS OR ADVANCE SALARY Total income (excluding salary received in arrears or advance salary) Salary received in arrears or advance Total income (as increased by salary received in arrears or advance) (Add item 1 and item 2) Tax on total income (as per item 3) Tax on total income ( as per item 1) Tax on salary received in arrears or advance (difference of item no.4 and item no.5) Tax computed in accordance with table “A” (brought from Column 7 of Table “A”) Relief under Section 89 (indicate the difference between the amounts mentioned against items 6 & 7) TABLE “A” (see item 7 of Annexure-I) Previous year(s) 1 Total income of the relevant previous year (Rs.) Salary received in arrears or advance relating to the relevant previous year as mentioned in column (1) (Rs.) Total income (as increased by salary received in arrears or advance of the relevant previous year mentioned in column 1[Add column (2) and (3)] (Rs.) Tax on total income (as per column 2) (Rs.) Tax on total income (as per column 4) (Rs.) Difference in tax (Amount under column 6 minus amount under column (5) (Rs.) 2 3 4 5 6 7 23 Financial Year 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 Income Tax Rate 0-50000 Nil 50001-60000 10% 60001-150000 1000+20% 150001 & above 19000+30% Surchage on tax payable rate Taxable income upto 60000 Nil Taxable income above 60000 2% 0-50000 Nil 50001-60000 10% 60001-150000 1000+20% 150001 & above 19000+30% Surchage on tax payable rate Taxable income upto 60000 Nil Taxable income above 60000 5% 0-50000 Nil 50001-60000 10% 60001-150000 1000+20% 150001 & above 19000+30% Surchage on tax payable rate Taxable income upto 850000 Nil Taxable income above 850000 10% Standard Deduction For gross income 150000 or less 0-50000 Nil 50001-60000 10% 60001-150000 1000+20% 150001 & above 19000+30% Surchage on tax payable rate Taxable income upto 850000 Nil Taxable income above 850000 10% Education cess @2% on total tax payable (including surcharge if any) is applicable 0-100000 Nil 100001-150000 10% 150001-250000 5000+20% 250001 & above 25000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @2% on total tax payable (including surcharge if any) is Applicable For gross income 500000 or less 40% of Gross salary or Rs.30000 whichever is less Gross income above 500000 Rs.20000 Gross income 150001 to 300000 Gross income 300001 to 500000 Gross income above Rs.500000 For gross income 150000 or less Gross income 150001 to 300000 Gross income 300001 to 500000 Gross income above Rs.500000 1/3rd of Gross salary or Rs.30000 whichever is less Rs.25000 Rs.20000 Nil 1/3rd of Gross salary or Rs.30000 whichever is less Rs.25000 Rs.20000 Nil For gross income 500000 or less 40% of Gross salary or Rs.30000 whichever is less Gross income above 500000 Rs.20000 No Standard Deduction for the FY 2005-06 Tax rate for Women is as follows 0-135000 Nil 135001-150000 10% 150001-250000 3500+20% 250001 & above 23500+30% 24 2006-2007 2007-08 2008-09 0-100000 Nil 100001-150000 10% 150001-250000 5000+20% 250001 & above 25000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @2% on total tax payable (including surcharge if any) is Applicable 0-110000 Nil 110001-150000 10% 150001-250000 4000+20% 250001 -1000000 24000+30% Above 1000000 249000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable 0-150000 Nil 150001-300000 10% 300001-500000 15000+20% 500001 -1000000 55000+30% Above 1000000 205000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable No Standard Deduction for the FY 2006-07 Tax rate for Women is as follows 0-135000 Nil 135001-150000 10% 150001-250000 3500+20% 250001 & above 23500+30% No Standard Deduction for the FY 2007-08 Tax rate for Women is as follows 0-145000 Nil 145001-150000 10% 150001-250000 500+20% 250001 -1000000 20500+30% Above 1000000 245500+30% No Standard Deduction 0-180000 Nil 180001-300000 10% 300001-500000 12000+20% 500001 -1000000 52000+30% Above 1000000 202000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable 25 2009-10 0-150000 Nil 150001-300000 10% 300001-500000 15000+20% 500001 -1000000 55000+30% Above 1000000 205000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable 2010-11 0-160000 Nil 160001-300000 10% 300001 -500000 14000+20% Above 500000 54000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable 2011-12 0-160000 Nil 160001-500000 10% 500001 -800000 34000+20% Above 800000 94000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable No Standard Deduction Tax rate for Women is as follows 0-180000 Nil 180001-300000 10% 300001-500000 12000+20% 500001 -1000000 52000+30% Above 1000000 202000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable No Standard Deduction Tax rate for Women is as follows 0-190000 Nil 190001-300000 10% 300001 -500000 11000+20% Above 800000 51000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable No Standard Deduction Tax rate for Women is as follows 0-190000 Nil 190001-500000 10% 500001 -800000 31000+20% Above 800000 91000+30% Surchage on tax payable rate Taxable income upto 10,00,000 Nil Taxable income above10,00,000 10% Education cess @3% on total tax payable (including surcharge if any) is Applicable 26 2012-13 0-2000000 Nil 200001-500000 10% 500001-1000000 30000+20% 1000001 -above 130000+30% Education cess @3% on total tax payable is Applicable No Standard Deduction 2013-14 0-200000 Nil 200001-500000 10% 500001-1000000 30000+20% 1000001 -above 130000+30% Education cess @3% on total tax payable is Applicable Note: Resident individual who has net taxable income not exceeding Rs 500000 is eligible for a tax rebate of 100% of tax or Rs.2000 whichever is less. No Standard Deduction 27