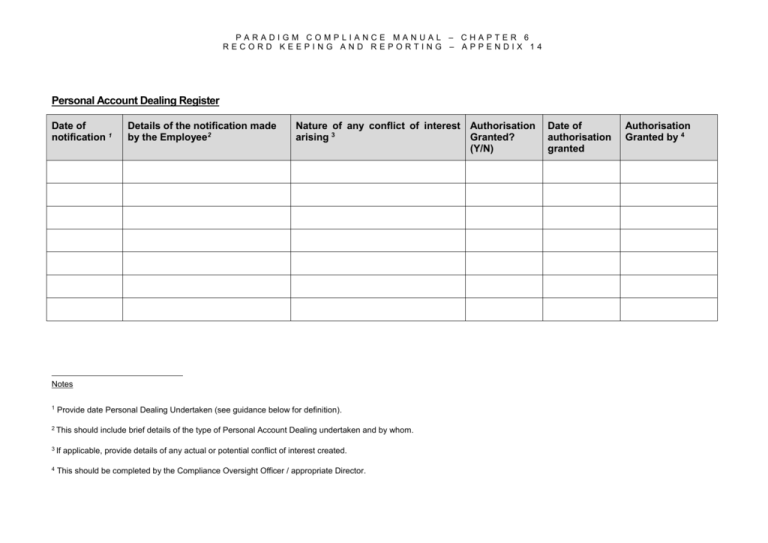

Personal Account Dealing Register

advertisement

PARADIGM COMPLIANCE MANUAL – CHAPTER 6 RECORD KEEPING AND REPORTING – APPENDIX 14 Personal Account Dealing Register Date of notification 1 Details of the notification made by the Employee2 Nature of any conflict of interest Authorisation arising 3 Granted? (Y/N) Notes 1 Provide date Personal Dealing Undertaken (see guidance below for definition). 2 This 3 If 4 should include brief details of the type of Personal Account Dealing undertaken and by whom. applicable, provide details of any actual or potential conflict of interest created. This should be completed by the Compliance Oversight Officer / appropriate Director. Date of authorisation granted Authorisation Granted by 4 PARADIGM COMPLIANCE MANUAL – CHAPTER 6 RECORD KEEPING AND REPORTING – APPENDIX 14 Guidance The regulator’s requirements concerning ‘Personal Account Dealing’ are intended to ensure that a firm’s customers are not disadvantaged by the personal dealings of the firm’s relevant persons (including dealings undertaken by a relevant person’s ‘associate (e.g. spouse) on their behalf). The rule require that firms establish, implement and maintain adequate arrangements aimed at preventing activities giving rise to a conflict of interest, contravening the Market Abuse Directive or the misuse or improper disclosure of confidential information. 1. Personal Account Dealing is covered in section 11.7 of COBS. It is defined as a transaction for the account of a relevant person, or his associate, in a designated investment other than: (a) a transaction in a life policy; or (b) a transaction in a unit in a regulated collective investment scheme; or (c) a discretionary transaction if there is no prior communication with the employee and the discretion is not exercised by the firm Therefore, whilst the definition exempts much of the investment business undertaken by member firms (i.e. life policy contracts and regulated collective investment schemes), the requirement will still be applicable to other investment types for which most members will also hold FCA permissions – e.g. ‘shares’. Consequently, members will need to ensure they implement Personal Account Dealing procedures for these other investment types. 2. This Personal Account Dealing procedure sets out the requirements that staff acting for or on behalf of clients must follow in order to prevent any conflict of interest. They also refer to preventing an individual from entering into transactions prohibited under the Market Abuse Directive, in relation to inside information, and also the misuse or improper disclosure of confidential information. 3. A relevant person, to whom the Personal Account Dealing rules apply, is considered to be: (a) a director, partner or equivalent, manager or appointed representative (or, where applicable, a tied agent) of the firm; or (b) a director, partner or equivalent, or manager of any appointed representative (or where applicable, a tied agent) of the firm The rules will only apply to other employees to the extent that they are involved in the provision of designated investment business. The rules also apply in respect of outsourcing arrangements. 4. A firm must have arrangements in place to ensure they receive notification of any personal account dealing and a record is retained of this, along with any authorisation or prohibition in connection with such a transaction.