Sample Exam Questions

advertisement

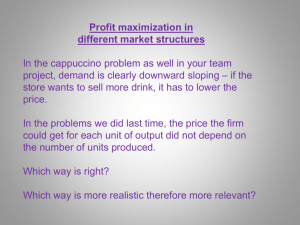

Sample Exam Questions Economics 503 Microeconomics 1. Assume that the newspaper market in Hong Kong is characterized by monopolistic competition. The marginal cost of producing South China Morning Post and Ming Pao are approximately equal. SCMP sells at a price of HK$8 per copy while Ming Pao sells at a price of $6 per copy. In the long run, would we expect that SCMP was earning higher profits or lower profits than Ming Pao? Explain why or why not? Each of these newspapers are being produced in markets with differentiated goods and free entry. If SCMP were indeed earning higher profits, new English language newspapers would enter the market pushing down the demand for SCMP until the price was equal to average cost. This must mean that the average cost of producing the SCMP is greater than the average cost of producing Ming Pao. This could be because the fixed costs are spread over many customers. 2. As an experiment, McDonalds raises the price of two of its sandwiches. The following chart shows the sales per restaurant per week Big Mac Filet o’ Fish Before P $12 $20 After P $15 $24 Q 1200 500 Q 800 450 Calculate the elasticity of demand for these two sandwiches Calculate the marginal cost of producing each sandwich is HK$10. What is the profit maximizing price for each sandwich? Q2 Q1 .The elasticity of demand is Q2 Q1 2 P2 P1 . In the case of the Big Mac, the price P2 P1 2 elasticity of demand % Change in Price % Change in Quantity Elasticity Big Mac 0.222222 -0.4 -1.8 Filet o Fish 0.181818 -0.10526 -0.57895 In the case of the Big Mac, the rule of thumb suggests P 1 1.8 2.25 With a marginal cost of 10, the profit maximizing MC 1 ( 1 ) .8 elasticity price is 22.50. In the case of the Filet o’ Fish, demand is inelastic. Raising the price increases revenues. McDonalds should raise the price at least to 24 and beyond until the elasticity becomes less than 1. 3. A person has $100 to spend on either apples or oranges. The price of apples is $5 and the price of oranges is $10 dollars. What is the ratio of the marginal utility of apples relative to the marginal utility of oranges when the consumer is choosing the optimal amount of apples and oranges? Draw the budget constraint, clearly marking the intercepts. Draw the indifference curve at the optimal combo of MU APPLES P 5 APPLES .5 apples and oranges. MU ORANGES PORANGES 10 Oranges 10 [ORANGES*,APPlES*] Apples 20 4. The following table shows information on the Long run average total cost curve and the demand curve. Plot the following data on a graph. Show the areas of economies and diseconomies of scale and constant returns to scale. What is the minimum efficient scale? What is the scale of production in this economy? Quantity LR ATC 1 33 2 27 3 25 4 25 5 30 6 38 7 50 Price Quantity 50 43 36 29 22 15 8 1 2 3 4 5 6 7 Scale Economies LR ATC Scale Diseconomies Constant Returns to Scles Q 3 4 5. Consider two industries: gravel and gourmet restaurants. The first produces an undifferentiated product while there are a large number of potential types of cuisine, each with its own particular qualities. There are not large barriers to entry into either industry. Explain in which industry firms will be operating at a scale closest to an efficient level. Why? The gravel industry is likely to be perfectly competitive. Firms will be operating at a scale where price equals marginal cost. In the long run, firms will change scale until the average cost equals price. Marginal cost equals the average cost where average cost is at a minimum. Firms operate at a scale that minimizes average cost at any level of demand. The gourmet industry is monopolistically competitive. Firms will charge a price higher than average cost. In the long run, firms will enter or exit until price equals average cost. But marginal cost will be below price which is below average cost. When marginal cost is below average cost, average cost has not reached its minimum. Firms will produce at a scale below the scale the minimizes average cost. Macroeconomics 6. What are the three types of policy lags? Is the combined lag likely to be longer for fiscal or montetary policy? The lags are a. Recognition Lag b. Administrative Lag c. Impact Lag Administrative lags for fiscal policy are likely to be so long, that the lag for fiscal policy is longer. 7. Which will cause a larger short-run increase in prices, an anticipated or unanticipated increase in aggregate demand? Why? Will they cause the same increase in prices in the long run? A shift out in the aggregate demand represents consumers willingness to pay a higher price for any level of output. If this comes as a surprise, there will be some long-term contracts signed that will not take higher price levels into account. If firms with fixed input prices can sell their production at higher prices, the profit maximizing scale of production will increase. But with more goods produced, the higher demand will not translate 100% into higher prices. P SRAS 3 P****=PE*** 2. Unanticpated Demand Shift P** 2 3. Anticipated Demand Shift P*=PE 1 ´ YLR AD AD GDP 8. Suppose that the central bank increases the money supply. Assume that the output level is below the potential GDP before the increase of money supply.) In order to increase money, the central bank uses the open market operation. Explain what the 10 central bank should do in the open market operation. How does the central bank increase the monetary base and money supply? The central bank will need to conduct an open market purchase of government bonds. They will pay money for the bonds which will increase the money holdings of the banks who will lend this money. The money will circulate through the banking system creating multiple bank deposits which are part of the money supply. 9. Suppose that the change of money supply is not expected by the public and that the increase of money supply is not enough to achieve the potential GDP in the short run. Describe the short-run equilibrium, and the transition to the new long run equilibrium by using AD/AS diagram and money market diagram. What happens to the output, the price levels, and the resource prices? P * P =P P** SRAS YLR E SRAS´ 1. Output below potential 2. Open Market Purchase 3. Self-correction Mechanism 2 1 3 ´ AD AD GDP An unexepected increase in the money supply will push interest rates in money markets down. Households will attempt to push the extra money into the loanable funds market until the interest rate is low enough that people are willing to hold the extra money. Lower interest rates will increase demand for output. This will push up price level and increase production. But not enough to get output back to potential or prices back up to expectations. Input prices are still high. Overtime, contracts will be renegotiated to reduce input costs. As costs come down, prices will drop and consumer will be able to increase production. i LD ´ LS 1 2 MD Loanable Funds 10. Suppose that the central bank increases the money supply and that this change is expected. The output level is at the potential GDP before the increase of money supply. Describe the short-run equilibrium, and the transition to the new long run equilibrium by using AD/AS diagram. What happens to the output, the price levels, and the resource prices? The money supply increases as expected. This would push up the willingness to pay money for any level of goods. But input firms expect high prices so they demand high prices for their own goods. In the short run, households are willing to pay higher prices for goods but producers demand higher prices to produce the same amount. The economy smoothly moves to higher price levels in the short run and long run. P SRAS 2 P****=PE*** 2. Anticipated Demand Shift P** P*=PE 1 ´ YLR AD AD GDP