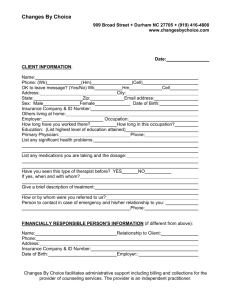

Senior Management Questionnaire

advertisement

CORPORATE POLICY 2-3-2 - ASSETS MANAGEMENT QUESTIONNAIRE Employee Name:________________________ Pursuant to Policy 2-3-2 on Assets, the relocation of assets to sites off CBC/Radio-Canada premises must be authorized in writing and supported by appropriate documentation. Managers/employees must ensure that adequate controls are in place to safeguard such assets. Assets located off CBC/Radio-Canada premises must be physically verified at least once a year and copies of such lists must be sent to Human Resources to ensure recovery if/when the employee leaves the Corporation. Accordingly Senior Management is asked to complete the following questionnaire. If you have other goods or receive other services not described herein, please add them to the list. Assets off CBC/Radio-Canada Premises (must be tracked in SAP) 1. Do you have any of the following CBC/Radio-Canada paid assets (at home or mobile)? List them on the chart below. Type Yes/No Manufacturer Model Barcode Asset description Serial number Cost centre Plant Television Radio Fax machine Desktop Computer Laptop Computer Printer Sirius Satellite Receiver CBC/Radio Canada Car or Truck Other NOTE: All assets must have an asset tag/bar code before submitting to Finance & Administration. Please contact Finance & Administration if new asset tags/bar codes are required before submitting report. Mobile assets 2. Do you use any of the following CBC/Radio-Canada paid assets? Type Cell Phone Personal Digital Assistants (PDAs) (i.e. palm pilots, blackberries, etc) Other Yes/No If yes, Describe Serial number Must be Tracked in SAP Yes/No No No No Services 3. Do you receive any services paid by CBC/Radio-Canada and not provided for in a written agreement with CBC/Radio-Canada? Type Yes/No If yes, Describe Monthly cost Must be Tracked in SAP Yes/No Cable Television No Satellite Television No Sirius Satellite Service No Personal Limo service No Telephone or Fax line No Other No Verifying with your direct reports 4. Do you request/receive any similar reporting from your direct and indirect reports for the same kind of information. Type Yes/No If yes Describe frequency Indicate whether sent to HR department Yes/No Direct reports Their direct reports NOTE: It would be preferable to submit electronic copies to Finance & Administration to allow for easier updating of SAP, however, hard copies are also acceptable. Signature of CBC/Radio-Canada Employee/Manager/Supervisor/Officer Date CORPORATE POLICY 2-3-2 - ASSETS PROCEDURES AND GUIDELINES The following sections of Corporate Policy 2.3.2 – Assets – outline the procedures & guidelines and roles and responsibilities pertaining to Assets off CBC premises. 4.5 ASSETS AND/OR SERVICES PAID BY THE CORPORATION LOCATED OFF CBC PREMISES GUIDELINES – ACCEPTABLE USE OF THE CORPORATION’S ASSETS/PAID SERVICES Operational requirements may require CBC staff to work off CBC premises and as such be required to either work with and/or have access to CBC assets and/or paid services off CBC premises. This includes, but is not limited to, such assets/paid services as: Personal Computers (PCs) including laptops, printers, etc. Access to CBC systems (i.e. SAP, Intranet, etc.) Access to Internet services Access to non CBC systems/services (i.e. satellite and cable services) Mobile communication devises (i.e. cell phones, satellite phones, etc.) Personal Digital Assistants (PDAs) (i.e. palm pilots, blackberries or similar types of equipment) Vehicles Other work tools/assets as approved by media/support Vice Presidents It is the responsibility of individual managers to determine whether or not employees require the use of and/or access to CBC assets and/or paid services located off CBC premises. The following should be considered in making such decisions: Is the employee required to work outside of normal business hours? Is the employee required to travel on a regular basis for work? Does the individual manager or other CBC staff need to reach the employee on short notice and/or outside normal business hours? Is the employee required to be on call? Have special work-hour arrangements been previously agreed to for the employee? It is the responsibility of individual managers to ensure that: The Corporation’s assets and/or services paid by the Corporation are used by employees primarily for CBC business The relocation of such assets off CBC premises are authorized in advance in writing and supported by appropriate documentation (a list of the individual assets, the asset bar code, and the address of the off premises location) Such assets are recovered from the employee when they leave the Corporation and that paid services are cancelled Adequate controls are in place to safeguard such assets. All such assets and/or services paid by the Corporation under their area of responsibility are inventoried and certified at least once a year If they manage such assets in SAP, that such assets are identified in the designated field as “OP”, which is the code to identify “Off Premises” assets All other low value attractive assets, as per the lists approved by Senior Management are managed and tracked in SAP – refer to list in Appendix D. (Note: it is the responsibility of the individual managers and not Finance and Administration to maintain input, update and delete the approved list of low value assets, however, if managers provide Finance with an approved Write-Off/Disposal form and a list of low value assets to be deleted, Finance will delete them.) The documentation pertaining to the inventory is made available on request for audit purposes A permanent form of CBC identification (bar code or LVA asset tag) is inscribed on each asset to identify it as CBC property Finance and Administration is advised in a timely manner of all transfers, write-off, trade-in, loss and disposal of all assets managed in SAP and located off CBC premises Senior Management reporting directly to the President must complete an annual disclosure form attesting to which assets, and/or services paid by the Corporation, which they use and/or have access to off CBC premises, and to the control they exercise over their own management for such assets within their components and submit such form to the VP & CFO who will ensure that a copy is sent to Human Resources to be maintained in their files, and a copy to Finance and Administration to update SAP. Human Resources will ensure that such assets are recovered from the respective Senior Manager and any services paid by the Corporation are cancelled when that manager leaves the Corporation. When assets are recovered and services cancelled Human Resources will advise local Finance and Administration who will update SAP accordingly. It is the responsibility of each Vice Presidential component to ensure that all employees under their area of responsibility complete the disclosure form and each respective manager will be responsible for recovering such assets from employees reporting to them when they leave the department and/or Corporation. With the exception of the disclosure forms for Senior managers reporting directly to the President, copies of all forms should be sent to the Senior Finance and Administration Officers in their respective Network/Region/Location, who will forward such copies to their respective Network Finance and Administration office in order to update SAP. 15. BUSINESS RULES AND GUIDELINES - CAPITAL ASSETS (Includes Assets off CBC Premises) As a general rule, capital assets must be processed through Supply Management. Purchases of Real Estate will be negotiated and processed by the Real Estate Division. Supply Management and Shipping and Receiving departments will capture all the information required to track, record and manage capital assets in SAP (i.e. make, model, serial #, etc.). Shipping and Receiving will affix a bar code upon receipt of the asset and update SAP Standard descriptions for each class of assets must be used It is the ultimate responsibility of managers to ensure that all the required information is provided to Finance and Administration, including the assignment of the bar code if the Purchasing or the Shipping and Receiving departments did not obtain it Managers are responsible for the tracking and management of such assets under their area of responsibility Managers are responsible to ensure that capital assets are physically verified / inventoried at least once every five years The manager responsible must approve transfers, write-offs and disposals and process them through Finance & Administration using electronic forms on the Intranet. Local Finance & Administration should be copied on all correspondence on transfers and writeoffs, including assets on and off CBC premises 16. BUSINESS RULES AND GUIDELINES - NON-CAPITAL - LOW VALUE ASSETS (LVA) (Includes Assets off CBC Premises) Media and Support management will establish lists of non-capital assets to be tracked and managed by all managers under their area of responsibility in SAP (see Appendix D). Where SAP is used to track and manage such assets, managers should be aware that, if they input non-capital assets in SAP, they must also remove them when required In order to assist in the tracking and management of non-capital assets, managers should use the Supply Management department in the purchase of such assets. Managers will determine which low value assets will be bar coded, tracked and managed and will advise Supply Management when they submit their “Request to Purchase” Shipping and Receiving departments will endeavor to capture all the information required to track, record and manage non-capital (attractive) assets in SAP (make, model, serial #, etc.). However, it is the ultimate responsibility of managers to capture all the required information if not obtained by Shipping and Receiving, including the assignment of the bar code With the exception of the assets listed in Appendix D and all assets located off CBC premises, which must be physically verified annually, managers must physically verify all other LVA assets at least once every five years. Managers must control transfers and disposal of such assets. The electronic Transfers and Write-off forms in Appendix E are also to be used for non-capital assets.