Accounting Syllabus

advertisement

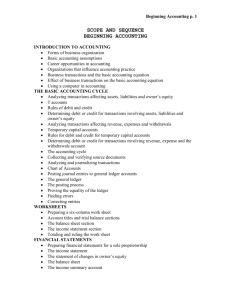

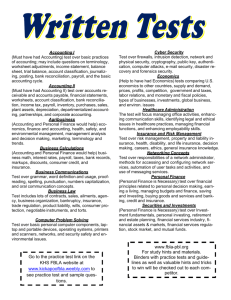

WESTWOOD HIGH SCHOOL ROP-Computerized Accounting 2009-2010 Course Syllabus Teacher: Mr. Milt Apple Work Phone: 256-3235 ext.3006 Email: mapple@westwoodusd.org Classroom: Business Room Text: Glencoe Accounting Glencoe Accounting Working Papers Course Description: Glencoe Accounting provides complete coverage of three types of businesses—proprietorship, partnership, and corporation. Each type of business is presented in a complete accounting cycle covering analyzing transactions, journalizing, posting, petty cash, financial statements, and adjusting/closing entries. Students will have extensive training in accounting theory (the why) and accounting procedures (the how) using an entrepreneurial approach. Students will receive thorough instruction in accounting terminology, and financial statement analysis. Computerized accounting will be included as much as possible. Students will acquire entry-level accounting skills for bookkeeping and accounting clerk positions. Students will also be prepared for financial accounting courses at the college level. Homework: Be prepared for at least 15-30 minutes of homework every night. Please be sure to look over your homework before you leave class so you can be sure you understand the assignment and its content. “Not understanding” is an unacceptable excuse for not doing homework. Homework is due at the beginning of class on the due date. If attending a school field trip or activity, homework that is due the day of the trip must be turned in before going on the trip. Late homework will reduce your grade significantly! Absenses/Make-up work: A student is expected to make-up all work that is missed while absent. It is the student’s responsibility to find out what work was missed. It is a good idea to have a “buddy system” or a friend to call. Attendance: Attendance (reporting to work as scheduled, on time, and ready to work) is extremely important. It is one of the top career performance standards, therefore, it is crucial that you be in class and on time! Responsibility: It is your responsibility to bring pencils with erasers to class everyday, do not use pen in Accounting! You have to be prepared to do your job at work. Neatness: Quality, not quantity! If your work is not neat, points will be deducted. Take pride in your work! Cheating: Cheating will not be tolerated. A student will receive a zero for that particular assignment. Parents will be called and administrators will be notified. Grading Evaluation: Your grade will be based upon daily assignments, accounting dictionary, group assignments, quizzes, tests, projects, presentations, and the final examination. Class attendance may have a bearing on your grade. Citizenship can also affect a student’s grade positively or negatively. Grades are cumulative ending with the semester grades. If you pass the final exam, you may receive college credits through Lassen College. Grading Policy: A AB+ B BC+ C CD+ D DF = = = = = = = = = = = = 91-100 % 90 % 89 % 81-88 % 80 % 79 % 71-78 % 70 % 69 % 61-68 % 60 % 59 % or below Course Calendar WEEK 1 Course Outline/Classroom Rules and Expectations Introduction to Accounting Starting a Proprietorship The Accounting Equation (1-1) CH 1 Accounting Terms: Due Friday WEEK 2 How Business Activities Change the Accounting Equation (1-2) Reporting Financial Information on a Balance Sheet (1-3) CH 1 Review/Study Guide How Transactions Change Owner’s Equity in an Accounting Equation (2-1) Reporting Accounting Equation Changes on a Balance Sheet (2-2) CH 2 Accounting Terms: Due Friday WEEK 3 CH 2 Review/Study Guide Debits and Credits Using T-Accounts (3-1) Analyzing How Transactions Affect Accounts (3-2) WEEK 4 Analyzing How Transactions Affect Owner’s Equity Accounts (3-3) Journals, Source Documents, and Recording Entries in a Journal (4-1) CH 3 Accounting Terms: Due Friday WEEK 5 CH 3 Review/Study Guide Buying on Account and Paying on Account (4-2) Journalizing Transactions that Affect Owner’s Equity (4-3) Receiving Cash on Account (4-3) CH 4 Accounting Terms: Due Friday WEEK 6 CH 4 Review/Study Guide Preparing a Chart of Accounts (5-1) Posting from a General Journal to a General Ledger (5-2) Emphasis in Automated Accounting WEEK 7 Completed General Ledger and Proving Cash (5-3) Making Correcting Entries (5-3) CH 5 Accounting Terms: Due Friday WEEK 8 CH 5 Review/Study Guide Checking Accounts (6-1) Bank Reconciliation (6-2) Dishonored Checks and Electronic Banking (6-3) Petty Cash (6-4) WEEK 9 Reinforcement Activities including Automated Accounting CH 6 Accounting Terms: Due Friday CH 6 Review/Study Guide WEEK 10 Creating a Work Sheet (7-1) Planning Adjusting Entries on a Work Sheet (7-2) WEEK 11 Finding and Correcting Errors on the Work Sheet (7-4) Chapter 7 Review/Study Guide CH 7 Accounting Terms: Due Friday WEEK 12 Preparing an Income Statement (8-1) Balance Sheet Information on a Work Sheet (8-2) WEEK 13 CH 8 Review/Study Guide CH 8 Accounting Terms: Due Wednesday (before Thanksgiving) WEEK 14 Recording Adjusting Entries (9-1) Recording Closing Entries (9-2) WEEK 15 Preparing a Post-Closing Trial Balance (9-3) CH 9 Reinforcement Activities WEEK 16 CH 9 Review/ Study Guide Computerized Accounting WEEK 17 Journalizing Purchases Using a Purchases Journal (10-1) Journalizing Cash Payments Using a Cash Payments Journal (10-2) Performing Additional Cash Payments Journal Operations (10-3) WEEK 18 Journalizing Other Types of Transactions Using a General Journal (10-4) Computerized Accounting CH 10 Review/Study Guide WEEK 19 Additional Review CH 10/Begin CH 11 1st Semester Final: CH 10 + CH 11 Problems ________________________________________________________________________ WEEK 20 Journalizing Sales on Account using a Sales Journal Journalizing Cash Receipts using a Cash Receipts Journal WEEK 21 Posting to General and Subsidiary Ledgers Posting to an Accounts Payable Ledger (12-1 Work Together/On Your Own) Posting from other journals to an Accounts Payable Ledger (12-2 WT/OYO) Posting to an Accounts Receivable Ledger (12-3 WT/OYO) Posting totals to a General Ledger (12-6 WT/OYO) WEEK 22 Application Problems 12-1 thru 12-6 Mastery Problem & Challenge Problem WEEK 23 Preparing Payroll Records Preparing Payroll Time Cards (13-1 WT/OYO) Determining Payroll Tax Withholding (13-2 WT/OYO) Preparing Payroll Records and Checks (13-3 & 13-4 WT/OYO) WEEK 24 Payroll Accounting, Taxes, and Reports Recording a Payroll (14-1 WT/OYO) Recording Employer Payroll Taxes (14-2 WT/OYO) Paying Withholding and Payroll Taxes (14-4 WT/OYO) WEEK 25 Beginning a Work Sheet for a Merchandising Business (15-1 WT/OYO) Analyzing and Recording Work Sheet Adjustments (15-2 WT/OYO) Completing Work Sheets (15-3 WT/OYO) Legal issues in Accounting WEEK 26 Developing your own Business (proprietorship) Financial Statements for Partnerships/Proprietorships Income Statement (16-1 WT/OYO) Component Percentages (16-2 WT/OYO) WEEK 27 Distribution of Net Income and Owner’s Equity Statements Balance Sheet Continuation of developing own business with financial statements WEEK 28 Professional Business Ethics Careers in Accounting Presentation Financial Ratios and their importance WEEKS 29-36 Starting a Proprietorship and Designing and Developing a Budget Completing Financial Statements Using Financial Ratios to determine Business Health and Profit