UGANDA WOMEN'S FINANCE TRUST LIMITED (UWFT) takes pride

advertisement

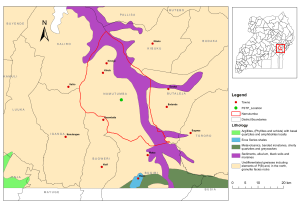

UGANDA WOMEN’S FINANCE TRUST PROFILE Background of Uganda Women’s Finance Trust Ltd UGANDA WOMEN’S FINANCE TRUST LIMITED (UWFT) takes pride in the fact that it is the oldest indigenous micro finance institution in Uganda. UWFT developed its roots from a number of conferences, which were taking place around the world starting with the International Women’s Conference held in Mexico in 1975 that ended with the declaration of 1975-1985 a decade dedicated to the empowerment of women. In reactivating political activities at national level after the military rule of the 1970’s, the political leaders also felt challenged by the global call for women empowerment and set up ‘women’ departments/wings within the political parties hence enhancing the opportunities for women issues to be addressed. Challenged from both the global and national angles, a group of professional and business women, who themselves felt that the formal financial systems were not women friendly, took it upon themselves to develop a mechanism that would enable low income women to access credit as a tool for economic empowerment. What were the issues that constrained women from accessing financial services in banks – one may be tempted to ask? The actual structures were intimidating, the male staff had an attitude that made the women even more scared, the requirements for opening a simple savings account did not protect the financial privacy / confidentiality of married women. What is ironical is that a married woman could operate a business account but not a personal account without the consent of her spouse! Cultural practice (not law) constrained women from owning landed property that the banks would require for collateral. The list is long. Against this background UWFT was set up to offer a woman friendly financial environment whereby women would be counseled and educated on the benefits of savings and utilizing credit appropriately. Women were taught simple business management techniques, record keeping, just to enable them operate their enterprises. No formal bank had the skills and what it takes to hand hold these small credit customers as they were considered risky and in most cases unbankable. The coming on the scene by UWFT was a very welcome development, which was followed by many similar institutions. As of December 2002, there were approximately 500 documented micro finance institutions and many member and community based organizations offering financial services in Uganda. Objectives for which UWFT was set up: to economically empower low income women through the provision of a package of financial services in a convenient and efficient manner, to mainstream women into the economic development of Uganda, to educate women about financial services as a way of uplifting their standards and those of their families and communities. 1 1.1 MISSION, VISION AND CORE VALUES Vision: Low-income people have access to financial services. Mission: To provide unique financial services to low income people in Uganda, especially women, in a manner that delights our customers and adds value to our stakeholders. 1.2 Core Values: The following core values define UWFT’s key shared beliefs and motivation: 1.3 Client focused products and services: We believe in providing unique products and services that meets customer needs and exceeds their expectations. Attractive returns to all stakeholders: We believe in efficient investment of our resources to create additional value for our customers, investors and all stakeholders. Trust: We believe in creating a transparent environment that gives confidence to all stakeholders. Innovation: We believe in new ideas and ways of doing things. AREAS OF OPERATION UWFT operates through twenty outlets divided into 5 regions for administrative purposes. Table 1 below shows the delivery network detailing the region of operation, the location of branch outlets and the districts served. Appendix 1 has a map with details. Area/ Region Central Middle East Branch Offices Kampala; Entebbe; Mukono; Kayunga and Lugazi Masaka; Mbarara; Ntungamo;and Ishaka Mbale; Tororo; Pallisa; Busia District Kampala; Mpigi; Wakiso; Luwero; Kayunga & Mukono. Mbarara; Rakai; Kalangala; Ntungamo; Rukingiri; Bushenyi; Kabale; Sembabule Mbale; Tororo; Pallisa; Sironko; Kapchorwa Near East Far East Jinja; Iganga; Kamuli and Bugiri Kumi; Soroti and Kaberamaido; Kamuli; Jinja; Bugiri; Iganga; Mayuge Kumi; Soroti; Kaberamaido; Lira; Busia; Katakwi Western 1.3.1 Ownership: Ownership UWFT is registered both as an NGO as well as a Company limited by guarantee. However the passing of the MDI Bill, presents a window of opportunity and UWFT is re-positioning itself to transform into a regulated deposit taking institution (MDI), attract investors and reconstitute its ownership into a company limited by shares. 2 1.3.2 The Impact of the Services: The objectives of UWFT have been a strong driving force behind all the activities undertaken by the organization. The provision of small loans by UWFT enabled the women to break the stranglehold of poverty on their lives. With a small loan they have been able to acquire access to productive assets and to hired labour. This has led to an increase in productivity and income. The loans were coupled with wise investment decisions and careful supervision. Achievements Clear and well documented policies and procedures especially for the credit operations, internal controls, accounting and human resources. High on the learning curve – 19 years industrial experience Demonstrated client commitment Demonstrated potential for healthy growth of the business. Wide branch network (19), suitable for deeper penetration and future services like money transfer and agency. Highly decentralized and functional branch network. Introduction of result-oriented, strategic management Good support and rapport with key donors Good industrial reputation Good performance based reward system Committed multi-disciplinary staff 2. The Future Much as the formalization or transformation poses challenges, the opportunities far out weigh the challenges. UWFT, with its dynamic leadership and highly motivated and professional staff, is poised to set the pace for the micro finance industry in Uganda. UWFT has been the leading institution in micro finance and will strive to maintain this position. With its broadened vision to ensure that low-income people have access to financial services, UWFT is an attractive and appropriate partner for investors seeking to get both social and commercial return on their investments. 3. UWFT is committed to providing unique financial services that meet the needs of its customers in a manner that delights them and at the same time add value for the stakeholders – a situation where everybody is a winner. MANAGEMENT: The organisation structure is deliberately flat for effective management and responsiveness to changes in the environment. Appendix 2 shows a detailed organogram. The Board of Directors is composed of highly committed persons with a good mix of expertise and a wealth of experience. 3 The senior management is a strong team of dynamic professionals, well suited to lead the company through a successful transformation process. Appendix 3 shows detailed profile for the Board of Directors and Senior Management. 4. INFORMATION SYSTEM: The Planning, Controlling and Monitoring Systems in the Institution: Planning UWFT has a systematized process that guides strategic planning on a rolling basis. It also has guidelines for developing annual operational plans, which are derived from the strategic plan, and annual budgets. Controlling UWFT has established and documented Internal control systems which include but not limited to the following: Financial management system that includes Budgetary controls, Accounting and Financial controls, reporting and accountability. Credit management system that includes clear under writing policies and procedures, monitoring and supervision guidelines, portfolio quality management. Human resource management that includes staff policies and procedures for recruitment, capacity development, deployment, reward, retention and separation. Management information system that includes computerized loan tracking system. A functional Internal Audit and Inspection system. A functional External Auditing currently carried out by Deloitte and Touche. The Board exercise overall oversight and control of the Institution through established committees: (1) finance and operation committee which also performs the Asset and Liability management role, (2) Personnel and Administration committee. Monitoring Portfolio performance – lending and saving mobilization are the key activities of the Institution. The monitoring of these activities is through IT “Loan Performer”, a loan tracking software developed by Crystal Clear Ltd. There are also frequent field visits by management. 4 5. SWOT Analysis: STRENGTHS, WEAKNESSES, OPPORTUNITIES AND THREATS Strengths An experienced and skilled senior management team. Committed Board members Clear and well documented credit and financial policies High on the learning curve – 19 years industrial experience Good support and rapport with key donors Client oriented culture Good industrial reputation Highly decentralised and functional branch network Good performance based reward system Committed multi-disciplinary staff Weaknesses Marketing, Research and product development function just being established Inadequate funding to finance growth and expansion The staff are young and dynamic but with less industry related skills. (Training programmes are on-going) The Internal Audit department is not fully staffed (but recruitment is on-going) Partly computerized accounting and loan tracking system. (Installation of Solomon at Head Office and branches on-going) Opportunities A stable political environment Conducive macro-economic conditions (Steady economic growth, low single digit inflation, liberal interest rates) Government supportive of Micro-finance sector MDI bill friendly Banks see MFIs as business opportunities to lend to Development agencies (donors) are still supportive to the development of MFI industry Threats Lack of credit references among the microfinance sector High cost of funds Many MFIs compete for very few financiers Low confidence in the Banking Industry Scarcity of Long term funds Private sector does not see the opportunity to invest in micro-finance Potential disruptive government micro-finance programmes Low credit culture 5 Appendix 1 Areas of Operation 6 Appendix 2 Organogram 7 Appendix 3 Board of Directors and Management Profile 8 9