2 application for user status

advertisement

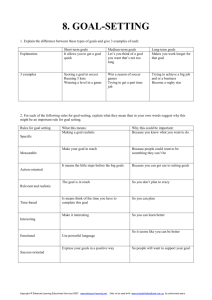

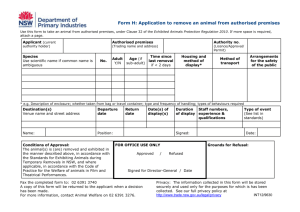

USER ADMINISTRATOR PROCEDURES Application for Authorised User Status This document sets out the User Administration Procedures that are applied by the Bond Exchange of South Africa Limited (“BESA”) in processing an application for authorised user status. This document is intended for use within BESA and is not intended for use for any other purpose. Submitted to FSB Prepared by Market Regulation Division Date 29 May 2009 Document type Working Paper Status Draft Version 0.1 Confidentiality Notice Unless otherwise indicated, the contents of this document, including any attachments hereto are proprietary to the Bond Exchange of South Africa and are confidential, legally privileged and protected by law; and may not, without the prior written consent of the chief executive officer of the Exchange, be disclosed to any third party, copied or distributed. Copyright© Bond Exchange of South Africa TABLE OF CONTENTS 1 INTRODUCTION ........................................................................................................................... 3 2 APPLICATION FOR USER STATUS ........................................................................................ 4 2.1 Overview .................................................................................................................................. 4 2.2 Application Process ................................................................................................................. 4 2.2.1 2.2.2 3 4 5 Legal & Compliance .................................................................................................... 5 Systems Implementation ............................................................................................ 5 2.3 Mapped Process ...................................................................................................................... 7 2.4 Application Process ................................................................................................................. 9 2.5 Choosing a Lead Regulator ..................................................................................................... 9 2.6 Choosing a Settlement Agent/ Participant ............................................................................. 10 OFFICER REGISTRATION ....................................................................................................... 11 3.1 Objective ................................................................................................................................ 11 3.2 Procedures Performed ........................................................................................................... 11 3.3 Prescribed Examinations ....................................................................................................... 12 3.4 First Time Registrations ......................................................................................................... 12 3.5 Applicable Exemptions .......................................................................................................... 13 3.6 South African Institute of Financial Markets .......................................................................... 13 3.7 Conditional Dispensation ....................................................................................................... 14 3.8 Representative and Alternate Representative Officers ......................................................... 15 TRADER REGISTRATION ........................................................................................................ 16 4.1 Application for Registration .................................................................................................... 16 4.2 Procedures Performed ........................................................................................................... 16 4.3 Prescribed Examinations ....................................................................................................... 17 4.4 Conditional Dispensation ....................................................................................................... 17 4.5 Exemptions ............................................................................................................................ 18 4.6 Usage of Codes ..................................................................................................................... 19 TERMINATION OF USER STATUS ........................................................................................ 20 5.1 Procedures Performed ........................................................................................................... 20 Bond Exchange of South Africa Application for User status 29 May 2009 Page 2 of 20 1 INTRODUCTION The application for authorised user status is the initial step that authorised users goes through before they can be admitted to participate on the bond platform. This process is a key step in ensuring that the potential authorised user is legible to be an authorised user, is of sound financial standing, that its Directors and staff are sufficiently skilled and competent and of the right integrity and qualifies on all the regulatory requirements and therefore may not introduce risk on the market. This step is viewed as a major control tool to managing risk and is thus quite a vigorous and involved process. This document sets out the procedures (application and termination of authorised user status) that are applied by the Market Regulation Division (MRD) in processing the application for authorised user status. Bond Exchange of South Africa Application for User status 29 May 2009 Page 3 of 20 2 APPLICATION FOR USER STATUS 2.1 Overview On application for authorised user status, the applicant has to adhere to the highest standard of integrity and code of ethics as determined by the Board. To ensure that the applicant sufficiently complies with the requirements as set out in the Rules, Directives and the Act, the MRD has to review all documentation set out in section 2.2.1 and establish that it is complete and correct. Read together, the Securities Services Act (“SSA”) and the Rules stipulate minimum admission standards for authorised user status. Properly applied, these standards help to ensure that authorised users, their management and trading staff are able to meet the expectations of the investing public with regard to the exercise of fiduciary responsibility, due care & skill and fair trading. Only entities which maintain at least the minimum capital prescribed by law are admitted as authorised users. The SSA and the Rules prescribe minimum requirements for authorised user status, which include – Incorporation or registration as a company under South African law or the laws of an approved foreign jurisdiction in the case of juristic persons; Compliance with minimum capital requirements as well as complying with the officer and trader registration standards relating to integrity, character and qualifications; Appointment of a Lead Regulator in consultation with the Registrar where applicable and the Participant through which the authorised user will facilitate settlement; Implementation of the necessary system resources for trade reporting and settlement; Compliance with the Rules relating to fidelity cover, guarantee fund contributions, trading and settlement. 2.2 Application Process The applicable form can be found on the website www.bondexchange.co.za or the applicant can contact the User Administrator on (011) 215-4108 or melissav@bondexchange.co.za. The Authorised user status registration process is comprised of two components – Legal & Compliance1: filing the required returns with the MRD for review & approval Systems implementation: loading the applicant on the relevant BTB and Strate systems 1 See Section 2.2.1 Bond Exchange of South Africa Application for User status 29 May 2009 Page 4 of 20 These two processes may proceed in parallel and timing is largely dependent on the necessary Telkom lines being available in order to connect to the BESA trade capture systems (BTB) and (Intersec). 2.2.1 Legal & Compliance Listed below is a checklist of the various application forms and additional correspondence which must be filed with MRD on submission of application for Authorised user status. Application for Authorised user status on Form F2.2.1.2[A] Resolution of the Board of Directors approving the application Memorandum and Articles of Association Letter of Good Standing from the Board of Directors of the entity applying for authorised user status Letter from a foreign regulatory authority confirming that the foreign applicant is a member of that regulatory authority Business Plan-short, medium and long term Directors’ Curriculum Vitaes Certified copy of the company’s registration certificate 2 copies of latest annual financial statements If the entity applying for authorised user status is new and does not have a business track record-3 month’s bank statements are required Correspondence confirming current lead regulator and choice of BESA as lead regulator if the juristic person is not incorporated in South Africa Name and address of auditors Risk Management Plans /processes Audit certificate confirming adequate fidelity cover held by firm System Capture Form Form F2.2.1.2[B] Officer Registrations Form F2.4.1[A] Trader Registrations Form F2.5.1[A] Capital Adequacy Returns FormsF9.3.1[A]/F9.3.2[A]/ F9.3.2[B] Confirmation that communication lines to facilitate systems’ connectivity are in place Correspondence from the Participant confirming – acceptance of the appointment as Participant; that the necessary Participant agreements have been signed; the date that the Participant services will commence. Any additional information that maybe required It is recommended that the applicant submit copies of the application forms before sending originals, as any items outstanding on all application forms will not be completed by the User Administrator. Once the noting of outstanding items has been sent, the completed original application forms can be sent. No forms will be accepted if they are incomplete. 2.2.2 Systems Implementation Bond Exchange of South Africa Application for User status 29 May 2009 Page 5 of 20 In order for BESA to load an authorised user onto the system, Form F2.2.1.2 [B] System Capture Form is to be submitted. The authorised user ensures that the relevant hardware and communication lines to facilitate systems connectivity are in place. BESA MRD will forward the System Capture Form for the new authorised user to be loaded. BESA Client Interactive Centre (CIC) contacts the Service Provider for the Official ID and Password in order for the service provider and STRATE to connect to the relevant systems and to connect the authorised user to the BTB System. Confirmation is then sent to the BESA MRD that the authorised user has been loaded. The back-office user names, contact numbers and e-mail addresses are requested from the authorised user by the CIC. The User List is updated with the new back-office users. Trader registrations authorised by the BESA MRD are forwarded to the CIC for loading onto BTB. The trader is then added to the BTB User List. Confirmation is sent to the MRD that the trader has been loaded. The trader is then issued, via facsimile or electronically, with a unique trader code. Once these procedures are completed, the IT person at the authorised user firm may begin the set-up for BTB or other system resources and infrastructure that would enable connectivity to BTB as approved by BESA, the BESA CIC will assist the user with the user ID. Once the systems are installed, BESA recommends to the authorised user firm that on-site training sessions for the relevant back-office and trading staff should be arranged. The training sessions last between one to two hours and are facilitated by BESA CIC. The authorised user firm’s Compliance Officer is required to submit written notification should a back-office staff member or trader leave the employ of the user firm. The person’s details are then removed from the trading system. It is the responsibility of the user firm to ensure that all back-office staff is suitably qualified. Listed below is a checklist of entry-level requirements and hardware Confirmation on an official letterhead that the applicable communication line is installed and operational; For diginet lines circuit numbers must be supplied in order for our IT department to liaise with Telkom; and Once BESA CIC receives the System Capture Form for the loading of a new authorised user, the CIC contacts the Service Provider for the Official ID and Password. The authorised user is loaded on STRATE Ltd’s UAT. A Service Level Agreement is put in place between STRATE Ltd and the Service Provider. The BESA CIC sends confirmation to the BESA MRD that the authorised user has been loaded. Bond Exchange of South Africa Application for User status 29 May 2009 Page 6 of 20 2.3 The Participant loads the relevant settlement accounts. The Participant and Service Provider will liaise to ensure that the relevant links are in place. Once the application is approved it is then loaded onto Production, Mapped Process Bond Exchange of South Africa Application for User status 29 May 2009 Page 7 of 20 New Authorised User Registration Step 1 BESA receives completed membership pack 19 May 2009 Membership Application System Capture form Officer Registrations Trader Registrations Capital Adequacy Returns Form F4.2.1 [A] Form F4.2.1 [B] Form F4.5.1 [A] Form F4.6.1 [A] Form F9.3.1 [A] Form F9.3.2 [A] Form F9.3.2 [B] Resolution of the Board of Directors Certificate of Good Standing Certified copy of company registration certificate X2 copies of latest annual financial statements If no business track record, three month bank statements Correspondence confirming current lead regulator and choosing BESA as lead regulator if juristic person is not incorporated in South Africa Confirmation of Auditors Audit certificate confirming adequate fidelity cover held by firm Confirmation that applicable communication line is installed or applied for Name change documentation Memorandum and Articles of Association Business Model Directors CV’s Step 2 MRD review documentation and actions them as follows (Process can run simultaneously with Step 3) Set up meeting with new applicant to motivate their application to BESA MRD (Head, Compliance, Legal & User Admin) Request further information Forward letter noting outstanding items System Capture Form fwd to: CIC & BESA IT (BTB installed on Test Environment) Lead Regulator Participant STRATE Timeline: Dependant if Telkom line is installed and operative 5 Business days or 6 weeks if not operative Service Level Agreement effected between STRATE and Service Provider Step 3 MRD to review outstanding documentation submitted 5 Days Notify BTA/DTA of application BTA/DTA approves application by issuing a certificate of Good standing MRD sends Regulatory Bulletin to notify the market MRD to visit applicant to view premises and systems. No objection User Admin to advise participants to load applicant on Production environment Step 4 MRD to do a checklist to see if everything is in order Bond Exchange of South Africa Application for User status 29 May 2009 MRD (Head, Compliance, Legal, User Admin to approve Objection received The objecting party needs to give reasons on why they are objecting. MRD will review the objection and make a ruling or a finding. Board requested to note the application Members are notified of the approval of the new applicant via Regulatory Bulletin Page 8 of 20 2.4 Application Process On receipt of the fully completed information pack, BESA will action the application as follows: – The forms and documentation are reviewed by the MRD and a letter forwarded to the applicant noting any outstanding items. Applicant to motivate application to MRD Request and review of further information and MRD recommendation to BTA on application On receipt of outstanding items and recommendation of the application, STRATE and BESA CIC are notified of the application and requested to load the applicant onto the respective STRATE Ltd and BTB systems. The Service Level Agreement between STRATE Ltd and Service Provider is effected. The relevant market association is notified of the application for authorised user status and the market association issues an approval certificate or a certificate of good standing. A Regulatory Bulletin is distributed to market participants notifying them of the new application. As per the Rules, the Authorised users have 14 days within which to object in writing to the application. Site visit to applicant’s premises to inspect infrastructure, systems and readiness Initial Capital Adequacy returns are forwarded to the Surveillance Analyst of the Exchange for review & sign-off. Traders are loaded onto the BTB trade capture system. Head: Market Regulation is requested to review & approve the application. The Board is requested to note the new application. Authorised User’s are notified of the approval of the new applicant via a Regulatory Bulletin. 2.5 Appointment of a Lead Regulator BESA Rules require authorised users to elect a Lead Regulator to monitor their adherence to minimum capital adequacy standards. Some BESA authorised users are lead regulated by the JSE and the Banking Supervision of the South African Reserve Bank. Any juristic person applying for BESA authorised user status is required to submit documentation confirming the current lead regulator, i.e. the regulatory authority. In the event that the juristic person is not incorporated in South Africa, the applicant is required to elect BESA as their Lead Regulator. An authorised user is only required to report capital adequacy compliance to their Lead Regulator. On submission of an authorised user status application, an applicant must include either – Correspondence from their Lead Regulator confirming that the firms capital is adequate for the level of business undertaken; or Bond Exchange of South Africa Application for User status 29 May 2009 Page 9 of 20 2.6 A completed set of capital adequacy forms as provided by BESA, i.e. forms F9.3.1 [A]/F9.3.2 [A]/F9.3.2 [B]. Appointment of a Settlement Agent/ Participant Settlement Agents or Participants as they are called perform settlement electronically on behalf of their clients. Settlement is performed not only for BESA authorised users but also down to the individual client level, that is, who ever is the ultimate buyer or seller. Every applicant for authorised user status is required to enter into a business relationship with a Participant where the Participant agrees to facilitate settlement on behalf of the applicant. The contact details of the Participants who facilitate settlement on behalf of BESA authorised users and their clients are detailed below. Participants are regulated by Strate, the licensed central securities depository. A complete list of all the approved Participants can be obtained from Strate. Listed below are contact numbers for the different authorised Settlement Agents – Company ABSA Bank Ltd First National Bank Nedbank Ltd Standard Bank Corporate & Investment Banking Strate Ltd Contact Rudolph Brecher Priscilla Abrahams Olivier August Rudolphb@absa.co.za Priscilla.Abrahams@firstrandbank.co.za OliverA@Nedbank.co.za Telephone +27 11 350-7839 +27 11 371-3342 +27 11 667-1294 Fax +27 11 350-7811/2 +27 11 371-7964 +27 11 667-1705 Pepsi Vermeulen Pepsi.vermeulen@standardbank.co.za +27 11 636 1569 +27 11 636-3817 Monica Olwagen monicao@strate.co.za +27 11 759-5360 +27 11 759-5500 Bond Exchange of South Africa Application for User status 29 May 2009 Page 10 of 20 3 OFFICER REGISTRATION 3.1 Objective In terms of Rule C2.4, on approval of authorised user status, an authorised user is obliged to appoint and register a Compliance Officer, Representative Officer and their respective alternates to fulfil specific duties as set out in the Rules. An authorised user is not permitted to continue its business activity unless if these requirements have been met. An application for the registration of a Compliance Officer, Representative Officer and the respective Alternates shall be made on Form F2.4.1[A], accompanied by a certified copy of an identification document and successful completion of the prescribed examinations. The prescribed examination requirement in terms of Directive C2.4.3.2 is only applicable to the Compliance Officer and Alternate Compliance Officer and not the Representative and Alternate Representative Officer. 3.2 Procedures Performed The applicable form can be found on the website www.bondexchange.co.za or the applicant can contact the User Administrator on (011) 215-4108 or melissav@bondexchange.co.za. A separate application form F2.4.1 [A] must be completed and submitted to MRD in respect of every prescribed officer employed by a User firm. To apply for registration the following steps need to be completed – Complete all the sections of the form and answer all applicable questions in full; Ensure that the declaration in Section 3 is read and understood and that all “Yes” answers are fully explained on a separate page; Attach all supporting documentation as specified in Section 2; Submit the original form and supporting documentation for the attention of – Ms. Melissa Vermeulen User Administrator: Market Regulation Division Tel: (011) 215-4108 Fax: (011) 215-4100 Email: melissav@bondexchange.co.za Mezzanine Level PO Box 77 30 Melrose Boulevard Melrose Arch 2076 All responses must be printed in black in or typed, and all signatures must be original and supporting documents must be certified. All applications must be completed in full and where they are incomplete; the application will not be processed. The MRD does not complete or amend any application forms on behalf of an applicant. Bond Exchange of South Africa Application for User status 29 May 2009 Page 11 of 20 In terms of these procedures, it is a requirement of the Rules that there should be segregation of duties of the front office from the middle and back office; it is on that basis that we require that the Compliance and Alternate Compliance Officer not be involved in any trading activities, or the administration of trading for proper supervision. 3.3 Prescribed Examinations Compliance Officers and Alternate Compliance Officers employed by BESA Authorised Users must comply with the minimum registration requirements as prescribed in BESA Rules, including prescribed examination requirements, prior to being registered with BESA. To ensure that Registered Officers meet certain minimum standards all Compliance Officers and Alternate Compliance Officers must obtain a pass in the Registered Person Examination (“RPE”), or the equivalent institution recognised and/or approved as provider of accreditation and/or training for market professionals in the authorised user’s jurisdiction, of the following modules or equivalent modules – Introduction to Financial Markets Bonds and Long Term Debt Instruments Regulations of the South African Financial Markets Rules of the Bond Exchange of South Africa Compliance and Alternate Compliance Officers who have oversight over authorised users’ interest rate derivative trading activities must also obtain a pass in the additional module of the RPE or an equivalent module in the respective jurisdiction – 3.4 Derivatives First Time Registrations On approval of a new user firm where the Compliance Officer or Alternate Compliance Officer does not have the requirement, the following will apply Fully completed Form F2.4.1[A] with all relevant supporting documentation Proof of registration with the South African Institute of Financial Markets (SAIFM) or the equivalent institution recognised and/or approved as provider of accreditation and/or training for market professionals in the Authorised User’s jurisdiction Dates of examination The officer needs to complete the examinations within 6 months on submission of the registration form In the event that the requirement has not been met at the expiry of the extension a penalty shall be imposed and BESA reserves the right to require the authorised user to register another compliance officer Bond Exchange of South Africa Application for User status 29 May 2009 Page 12 of 20 3.5 Applicable Exemptions Where the Compliance Officer or Alternate Compliance Officer does not fulfil the above requirements, the following shall apply – Proof of registration with the South African Institute of Financial Markets (“SAIFM”), or proof of registration with the equivalent institution recognized and/or approved in the authorised user’s jurisdiction as a provider of accreditation and training for market professionals Proof of dates on which examinations will be written Proof of completion of the examinations within 6 months of submission of the registration form BESA shall at its sole discretion decide on the professional qualifications and/or accreditations to recognise for the purposes of granting Compliance Officers and Alternative Compliance Officers exemptions from the following modules: Introduction to Financial Markets Bonds and Long Term Debt Markets Derivatives The Rules of the Bond Exchange of South Africa and the Regulations of the South African Financial Markets of the Registered Person Examination are mandatory modules which must be successfully completed before registration or within the initial 6 month dispensation period. All Compliance Officers and Alternate Compliance Officers shall be required to register with the South African Institute of Financial Markets for the purposes of completing the Rules of the Bond Exchange of South Africa and the Regulations of the South African Financial Markets modules. 3.6 South African Institute of Financial Markets Candidates should contact the South African Institute of Financial Markets for additional information for examinations – Ms Christie van Wyngaardt General Manager Tel: (011) 802-4768 Fax: (011) 802-3476 Email: Christie@saifm.co.za Web: www.saifm.co.za or www.virtualexaminationcentre.com Bond Exchange of South Africa Application for User status 29 May 2009 Page 13 of 20 3.7 Conditional Dispensation Upon initial registration as a Compliance or Alternate Compliance Officer, Registered Officers who do not have the prescribed examination will be granted a 6 month dispensation period in which they are required to successfully complete the prescribed examinations. Failure to fulfil this requirement shall incur a penalty in accordance with Directive C12.1.3.2. Compliance Officers and Alternate Compliance Officers are required to submit documentation explaining the reasons behind the failure to fulfil the requirements. BESA shall at its sole discretion decide on granting such Compliance Officer and/or Alternate Compliance Officer an additional dispensation period of 6 months to fulfil the requirements. Failure to fulfil the requirements after due consideration has been granted to extend the initial dispensation period by an additional 6 months shall incur an additional penalty in accordance with Directive C12.1.3.2. Such Compliance Officer(s) and Alternate Compliance Officer(s) shall not be granted any additional dispensation and shall be de-registered. Authorised users are liable for the penalties imposed in accordance with Directive C2.4.3. Compliance Officers and Alternate Compliance Officers previously registered with BESA who voluntarily leave the employ of an Authorised User firm and subsequently re-enter the market with another Authorised User firm shall comply with the following requirements: Within One Year: Compliance Officers and/or Alternate Compliance Officers who have not been registered with BESA for a period of 12 months or less shall not be required to write any examinations, providing that such Officers have previously written such examinations. After One Year: Compliance Officers and/or Alternate Compliance Officers who have not been registered with BESA for a period of more than 12 months, but less than 3 years, shall be required to write the Rules of the Bond Exchange of South Africa and the Regulations of the South African Financial Markets modules. Such Compliance Officers or Alternate Compliance Officers shall not however be required to write any other technical examinations. After Three Years: Any conditional dispensation previously granted to Compliance Officers and/or Alternate Compliance Officers who have not been registered with BESA for a period of at least 3 years will have lapsed. Such Compliance Officers or Alternate Compliance Officers shall be required to write all the requisite modules in order to be registered. Bond Exchange of South Africa Application for User status 29 May 2009 Page 14 of 20 De-registration Provision: Should a Compliance Officer or Alternate Compliance Officer leave the employ of the authorised user firm under whose name they were registered, their registration status shall be suspended and such Registered Officers shall be required to re-register with BESA on employment with another authorised user firm. It is the responsibility of both the Compliance Officer and/or the Alternate Compliance Officer to notify BESA on leaving the employ of an authorised user firm. 3.8 Representative and Alternate Representative Officers In addition to the registration of Compliance Officers and Alternate Compliance Officers, Authorised Users must register a Representative and Alternate Representative Officer in the same manner as provided for in Rule C2.4.4. Such registration shall be made on Form2.4.1 [A]. The prescribed examinations referred to in Directive C2.4.3 are not applicable to the Registered Representative and Alternate Representative Officers. Bond Exchange of South Africa Application for User status 29 May 2009 Page 15 of 20 4 TRADER REGISTRATION 4.1 Application for Registration In terms of Rule C2.5, on approval of authorised user status, an authorised user must appoint and register one or more traders. The trader must prior to concluding the buying and selling of listed securities, comply with qualification requirements and must agree to be bound by the Rules, Directives and the Act. . 4.2 Procedures Performed The applicable form can be found on the website www.bondexchange.co.za or the applicant can contact the User Administrator on (011) 215-4108 or melissav@bondexchange.co.za. No person employed by or associated with a BESA authorised user may conclude trades in BESA listed instruments nor may such person access the BTB trade capture system unless registered as a trader with BESA. A separate application form F2.5.1 [A] must be completed and submitted to MRD in respect of every prescribed trader employed by a User firm. To apply for registration the following steps need to be completed – Complete all the sections of the form and answer all applicable questions in full Ensure that the declaration in Section 3 is read and understood and that all “Yes” answers are fully explained on a separate page Attach all supporting documentation as specified in Section 3 Submit the original form and supporting documentation for the attention of – Ms. Melissa Vermeulen User Administrator: Market Regulation Division Tel: (011) 215-4108 Fax: (011) 215-4100 Email: melissav@bondexchange.co.za Mezzanine Level PO Box 77 30 Melrose Boulevard Melrose Arch 2076 All responses must be printed in black ink or typed, and all signatures must be original and supporting documents must be certified. All applications must be completed in full and where they are incomplete; the application will not be processed. The Market Regulation Division does not complete or amend any application forms on behalf of an applicant. Bond Exchange of South Africa Application for User status 29 May 2009 Page 16 of 20 4.3 Prescribed Examinations Traders employed by BESA authorised users must comply with the minimum registration requirements as prescribed in the Rules, including prescribed examination requirements prior to being registered as an authorised user. To ensure that Traders meet certain minimum standards all Traders must obtain a pass in the Registered Person Examination (“RPE”), or the equivalent institution recognised and/or approved as provider of accreditation and/or training for market professionals in the prospective authorised user’s jurisdiction of the following modules or equivalent modules – Introduction to Financial Markets Bonds and Long Term Debt Instruments Rules of the Bond Exchange of South Africa Money Markets Traders who are responsible for the Authorised Users’ interest rate derivatives trading activities must also obtain a pass in the additional module of the RPE – 4.4 Derivatives Conditional Dispensation A Trader previously registered with BESA who voluntarily leaves the employ of an Authorised User and subsequently re-enters the market with another Authorised User shall comply with the following requirements: Within One Year: A Trader who has not been registered with BESA for a period of 12 months or less shall not be required to write any examinations. After One Year: A Trader who has not been registered with BESA for a period of more than 12 months, but less than 3 years, shall be required to write the Rules of the Bond Exchange of South Africa. After Three Years: A Trader who has not been registered with BESA for a period of 3 years or more, any conditional dispensation previously granted by BESA shall have lapsed. Such Trader(s) shall be required to write all the requisite modules in order to be registered. Bond Exchange of South Africa Application for User status 29 May 2009 Page 17 of 20 4.5 Authorised Users are not permitted to allow such Trader(s) to conclude transactions in BESA listed securities until they have fulfilled the qualification requirements. Failure to adhere to this requirement shall attract a penalty in accordance with Directive C12.1.3.2. Applicable Exemptions Where the Trader does not fulfil the above requirements, the following shall apply – Proof of registration with the South African Institute of Financial Markets ("SAIFM”), or proof of registration with the equivalent institution recognized and/or approved in the authorised user’s jurisdiction as a provider of accreditation and/or training for market professionals Proof of dates on which examinations will be written Such Trader must complete the examinations prior to being registered with BESA Proof of any conditional dispensation granted by BESA previously BESA shall at its sole discretion decide on the professional qualifications and/or accreditations to recognise for the purposes of granting Traders exemptions from the following modules: Introduction to Financial Markets Bonds and Long Term Debt Markets Money Markets Derivatives Authorised user is required to submit documentation for the purposes of any exemptions that are applied for. The Rules of the Bond Exchange of South Africa is a mandatory Registered Persons Examination module which must be successfully completed before registration or within the 6 month dispensation period. All Traders shall be required to register with the South African Institute of Financial Markets for the purposes of completing the Rules of the Bond Exchange of South Africa module. Bond Exchange of South Africa Application for User status 29 May 2009 Page 18 of 20 4.6 Usage of Codes Registration of Traders is handled by the Market Regulation Division. Please submit written notification to our User Administrator at the MRD on marketregulation@bondexchange.co.za should any of your registration details change. The allocation of Trader codes is facilitated by the CIC of BESA only on instruction from the MRD. Should a Trader leave the employ of the Authorised User firm under whose name they were registered, their registration will be suspended and they will be required to re-register with BESA on employment with another Authorised User firm. It is the responsibility of the Compliance Officer to notify BESA on any change of particulars relating to Authorised User Traders. Failure to do so shall attract a penalty in accordance with Directive C12.1.3.2 A fine shall be imposed in accordance with Directive C12.1.3.2 should an authorised user Trader be found to be utilising an un-authorised trader code. Bond Exchange of South Africa Application for User status 29 May 2009 Page 19 of 20 5 TERMINATION OF USER STATUS 5.1 Procedures Performed An authorised user who wishes to resign authorised user status is required to – Submit written notice of the voluntary intention to resign authorised user status to the MRD, at least one calendar month prior to the proposed date of resignation. Liaise with the MRD to ensure notice was received and to confirm any outstanding obligations as prescribed in the Rules. Ensure that all financial and Settlement obligations to be discharged prior to resignation have been approved. authorised user should note that they will still be liable for membership fees in the notice period. The Bond Exchange of South Africa Limited will – Notify the market of the intention to resign; Notify the market association of the authorised user’s intention to resign and approves resignation on the recommendation of management. Notify the market via a Regulatory Bulletin of resignation being effective. Bond Exchange of South Africa Application for User status 29 May 2009 Page 20 of 20