Analysis of Educational Attainment's Effect on

advertisement

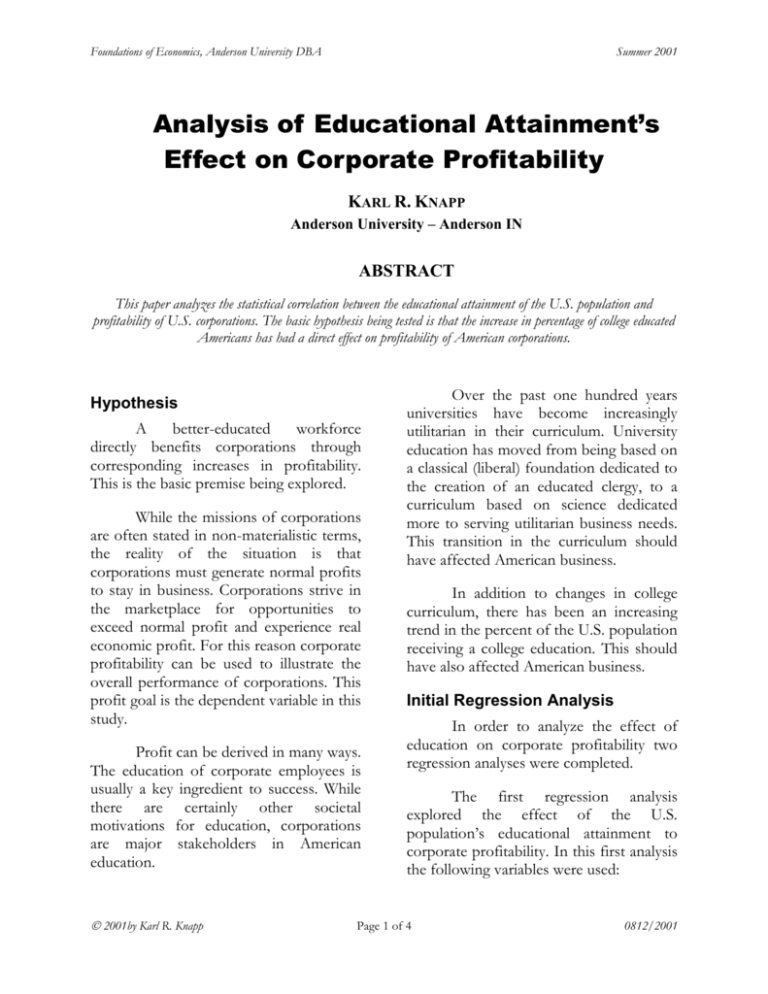

Foundations of Economics, Anderson University DBA Summer 2001 Analysis of Educational Attainment’s Effect on Corporate Profitability KARL R. KNAPP Anderson University – Anderson IN ABSTRACT This paper analyzes the statistical correlation between the educational attainment of the U.S. population and profitability of U.S. corporations. The basic hypothesis being tested is that the increase in percentage of college educated Americans has had a direct effect on profitability of American corporations. Hypothesis A better-educated workforce directly benefits corporations through corresponding increases in profitability. This is the basic premise being explored. While the missions of corporations are often stated in non-materialistic terms, the reality of the situation is that corporations must generate normal profits to stay in business. Corporations strive in the marketplace for opportunities to exceed normal profit and experience real economic profit. For this reason corporate profitability can be used to illustrate the overall performance of corporations. This profit goal is the dependent variable in this study. Profit can be derived in many ways. The education of corporate employees is usually a key ingredient to success. While there are certainly other societal motivations for education, corporations are major stakeholders in American education. 2001by Karl R. Knapp Over the past one hundred years universities have become increasingly utilitarian in their curriculum. University education has moved from being based on a classical (liberal) foundation dedicated to the creation of an educated clergy, to a curriculum based on science dedicated more to serving utilitarian business needs. This transition in the curriculum should have affected American business. In addition to changes in college curriculum, there has been an increasing trend in the percent of the U.S. population receiving a college education. This should have also affected American business. Initial Regression Analysis In order to analyze the effect of education on corporate profitability two regression analyses were completed. The first regression analysis explored the effect of the U.S. population’s educational attainment to corporate profitability. In this first analysis the following variables were used: Page 1 of 4 0812/2001 Foundations of Economics, Anderson University DBA Summer 2001 Independent Variable: Corporate Profits per Labor Force Member Dependent Variable: % of Population Completing 4 or More Years of College The independent variable was calculated on a per-labor-force-member basis to account for the growth in corporate profits attributable to the growth of the domestic market (civilian labor force). Results of this initial regression analysis showed a strong correlation between the dependent variable and the independent variable. Adjusted R2 T-Stat of Independent Variable T-Stat of the Intercept 84.7 14.7 12.9 The final regression analysis built upon the initial regression by adjusting for the effect of inflation on corporate profitability. The consumer price index (CPI) was used to adjust corporate profits to a ‘real’ basis. In the final regression analysis, the following variables were used: Independent Variable: InflationAdjusted Corporate Profits per Labor Force Member Dependent Variable: % of Population Completing 4 or More Years of College Results of this final regression analysis showed virtually no correlation between the dependent variable and the independent variable. Educational Impact on Corporate Profits Per Labor Force Member $25,000 Corporate Profits per Labor Force Member Final Regression Analysis The consumer price index (CPI) was used to adjust corporate profit. $30,000 y = 1049.5x - 7125.6 R2 = 0.8508 $20,000 likely means that the equation is missing explanatory variables. Adjusted R2 T-Stat of Independent Variable T-Stat of the Intercept $15,000 $10,000 $5,000 -0.02 -0.28 3.27 $0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 Educational Impact on Real Corporate Profits Per Labor Force Member % of Population with 4 Years of College or More $5,000 2001by Karl R. Knapp $4,500 $4,000 Real Corporate Profits per Labor Force Member In this initial regression the hypothesis proved to be significant by explaining 84.7% of the variation in the dependent variable. The T-Stat of the dependent variable was certainly significant at 14.7 (above 2.0). The main weakness in this initial regression was that the T-Stat of the Intercept was also strongly significant at 12.9. This most $3,500 y = -4.6697x + 3440.3 2 R = 0.002 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 % of Population with 4 Years of College or More The hypothesis proved to be insignificant. When adjusting for inflation, Page 2 of 4 0812/2001 Foundations of Economics, Anderson University DBA Summer 2001 the increased educational attainment of the U.S. population shows almost no effect on real corporate profitability per labor force member. Conclusion In conclusion the educational attainment of the U.S. population be used to explain changes in corporate profitability. The initial regression analysis performed showed that several other variables missing from the equation explain the changes in corporate profitability. While educational attainment may indeed be significant in the context of a more comprehensive formula, when taken alone it cannot be said to explain the variances in corporate profitability. 2001by Karl R. Knapp Data Sources U.S. Census Bureau. (2001). Educational attainment, completed 4 years of college or more, % of total population, not seasonally adjusted. Statistical Abstract of the U.S. U.S. Department of Commerce, Bureau of Economic Analysis (2001). Corporate profits with inventory valuation adjustment (IVA) & capital consumption adjustment (CCAdj), billions of dollars, seasonally adjusted annual rate. U.S. Department of Labor, Bureau of Labor Statistics (2001). Civilian labor force, thousands, seasonally adjusted. U.S. Department of Labor, Bureau of Labor Statistics (2001). Consumer price index for all urban consumers (CPI), all items, 1982-1984=100, not seasonally adjusted. Page 3 of 4 0812/2001 Foundations of Economics, Anderson University DBA Year Civilian Labor Force Consumer (Thousands) Price Index Summer 2001 Corporate Profits (Billions) Inflation Adjusted Corporate Profits (Billions) % of Total Population Corporate Inflation Adjusted Completed 4 Profits per Corporate Profits Years of College Civilian Labor per Civilian Labor or More Force Member Force Member 1960 70,395 29.8 209.4 209.4 7.7 $2,975 $2,975 1961 70,077 30.0 213.9 212.5 8.0 $3,052 $3,032 1962 70,854 30.4 246.2 241.3 8.4 $3,475 $3,406 1963 72,188 30.9 270.6 261.0 8.7 $3,749 $3,615 1964 73,465 31.2 299.4 286.0 9.1 $4,075 $3,893 1965 75,093 31.8 343.8 322.2 9.4 $4,578 $4,290 1966 76,641 32.9 367.8 333.1 9.7 $4,799 $4,347 1967 78,491 33.9 358.4 315.1 9.9 $4,566 $4,014 1968 79,463 35.5 386.1 324.1 10.2 $4,859 $4,079 1969 81,624 37.7 374.9 296.3 10.4 $4,593 $3,631 1970 83,670 39.8 326.6 244.5 10.7 $3,903 $2,923 1971 85,625 41.1 380.6 276.0 11.3 $4,445 $3,223 1972 87,943 42.5 439.0 307.8 12.0 $4,992 $3,500 1973 90,890 46.2 495.8 319.8 12.6 $5,455 $3,519 1974 92,780 51.9 457.8 262.9 13.3 $4,934 $2,833 1975 94,409 55.5 532.1 285.7 13.9 $5,636 $3,026 1976 97,348 58.2 642.2 328.8 14.4 $6,597 $3,378 1977 100,491 62.1 763.8 366.5 14.8 $7,601 $3,647 1978 103,809 67.7 868.8 382.4 15.3 $8,369 $3,684 1979 106,258 76.7 890.1 345.8 15.7 $8,377 $3,255 1980 107,352 86.3 793.9 274.1 16.2 $7,395 $2,554 1981 108,912 94.0 875.8 277.6 16.8 $8,041 $2,549 1982 111,083 97.6 805.0 245.8 17.5 $7,247 $2,213 1983 112,327 101.3 1016.5 299.0 18.1 $9,049 $2,662 1984 114,581 105.3 1239.0 350.6 18.8 $10,813 $3,060 1985 116,354 109.3 1289.8 351.7 19.4 $11,085 $3,022 1986 118,611 110.5 1202.9 324.4 19.8 $10,142 $2,735 1987 120,729 115.4 1386.5 358.0 20.2 $11,484 $2,966 1988 122,622 120.5 1620.2 400.7 20.5 $13,213 $3,268 1989 124,497 126.1 1582.7 374.0 20.9 $12,713 $3,004 1990 126,142 133.8 1634.3 364.0 21.3 $12,956 $2,886 1991 126,664 137.9 1724.9 372.7 21.4 $13,618 $2,943 1992 128,554 141.9 1812.3 380.6 21.4 $14,098 $2,961 1993 129,941 145.8 2042.1 417.4 21.9 $15,716 $3,212 1994 131,951 149.7 2292.8 456.4 22.2 $17,376 $3,459 1995 132,511 153.5 2675.0 519.3 23.0 $20,187 $3,919 1996 135,113 158.6 3016.1 566.7 23.6 $22,323 $4,194 1997 137,153 161.3 3335.1 616.2 23.9 $24,317 $4,492 1998 138,613 163.9 3109.7 565.4 24.4 $22,434 $4,079 1999 140,185 168.3 3300.6 584.4 25.2 $23,545 $4,169 2001by Karl R. Knapp Page 4 of 4 0812/2001