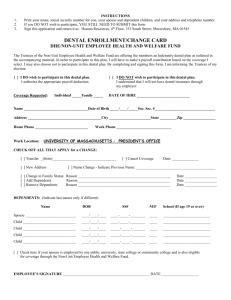

6032085v5 - Farmingdale Supplement Lang to Booklet

advertisement