A Proposed Integrated Framework for 527 Regulation

advertisement

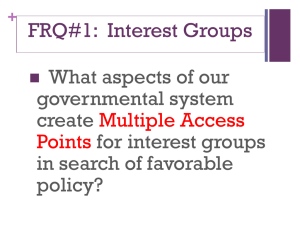

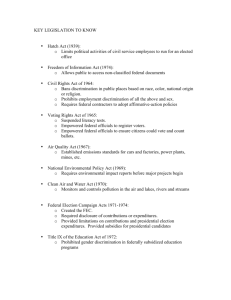

Laws Working Together: A Proposed Integrated Framework for 527 Regulation by Giannina Marin Table of Contents I. REGULATORY FRAMEWORK ....................................................................................................... 2 A. FEDERAL ELECTION LAW ......................................................................................................... 2 B. TAX PROVISIONS .................................................................................................................... 12 II. THE HUNDRED MILLION DOLLAR GAP: THE SKEWED DEFINITIONS OF POLITICAL ORGANIZATION AND POLITICAL COMMITTEE ............................................................................ 17 A. THE GAP ................................................................................................................................ 17 B. THE FEC’S ATTEMPT AT CLOSING THE GAP THROUGH RULE-MAKING................................... 18 C. FEC ENFORCEMENT OF FECA AND BCRA AFTER THE 2004 ELECTIONS: VICTORY OR LOSS? ................................................................................................................................................... 20 III. SUMMARY AND CRITICAL ANALYSIS OF SUGGESTED SOLUTIONS ....................................... 20 A. WHO SHOULD REGULATE: ELECTION LAW VS. TAX LAW ...................................................... 22 1. The Tax Writing Process vs the Election Law Writing Process ......................................... 22 2. The Competence of the IRS vs the FEC.............................................................................. 23 B. WHAT SHOULD THE LAW SAY? .............................................................................................. 25 1. Regulating Coordination .................................................................................................... 25 2. Reforming the FECA definition of “political committee” ................................................. 26 3. Major Purpose Test ............................................................................................................ 27 4. Arbitrage Issues Arising from a Concentration on 527 Organizations ............................. 30 IV. SUGGESTED FRAMEWORK: AN INTEGRATED 527 PACKAGE ................................................ 31 A. CONGRESS IS THE PROPER ENTITY TO ENACT THE 527 PACKAGE .......................................... 31 B. THE 527 PACKAGE INVOLVES BOTH ELECTION LAW AND TAX LAW ...................................... 31 C. LIMITS OF THE 527 PACKAGE: TRUE ISSUE ADVOCATES ........................................................ 34 V. CONCLUSION ............................................................................................................................ 34 Congress has failed to make the Federal Election Campaign Act of 1971, as amended, compatible with the section 527 of the Internal Revenue Code, the section that creates taxexempt political organizations (“527s” or “527 organizations”). The few limitations the Tax Code imposes on the tax-exemption eligibility of § 527 organizations and lack of clarity regarding the proper place of these tax law creatures under federal election law jointly operate as 1 the greatest loophole of federal election law, allowing parties and political activists to raise and spend hundreds of millions of dollars to influence federal elections while avoiding the application of both the transfer tax and federal election law. Although the problem became obvious in the 2004 elections, when 527s raised over $256 million and unleashed some of the most damaging and effective political advertisements, legislators have, to date, been unable to establish a regulatory scheme that subjects 527s to federal election law. Although some attempts have been made, the proposed schemes have been lacking. This paper argues that, given the historical ability of parties and political organizations to find loopholes and mold their groups to avoid regulation, an effective strategy must consider both sources of law and include mutually enforcing limitations and penalties. Part I of this paper discusses the federal election law and applicable Internal Revenue Law. Part II traces the gap between the tax law and election law, focusing on the issues surrounding organizations arising under § 527. Part III summarizes and analyzes solutions proposed by commentators as well as bills introduced in the House and Senate. Finally, Part IV proposes an integrated legislative plan to reform federal election law definitions to include 527 organizations and leverage the tax system’s forceful hand to ensure compliance. I. REGULATORY FRAMEWORK A. FEDERAL ELECTION LAW Especially since the industrial expansion of the post-Civil War era, the United States has been characterized by significant disparities in the wealth of its citizens.1 A very small few individuals and corporations hold—and more importantly, control—most of the wealth in the 1 United States v. Automobile Workers, 352 U.S. 567, 570 (1957). 2 United States.2 Those individuals have not shied away from making political contributions, not with the purpose of enhancing the democratic process but with the intent of gaining access to and leverage over government officials in order to further their own interests.3 Given that it has been found that the election officials indeed grant special treatment to generous contributors,4 improper influence arising from large contributions to electoral campaigns has long been a valid concern of government officers. Since the start of the 1900s, the federal government stepped in as the main regulator of federal election campaigns. Congress has enacted multiple statutes aimed at limiting suspect contributions and then amended those statutes numerous times to remove loopholes and avoid their circumvention. As early as 1905 President Theodore Roosevelt called on Congress to stop corporate directors from using company money to electioneer.5 In 1907 Congress responded, enacting the Tillman Act, which banned any corporate contributions in connection with a federal election.6 Next, Congress turned its attention to federal employees, enacting “an Act to Prevent Pernicious Political Activities,” better known as the Hatch Act,7 which prohibited federal employees from engaging in partisan activities. The act also set forth the first limitations on contributions by individuals and limitations on total receipts and expenditures of “political 2 As of 2006, twenty percent of households held eighty-four percent of the total wealth in the United States; they also held 89.3% of all corporate stock. William Domhoff, Who Rules America?, September 2005, Updated December 2006, http://sociology.ucsc.edu/whorulesamerica/power/wealth.html 3 S. Rep. No. 93-689, 93rd Cong., 2d Sess. 4-5, USCCAN 1974, p. 5587. 4 Id. 5 “In his annual message to Congress in December 1905, President Roosevelt stated that ‘directors should not be permitted to use stockholder’s money’ for political purposes, and he recommended that ‘a prohibition’ on corporate political contributions ‘would be, as far as it went, an effective method of stopping the evils. . . .’” McConnell v. FEC, 540 U.S. 93, 115 (2003) citing United States v. Automobile Workers, 352 U.S. 567, 571 (1957). 6 Pub. Law. No 34, 34 Stat. 864 (1907). 7 Hatch Act, Pub. Law. No. 753, 54 Stat. 767 (1940), codified at 5 USC §§7321-7328. 3 committees.”8 Then, between 1943 and 1947, Congress took aim at labor unions; it prohibited all union contributions in connection with federal elections9 as well as all other election-related expenditures by them.10 In 1972, Congress enacted the Federal Election Campaign Act (FECA), which, after numerous amendments, is still the main body of law regulating federal elections today. FECA of 197211 required disclosure of contributions exceeding $10012 and of expenditures over $1,000,13 prohibited contributions in the name of another,14 and prohibited all contributions by government contractors.15 The Act maintained the Hatch Act’s ban on contributions from the treasury funds16 of corporations and labor unions, but it enabled corporations and unions to “establish[], administ[er], and solicit[] contributions to a separate segregated fund to be utilized for political purposes.”17 Therefore, corporations and labor unions could not use treasury funds to electioneer, but they were freely able to solicit contributions from their shareholders or members to separate funds and later spend those funds for political purposes.18 8 54 Stat. at 770, 772. The limitations were largely intended to limit union contributions. McConnell v. FEC, 540 U.S. 93, 116-17 (2003). 9 McConnell, 540 U.S. at 117 citing War Labor Disputes Act (Smith-Connelly Anti-Strike Act), 57 Stat. 167 (1943). 10 Labor Management Relations Act, 1947 (Taft-Hartley Act), Pub. Law. No. 101, 61 Stat. 136, 159 (1947). 11 Pub. Law. No. 92-225, 86 Stat. 3 (1972). 12 Id. at §§ 301-302. 13 Id. at § 303. 14 Id. at § 310. 15 Id. at § 611. 16 The term refers to general corporate funds as opposed to “segregated funds.” 17 Id. at § 608. 18 McConnell v. FEC, 540 U.S. 93, 118 n.2, 203 (2003). 4 Despite FECA limitations, the 1972 presidential candidates amassed large contributions, having found numerous ways to evade the contribution limits.19 For example, American Milk Producers, Inc. made a $2,000,000 contribution to President Nixon’s campaign which was not subjected to disclosure requirements because American Milk Produces, Inc. split the contribution into hundreds of smaller contributions to Nixon committees in various states.20 FECA was then amended in 1974. The Federal Election Campaign Act Amendments of 197421 required each candidate to designate a principal campaign committee,22 required disclosure of the source of political funds,23 limited contributions to a candidate by political committees other than the candidate’s principal committee to $5,000 per election,24 limited individuals’ contributions to a candidate to the sum of $1,000 per election,25 and limited total contributions by any single contributor to $25,000 per calendar year.26 The amendments also limited expenditures related to a candidate to $1,00027 as well as total expenditures by the candidates themselves.28 Lastly, the 1974 amendments established the Federal Election Commission (FEC).29 Additionally, a large part of the problem arises because outside groups are often willing to independently raise funds and spend them to influence elections. FECA sought to regulate Buckley v. Valeo, 519 F.2d 821, 837 (D.C. Cir. 1975) (“The achievements of the statutes were overmatched by what proved to be wholesale circumvention, including notably the invention and proliferation of political committees that purported to be independent and outside the knowledge and control of the candidates and designated campaign committees. The infinite ability to multiply committees eviscerated statutory limitations on contributions and expenditures.”). 20 McConnell v. FEC, 540 U.S. at 120 n.6, 203. 21 Pub. L. No. 99-443, 88 Stat. 1263 (1974). 22 Id. at § 202(f)(1). 23 Id. at § 201. 24 Id. at § 101(b)(2). 25 Id. The ban not only reached direct contributions to the candidate but also reached “contributions made by a person, either directly or indirectly, on behalf of a candidate.” Id. at § 101(b)(6). 26 Id. at § 101(b)(3). 27 Id. at § 608. 19 5 such groups by classifying them as “political committees.”30 For example, after limiting contributions to candidates and parties, FECA § 441a specifically prohibits contributions in excess of $5,000 “to any other political committee.”31 The section is intended to extend the reach of FECA contribution limitations to outside groups,32 and there are similar provisions in other sections of FECA.33 Such groups, if not deemed “political committees,” are largely unregulated by FECA.34 FECA loosely defines “political committee” as the segregated fund of a corporation or political organization,35 the local committee of a political party,36 and “any committee, club, association, or other group of persons which receives contributions aggregating in excess of $1,000 during a calendar year or which makes expenditures aggregating in excess of $1,000 during a calendar year.”37 The seemingly broad definition has, however, been narrowly applied. 28 Id. at § 101(c). Id. at § 310. 30 2 U.S.C. § 433 (requiring registration of political committees); Id. at § 434 (requiring disclosure statements from political committees); Id. at § 441a (applying maximum contribution and expenditure limitations to political committees). The definition of “political committee” is set forth in 2 U.S.C. § 431. 31 Id. at § 441a(a)(1)(C). 32 Id. at. § 441a(a). 33 See, e.g., Id. at § 433 (requiring registration of political committees); Id. at § 434 (requiring disclosure statements from political committees); Id. at § 441a(a)(1)(C), (a)(3) (applying maximum contribution limitations to political committees); Id. at § 441b (prohibiting any contributions by corporations and labor unions to political committees). 34 See, e.g., 11 C.F.R. § 104.4 (requiring disclosure statements of independent expenditures made by political committees but not referring to groups that are not political committees); Paul S. Ryan, 527s in 2008: The Past, Present and Future of 527 Organization Political Activity Regulation, 45 HARV. J. LEGIS. 471, 472 (2008) (“By contrast 527 organizations that are not “political committees” are generally subject to few if any campaign finance restrictions. . . .”). 35 2 U.S.C. § 431(4)(B); see also supra text and notes at 17-18. 36 Id. at § 431(4)(C). 37 Id. at § 431(4)(A). 29 6 In Buckley v. Valeo,38 the Supreme Court upheld FECA and its 1974 amendments but narrowly construed the provisions applying to “expenditures” by independent groups or individuals. It interpreted the limitations as applying only to “communications that in express terms advocate the election or defeat of a clearly identified candidate for federal office.”39 As such, groups or individuals making expenditures independently of the candidate could, free of FECA limitations, raise and expend any funds to promote particular views if they did not expressly support or oppose any candidate.40 The Court’s pronouncements were interpreted by the FEC as limiting the application of FECA’s contributions regulations to only political committees.41 The Court’s pronouncements in Buckley, were interpreted as setting forth a Constitutional limitation to the statutory definitions of “expenditure” and “contribution;” it was understood that the terms could only refer to funds relating to express advocacy.42 The political expenditures of political committees engaged only in issue advocacy or engaging in non-partisan electoral activities were thus not regulated under FECA. This limited definition also attached to FECA regulations limiting groups organized as corporations, thus allowing corporations to engage in political speech if they refrained from expressly advocating for or against a candidate.43 The termed “issue ads” could therefore be financed with “soft money,” funds subject to neither the maximum contribution and expenditure limitations of FECA nor its requirements to disclose the source of the funds.44 The eventual result was an avalanche of very effective issue 38424 U.S. 1 (1976). Id. at 44. 40 Id. at 45. 41 Richard Briffault, Law and Democracy: A Symposium on the Law Governing Our Democratic Process: The 527 Problem and the Buckley Problem, 72 GEO. WASH. L. REV. 949, 970 (2005). 42 Id. 43 FEC v. Wisconsin Right to Life, Inc., 127 S. Ct. 2652, 2658 (2007). 44 McConnell v. FEC, 540 U.S. 93, 126 (2003). 39 7 advocacy groups that, claiming to act independently of the candidates, wield an unconstrained ability to fundraise millions and spend those millions to influence elections. These expenditures were not limited to a few rogue individuals, and the groups that Congress intended to regulate the most, such as corporations and unions, leaped at the opportunity.45 Many of the unregulated expenditures were made by groups operating under false or misleading names that did not reveal the source their funds, such as Swift Boat Veterans for Truth,46 the Coalition-Americans Working for Real Change,47 Citizens for Better Medicare,48 and Republicans for Clean Air.49 These groups were political organizations organized under IRC § 527, which, as explained below,50 are not expressly regulated by FECA in any way. Expenditures made in coordination with or controlled by the candidate are not affected by the narrowed scope pronounced in Buckley because such expenditures are treated as “contributions” to the candidate under FECA § 101(b)(6)51 and not as “expenditures.”52 All expenditures made in coordination with a candidate would therefore still be limited to $1,000. The courts, however, have required proof of candidate control or negotiation regarding the expenditures, and the FEC has struggled to uphold its burden.53 Establishing consultation Id. at 127 (“Corporations and unions spent hundreds of millions of dollars of their general treasury funds to pay for these ads . . . unregulated by FECA.”). 46 Glen Justice & Eric Lichtblau, Bush’s Backers Donate Heavily to Veteran Ads, NY TIMES, Sept 11, 2004, available at http://www.nytimes.com/2004/09/11/politics/campaign/11swift.html. 47 McConnell, 540 U.S. at 197. The group was funded by business organizations opposed to organized labor. Id. 48 Id. The group was funded by the pharmaceutical industry. Id. 49 Id. at 197. The group was funded by Charles and Sam Wyly. Id. 50 See infra Part I.B and Part II. 51 See supra note 25. 52 Buckley v. Valeo, 424 U.S. at 46. 53 FEC v. Christian Coalition, 52 F. Supp. 2d 45, 89 (D.D.C. 1999). 45 8 between a campaign and a would-be spender has been found insufficient by the courts.54 Likely as a result of such negative treatment by the courts, the FEC tends to allow a significant degree of collaboration before attempting enforcement.55 This hard burden to establish coordination, coupled with the “issue advocacy” opportunity set forth above, has left a large window of opportunity for candidates to tacitly solicit funds and direct willing contributors (who had already contributed the maximum amount) to donate to the national party committees, state parties, or outside groups running independent issue advertisements.56 In response to these enforcement issues, Congress attempted to cast a broader net in its enactment of the Bipartisan Campaign Reform Act of 2002 (BCRA), also known as the McCain– Feingold Act,57 in which Congress sought to extend more limitations to the political expenditures of independent groups and specifically limited the ability of corporations and unions to engage in political speech. First, it required disclosure statements from every person expending over $10,000 in electioneering communications.58 BCRA defined “electioneering communications” as a communication, made sixty days before an election or thirty days before a primary, that refers to a clearly identified candidate for federal office.59 Importantly, the definition did not require express advocacy. The limitation on corporations and labor unions went further; these two groups were specifically barred, subject to certain limited exceptions, from expending 54 Id. Meredith Johnston, Note, Stopping “Winks and Nods”: Limits on Coordination as a Means of Regulating 527 Organizations, 81 N.Y.U.L. REV. 1166, 1188 (2006). (“The FEC allows for a high degree of coordination before any resulting expenditures will be treated as contributions. Campaign officials may meet with 527 organization leaders, as long as they are not acting as agents of the campaign. Benjamin Ginsberg provided legal advice to the Swift Boat Veterans while he was serving as outside counsel to President Bush's campaign.”). 56 McConnell v. FEC, 540 U.S. 93, 125-27 (2003). 57 Pub. L. No. 107-155, 116 Stat. 81 (2002). 58 2 U.S.C. § 434(f). 55 9 general treasury funds for electioneering communications.60 Lastly, it should be noted that, although not required to do so, some politically active groups are organized as corporations and would thus be prohibited from running ads referring candidates during the prohibited period.61 In McConnell v. FEC, the Court reviewed a facial challenge to these and other provisions of BCRA. The Court categorically upheld BCRA’s disclosure requirements related to electioneering communications.62 It also upheld BCRA’s ban on electioneering communications but only when the communication consists of express advocacy or “the functional equivalent of express advocacy.”63 The court also noted that organizations could still run ads during the relevant pre-election timeframe by not mentioning any candidates.64 In a subsequent as-applied challenged to BCRA, the Court explained and refined its holding in McConnell.65 In Wisconsin Right to Life, the Court struck down the application of BCRA against an organization that, during the 30 days prior to a senatorial election, ran an advertisement criticizing the filibuster and exhorting constituents to call two specific senators and express their discontent with the practice.66 The two senators were currently up for reelection. The FEC argued that the organization did not intend its advertisement to raise awareness about the issue but instead intended viewers of the ad to vote against the named senators. The court rejected the application of an “intent-and-effect test” in an as-applied 59 Id. at § 434(f)(3)(A). Id. at § 441b(b)(2). Under BCRA, however, corporations and labor unions may engage in communications on any subject to stockholders and members and their respective families, and they may establish and manage segregated funds to be utilized for political purposes. Id. at § 441b(b)(2)(A)-(C). 61 See, e.g. FEC v. Wisconsin Right to Life, Inc., 127 S. Ct. 2652 (2007). 62 McConnell v. FEC, 540 U.S. 93, 194-200 (2003). 63 Id. at 206. 64 Id. 65 Wisconsin Right to Life, Inc., 127 S. Ct. 2652. 66 Id. at 2658-70. 60 10 challenge.67 It instructed that the standard should be objective.68 It explained that “a court should find that an ad is the functional equivalent of express advocacy only if the ad is susceptible of no reasonable interpretation other than as an appeal to vote for or against a specific candidate.”69 Therefore, corporations may fund very damaging ads and may run those ads during the prohibited period, so long as they can make a reasonable argument that their communication was intended to create issue awareness and not to advocate for or against the named candidate. As suggested above, BCRA applies to both for-profit and non-profit corporations. Nonprofit corporations that are not 527s must also use segregated funds for electioneering communications.70 Certain non-profits, however, are exempted from the application of FECA and, thus, all regulation. FECA does not apply to communications by a section 501(c)(4) organization or 527 political organization when the communication is paid for exclusively by funds provided directly by individuals who are not banks, corporations and labor unions.71 The Court in McConnell interpreted the Act as respecting and adopting the limitation it had set forth in FEC v. Beaumont;72 it held that the segregated fund requirement does not apply to organizations bearing three characteristics: (1) they were formed for the express purpose of promoting political ideas and cannot engage in business activities, (2) they have no shareholders or other affiliated persons that have a claim on assets or earnings, and (3) they were not established by a business corporation or labor union and do not accept contributions from them.73 67 Id. at at 2665-66. Id. 69 Id. at 2667. 70 FECA § 316(c)(6) added by BCRA § 204. 71 2 U.S.C. § 441b(c)(2). 72 539 U.S. 146 (2003). 73 McConnell v. FEC, 540 U.S. 93, 210-11 (2003) citing Beaumont, 539 U.S. 146. 68 11 Given the strong evidence that high officials of both presidential campaigns often communicated with influential outside political groups during the 2002 elections, Congress also sought in BCRA to more sweepingly prevent coordination between independent groups and political parties or candidates. BCRA adjusted the candidate-focused definition of “contribution” to include “expenditures made by any person (other than a candidate or candidate's authorized committee) in cooperation, consultation, or concert with, or at the request or suggestion of, a national, State, or local committee of a political party. . . .”74 In BCRA, Congress instructed the FEC to establish new rules regarding “coordinated regulations” and stated that the new regulations “shall not require agreement or formal collaboration to establish coordination.”75 The Court upheld the statute against claims that the provision is overbroad, noting a narrower provision could be easily avoided by supporters who would likely closely communicate and consult with the campaign but, “after a wink or nor,” refuse to enter into a binding agreement.76 B. TAX PROVISIONS The complicated legal framework applicable to political groups is not limited to the acts and cases described above. Indeed, many of the complications and loopholes that Congress has long tried to fix would not have been relevant without the aid of existing Tax Code (“the Code”) provisions that grant all political organizations non-profit status, exclude contributions to candidates from income, and immunize political contributions from the application of the transfer tax (also known as the gift tax). 74 2 U.S.C. § 441a(a)(7) (2006); see also supra text at note 51. Bipartisan Reform Act of 2002 § 214(c). 76 McConnell, 540 U.S. at 219-24. 75 12 First, section 102(a) of the Code excludes “gifts” from gross income,77 allowing candidates and parties to solicit and receive political contributions without reporting income and paying income tax on such contributions.78 Amounts transferred between political organizations are specifically excluded from treatment as income to the candidates.79 Gifts, however, are usually subject to a transfer tax that is payable by the donor.80 The gift tax is due upon a completed transfer of property.81 The Code, however, specifically exempts transfers to political organizations from the application of the transfer tax.82 The combined result is that neither the contributor nor the political organization is required to pay taxes for political contributions. These two provisions encourage political contributions by allowing the political organization to receive and use the full amount of the donation without any additional cost to the donor. The application of the gift tax would likely have a particularly chilling effect on contributions since the tax must be paid by the donor, thus making the contribution more expensive to the contributor. Section 527 of the Code was enacted simultaneously with the gift tax exclusion for political contributions and, in turn, defines the “political organizations” (“527 organizations” or “527s”) that may receive such gift tax exempt contributions.83 The section was enacted to resolve surfacing controversy regarding the taxability of political contributions under the scheme 77 IRC § 102(a). Hugh K. Webster & Heidi K. Abegg, , Lobbying and Political Expenditures, 613-3rd TAX MGMT. PORT. A39 (BNA) (2002); Lloyd H. Mayer, The Much Maligned 527 Institutional Choice, 87 B.Y.U. L. REV. 625, 640 (2007). 79 IRC § 527(d)(1). 80 IRC § 2501(a)(1). 81 Id. 82 IRC § 2501(a)(4). 83 Pub L. No 93-625, 88 Stat. 2108 (1975) codified at 26 U.S.C. § 527. 78 13 set forth above84 and now, along with the § 2501(a)(4) gift tax exemption, controls the tax treatment of political contributions.85 The section defines a “political organization” as “a party, committee, association, fund or other organization (whether or not incorporated) organized and operated primarily for the purpose of directly or indirectly accepting contributions or making expenditures, or both, for an exempt function.”86 “‘[E]xempt function’ means the function of influencing or attempting to influence the selection, nomination, election, or appointment of any individual to any Federal, State, or local public office. . . .”87 The definition is quite broad and does not require any particular type of organization.88 A separate bank account of an individual or of a corporation can qualify as a 527 organization if it was set up to electioneer and is clearly identified as such.89 The Code neither requires nor prohibits affiliations between 527 organizations and candidates or parties.90 Section 527 organizations can therefore be completely independent of candidates and parties or fully controlled by them. Section 527 organizations are specifically exempted from income taxation,91 and they are subject to minimal regulation. They are not subject under the Code to any limitation on solicitation or expenditure of funds. 527s, as all tax-exempt organizations, are required to file an annual Form 990 Income Tax Return. Section 527 itself imposes minimal additional requirements; a 527 is merely required to disclose the amount, date and purpose of all 84 See Webster, supra note 78, at A-39; IRS Announcement 73-84, 1973-2 C.B. 461. IRC § 527; see also Mayer, supra note 78, at 640. 86 IRC § 527(e)(1). 87 IRC § 527(e)(2). 88 MARILYN PHELAN, MERTENS LAW OF FEDERAL INCOME TAXATION §§ 34:216 (2008). 89 Id. at §§ 34:218. 90 See IRC § 527. 91 IRC § 527(a). 85 14 expenditures when the organization’s annual expenditures are greater than $50092 and the name and address of contributors who contributed more than $200 during the calendar year.93 The disclosure requirements of section 527 do not apply to all 527s; the Code exempts the following from disclosure: those reporting to the FEC as political committees, 527s operating only in the state and local arena, those that will not have receipts greater than $25,000 for any taxable year, and those whose expenditures are independent expenditures.94 As such, the disclosure requirements attempt to ensure reporting by larger (more than $25,000) candidate or partyassociated organizations that attempt to influence federal elections but which do not report to the FEC as political committees. The section does not condition an organization’s tax exemption on proper reporting but instead imposes a thirty five percent tax95 on the particular amount that the organization received or expended without making the required disclosures;96 the organization’s other funds for which disclosures are made remain untaxed. Since the organization can retain its tax exemption for purposes of its other funds, the tax for failure to disclose has been criticized by some as inadequate to ensure disclosure and has been characterized as a being a fee that the organization can choose to pay in order to conceal the sources of its funds or the objects of its expenditures.97 Thus far, it appears that the Tax Code grants free reign to political organizations and their contributors. But this is not the complete story. Although, once a political contribution has been 92 IRC § 527(j)(3)(A). IRC § 527(j)(3)(B). 94 IRC § 527(j)(5). 95 IRC § 527(b) imposes the tax at “the highest rate of tax specified in section 11(b).” IRC § 527(b)(1). 96 IRC § 527(j)(1). 97 Ryan supra note 34, at 481 (“The penalty for a 527 organization's failure to comply with disclosure requirements is payment of tax on the undisclosed funds, which amounts to a non-disclosure option.”) 93 15 made, the Code preserves to the political organization the full benefit of the contribution by not levying any tax on such receipts or transfers, it can be said that the Code seeks to discourage large political gifts from being made at all. As explained in the following paragraphs, it is a clear goal of the Code to prevent the wealthy from using their tax positions to enhance their political influence, and it removes all tax-related incentives for political contributions. The Code disallows income tax deductions for political expenditures.98 Therefore, corporations and individuals engaged in business may not deduct political contributions from the calculation of their income taxes, even if they made the contribution in order to advance their business interests.99 Deductions for advertisements, dinners or programs, and inaugural events made in connection with political parties or political candidates are also specifically disallowed.100 Additionally, tax-exempt organizations eligible for tax-deductible charitable donations (501(c)(3) organizations) may not engage in political activities.101 Tax-exempt 501(c)(4) organizations, though never eligible for a tax deductible donation, may be subject to the gift tax for funds used for political expenditures.102 The intent and result behind these limitations is that all political contributions be made with after-tax dollars. Such a requirement prevents wealthy taxpayers in higher income brackets from leveraging their tax deductions to make a larger donation than a less wealthy taxpayer by sheer virtue of receiving a greater tax 98 IRC § 162(e). See generally McConnell v. FEC, 540 U.S. 93, 124-27 (2003) (discussing the use of political contributions by corporations and labor unions as tools to advance their business interests) 100 IRC § 276. 101 IRC § 501(c)(3); See also NICHOLAS P. CAFARDI & JACLYN F. CHERRY, TAX EXEMPT ORGANIZATIONS: CASES AND MATERIALS 180-193 (2d ed. 2008) (describing the “political activities test” applied for 501(c)(3) eligibility). 102 Gregg D. Polsky, A Tax Lawyer’s Perspective on Section 527 Organizations, 28 CARDOZO L. REV. 1773, 1781 (2007). 99 16 deduction for their contribution. Such limitations take root on similar concerns to those addressed by election law.103 II. THE HUNDRED MILLION DOLLAR GAP: THE SKEWED DEFINITIONS OF POLITICAL ORGANIZATION AND POLITICAL COMMITTEE A. THE GAP As just explained, election law seeks to regulate fundraising and expenditures of political committees as well as require them to disclose information regarding the source and use of their funds. On the other hand, the Tax Code barely places any restrictions on the political involvement of 527s. The Code, in fact, penalizes 527s with taxation on any non-exempt function income, which is essentially any non-political function income.104 527s will therefore always be political, although they might not be engaged in political activities related to federal elections and might instead be involved in state or local elections.105 The Code, however, never requires compliance with FECA or any other campaign finance law. Under the Code, subject to an arguably optional disclosure requirement,106 political organizations may freely fundraise and spend their funds on any political activity without risking loss of their tax-exempt status. A gap exists because neither FECA nor BCRA specifically address the status of 527s under election law. Given the extensive and influential political activity of 527s, it would be logical that they be subject to election law. Congress, in fact, in enacting section 527 intended 527 organizations to be subject to election law.107 But, as suggested above, the definition of “political organization” under section 527 is much broader than the definition of “political 103 Mayer, supra note 78, at 638. IRC §§ 527(b), (c). 105 IRC § 527(e)(2). 106 See supra text at notes 96, 97. 107 Mayer, supra note 78, at 644 (“Congress assumed that FECA requirements would apply to 527s.”). 104 17 committee” under FECA.108 There is a disconnect between the two laws’ requirements. For example, a group that exists for the primary purpose of influencing federal elections could easily register and become a section 527 organization, but it would not be a political committee regulated by FECA unless it engages in express advocacy.109 B. THE FEC’S ATTEMPT AT CLOSING THE GAP THROUGH RULE-MAKING After BCRA, the FEC engaged in rule-making in an attempt to bring 527s under election law. The FEC took aim at certain actions commonly engaged in by 527s. It widened its interpretation of “contribution,” indicating that any funds contributed to an independent group in response to literature that stated that the funds would be used to support or oppose a clearly identified candidate would be treated as “contributions” under FECA.110 In the same rulemaking process, the FEC also targeted independent group expenditures and required independent groups to use federal funds (funds raised in accordance with FECA requirements, also referred to as “hard money”) for certain specified portions of such expenditures.111 It required “nonconnected committees” to “pay their administrative expenses, costs of generic voter drives, and costs of public communications that refer to any political party . . . with at least 50 percent [f]ederal funds.”112 The FEC’s regulations are a step in the right direction, but they are unlikely to resolve the problem. First, the problem itself that the FEC is attempting to remedy (non-regulation of 527s) 108 Compare IRC § 527(e)(1), supra text and note at 86 with 2 U.S.C. §§ 431(4)(A)-(C), supra text at notes 3537. See also Ryan, supra note 34, at 480 (listing organizations that fall under § 527 but are not regulated by FECA). 109 Johnston, supra note 55, at 1180. 110 69 FR 68056-01 (2004) partly codified in 11 C.F.R. 100.57 (2004). 111 69 FR 68056-01 (2004) partly codified 11 C.F.R. 106.6 (2004). 18 makes the broader definition of “contribution” unlikely to remedy the situation at all. Large 527 organizations tend to receive funds from large donations as opposed to multiple small contributions. 113 Additionally, since 527s are not shy about expressing their message, it would not be difficult for potential contributors to discern for what candidate a soliciting 527 will advocate. The regulations requiring independent groups to partially fund specific activities, such as voter drives and public communications, with federal funds when a candidate or party name is mentioned at the activity would be expected to be more effective because the groups desire their events to help their preferred candidate or party, which would be harder for them to effectuate if they refrain from mentioning their alliances. Additionally, the FEC, as instructed by BCRA, intended in the same rule-making process to more clearly define “political committee.”114 After the notice and comment process, however, the agency declined to issue a rule at all and instead decided to approach the determination on a case-by-case basis.115 The court required the FEC to explain its decision to adjudicate instead of setting forth a rule116 and later upheld the FEC’s decision.117 112 11 C.F.R. 106.6(c). See, e.g. DallasNews.com, John Kerry Accepts T. Boone Pickens’ Swift Boat Challenge, November 16, 2007, last visited on October 27, 2008 http://www.dallasnews.com/sharedcontent/dws/dn/latestnews /stories/111707dnnatkerrypickens.de9d26.html; Wikipedia.org, T. Boone Pickens, visited on October 27, 2008, http://en.wikipedia.org/wiki/T._Boone_Pickens (“In 2004, Pickens contributed to 527 Republican groups, including a $3 million contribution to the Swift Vets and POWs for Truth viciously attacking Bush's rival, John Kerry, and $2.5 million to the Progress for America advocacy group.”). 114 FEC Notice 2004-6, 69 FR 11736 (2004). 115 Shays v. Fed. Election Comm'n, 424 F. Supp. 2d 100, 112-13 (D.D.C. 2006). 116 Id. at 116. 117 Shays v. Fed. Election Comm'n, 511 F. Supp. 2d 19 (D.D.C. 2007). 113 19 C. FEC ENFORCEMENT OF FECA AND BCRA AFTER THE 2004 ELECTIONS: VICTORY OR LOSS? Despite the FEC’s seemingly helpful rule enactments in 2004, the success of its post2004 election enforcement actions can be questioned. FEC Program Director Paul Ryan points out that “the FEC’s case-by-case enforcement action approach has serious shortcomings.”118 The FEC has taken up enforcement action against a few 527s, but many more that participated in the 2004 elections remain unscathed. Arguably, the FEC started at the top, trying to send a message to other large and smaller groups that it will not allow the actions of 527s to remain unregulated.119 But even in those cases that the FEC has fully prosecuted and reached a conciliation agreement, the fines imposed pale in comparison to the amounts raised and expended by the groups involved.120 The prosecutions also did not occur until some two years after the elections in which the groups participated, possibly because of political influences themselves and delayed appointments in the recent past.121 As such, it can be expected that some 527s will choose to continue to act and take their chances. III. Summary and Critical Analysis of Suggested Solutions The 527 gap has been considered by many commentators, especially in the wake of the $611.7 million dollars spent by unregulated 527s in the 2004 election122 despite Congress’s best efforts to close FECA loopholes through the enactment of BCRA. The FEC has fined only a 118 Ryan, supra note 34, at 503. Id. 120 Id. 121 Peter Overby, Morning Edition: FEC Fines ‘527’ Groups, Including Swift Boat Veterans, NATIONAL PUBLIC RADIO, December 14, 2006, available at http://www.npr.org/templates/story/story. 119 America.gov, Ralph Danheisser, “527” Committees Spend Millions on Political Discourse: Issues-advocacy Approach Exempts Them from Limits on Campaign Funding, April 3rd 2008, http://www.america.gov/st/elections0820 122 small number of the 527s that waged partisan political crusades in the 2004 elections, and the fines it did levy were as low as twelve percent of the expenditures those groups made.123 Such weak action is likely to prove ineffective at deterring 527s from side-stepping the rules in future elections. Arguably, the FEC is not the sole culprit, since it is charged with enforcing a body of law that calls to mind an image of a tree after the passage of a flock of wood peckers—full of holes. Of course, the flood of 527s coincides with an area blanketed with uncertainty regarding the application of FECA. Congress’s original intention that 527s fall under FECA124 has become irrelevant after thirty years of inaction and cannot be relied on as a resolution to the problem. In the 2008 Presidential election, for example, 527s raised $425,561,881 and spent $374,187,522 to influence the election,125 demonstrating that further regulatory action is necessary. Commentary generally takes one of two approaches: it considers and suggests a particular solution, or it concentrates on what body of law (election law or tax law) is most appropriate for regulation of 527s. An effective solution, however, needs to address both the uncertainty in the law and the enforcement difficulties that have become apparent in the recent past. The law needs to be redefined to more clearly address 527s. Additionally, stronger enforcement methods that deter intentional circumvention should be put into place. The following paragraphs summarize approaches suggested in prior commentary. english/2008/April/20080403113513abretnuh0.9178125.html. (“. . .527s raised more than $599.2 million, and logged expenditures of $611.7 million.”). 123 Overby, supra note 121 (explaining that Swift Vote Veterans spent $ 25,000,000 but were only fined $299,500). 124 See supra note 107. I. 125 OPENSECRETS.COM, 527S: ADVOCACY GROUP SPENDING IN THE 2008 ELECTIONS, OCTOBER 21, 2008, HTTP://WWW.OPENSECRETS.ORG/527S/INDEX.PHP. 21 A. WHO SHOULD REGULATE: ELECTION LAW VS. TAX LAW 1. The Tax Writing Process vs the Election Law Writing Process Professor Lloyd Mayer argues that the election law drafting process is better suited to tackle the 527 regulation issue than the tax law drafting process. He contends that the drafting of election law provisions rather than tax law provisions to regulate 527s would be more visible to the media and public, thus receiving more scrutiny and being more desirable. He gives two reasons. First, he points out that past election law drafting procedures affecting political expenditures (FECA and BCRA) received more attention than their tax law counterparts.126 For example, he indicates that both IRC § 527 and its later amendment to require disclosure passed with little commentary or attention.127 Second, he argues that amendments to election law are likely to involve funding restrictions or disclosure requirements, as opposed to increased costs from increased taxation, and that such funding restrictions and disclosure requirements are more constitutionally charged and more likely to attract public and judicial scrutiny. Scrutiny, he suggests, would limit Congressmen’s abilities to further personal goals above those of the public. He, therefore, concludes that re-writing election law is a better vehicle for 527 regulation. In his analysis, however, Professor Mayer does not discuss the politically charged environment that currently surrounds the issue of 527 regulation.128 The amount of funds spent by 527s in the 2004, 2006 and 2008 elections and the lack of regulation over such expenditures is the subject of articles,129 blogs,130 and broadcasts.131 The sector itself has called for clarification 126 Mayer, supra note 78, at 661-63. Id. at 662. 128 See generally Mayer, supra note 78. 129 Carl Hulse & Sheryl G. Stolberg, G.O.P. Is Taking Aim at Advocacy Groups, N.Y. TIMES, March 31, 2006, available at http://www.nytimes.com/2006/03/31/washington/31groups.html?scp=8&sq=527&st=cse 127 22 of the law.132 Given the charged state of the issue, regulation affecting 527s is likely to attract a great deal of attention regardless of which Congressional committee is doing the drafting. Furthermore, Professor Mayer seems to conclude that the Tax Code is somehow less potentially harmful to 527s because the Code has never been concerned with restricting the funding of 527s or absolutely requiring disclosure. But the fact that the Code has not much regulated 527s in the past does not mean that the Code cannot increasingly regulate them in the future. He fails to consider the fact that the Code—especially in the area of non-profit organizations—often sets forth limits on both sources of funds and expenditures. Additionally, the Code imposes excise taxes and penalties as high as 200% on some non-profit organizations and their directors that willingly fail to follow Tax Code requirements and limitations.133 Similar requirements and penalties could be imposed on 527s. Such penalties would not likely be considered harmless by 527s, their contributors or their directors. 2. The Competence of the IRS vs the FEC Another consideration that should shape the chosen course of action is the currently available enforcement avenues. Specifically, lawmakers should focus on efficiency and deterrence. The competence of the applicable agency to tackle its expanded role is of central importance. Professor Mayer also considered this issue and concluded that the FEC would be 130 Jayson K Jones & Ana C. Rosado, MoveOn Terminates its 527, June 20, 2008, THE CAUCUS: THE N.Y. TIMES POLITICAL BLOG, available at http://thecaucus.blogs.nytimes.com/2008/06/20/moveon-terminates-its527/ 131 See supra note 121. 132 Ryan, supra note 34, at 504-505. 133 Cafardi, supra note 101, at 904-14. See, e.g., IRC § 4941 (imposing a 10% tax on self-dealing followed by a 200% for failing to remedy the transaction), IRC § 4942 (imposing an initial 5% tax on private foundations that fail to make required minimum distributions and a later 100% tax for failing to correct within one year). 23 better suited than the IRS to enforce any resulting 527 regulation.134 First, the FEC, he argues, has expertise in regulating the disclosure requirements and funding limitations imposed by election law.135 Additionally, he argues that political organizations are required to deal with the FEC and would already know how to work with the FEC through informal means; involving the IRS as a second agency would make compliance burdensome. He further rightly points out that the IRS has a very low audit rate (.8% in the case of tax exempt organizations)136 and is quite slow, an undesirable quality in the face of short election cycles.137 As Professor Mayer points out, the FEC is definitely the expert on election law and the IRS is already considerably over-extended. On the other hand, the FEC has consistently proven somewhat inadequate at enforcing FECA against 527s. But there is no indication that the IRS would be any better suited to direct enforcement. Additionally, the IRS is familiar with regulation of expenditures and contributions of tax-exempt organizations.138 The IRS’s regulation of such requirements and prosecution for willing failures to disclose is facilitated, in part, because all 527s are already required to register with the IRS and, under penalty of perjury, file a yearly Form 990. Some further interaction with the IRS would therefore not be particularly different from status quo and would not prove overly burdensome to either the organizations or the IRS. 134 Mayer, supra note 78, at 682. Id. at 663. 136 Id. at 672. 137 Id. at 673. 138 See, e.g., Cafardi, supra note 101, at 190-93, 904-14 (discussing the political activities restriction applied to 501(c)(3) organizations and the investment, distribution and business holdings limitations imposed on private foundations, respectively). 135 24 B. WHAT SHOULD THE LAW SAY? 1. Regulating Coordination It has been argued that Congress should focus its attention on coordination activities between the parties and 527s.139 It is argued that focusing on coordination will thwart the unregulated political participation of donors whose sole intention is to curry favor with and gain access to elected officials, but it will not discourage the speech of those that truly intend to advocate an issue.140 Additionally, Congress already attempted to prevent coordination in its enactment of the BCRA, but the FEC failed to enact strong regulations defining “coordinated communication.”141 Congressionally set forth definitions of “solicit” and “direct” within the context of BCRA would be necessary.142 Though arguably a great solution to parse out the true issue-advocators from the politically motivated millionaires, enforcement difficulties make the coordination approach impractical. It requires reliable information regarding communications. It would be constitutionally questionable to ask for a list of every person that campaign officials meet with or speak to. Even if someone does indicate to the FEC that the campaign has spoken to a wealthy individual, it would be hard to know what was said. The organization’s later actions would serve as circumstantial evidence of a possible agreement but the evidence will unlikely be different from the evidence that was rejected in FEC v. Christian Coalition as failing to sufficiently establish coordination.143 Additionally, adjusted definitions of what constitutes tacit solicitation or direction of funds would likely be circumvented by interested parties. Candidates could, for 139 See generally Johnston, supra note 55. Id. at 1197. 141 Id. at 1200-01. 142 Id. at 1202. 140 25 example, have a news spot on their websites listing all politically-charged advertisements that are being run in the news and indicate who funded the ads. Candidates could convincingly argue that their intent in reporting that information is to create transparency by revealing to the public who is funding communications. The result would likely be that savvy, willing donors who have already contributed the full amount allowed by election law would use the list as a source of potential contributees that will support their candidate. 2. Reforming the FECA definition of “political committee” The members of Congress are aware of the flaws in the legislative scheme, and bills attempting to bring 527s under FECA have been introduced in Congress every year since the 2004 elections.144 Similar to prior bills, the stated purpose of the 527 Reform Act of 2007 (“527 Reform Act” or “the Act”) was “to clarify when organizations described in section 527 of the Internal Revenue Code of 1986 must register as political committees.”145 The 527 Reform Act proposes amending FECA to add “any applicable 527 organization” to the definition of “political committee.”146 The amendment would make FECA apply to all “applicable 527 organizations.” The Act then defines “applicable 527 organization” as an organization that has notified the Secretary of the Treasury of its 527 status and which is not specifically excepted.147 It then excepts from the definition a whole host of organizations, such as tax-exempt nonpolitical organizations, organizations with receipts no greater than $25,000, political committees 143 See supra, note and text at 53-56. e.g., 527 Reform Act of 2007, H.R. 420, 110th Cong., 1st Sess. (2007); 527 Reform Act of 2007, S. 463, 110th Cong., 1st Sess. (2007); 527 Reform Act of 2006, H.R. 513, 109th Cong., 2nd Sess. (2006); 527 Reform Act of 2005, H.R. 513, 109th Cong., 1st Sess. (2005); 527 Reform Act of 2004, H.R. 5127, 108th Cong., 2nd Sess. (2004). 145 527 Reform Act of 2007, H.R. 420, 110th Cong., 1st Sess. (2007), hereinafter “527 Reform Act.” 146 527 Reform Act § 2. 147 527 Reform Act § 2(b). 144See, 26 of state or local candidates, organizations making expenditures that are deductible under § 162, and organizations making expenditures exclusively for state or local elections purposes.148 The list of excepted organizations closely mirrors the list of 527 organizations exempted by the Code from its disclosure requirements.149 After the exceptions, the 527 Reform Act’s definition would include 527s active in federal elections in the FECA definition of “political committee,” thus making federally-active 527s subject to FECA while excluding 527s that strictly act in other arenas. Much like the earlier years’ 527 reform bills, the 2007 bill did not pass. FEC Program Director and Associate Legal Counsel Paul Ryan argues that the bill’s definition, or a similar one, should be adopted; he also suggests that state and local governments should similarly seek to regulate state and local 527s.150 He points out that the large amounts of unregulated political spending have been facilitated by the uncertainty in the law, a fact that became apparent in the prosecuted 527s’ defenses to the few FEC prosecutions that followed the 2004 elections.151 He states that some FEC officials as well as the 527 community are frustrated at the uncertainty of the law and argues that the 527 Reform Act’s definition is preferable because its boundaries would be clear, making all Federally-active 527s subject to FECA.152 3. Major Purpose Test Advocates of the “major purpose” approach view the world of independent political contributors as split into two kinds of groups: (1) groups with an avowed major purpose of 148 527 Reform Act §§ 2(b)-(d). Compare 527 Reform Act §§ 2(b)-(d) with IRC § 527(j)(5). 150 See generally Ryan, supra note 34. 151 See id. at 493-94 (discussing the arguments raised by SwiftVets in which it argued that it was uncertain about the continued validity of the “advocacy test” given prior appellate court decisions and FEC action). 152 Id. at 504-05. 149 27 supporting or opposing a particular candidate for office, and (2) groups whose primary concern regards a specific cause, such as healthcare or gun control, and that sometimes expend funds to support or oppose a candidate if they feel that it will advance their cause.153 It is argued that contributions by individuals to the first type of group, “political committees” or “electionfocused” groups, should be subject to FECA requirements because such contributions give rise to the same undue influence concerns as direct contributions to the candidates themselves.154 In contrast, it is argued that contributions to “issue-focused” groups should not be subject to FECA regulation because they would not necessarily curry favor with the candidate and any limitations would intrude on an individual’s First Amendment right to support a cause of his or her choosing.155 Proponents of the major purpose test contend that the expenditures of an organization will place it in one group as opposed to the other, depending on how they spend the majority of their funds. That is, a group that expends the majority of their funds in electionrelated activities, as opposed to creating issue-awareness, should be fully regulated under FECA. Theoretically, the major purpose test is a good solution to the issue of 527 regulation because all 527s would be categorized, by definition,156 as “political committees” and would, thus, be regulated by FECA. The shortcomings of the major purpose test arise in the effort to Edward B. Foley, The “Major Purpose” Test: Distinguishing Between Election-Focused and Issue-Focused Groups, 31 N. KY. L. REV. 341, 342 (2004); see also Benjamin S. Feuer, Comment, Between Political Speech and Cold, Hard Cash: Evaluating The FEC’s New Regulations for 527 Groups, 100 Nw. U. L. Rev. 925, 94650 (2006) (discussing and critically analyzing the major purpose test). 154 Foley, supra note 153, at 344-48. 155 Id. at 347-51. Professor Foley distinguishes the First Amendment interest of contributors of issue-focused groups from the interests of contributors of election-focused groups. Id. He relies on the Supreme Court’s pronouncements in McConnell, in which the Court found that an amount limitation on direct contributions to candidates does not violate an individual’s First Amendment right because any donation amount expresses the individual’s support. Id.; see also McConnell v. FEC, 540 U.S. 93, 135-36 (2003). The Court found that a larger donation would express little more than the original contribution accomplished. McConnell, 540 U.S. at 36. 153 28 simplify its application by looking at how the entities spend their funds; the issue would arise mostly outside the boundaries of 527 organizations. The test becomes over-inclusive and underinclusive of some none-527 organizations. That is, if Congress amended FECA (or the FEC promulgated a rule) to include “all organizations whose major purpose is to influence a federal election” under the definition of “political committee” and defined an organization’s major purpose according to how the organization spends the majority (more than 50%) of its funds, it would bring desirable clarity but it might affect some organizations in unintended ways. For example, a gun club organized as a 501(c)(6) might one year feel that a particular pro-regulation Presidential ticket would be extremely harmful to its interests. It might, that year, engage in abnormal fundraising and expend the large majority of its funds to ensure the defeat of the threatening candidate. The organization’s abnormal activities in that election year could result in qualification for FECA regulation, despite the organization’s major purpose of being a social gun club. Alternatively, the statute might be under-inclusive when applied and could in fact encourage groups to become involved in federal elections. For example, consider a careful, non527, pro-life group that normally limits its activities to public demonstrations and publication of information bulletins. This careful organization would not, in fear of FEC fines, generally expend any funds to influence an election. The group might feel empowered by the “majority of funds” delineation to begin to spend 49% of its funds to influence federal elections without any fear of sanction. The amendment might therefore result in involvement of even more groups in federal elections. 156 See supra text at notes 86, 87. 29 Lastly, as suggested by the example above, organizations, especially large ones, are always in a position to control both their fundraising and their expenditures. A simple focus on how they spend their funds will likely enable them to adjust their spending in order to avoid undesirable regulation. As such, although the “major purpose” test is a colorable solution in theory, it in the end stands to have too many undesirable consequences and offers opportunity for circumvention. 4. Arbitrage Issues Arising from a Concentration on 527 Organizations One commentator suggests that it would be ineffective to concentrate on including 527s under election law. His concern is that a focus on 527s per se as opposed to on certain activities that FECA should regulate will result in organizations moving away from 527 and into other Tax Code sections in order to avoid regulation. The argument fails to recognize the definition of a political organization under IRC § 527. As explained by Professor Gregg Polsky, “[a]n organization either is or is not a political organization for tax purposes based strictly on its activities.”157 A tax-exempt organization’s activities will limit its abilities to choose what code section it will operate under. A 501(c)(3) organization may not engage in any political activity,158 but a 501(c)(4) organization may engage in political activity so long as it is related to its tax exempt status and it is not its major purpose to engage in political activity.159 Only a 527 organization must have a main purpose of engaging in political activity or it will face taxation. Additionally, case law and legislative history 157 Polsky, supra note 102, at 1784. A Tax Lawyer’s Perspective on Section 527 Organizations, 28 CARDOZO L. REV. 1773, 1784 (2007). 158 See generally Cafardi, supra note 101, at Chapter 3. 159 See Id. 30 demonstrate that it has not been easy to identify and isolate specific kinds of political activities that should subject an organization to FECA requirements.160 IV. SUGGESTED FRAMEWORK: AN INTEGRATED 527 PACKAGE Given the historical ability of parties and political organizations to find loopholes and mold their contributing groups to avoid regulation, the most effective and efficient strategy should consider both sources of law and include mutually enforcing limitations and penalties (“the 527 package”). A. CONGRESS IS THE PROPER ENTITY TO ENACT THE 527 PACKAGE Congress should draft and enact the changes, and it should not delegate the authority to either the IRS or the FEC to draft a rule until after Congress puts the overarching framework in place. First, as discussed above, FEC’s rule-making has in the past proven insufficient. Specifically, the FEC has already refused to set forth a rule delineating which 527s constitute political committees; it should not be expected to act any differently in the future. Additionally, a comprehensive legal package simultaneously instituting changes in both election law and tax law could only come from Congress. B. THE 527 PACKAGE INVOLVES BOTH ELECTION LAW AND TAX LAW Political activists have proven to be experts at circumventing the law, at least, that is when they can do so without a significant risk to their coffers. An effective regulatory scheme should therefore leave as little wiggle room as possible and threaten repercussions that are strong and swift enough to dissuade groups from taking their chances. 160 See supra Part IA, Part IIB. 31 First, Congress should, as previously proposed, amend FECA to directly include federally-active 527 organizations in the definition of “political committee.” Such a definition would be more effective than the “major purpose” test for several reasons. First, 527 registration is a good test of what organization should be regulated under FECA because 527 organizations, by definition, are politically-centered organizations. Specifically referring to federally-active 527s in the statute would directly accomplish what the major purpose test seeks to indirectly do: subject all federally-active 527s to regulation under FECA. Given that all 527s must file a Notice of Section 527 Status, Form 8871, it would be simple to discern which organizations are subject to FECA under the new amendment; all organizations filing a Form 8871 that plan to expend any funds whatsoever for federal (as opposed to state or local) election purposes would be subject to FECA. An organization is not likely to refrain from filing with the IRS to avoid FECA regulation because it would then not be able to obtain tax exempt status under § 527.161 Lastly, a definition that does not risk affecting any organization that is not a 527 organization is more likely to be passed by Congress than a “major purpose” definition since other types of less active political organizations would not feel threatened and would not feel compelled to join the lobby against the resolution. Second, although the FEC would be primarily charged with enforcement of FECA against all 527s, tax law can easily be adjusted to assist in compelling compliance with FECA disclosures. First, subsection “j” of section 527 could be amended to state that “the organization must comply will all applicable disclosure and expenditure and contribution limitations set forth “An organization that is required to file Form 8871, but fails to do so on a timely basis, will not be treated as a tax-exempt section 527 organization for any period before the date Form 8871 is filed. In addition, the taxable income. . . .” Form 8871 Instructions, available at http://www.irs.gov/instructions/i8871/ch01.html# 161 32 by applicable election law.” The annually filed Form 990 could be adjusted to require filing 527s to check a box where they affirmatively state that they have complied with all applicable FECA requirements. A 527’s Form 990 where the box is not checked would not be in compliance with section 527 requirements, thus being subject to a substantial excise tax or revocation of its taxexempt status, as set forth by Congress. Since the form is signed under penalty of perjury, an organization’s representative would subject himself to criminal prosecution if he checks the box while in knowing violation of FECA requirements. The clarity brought to the regulatory scheme by adding “federally active section 527 organizations” to the definition of “political committee” would eliminate the ability of 527s to take their chances and later argue that they were unsure of whether the organization was subject to FECA regulations. Once it is clear that 527s must comply with FECA, the proposed assistance from the tax laws will further ensure compliance because individual representatives will likely not be willing to make misrepresentations under penalty of perjury. Additionally, the liability of the person who filed the form would persist even if the organization disbands. Furthermore, the proposed scheme would work well alongside existing procedures by requiring only minimal, immaterial changes to the procedures already put in place by the IRS and the FEC. There would be no new paperwork but merely a new line in a Form that must already be filed annually. The consequences, however, of failing to comply would be much higher, therefore eliminating the incentive of 527 directors to turn a blind eye to the law. d0e133. 33 C. LIMITS OF THE 527 PACKAGE: TRUE ISSUE ADVOCATES The proposed 527 package would not reach groups that engage solely in issue advocacy. Given the IRC § 527(e)(2) definition of “exempt function,”162 groups whose principal objective is to advance an issue—as opposed to seeking the election or defeat of candidates—are unlikely to organize under section 527 at all. The proposed definition of “political committee” would allow such groups to remain unregulated by FECA. The omission was intentional. First, such groups enjoy the strong First Amendment protections, and any attempts to regulate their funds would be highly scrutinized and possibly struck down. Second, their expenditures, though often politically-related, are aimed at advancing particular causes and do not present the same undue influence and corruption risks presented by organizations aimed at supporting candidates. As such, under the proposed package, some politically-aimed expenditures will remain unregulated, but such speech has long been deemed desirable by the American public and is protected by the Constitution.163 V. CONCLUSION Political groups have through the years proven to be experts at circumventing the requirements of campaign finance laws. They have been aided by ambiguities in the law and a lack of strong, strictly-enforced penalties. Redefining the FECA definition of “political committee” would lay strict boundaries and clearly indicate that all 527 organizations are subject to election law regulation. Using tax law to further intimidate organizations into voluntary compliance without giving rise to any substantial additional audit work for the IRS is an effective use of existing legal frameworks and for the Code to help regulate the 527s it creates. 162 163 IRC § 527(e)(2); see also supra text at 87. Perhaps a group can take up the issue and argue for regulation of even issue-advocacy groups. 34