Chapter 2

advertisement

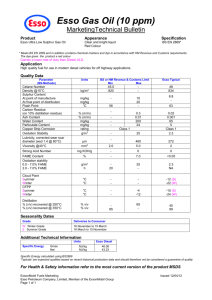

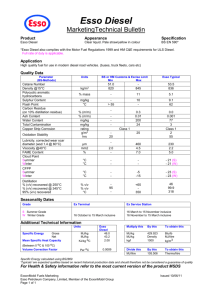

Business Research Practices Chapter 2 Literature review 2.1 The Overview of Exxonmobil In 1998, Exxon and Mobil signed a definitive agreement to merge and form a new company called Exxon Mobil Corporation. "This merger will enhance our ability to be an effective global competitor in a volatile world economy and in an industry that is more and more competitive," said Lee Raymond and Lou Note, chairmen and chief executive officers of Exxon and Mobil, respectively. After shareholder and regulatory approvals, the merger was completed November 30, 1999. The corporate entities that would become Exxon and Mobil began the 20th century as components of one company. At the end of the century, they came together as a single premier organization. For most of the years in between, they blazed separate trails as independent, competing enterprises. Each company placed a singular imprint on the energy industry and on a dynamic era of world history while, in many ways, energy is today one of the world’s most essential. ExxonMobil and its affiliated companies are present on a world scale, doing business in some 200 countries and territories. Exxonmobil explore for oil and natural gas on six of the seven continents and are the world's largest non-government gas marketer and reserves holder. Exxonmobil offer a wide range of fuels, lubricants and petroleum products under the ExxonMobil, Esso and Mobil brands in Thailand Esso will change its service station strategy from dealer-owned to company-owned and operated. This policy will allow Esso to effectively implement a price cutting strategy and control the quality of the fuel it sells. The oil market situation this year will continue downwards with low marketing margins. The margin this year has plunged to around Bt0.70-0.80 per liter compared with Bt1.30-1.40 last year. The situation is expected to deteriorate further next year since the demand for fuel oil is projected to fall in 2000. The lower margins have forced many oil companies to shut down some of their service stations. At present, the profit margin for oil products in Thailand is about Bt0.70 to Bt0.80 a litre, but it sometimes falls lower, he said. For example, diesel and petrol were sold at a loss in the middle of last month Esso Thailand delivers products and services under the trademarks of ESSO and EXXON. Products include; fuels, lubricants, and specialty products (such as metal working fluids, white oils, insulating oils, jute batching oils, and rubber oil). During the early 1990's Esso and the other international and local fuel oil supply companies all pursued policies of rapid countrywide service station expansion. Esso in order to differentiate itself from its competitors undertook an internal study to look at Thailand best practices and develop an optimal competitive expansion strategy to increase Esso's competitive market position. Copyright @ Siam University / School of BBA and MBA - 1- Business Research Practices 2.2The Structure of Exxonmobil in Thailand Figure 2 : Types of business Exxonmobil Mobil brand Esso brand Industrial Retail Fuels income Non-fuel income Source : Exxonmobil Business Structure in Thailand 2.3 Type of Project: Competitive Market Research/Thailand Tractus, in collaboration with the Broker Group's market research division developed and administered a questionnaire to customers at selected Esso sites in Thailand and collected traffic flow and general competitor presence information in areas surrounding six targeted sites each regional area, including: Created and developed a characteristic Esso customer profile from interviews held with customers at the Esso service stations; Assisted in determining what products and services were most desired by Thai consumers at service stations; Quantified traffic flow passing and entering the targeted Esso sites to determine passing traffic market share; Copyright @ Siam University / School of BBA and MBA - 2- Business Research Practices Quantified passenger cars, diesel pickups, heavy trucks frequency to determine if there was a differentiation in products and services desired by different types of motorists; Determined the current level of Thai consumer's market sophistication and current/future interest in other services or products; Screened the area surrounding the targeted sites for competitor presence; Gathered information on competitor presence, products/services available, and a general background on their business development strategy; Evaluated competitors product and service offerings; and developed a competitive site profile and compiled a preliminary list of potential co-locator products/services to be offered. Retail Stations ExxonMobil sells motor fuels at 45,000 stations in more than 100 countries. In the early 1900s small stores sold gasoline in cans to the first automobile drivers. Service stations became widespread in the United States and Europe in the 1920s as the vehicle population began to grow. In the United States, the total number of service stations grew steadily, booming after World War II as America became a nation on wheels. In the 1970s, however, changing customer needs and increasingly stringent safety and environmental practices made many small service stations uneconomic. U.S. customers want the convenience, service and value generally found in large multi-pump facilities located on major travel routes and offering convenience stores or fast food restaurants. The conventional "gas station" that includes service bays — a common sight in the U.S. a generation ago — is less common today because of improved automobile reliability and longer service intervals. Scale and volume are critical to service station efficiency and success. A service station in the U.S. or Europe may dispense more than 250 thousand gallons (one million liters) of gasoline every month. Similar trends are evident in other industrial countries, while smaller neighborhood stations with service bays are still common in Latin America, Asia and Africa where older vehicles still require more frequent maintenance. Thirty years ago, many U.S. stations were owned and operated by oil companies themselves. Today, ExxonMobil owns and operates about 6 percent of the 16,000 branded outlets in the U.S. The remaining 95 percent are operated by independent dealers, by distributors with multiple outlets or by other companies. Relationships with our dealers and distributors are governed by contracts covering rent, supply arrangements, quality assurance, marketing and other issues to form a sound business relationship and assure value and service for our customers. Copyright @ Siam University / School of BBA and MBA - 3- Business Research Practices What may not be obvious at a service station is the advanced technology used to ensure safety and environmental protection as well as service and quality. When customers refuel, the gasoline is pumped from underground storage tanks to the island dispenser and through the hose and nozzle into the vehicle's tank. Modern service stations use rust-proof, double-walled tanks made of fiberglass, with special corrosion protection and emergency shut-off controls. Vapor recovery systems are employed where needed to reduce air emissions. Advanced leak detection devices can be monitored remotely in centralized locations to protect the local environment. Along with safety and sound environmental management, customer convenience is the focus of today's retail gasoline business. Faster pump dispensers and the ability to pay at the pump island are increasingly common features in highly developed markets. New technologies such as ExxonMobil's SpeedpassTM allow purchases without cash or conventional credit cards. In addition to motor fuel, many service stations now include other retail offerings. Worldwide there are more than 11,000 Exxon, Mobil and Esso branded convenience stores, providing customers in many parts of the world with fresh food and baked goods as well as convenience items. In developing countries, Esso and Mobil branded stations bring people clean, safe and efficient service to support increasing mobility and a growing standard of living. All this takes a significant investment. In metropolitan U.S. markets, a single retail facility may cost nearly $2 million to build and stock. In large cities or on major highways, the cost may be significantly higher. People, hard work, advanced technologies, investment capital and careful management — these are the necessary ingredients to compete business ExxonMobil has been in business for nearly 120 years. Despite our size and success, we currently supply only 15 percent of United States and worldwide gasoline demand Continually reduce costs to achieve best-in-class performance Capture full benefits of integration with ExxonMobil's operations Marketing earnings declined in 1999, primarily due to an inability to pass along higher crude prices, as well as intense competition in all markets. Foreign exchange effects were also unfavourable. Sales volumes increased slightly above 1998 levels Focus on businesses that capitalize on our core competencies Build proprietary technology positions Selectively invest in internationally advantaged projects Copyright @ Siam University / School of BBA and MBA - 4- Business Research Practices ExxonMobil markets gasoline and other fuel products at more than 45 thousand branded service stations in more than 100 countries. Its affiliates serve aviation customers at 700 airports in 80 countries, marine customers at 150 ports in 60 countries and some 1 million industrial and wholesale customers in 50 countries. The company markets under three of the best known brands in the world: Exxon, Mobil, and Esso. Marketing earnings declined in 1999, primarily due to an inability to pass along higher crude prices, as well as intense competition in all markets. Foreign exchange effects were also unfavourable. Sales volumes increased slightly above 1998 levels 2.4 STRONG PRESENCE IN ESTABLISHED MARKETS In the United States, market sales of motor gasoline increased 4 percent in 1999. ExxonMobil continued to upgrade retail facilities, installing over 150 modern destination convenience stores during the year. These investments have significantly increased merchandise sales. Imperial Oil Limited (ExxonMobil interest 69.6 percent), the largest refiner and marketer in Canada, continued to expand its network of convenience stores and recently opened a new Tiger market destination convenience store in Calgary, Alberta. The site is the first in a series of about 80 such stores Imperial plans to build in major Canadian markets over the next 3 years. Imperial's retail motor gasoline sales increased 3 percent in 1999. ExxonMobil and Tesco (the leading grocer in the United Kingdom) have been test marketing over the past year at nine sites in the United Kingdom. The Tesco branded stores, with Esso branded forecourts, provide customers the quality and value of Esso's product offering and Tesco's grocery retailing expertise. Consumer acceptance of the alliance has exceeded expectations 2.5 GLOBAL MARKETING EXPANSION CONTINUES ExxonMobil has continued to identify and pursue profitable expansion opportunities in higher growth markets, particularly in Latin America and Asia-Pacific. ExxonMobil is currently among the industry leaders in retail chain modernization and has produced two very successful large-format convenience stores concepts. Both the On The Run and Tiger market largeformat C-store concepts have produced industry leading results in the United States and abroad. ExxonMobil has developed more than 440 large-format convenience stores in the United States under the Tiger market and On The Run brands. Overall sales results as well as same-store sales increases continue to exceed industry averages. In addition, the On The Run convenience store design was recently awarded "The Best New Overall C-Store Concept" by Convenience Decisions . Copyright @ Siam University / School of BBA and MBA - 5- Business Research Practices Each year, ExxonMobil prepares a detailed, long-term outlook of worldwide economic growth and energy demand. These forecasts, which we have prepared for decades, are used to help us plan our business. Of course, ExxonMobil is not the only organization interested in the future of energy demand and supply. Energy policy is an important part of the world of energy, and governments in the U.S. and around the world are interested in understanding this subject. The work by organizations such as the International Energy Agency and the U.S. Department of Energy, as well as other leading economic and energy forecasters, has also been considered in developing the economic and energy trends 2.6 Industry Conditions Worldwide primary petrochemical demand grew by 5 percent during 1999. Growth was driven by strong economies in the developed nations of the world and the beginning of a recovery in Asia-Pacific. Commodity prices increased during 1999 in response to rising feedstock costs. However, margins continued at near bottom of cycle conditions for many of the company's high-volume commodity products. Restructuring of the petrochemical industry continues at an unprecedented level. Remaining firms are focusing on core businesses, building scale to extend global reach and improve competitiveness, while others are exiting petrochemicals completely. Magazine Gasoline Prices ExxonMobil takes its role as a fuel provider seriously and works hard to ensure a reliable supply of competitively priced gasoline to customers around the world. It's a vital product. Consumers are understandably sensitive to gasoline prices. And, with price signs in many parts of the world on every main street, every small change is instantly visible. People wonder why gasoline prices fluctuate so much, why prices vary from place to place, and why prices are not lower. Gasoline Prices over the Years During the First World War, gasoline sold for about $0.25 per gallon in the U.S. If that price had increased at the same rate as inflation (the change in the prices of other goods and services), gasoline in 2001 would cost nearly $3.00 per gallon. The price of gasoline has averaged about $2.00 per gallon in inflation-adjusted dollars over the last 80 years The Cost of Gasoline Over the long term, gasoline prices reflect crude oil prices, taxes and the cost of refining and distribution, including measures for environmental protection and a reasonable return for investors. Copyright @ Siam University / School of BBA and MBA - 6-