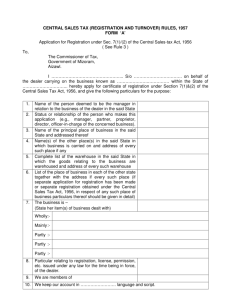

CST Rules

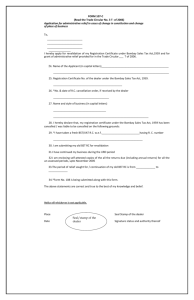

advertisement