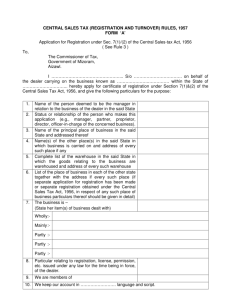

CST Rules

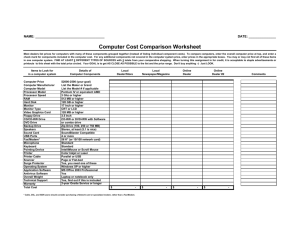

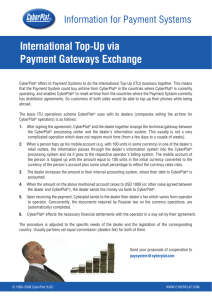

advertisement