Form W-7 - Stony Brook University

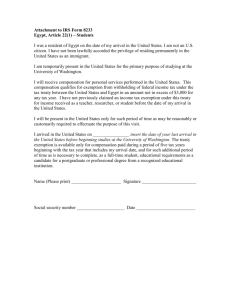

advertisement

WHO CAN SUBMIT FOR W-7 TO INTERNAL REVENUE SERVICE AND WHEN? If there is a tax treaty with your country and the United States, you can complete Form W-7 and Form 8233 at the time of your service to Stony Brook University. Please follow the attached instructions to complete Form W-7 and attach the following documents: A copy of letter requesting your presence for a speaking engagement, OR a copy of your contract with Stony Brook University Copy of Form 8233 completed, signed and stamped by Stony Brook University withholding agent in Section IV (see Jean Schaal for State and Stony Brook Foundation payments and Madeline Ricciardi for Research Foundation payments in Human Resource Services) A notarized (or certified) copy of your passport showing a valid VISA issued by the U.S. Department of State. If your documents display information on both sides – copy both sides and provide. Send the above to the Internal Revenue Service and attach a copy of Form W-7 and the original Form 8233 keep with your Independent Contractor package. (original Form 8233 will not be sent to IRS until you receive ITIN# until then you will be charged 30% tax) If you cannot claim a tax treaty exemption – you cannot complete for W-7 until the following year after your receive Form 1042S from, State Controller’s Office, Stony Brook Foundation or Research Foundation. Please follow the attached instructions to complete Form W-7 and attach the following documents: Income tax return (Form 1040NR with attached Form 1042S) that you are filing with the IRS. A certified or notarized copy of your passport showing a valid VISA issued by the U.S. Department of State. If your documents display information on both sides – copy both sides and provide. Don’t forget to write on the copies “This is a true copy of my passport” also write your name and address and sign in the presence of the notary. If you were paid by the Research Foundation, as soon as you receive your ITIN# you MUST notify Porshia Russell, in Procurement Office, of this number contact her at 631-632-6019 or by email at: Porshia.Russell@sunysb.edu If you were paid by State payroll, as soon as you receive your ITIN# you MUST notify Jean Schaal, in Human Resource Services, of this number contact her at 631-632-1119 or by email at: Jean.Schaal@sunysb.edu If you were paid by Stony Brook Foundation, as soon as you receive your ITIN# you MUST notify Al DiVenuto, in Procurement Office of this number, contact him at 631-632-9838 or by email at: Alfred.Divenuto@sunysb.edu PLEASE NOTE: WITHOUT ITIN # YOU CANNOT RECEIVE A TAX TREATY EXEMPTION ___________________________________________________________________________ HRSF0108i (11/11) Page 1 of 6 www.stonybrook.edu/hr Form W-7 - Application for IRS Individual Taxpayer Identification Number To access and/or print form: http://www.irs.gov/pub/irs-pdf/fw7.pdf Step by Step Instructions to Complete Form W-7 Step 1 Determine if you can claim a tax treaty exemption with the United States. Please refer to table below for countries with tax treaties on the last two pages If it is determined that you can claim a tax treaty benefit – Go to Step 2. If it is determined that you cannot claim a tax treaty, because there is no treaty with your home country and the U.S. – You must request ITIN # when you prepare your income tax return (Form 1040NR in the following year) and attach the income tax return to form W-7. Go to Step 3. Please note: you cannot receive a tax treaty exemption without ITIN # Step 2 On Form W-7 in the Section “Reason you are submitting Form W-7”, complete the following: Check box “a” – Nonresident alien required to obtain ITIN to claim tax treaty benefit Check box “h” – Other and write in “Exception 2(a) – Honoraria Payments Under box “h” enter additional information. Enter your country and tax treaty article number. Tax Treaty article number can be found on the table, on the last two pages. Go to Step 4 Step 3 On Form W-7 in the Section “Reason you are submitting Form W-7" complete the following: Check box “b” – Nonresident alien filing a U.S. tax return. Step 4 Line 1a: Enter your name Line 1b: If name on line 1a differs from birth name – enter birth name on line 1b. Step 5 Line 2: Enter U.S. mailing address Step 6 Line 3: Enter your home address in your country Step 7 Line 4: Enter your birth information Line 5: Check if you are male or female HRSF0108i (11/11) Page 2 of 6 www.stonybrook.edu/hr Step 8 Line 6a: Enter country of citizenship Line 6b: Enter foreign tax id, if applicable Line 6c: Enter VISA informationLine 6d: Check the box indicating the type of documents you are submitting to prove your foreign status and identity. Line 6e: If you ever received a temporary taxpayer identification number (TIN) or employer identification number (EIN), check the “YES” box and complete line 6f. If you do not know your temporary TIN or EIN number, check the “No/Do not know” box, then skip line 6f. Line 6f: This line may be left blank if you have not been issued a number in the past. If you have both a temporary TIN and EIN, attach a separate sheet listing both. If you were issued more than one TIN, attach a separate sheet listing all the temporary TIN’s you received. On this sheet be sure to write your name and “Form W-7” at the top. Line 6g: Do not complete this section; it is only to be completed if you checked reason f above. Step 9 If you can claim a tax treaty exemption with the United States – you must submit the following documents with the W-7: A copy of letter requesting your presence for a speaking engagement, OR a copy of your contract with a Stony Brook University. Copy of Form 8233 completed, signed and stamped by Stony Brook University withholding agent in Section IV (see Jean Schaal for State and Stony Brook Foundation payment and Madeline Ricciardi for Research Foundation payment in Human Resource Services). A notarized (or certified) copy of your passport showing a valid VISA issued by the U.S. Department of State. If your documents display information on both sides – copy both sides and provide. Don’t forget to write on the copies “This is a true copy of my passport” and also write your name and address, and sign in the presence of the notary. PLEASE NOTE: YOU CANNOT RECEIVE A TAX TREATY EXEMPTION WITHOUT AN ITIN # Go to Step 11 Step 10 If you cannot claim a tax treaty exemption – you must submit the following documents with the W-7 when you file your income tax return Form 1040NR in the following year: Income tax return (Form 1040NRand attach Form 1042S) that you are filing with the IRS A certified or notarized copy of your passport showing a valid VISA issued by the U.S. Department of State. If your documents display information on both sides – copy both sides and provide. Don’t forget to write on the copies “This is a true copy of my passport” and also write your name and address and sign in the presence of the notary. HRSF0108i (11/11) Page 3 of 6 www.stonybrook.edu/hr Step 11 Sign, date, and enter phone number in the “Sign here” section. No need to complete “delegate” section. DO NOT ENTER ANYTHING IN THE “ACCEPTANCE AGENT’S USE” SECTION! Step 12 Mail Original Form W-7 and certified or notarized supporting documents to: Internal Revenue Service ITIN Operation P.O. Box 149342 Austin, TX 78714-9342 Step 13 If you were paid by the Research Foundation, as soon as you receive your ITIN# you MUST notify Porshia Russell, in Procurement Office, of this number contact her at 631-632-6019 or by email at: Porshia.Russell@sunysb.edu If you were paid by State payroll, as soon as you receive your ITIN# you MUST notify Jean Schaal, in Human Resource Services, of this number contact her at 631-632-1119 or by email at: Jean.Schaal@sunysb.edu If you were paid by Stony Brook Foundation, as soon as you receive your ITIN# you MUST notify Al DiVenuto, in Procurement Office of this number, contact him at 631-632-9838 or by email at: Alfred.Divenuto@sunysb.edu W-7 application: http://www.irs.gov/pub/irs-pdf/fw7.pdf A guide to understand W-7 application: http://www.irs.gov/pub/irs-pdf/p1915.pdf DESCRIPTION OF TABLE COLUMNS Column A: Independent Contractors country of permanent citizenship. Column B: Maximum length of exemption. After the maximum years in the USA has been reached, the individual is subject to federal tax withholding. EXAMPLE: An independent contractor from China has been in the USA for 200 days and has a $5,000 contract. The $5,000 contract is taxable because the independent contractor has been in the USA over the 183 day limit. Column C: Maximum Independent Contractor amount for exemption. There are a few countries that have limits on the Independent Contractor amount, anything over this amount is taxable. Please note some countries have “pa” written after the amount. This means they can only receive a one-time $5000 tax exemption each year. Column D: The tax treaty article citation. HRSF0108i (11/11) Page 4 of 6 www.stonybrook.edu/hr COLUMN A COLUMN B COLUMN C COLUMN D Country of Residence Maximum Presence in USA Maximum Compensation Treaty Article Citation 183 DAYS NO LIMIT 183 DAYS 89 DAYS take tax take tax take tax 183 DAYS 183 DAYS 182 DAYS 183 DAYS NO LIMIT 89 DAYS 183 DAYS NO LIMIT NO LIMIT 183 DAYS take tax 183 DAYS 89 DAYS 119 DAYS take tax NO LIMIT 182 DAYS NO LIMIT 89 DAYS take tax 182 DAYS 183 DAYS 183 DAYS 183 DAYS NO LIMIT 183 DAYS 182 DAYS NO LIMIT 183 DAYS 182 DAYS 89 DAYS 182 DAYS 182 DAYS NO LIMIT NO LIMIT NO LIMIT $5,000.00 exemption when exemption when exemption when NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NIO LIMIT $10,000.00 exemption when NO LIMIT NO LIMIT NO LIMIT exemption when NO LIMIT NO LIMIT NO LIMIT $5,000.00 exemption when $3,000pa NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT $5,000.00 NO LIMIT NO LIMIT NO LIMIT $10,000.00 pa NO LIMIT NO LIMIT 14 14 15 14 filing taxes filing taxes filing taxes 13 VI (2) 17 14 14 15 14 14 14 7 filing taxes 13 15 15 filing taxes 14 16 14 (1) 14 filing taxes 18 14 14 14 15 14 14 15 14 13 15 15 15 AUSTRALIA AUSTRIA BANGLADESH BARBADOS BELGIM BULGARIA CANADA CHINA – PEOPLE’S REPUBLIC *COMMONWEALTH OF IND ST CYPRUS CZECH REPUBLIC DENMARK EGYPT ESTONIA FINLAND FRANCE GREECE GERMANY HUNGRY INDIA INDONESIA ICELAND IRELAND ISRAEL ITALY JAMAICA JAPAN KOREA, REP. OF KAZAKSTAN LATVIA LITHUANIA LIXEMBOURG MEXICO MOROCCO NETHERLANDS NEW ZELAND NORWAY PHILIPPINES POLAND PORTUGAL HRSF0108i (11/11) Page 5 of 6 www.stonybrook.edu/hr ROMANIA RUSSIA 182 DAYS 183 DAYS NO LIMIT NO LIMIT 14 13 SLOVAK REPUBLIC SLOVENIA SPAIN SOUTH AFRICIA SPAIN SRI LANKA SWEDEN SWITZERLAND THAILAND TRINIDAD & TOBAGO TUNISIA TURKEY UKRAINE UNITED KINGDOM VENEZUELA 183 DAYS NO LIMIT NO LIMIT 183 DAYS NO LIMIT 183 DAYS NO LIMIT NO LIMIT 89 DAYS 183 DAYS 183 DAYS 183 DAYS NO LIMIT take tax NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT NO LIMIT $10,000.00 $3,000.00 $7,500.00pa NO LIMIT NO LIMIT exemption when NO LIMIT 14 14 15 14 15 15 14 14 15 17 14 14 14 filing taxes 14 Note *: This represents the U.S.S.R (Commonwealth of Independent States) income tax treaty which includes Armenia, Azerbaijan, Belarus, Georgia, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, and Uzbekistan. Tax Treaties can be found at http://www.irs.gov/businesses/international/article/0,,id=96739,00.html. HRSF0108i (11/11) Page 6 of 6 www.stonybrook.edu/hr