Microsoft Word version

advertisement

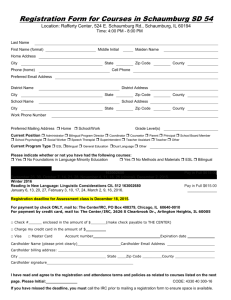

AB 36 Page 1 ASSEMBLY THIRD READING AB 36 (Perea and Blumenfield) As Amended February 18, 2011 Majority vote REVENUE & TAXATION 9-0 APPROPRIATIONS Ayes: Ayes: Perea, Donnelly, Beall, Charles Calderon, Cedillo, Fuentes, Gordon, Harkey, Nestande 15-0 Fuentes, Harkey, Blumenfield, Bradford, Charles Calderon, Campos, Davis, Gatto, Hall, Hill, Lara, Mitchell, Norby, Solorio, Wagner SUMMARY: Conforms to federal tax law that excludes from the gross income of a parent the value of health care benefits and reimbursements for medical care provided by the parent's employer to an adult child 26 years or younger. Specifically, this bill: 1) Excludes from the employee's gross income the value of employer-provided health coverage, under an accident or health plan, for the employee's adult child who, as of the end of the taxable year, has not attained the age of 27. 2) Excludes from the employee's gross income any reimbursements made under an employerprovided accident or health plan for medical expenses for the employee's child who, as of the end of the taxable year, has not attained the age of 27. 3) Allows self-employed individuals to deduct the cost of health insurance provided for an adult child through the end of the taxable year in which the child turns 26. 4) Allows a member of a nonprofit voluntary employees' beneficiary association that provides health benefits to an adult child, through the end of the taxable year in which the child turns 26, to exclude the benefit from the member's gross income. 5) Applies to expenses incurred and benefits provided on or after March 30, 2010. 6) Takes effect immediately as a tax levy. EXISTING FEDERAL LAW: Under federal law, the value of employer-provided health coverage under an accident or health plan is excluded from an employee's gross income, if provided to the employee, for his or her spouse, dependent or child who, as of the end of the taxable year, has not attained age 27 ("adult child"). The exclusion also applies to reimbursements for medical care expenses for an employee's adult child. Federal law also authorizes a similar exclusion for health benefits provided to the adult children of retired employees under qualified retiree health pension plans (Internal Revenue Code (IRC) Section 401(h)) and members of voluntary employees' beneficiary associations (IRC Section 501(c)). AB 36 Page 2 EXISTING STATE LAW: California, in conformity with the recently-enacted federal health care acts, requires group health plans and health insurance issuers to provide health care coverage for adult children up to the age of 26, beginning on or after September 23, 2010, except under specified circumstances (SB 1088 (Price), Chapter 660, Statutes of 2010). However, California does not conform to the federal change that excludes from tax the value of health care benefits provided by an employer to the employee's adult children under the age of 26. For health care benefit tax purposes, California law conforms to the definition of a qualifying child under IRC Section 152. FISCAL EFFECT: The Franchise Tax Board (FTB) staff estimates that this bill will result in a revenue loss of $4.8 million in fiscal year (FY) 2010-11, $38 million in FY 2011-2012, $35 million in FY 2012-13, $40 million in FY 2013-14, and $44 million in 2014-15. COMMENTS: Author's Statement. The author states, "With an estimated 1.2 million young adults between the ages of 19-25 uninsured, many young adults find themselves without medical coverage. By conforming California's tax laws to federal standards, the state creates an affordable health insurance option for the large pool of uninsured young adults in California. Although SB 1088 allows parents to add their adult child to their health care plan, the cost of non-conformity may become a tax burden some families may not be able to afford. AB 36 ensures many more young adults are insured and their parents are not burdened by additional taxes as a result." Committee comments: 1) Background. Congress amended the IRC to give certain favorable tax treatment for coverage for adult children. Specifically, IRC Section 105(b) was amended to extend the general exclusion from gross income for reimbursements for medical care under an employerprovided accident or health plan to any employee's child who has not attained age 27 as of the end of the taxable year. Similar amendments were also made to IRC Section 401(h) for retiree health accounts in pension plans, IRC Section 501(c)(9) for voluntary employees' beneficiary associations (VEBAs), and to IRC Section 162(l) for deductions by selfemployed individuals for medical care insurance. Furthermore, on April 27, 2010, the Internal Revenue Service (IRS) issued Notice 2010-38, in which it stated that the regulations under IRC Section 106 would be amended retroactively to March 30, 2010, to provide that coverage for an employee's child under age 27 is excluded from the employee's gross income. Most health benefits are provided to employees as health plan coverage through IRC Section 106, which expressly excludes from an employee's gross income coverage under an employer-provided accident or health plan. However, the recent amendment to the federal tax law only provided for an exclusion for employer reimbursements for medical care expenses (IRC Section 105(b)), and not employer-provided coverage. Prior to the enactment of recent health care acts, the exclusion for employerprovided health coverage under Section 106 had paralleled the exclusion for reimbursements for medical care under IRC Section 105(b). In issuing Notice 2010-38, the IRS re-affirmed that the exclusions under Sections 105 and 106 had always been parallel and concluded that there was no indication that Congress intended to provide a broader exclusion for AB 36 Page 3 reimbursements than for health plan coverage. Thus, on and after March 30, 2010, both coverage under an employer-provided accident or health plan and amounts paid or reimbursed under such a plan for medical care expenses of an employee's child who has not attained age 27 as of the end of the employee's taxable year are excluded from the employee's gross income under federal law. California adopts a broad range of IRS published guidance, though excludes letter rulings (FTB Letter 2010-5). Under Revenue and Taxation Code (R&TC) Section 17131, California conforms to IRC Section 106, as of the “specified date” of January 1, 2009. Thus, if this bill is enacted into law, IRS Notice 2010-38 would apply for California tax purposes as a regulation under the California Personal Income Tax Law (R&TC Section 17024.5(d)). 2) Employer Tax Compliance Burden. Because California has not conformed to the federal adult child health care benefit tax provision, an employer has the burden of determining how much to withhold from an individual's wages who takes advantage of the benefit. Many employers first realized the difference in federal and state income treatment when preparing W-2s for 2010. As more parents add their adult children to their health insurance, more employers will face this administrative burden. In addition, the employer not only has the task of dealing with different withholding requirements between the federal and state levels, it also lacks guidance in determining the proper withholding amount. 3) Additional Tax Liability on Parents. Parents could pay more taxes as a result of nonconformity, depending on the method used to calculate tax liability. As stated above, this tax has not been previously collected, so determining the financial burden on the participating parents is difficult to estimate. The tax liability could amount to upwards of hundreds of dollars per year. This added financial strain could dissuade parents from providing health care to their uninsured adult children. 4) Estimated Revenue Loss. Although this bill is estimated to result in a loss, the estimate may not be entirely accurate. Currently, there is no method set for determining the amount of the benefit to tax. Also, since this benefit has never been taxed in the past, passage of this bill would not result in a revenue loss to the General Fund. In fact, if this bill is not enacted, any amount collected would result in a windfall to the state. Estimating the amount of the windfall is difficult, given there is no set method that employers must follow. Therefore, the current FTB estimate could over or understate what would be collected if the benefit is taxed. 5) Young Adult Benefit. According to the Federal Department of Health and Human Services, young adults have the highest rate of uninsured of any age group. About 30% of young adults are uninsured, representing more than one in five of the uninsured. This rate is higher than any other age group, and is three times higher than the uninsured rate among children. Young adults have the lowest rate of access to employer-based insurance. Also, contrary to the myth that young people do not need health insurance, one in six young adults has a chronic illness like cancer, diabetes or asthma. Nearly half of uninsured young adults report problems paying medical bills. AB 36 Page 4 Related legislation: SB 1088 (Price), Chapter 660, Statutes of 2010. This bill extended the age which parents could add their adult child to their health care plan to 26 years of age. This bill did not affect tax treatment of this benefit. AB 1178 (Portantino), introduced in the 2009-10 Legislative Session, had a similar provision. AB 1178 was held in the Senate Appropriations Committee. Analysis Prepared by: Myriam Bouaziz/Oksana Jaffe / REV. & TAX. / (916) 319-2098 FN: 0000036