NATIONAL CHENGCHI UNIVERSITY

advertisement

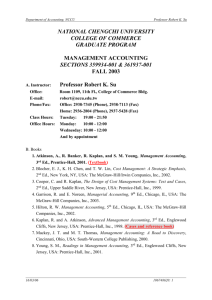

Department of Accounting, NCCU Professor Robert K. Su NATIONAL CHENGCHI UNIVERSITY COLLEGE OF COMMERCE DEPARTMENT OF ACCOUNTING REGULAR MS PROGRAM ADVANCED FINANCIAL STATEMENT ANALYSIS AND BUSINESS VALUATION FALL 2005 A. Instructor: Professor Robert K. Su Room 1109, 11th Fl., College of Commerce Bldg. robert@nccu.edu.tw 2938-7345 (Phone), 2938-7345 (Fax) Thursday: 14:10 - 17:00 Monday: 10:00 - 12:00 Wednesday: 16:00 - 18:00 And by appointment B. Course Objectives This course is designed to aid motivated graduate students with sufficient accounting background in comprehending the theoretical concepts and practical Office: E-mail: Phone/Fax: Class Hours: Office Hours: techniques in analysis of financial statements and business value. Through the lecture and discussion of text materials and research papers on certain accounting topics and the use of real-world financial statements as case examples, this course should help develop the student's ability to in depth analyze financial statements and business value. After successfully completing this course, the student should be able to apply the knowledge and techniques in the real world. C. Books 1. Arzac, E. R. 2005, Valuation for Mergers, Buyouts, and Restructuring, N.Y., NY, USA: John Wiley & Sons, Inc. 2. Eccles, Robert. G., Robert. H. Herz, E. Mary Keegan and David M. H. Philips, 2001, The ValueReporting Revolution: Moving Beyond the Earnings Game, John Wiley & Sons, Inc. 3. Fridson, M., and F. Alvarez, 2002, Financial Statement Analysis: A Practitioner’s Guide, 3rd Ed., N.Y., NY, USA: John Wiley & Sons, Inc. 4. Mard, M. J., J. R. Hitchner, S. D. Hyden and M. L. Zyla, 2002, Valuation for Financial Reporting: Intangible Assets, Goodwill, and Impairment Analysis, 3/7/2016 106762620: 1 Department of Accounting, NCCU Professor Robert K. Su SFAS 141 and 142, N.Y., NY, USA: John Wiley & Sons, Inc. 5. McKinsey & Company, Inc., T. Copeland, T. Koller, and J. Murrin, 2000, Valuation: Measuring and Managing the Value of Companies, 3rd Ed., N.Y., NY, USA: John Wiley & Sons, Inc. 6. Mulford, C. W. and E. E. Comiskey, 2002, The Financial Numbers Game, N.Y., NY, USA: John Wiley & Sons, Inc. 7. Palepu, K. G., P. M. Healy and V. L. Bernard, 2004, Business Analysis and Valuation, 3rd Ed., Mason, OH, USA: South-Western College Publishing. (Textbook) 8. Penman, S. H., 2003, Financial Statement Analysis and Security Valuation, 2nd Ed., N.Y., NY, USA: The McGraw-Hill, Companies. 9. Pratt, S. P., 2001, Business Valuation he Analysis and Use of Financial Statements, N.Y., NY, USA: John Wiley & Sons, Inc. 10. Pratt, S. P., 2002, Cost of Capital: Estimation and Applications, Hoboken, NJ, USA: John Wiley & Sons, Inc. 11. Schilit, H., 2002, Financial Shenanigans, 2nd Ed., N.Y., NY, USA: The McGraw-Hill, Companies. 12. White, G., A. Sondhi, and D. Fried, 2003, The Analysis and Use of Financial Statements, 3rd Ed., Hoboken, NJ, USA: John Wiley & Sons, Inc. 13. Wild, J., L. Bernstein, and K. R. Subramanyam, 2001, Financial Statement Analysis, 7th Ed, N.Y., NY, USA: The McGraw-Hill, Companies. D. Grading Policy 1. Final tests (Comprehensive, take-home) --------- 50% Case presentations and reports ------------------- 40% Evaluation and/or Homework -------------------- 10% Total 100% 2. You are encouraged to discuss any grading errors with the instructor so that you can receive all of the points that you have earned. However, grading errors will be corrected only for tests submitted for re-grading within one week of the date they are returned to you. 3/7/2016 106762620: 2 Department of Accounting, NCCU Professor Robert K. Su E. Important Notes and Policies 1. Tests must be taken as scheduled. No makeup test will be given. Missed tests will count as zero unless absence is authorized in advance by this instructor. Please feel free to call me at 2938-7345, email me at robert@nccu.edu.tw, or come see me in my office, to discuss your needs. 2. Presentations must be made as scheduled. Rescheduling is not welcome. Missed presentations will also count as zero unless absence is authorized in advance by this instructor. 3. Bring a hand calculator for each meeting. 4. You are expected to be an active learner and therefore to read the assigned materials before the class meets. 5. Class participation will be expected of all students. 6. The assignments and the class schedule may be modified, if necessary, at this instructor's discretion. 7. To show your respect for your own rights and your classmates’ right to education, please silence all telecommunication devices when the class is in session. 3/7/2016 106762620: 3 Department of Accounting, NCCU Professor Robert K. Su CLASS SCHEDULE Week Date Chapter 1 09/15 Subjects and Assignments Introduction to the Course Part I: Framework 2 09/22 1 Part II: Tools 3 09/29 2 Framework for Business Analysis and Valuation Using Financial Statements Strategy Analysis 4 5 6 10/06 10/13 10/20 3 4 4 Overview of Accounting Analysis Implementing Accounting Analysis Implementing Accounting Analysis 7 8 9 10 10/27 11/03 11/10 11/17 5 6 7 8 Financial Analysis Prospective Analysis: Forecasting Prospective Analysis: Valuation Theory and Concepts Prospective Analysis: Valuation Implementation Part III: Applications 11 11/24 9 12 13 14 Equity Security Analysis 12/01 10 12/08 11 12/15 12 Credit Analysis and Distress Prediction Mergers and Acquisitions Corporate Financial Policies Part IV: Cases 15 12/22 13 16 12/29 17 01/05 18 01/12 Communication and Governance Presentations: C1 & C2 Presentations: C3 & C4 Take-home final test (Comprehensive) 3/7/2016 106762620: 4 Department of Accounting, NCCU Professor Robert K. Su CASE STUDY AND PRESENTATION I. Cases: To be discussed in class. 1. 2. 3. 4. D1: F1: D2: F2: II. Rules A. Grouping and case assignment 1. The class is to be equally divided into four groups based on participants' preferences after the add/drop period. 2. Each group is required to present on one case. 3. The four cases will be randomly assigned to the groups. 4. Each case presentation is to be made by one independent group, but discussion is expected of the entire class. B. Methods and Coverage 1. Each presentation is to be delivered both orally and in writing. 2. Each oral presentation on the case should cover the followings within the specified time slots in a total of 70 minutes. Overrunning the time will lead to loss of credit. a. 5 minutes: General description of the firm b. 10 minutes: Operating environment and the firm’s competitive advantages c. 30 minutes: 5-year analysis and comparison with its industry or competitor d. 15 minutes: Reasonable stock price range e. 1 minute: Key learnings f. 9 minutes: Floor questions and answers 3. Each written report is due at the time of the oral presentation and should be typed (double-spaced) and cover the same subject matters as the oral presentation in the following format. a. 1 cover page b. 1 page for table of content c. No more than 10 pages of text d. No more than 10 pages of graphs and tables e. No more than 2 pages of reference f. A copy of the case company's financial statements 3/7/2016 106762620: 5 Department of Accounting, NCCU Professor Robert K. Su 4. The analysis and report should be done digitally; the use of auxiliary facility at the oral presentation is recommended. 5. Each presenting group should email the instructor the PowerPoint and Word files one day before the presentation. Sharing the files with classmates is encouraged. 6. Each presenting group should distribute a 2-page handout to the classmates before the presentation. 7. Rehearsals are highly recommended and discussions with the teacher, of course, are greatly welcome. C. Evaluation 1. Oral presentation a. Preparation (30%) b. Skill (25%) c. Content (30%) d. Response (15%) 2. Written report, due at the time of the oral presentation a. Skill (30%) b. Content (70%) 3. A group score will be assigned to each presenting group. 4. Member score: If every member of the group agrees, each member of the group will receive the same score. In case of a dispute among the members, a self-and-peer-evaluation will be conducted to determine the relative contribution of each member to the presentation. Each member will then receive a score computed based on her (his) contribution. 3/7/2016 106762620: 6 Department of Accounting, NCCU Professor Robert K. Su PRESENTATION EVALUATION SHEET Date: no Case: Group: Equal Contribution: ( ) yes, ( ) Members: ID No. Name 1. 2. 3. 4. 5. 6. 7. 8. Part 1: Oral % 1. Preparation (30%) 2. Skill (25%) 3. Content (30%) 4. Response (15%) Total Score (100%) Part 2: Written 1. Skill (30%) 2. Content (70%) Total 3/7/2016 (100%) 106762620: 7