Winners and losers?

advertisement

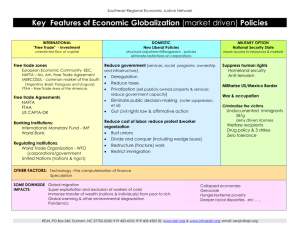

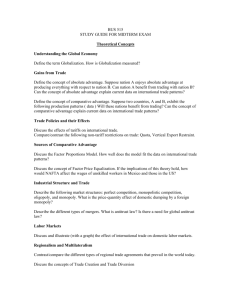

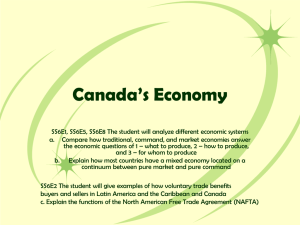

Case 11.8 Assessing NAFTA Winners and losers The North America Free Trade Agreement (NAFTA), ratified between the USA, Mexico and Canada in 1994, has a total population (in 2006) of 435 million with a GDP of over $14 trillion. This makes it comparable in both size and economic power to that of the enlarged EU of 25 states, which has a population of 457 million and a GDP of over $12 trillion. Unlike the EU, however, with its deepening level of integration, NAFTA’s primary focus is on trade liberalisation. In order to support this goal, there have been some specific attempts to harmonise laws and regulations in areas such as environmental management and labour standards. These are limited, however, and there is little desire to integrate the economies any further. Tariffs between the US and Canada were phased out in 1999. Mexican tariffs with the US and Canada are not due to be fully phased out until 2009. Of the three economies, Mexico would seem to have the most to gain from NAFTA, with open and free access to its rich neighbours. Supporters of NAFTA argue that the other two members are also likely to receive significant gains from the agreement. Critics, however, especially in the USA, argue that there is little if any benefit to the USA. Indeed, in the long term, the agreement may well be to its economic detriment. To judge between these positions, we must look at the evidence. Trade In 1994 the value of trade between the three members of NAFTA was estimated at some $354 billion (46 per cent of their total exports). By 2005 this had risen to $790 billion (57 per cent of their total exports). Between 1994 and 2004, the nominal value of US exports to Mexico and Canada rose by 119 per cent and 66 per cent respectively. Conversely, the nominal growth in US imports from Mexico and Canada was 215 per cent and 99 per cent respectively. The consequence is that a $13 billion US trade deficit with Mexico and Canada in 1994 had increased to $111 billion in 2004. One of the main determinants of this widening trade deficit was the depreciation of both the Mexican peso and Canadian dollar. Following the Mexican financial crisis in 1994/95, the peso lost 31 per cent of its value against the dollar, making Mexican goods super competitive in US markets. Since then, however, the real exchange rate has risen and regained its real 1993 value in 2000. The reason for this real appreciation was the higher inflation rate in Mexico than in the USA. This more than offset a further depreciation in the nominal exchange rate. The Canadian dollar depreciated in real terms against the US dollar until 2002. This was largely due to the Canadian government’s attempt to reduce real interest rates, which it did from the mid 1990s. Between 1989 and 2002 the Canadian dollar lost 28 per cent of its real value against the US dollar. Since then, the Canadian dollar has appreciated in real terms against the US dollar. 1 The real value of the Canadian dollar and Mexican peso against the US dollar is illustrated in the following chart. Note that the real value is calculated by adjusting the respective nominal exchange rate for differences in inflation between the country and the 120 Mexican peso Real exchange rate (1993 = 100) 110 100 Canadian dollar 90 80 70 60 50 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Source: based on data in OECD Economic Outlook (author’s calculations) Real exchange rate of the Canadian dollar and Mexican peso against the US dollar USA. Even if trade creation between NAFTA’s members does not appear to be equal, the agreement’s supporters suggest that all parties have benefited. Bryan Samuel, the US Acting Assistant Secretary of State for Economics and Business Affairs (2000) stated that: The economic benefits of NAFTA are clear. It has generated growth and economic momentum for many regions, communities and individual citizens. NAFTA has helped spur the creation of a North American market characterised by low and declining trade barriers, common standards, enhanced co-operation on labour and environmental issues and economic innovation and dynamism.1 Samuel advanced the following as indicative evidence of the benefits of NAFTA to the US economy. Taylor Dunn, a California firm which manufactures electric vehicles, added fifty workers because of increased sales after NAFTA reduced Mexico’s tariff on its products from 25 per cent to zero; 2 Farmland Industries of Kansas City, the largest farmer-owned co-operative in North America, which sold $50 million in wheat, corn and soybeans to Mexico pre-NAFTA, is now exporting $450 million of its products to Mexico, including beef and pork; Goulston Technologies of Monroe, North Carolina, which manufactures synthetic fibre lubricants, saw exports to Mexico increase 250 per cent since NAFTA began, and accordingly increased its employee base. Tariffs for its product dropped from 15 per cent to zero thanks to NAFTA.”2 Critic however are not so convinced, arguing that the widening trade deficit has had, and will have, a decisive impact upon the level of US employment, job loses, and US wages, which will invariably be driven downwards. Foreign Direct Investment (FDI) With the fall in trade barriers and falling value in currencies in Mexico and Canada, there has been a surge in foreign direct investment into both economies. Between 1994 and 2003, the stock of FDI in Mexico increased by 400 per cent (an increase of US$132 billion). In Canada over the same period it grew by 150 per cent (an increase of US$165 billion). Critics in the United States suggest that this surge in FDI was focused on establishing or enhancing production destined for export to the US market, adding to the threat to US jobs and wages. Jobs and wages The impact of the NAFTA agreement on jobs and wages is highly contentious and subject to significant debate. The official line is that: In expanding trade in North America, NAFTA has contributed to job creation at home. Since NAFTA entered into force, US employment has risen by over 7 per cent (12.8 million jobs) and unemployment has dropped from 6.5 per cent to 4.1 per cent. Many of these jobs are tied directly to increased trade, and according to Commerce Department data, export-related jobs pay an average of 16 per cent more than other jobs.3 Critics however are far from convinced. They suggest that intense import competition, and the growth in foreign export production, has led to significant job loses in the United States. Schott4 claims that some 750,000 jobs were lost as a result of the rapid growth in the US trade deficit with Mexico and Canada. He suggests that against the 20.7 million jobs created in the US between 1992 and 1999, 3.2 million were eliminated by the US trade deficit. Given NAFTA’s growing contribution to this deficit it must be seen as responsible for significant job loses within the United States. Schott also argues that employment created in the US can be easily explained by domestic factors, such as domestic consumption, investment and government spending. Little additional employment can be attributed to enhanced trade. Schott also points to other evidence to suggest that anywhere between 15 to 25 per cent of the growth in wage inequality in the US is the consequence of enhanced trade and import competition. 3 Winners and losers? The continued drive within the USA to create a Free Trade Area of the Americas (FTAA), in which all nations within the Americas (Cuba apart) will be members, suggests that those in favour of regional integration continue to hold the upper hand. Supporters and critics alike of the NAFTA agreement find it difficult to identify unambiguous support for their case. In the face of uncertainty, the NAFTA agreement is likely to be maintained, and a wider agreement throughout the Americas could soon become a reality. In January 2004 an agreement was signed by American leaders to create the FTAA, though no firm timetable was established. See the article http://news.bbc.co.uk/1/hi/world/americas/3394731.stm for more details. Question Using the Internet, investigate further the moves towards creating a Free Trade Area of the Americas. Do you feel it would be in the interests of the United States to be part of such an agreement? 1 2 3 4 Testimony before Senate Committee on Foreign Relations Washington, DC, 27 April 2000 ibid. ibid. Jeffrey J. Schott, Prospects for Free Trade in the Americas, (Institute for International Economics, 2001) 4